Professional Documents

Culture Documents

Philippine Documentary Stamp

Uploaded by

espalmadonelson0 ratings0% found this document useful (0 votes)

31 views25 pagesPhilippine Documentary Stamp

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhilippine Documentary Stamp

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views25 pagesPhilippine Documentary Stamp

Uploaded by

espalmadonelsonPhilippine Documentary Stamp

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 25

NTRC Tax Research Journal Vol. XXX.3 May - June 2018 }

A Review of the Philippine

Documentary Stamp Tax on Financial

Products and Transactions”

I. INTRODUCTION

Taxes are the lifeblood of any nation. Without taxes, the government would be

paralyzed for lack of motive power to activate and operate it, Like any other country, the

Philippines imposes a wide variety of taxes, among which is the documentary stamp tax

(st).

The DST is a tax upon documents, instruments, loan agreements and papers

evidencing the acceptance, assignment, sale or transfer of an obligation, right, or property

incident thereto and in respect of the transaction so had or accomplished. The DST is in

the nature of an excise tax. It is levied on the exercise by persons of certain privileges

conferred by law for the creation, revision, or termination of specific legal relationships

through the execution of specific instruments.

At present, there are 25 major categories of documents/instruments/transactions

that are being taxed at varying rates under Sections 174 to 198 of the National Internal

Revenue Code (NIRC) of 1997, as amended. The latest amendment was done through

Republic Act No. 10963, otherwise known as the Tax Reform for Acceleration and

Inclusion (TRAIN) that took effect in January 2018, which doubled the majority of the

rates to raise additional revenue. However, there are certain documents!

instruments/transactions that are exempt under Section 199 of the same Tax Code which

likewise need to be reviewed.

This paper provides basic information on the present DST structure and

recommend some amendments to simplify the DST structure and enhance equity in the

tax system. This could serve as inputs to fiscal policymakers in their review/assessment

of Package 4 on capital income and financial intermediary taxation of the Comprehensive

Tax Reform Program of the Department of Finance.

* Prepared by Lianne Carmeli B. Fronteras, Tax Specialist I, reviewed and approved by Monica G. Rempillo,

Chief Tax Specialist, Economics Branch, NTRC.

A Review of the Documentary Stamp Tax on Financial Products and Transactions 1

NIRC Tax Research Journal Vol. XXX.3 May - June 2018)

Il. HISTORICAL CHANGES IN THE DST RATES

‘The initial codification of the DST was done upon the effectivity of Act No. 1189!

on August 1, 1904, The DST, then referred to as the Stamp Tax (ST), was imposed on 18

major categories of documents/instruments/transactions. In 1939, Commonwealth Act

(CA) No. 466°, repealed the old law and renamed the ST as DST. The major categories of

documents/instruments/ transactions that were subject to the DST were increased to 24,

which were more or less similar to the current DST structure.

Through the years, various laws further changed the DST structure which paved the

way to higher DST rates and expanded its coverage but at the same time increased the

number of exemptions, viz: Republic Act (RA) No. 40° in 1946, RA 567 in 1950, RA.

1980° in 1957, RA 6110° in 1969, and Presidential Decree (PD) No. 69” in 1972.

In 1977, PD 118° consolidated and codified all internal revenue laws of the

Philippines. It renumbered the categories that were subject to the DST, increased the rates,

and added several items to the list of exempt documents/instruments/transactions. On the

other hand, under PD 1457’, the DST rates on almost all documents/instruments/

transactions were reduced. Another amendatory issuance include Executive Order (EO)

No. 194'° series of 1987 although these are on the DST on non-financial products and

transactions.

“An Act to Provide for the Support of the Insular Provincial and Municipal Governments, by Internal

“Taxation”, August 1, 1904,

*“An Act to Revise, Amend and Codify the Internal Revenue Laws of the Philippines”, June 15, 1939,

* “An Act to Amend Certain Sections of the National Internal Revenue Code, Relative to Documentary

‘Stamp Tax”, October 1, 1946,

+ An Act to Amend Title VI of Commonwealth Act Number Four Hundred and Sixty-Six, Otherwise

Known as the National Internal Revenue Code”, August 31, 1950.

* “An Act to Further Amend Section Two Hundred Twenty-Seven of the National Internal Revenue

Code”, June 22, 1957.

© An Act Amending Certain Provisions of the National Internal Revenue Code, as Amended”, August 5,

1969.

