Professional Documents

Culture Documents

Cost Accounting Quiz 1a Chapter 1 ....

Uploaded by

IrfanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting Quiz 1a Chapter 1 ....

Uploaded by

IrfanCopyright:

Available Formats

Subject: Cost and Management Accounting

Q.No.1 Indicate whether each of the following costs of an automobile manufacturer would be classified as

direct materials, direct labor, or manufacturing overhead.

(a) ____Windshield. (b) ____Engine

(c) ____Wages of assembly line worker. (d) ____Depreciation of factory machinery.

(e) ____Factory machinery lubricants. (f) ____Tires.

(g) ____Steering wheel. (h) ____Salary of painting supervisor.

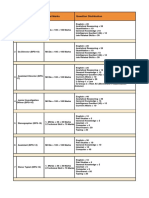

Q.No.2 Classify the following accounts of The Bottlers Ltd (which sells beverages) under one or more of the

following headings:

Manufacturing – Direct

Manufacturing – Indirect (Overheads)

Selling and Distribution

Administration

S.No Accounts Headings or Classification

01 Samples

02 Sugar

03 Factory Payroll

04 Foreman’s salary

05 Conveyance and travelling

06 Factory’s clerical salaries

07 Drivers’ wages

08 Gas, oil and grease

09 Depreciation of furniture and fixtures

10 Salesman’s salary and commissions

11 Light and power

12 Legal and Audit fee

13 Freight out/Carriage outwards

14 Income tax

15 Advertising

16 Rent of office buildings

17 Labels

18 Depreciation on machinery

19 Insurance

20 Water

21 Truck tyres

22 Bottle breakages

23 Telephone and communication

24 Stationery

Q.No.3 Classify the following costs as Variable (V), Fixed (F), or Semi-variable (SV) in terms of their behavior

with respect to volume or level of activity.

a) Property taxes_______________

b) Maintenance and repair_______________

c) Utilities_______________

d) Sales agent’s salary_______________

e) Direct Materials_______________

f) Insurance _______________

g) Depreciation by straight-line _______________

h) Sales agent’s commission _______________

i) Depreciation by mileage- automobile _______________

j) Rent _______________

Page 1 of 1

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Syllabus For Business Math and StatisticsDocument1 pageSyllabus For Business Math and StatisticsIrfanNo ratings yet

- Assignment of Business MathsDocument2 pagesAssignment of Business MathsIrfanNo ratings yet

- Business Maths ExcelDocument10 pagesBusiness Maths ExcelIrfanNo ratings yet

- SPSC Jobs 22-02-2019Document4 pagesSPSC Jobs 22-02-2019IrfanNo ratings yet

- Nab Tests WeitageDocument2 pagesNab Tests WeitageIrfanNo ratings yet

- 508-Financial Institutions and MarketsDocument2 pages508-Financial Institutions and MarketsIrfan0% (1)

- Important Note: Overage CandidatesDocument6 pagesImportant Note: Overage CandidatesIrfanNo ratings yet

- Bank Reconciliation ExampleDocument2 pagesBank Reconciliation ExampleIrfanNo ratings yet

- Press Note Vacancies CSS-2016Document1 pagePress Note Vacancies CSS-2016IrfanNo ratings yet