7 “Amending Certain Sections of the National Internal Revenue Code”, November 24, 1972.

“A Decree to Consolidate and Codify All the Internal Revenue Laws in the Philippines”, June 3, 1977.

ind for

° “Amending Certain Sections of the National Internal Revenue Code of 1977, as Amended,

Other Purposes”, dated June 11, 1978,

"© “Restructuring the Taxes and Providing for the Distribution of Receipts in Horse Racing, and for Other

", dated June 16, 1987.

2 A Review of the Documentary Stamp Tax on Financial Products and Transactions

NTRC Tax Research Journal ‘Vol. XXX.3 May - June 2018)

In 1993, when RA 7660"! was enacted, several major changes in the DST were again

introduced including the renumbering of sections, rewording of the categories and increasing

the rates. The DST on pre-need plans was introduced, among others.

Subsequent restructuring of the DST rates was done via RA 8424"? in 1997 (NIRC of

1997), RA 9243'° in 2004, RA 9648" in 2009, RA 10001'S in 2010, and RA 10963!° in

2017. The following are the highlights of these laws particularly on the DST affecting

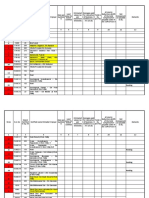

financial products and transactions: (Table 1)

1. RA 8424

Under RA 8424, the rates for most documents/instruments/transactions

under RA 7660 (1996) were generally retained. The category on “bonds, debentures

and certificates of indebtedness” was renamed as “debentures and certificate of

indebtedness”. Additional documents/instruments/transactions were also exempted

from the DST.

As observed, most of the DST rates were ad valorem while a few were fixed

amounts. The highest ad valorem tax rates were imposed on policies of insurance

upon property (Section 184), and fidelity bonds and other insurance policies

(Section 185) at 12.50%, followed by indemnity bonds (Section 187) at 7.50%. The

lowest rate was imposed on pre-need plans (Section 186) at 0.10%.

For fixed rates, the highest was PhP15.00 for certificates (Section 188) and

proxies (Section 192), each, followed by powers of attomey (Section 193) at

PhPS.00 and bank checks (Section 179) at PhP1.50.

"' “An Act Rationalizing Further the Structure and Administration of the Documentary Stamp Tax,

Amending for the Purpose Certain Provisions of the National Internal Revenue Code, as Amended, Allocating

Funds for Specific Programs, and for Other Purposes”, December 23, 1993.

"= “An Act Amending the National Intemal Revenue Code, As Amended, and for Other Purposes",

December 11, 1997,

"an Act Rationalizing the Provisions on the Documentary Stamp Tax of the National Internal Revenue

‘of 1997, as Amended, and for Other Purposes”, February 17, 2004

“An Act Exempting from Documentary Stamp Tax Any Sale, Barter or Exchange of Shares of Stock Listed

‘and Traded Through the Stock Exchange, Further Amending for the Purpose Section 199 of the National

Intemal Revenue Code of 1997, as Amended by Republic Act No, 9243, and for Other Purposes", dated June 30, 2009,

'S “An Act Reducing the Taxes on Life Insurance Policies, Amending for this Purpose Sections 123 and

183 of the National Internal Revenue Code of 1997, as Amended”, approved February 23, 2010.

“An Act Amending Sections 5, 6, 24, 25, 27, 31, 32, 33, 34, 51, 52, 56, 57, 58, 74, 79, 84, 86, 90, 91,

97, 99, 100, 101, 106, 107, 108, 109, 110, 112, 114, 116, 127, 128, 129, 145, 148, 149, 151, 155, 171, 174, 175,

177, 178, 179, 180, 181, 182, 183, 186, 188, 189, 190, 191, 192, 193, 194, 195, 196, 197, 232, 236, 237, 249,

254, 264, 269, and 288; Creating New Sections 51-A, 148-A, 150-A, 150-B, 237-A, 264-A, 264-B, and 265-A;

and Repealing Sections 35, 62, And 89; All Under Republic Act No. 8424, Otherwise Known as the National

Internal Revenue Code of 1997, as Amended, and for Other Purposes", dated December 19, 2017.

A Review of the Documentary Stamp Tax on Financial Products and Transactions 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- From 'Figurative Males' To Action Heroines: Further Thoughts On Active Women in The CinemaDocument13 pagesFrom 'Figurative Males' To Action Heroines: Further Thoughts On Active Women in The CinemaAlmeja SañudoNo ratings yet

- Research PDFDocument182 pagesResearch PDFaregawi selemonNo ratings yet

- Citizens Charter - STL PROGRAM - June2013Document15 pagesCitizens Charter - STL PROGRAM - June2013espalmadonelsonNo ratings yet

- Lead Soldering Safety Guideline: Health HazardsDocument1 pageLead Soldering Safety Guideline: Health HazardsespalmadonelsonNo ratings yet

- Fire Code of The PhilippinesDocument14 pagesFire Code of The PhilippinesespalmadonelsonNo ratings yet

- Bollywood SongbookDocument53 pagesBollywood Songbookmarken1No ratings yet

- Sss Aj ScriptDocument4 pagesSss Aj Scriptapi-631664658No ratings yet

- Final Valuation StatementDocument8 pagesFinal Valuation Statementcmrk07No ratings yet

- Empire UK - July 2020 PDFDocument124 pagesEmpire UK - July 2020 PDFJOSE BUSTOS67% (3)

- 2018 05 11 The Strange Difficult History of Queer Coding SYFY WIREDocument15 pages2018 05 11 The Strange Difficult History of Queer Coding SYFY WIREAceNo ratings yet

- + Disney: How To Train Your GPT To Craft World-Class Stories Like Disney (+ An Example)Document55 pages+ Disney: How To Train Your GPT To Craft World-Class Stories Like Disney (+ An Example)Raghavendra KuthadiNo ratings yet

- MOV Act 3 Scene I & 2Document18 pagesMOV Act 3 Scene I & 2Warshney GosaviNo ratings yet

- Angelina Jolie Press ConferenceDocument3 pagesAngelina Jolie Press ConferenceAgus Fernández NeseNo ratings yet

- Film, Television and The Psychology of The Social DreamDocument181 pagesFilm, Television and The Psychology of The Social Dreampaujp22No ratings yet

- Grave of The FirefliesDocument2 pagesGrave of The Firefliesflora xuNo ratings yet

- Executive SummaryDocument3 pagesExecutive SummarySandhea Suresh KumarNo ratings yet

- A Doll's House and FeminismDocument2 pagesA Doll's House and FeminismKwan Yi WongNo ratings yet

- Revision U1 U2Document10 pagesRevision U1 U2Nguyen Thanh Thang PH 1 6 5 8 4No ratings yet

- Ferris Bueller's Day OffDocument2 pagesFerris Bueller's Day OffMaru MoléNo ratings yet

- Ithazhil Kathai YezhuthumDocument2 pagesIthazhil Kathai YezhuthummuthuphysicsNo ratings yet

- 1st QTR Exam in English 7Document4 pages1st QTR Exam in English 7FLORAME OÑATENo ratings yet

- sim_playboy_january-december-1986_33_indexDocument57 pagessim_playboy_january-december-1986_33_indexPhlars TVNo ratings yet

- Genres of ViewingDocument12 pagesGenres of ViewingAizel Nova Fermilan Arañez100% (2)

- Netflix TitlesDocument817 pagesNetflix TitlesGiulianna RivaNo ratings yet

- PREPARE 3 Grammar Standard Unit 12Document2 pagesPREPARE 3 Grammar Standard Unit 12Juan Pedro100% (1)

- Pixel Fusion-1Document2 pagesPixel Fusion-1Yusuf GoriawalaNo ratings yet

- MacDougall Beyond Observation Cinema PDFDocument18 pagesMacDougall Beyond Observation Cinema PDFnk1347No ratings yet

- Err:509 Employee Name Employee Number Legacy Badge NumberDocument120 pagesErr:509 Employee Name Employee Number Legacy Badge NumberRahulNo ratings yet

- 2021 Academy Awards BallotDocument1 page2021 Academy Awards BallotToronto StarNo ratings yet

- BHEL Day Sports Nomination-HOD-Wise ListDocument22 pagesBHEL Day Sports Nomination-HOD-Wise ListsaurabhNo ratings yet

- Quarter III Media Based ArtDocument67 pagesQuarter III Media Based Artmeriejeantomampoc03No ratings yet

- Geo JapanDocument37 pagesGeo JapanLakuNo ratings yet

- La Paranoia English VersionDocument9 pagesLa Paranoia English VersionDaniel Ortiz VelazquezNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentapi-645824073No ratings yet