Professional Documents

Culture Documents

EN-O Private Limited Has Been in Business For Several Years. The Following Trial Balance Was DR $'000 CR $'000

Uploaded by

AhmadhHussainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EN-O Private Limited Has Been in Business For Several Years. The Following Trial Balance Was DR $'000 CR $'000

Uploaded by

AhmadhHussainCopyright:

Available Formats

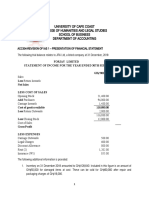

EN-O Private Limited has been in business for several years.

The following trial balance was

extracted from their books of account as at 30 September 2017:

Dr $’000 Cr $’000

Bad debt 15

Capital 609

Cash in hand and at bank 7

Discounts allowed 18

Discounts received 27

Dividends received 2

Drawings 12

Investments at cost 20

Motor vehicles: At cost 600

Accumulated depreciation (at 1October 2016) 300

Office expenses 35

Plant and equipment: At cost 240

Accumulated depreciation (at 1 October 2016) 144

Provision for bad and doubtful debts (at 1 October 2016) 3

Purchases 570

Salaries 105

Sales 900

Inventory (at 1 October 2016) 200

Trade payables 71

Trade receivables 160

Wages 74

Additional information:

1) Stock at 30 September 2017: $180,000.

2) Depreciation on motor vehicles is charged at a rate of 25% on cost and on plant and

equipment at a rate of 30% on cost.

3) Wages owing at 30 September 2017: $2,000.

4) Business rates paid in advance at 30 September 2017: $5,000.

5) A provision for bad and doubtful debts is maintained at a rate equivalent to 2.5% of

outstanding trade receivables as at the end of the year.

REQUIRED

Prepare for EN-O Private Limited, (i) Statement of Profit or Loss for the year to 30 September

2017 and the (ii) Statement of financial position as of that date.

(20 Marks)

(Total: 20 Marks)

You might also like

- BACC I FA Tutorial QuestionsDocument6 pagesBACC I FA Tutorial Questionssmlingwa0% (1)

- HPS 2201HBC 2202 Financial Accounting Ii Introduction To Account IiDocument5 pagesHPS 2201HBC 2202 Financial Accounting Ii Introduction To Account IiFRANCISCA AKOTHNo ratings yet

- Inflation Accounting CPPDocument3 pagesInflation Accounting CPPPradeepNo ratings yet

- Lab 3 Stock InvestmentDocument4 pagesLab 3 Stock InvestmentAlvira FajriNo ratings yet

- Bba Iii CfaDocument3 pagesBba Iii Cfasaksham sikhwalNo ratings yet

- Accounting Test LDocument7 pagesAccounting Test LmukungurutsepearsonNo ratings yet

- Paper - 5: Advanced Accounting: Particulars NosDocument32 pagesPaper - 5: Advanced Accounting: Particulars NosAmolaNo ratings yet

- Exercise - Accounting - Worksheet - Historia CompanyDocument15 pagesExercise - Accounting - Worksheet - Historia Companytristan ignatiusNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- CHP 6 Partnership Exercise 1-4Document5 pagesCHP 6 Partnership Exercise 1-4jasongojinkai2007No ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- AUDITOFINTANGIBLESDocument5 pagesAUDITOFINTANGIBLESPar Cor0% (1)

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- Caf 5 Far-IDocument5 pagesCaf 5 Far-IYahyaNo ratings yet

- 6sgp 2007 Dec QDocument7 pages6sgp 2007 Dec Qapi-19836745No ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- FAR-1 Complete PP With SolutionsDocument86 pagesFAR-1 Complete PP With SolutionsS Usama S75% (8)

- Financial Accounting F3 Assignment - Preparation of Financial StatementsDocument3 pagesFinancial Accounting F3 Assignment - Preparation of Financial StatementsRakesh RoshanNo ratings yet

- Higher Nationals: Assignment Brief - BTEC (RQF) Higher National Diploma in Business (Business Management)Document6 pagesHigher Nationals: Assignment Brief - BTEC (RQF) Higher National Diploma in Business (Business Management)Ngoc Nga DoanNo ratings yet

- FSQsDocument8 pagesFSQsNikesh KunwarNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- Corporate Reporting Past Question Papers (ICAB)Document55 pagesCorporate Reporting Past Question Papers (ICAB)Md. Zahidul Amin100% (1)

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- CH 04Document9 pagesCH 04Antonios FahedNo ratings yet

- AFA IIP.L IIIQuestion June 2016Document4 pagesAFA IIP.L IIIQuestion June 2016HossainNo ratings yet

- Audit of IntangiblesDocument2 pagesAudit of IntangiblesJaycee FabriagNo ratings yet

- Acctg 102 Prelim Exam With SolutionsDocument12 pagesAcctg 102 Prelim Exam With SolutionsYsabel ApostolNo ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- FR Question Pack of Learn SignalDocument53 pagesFR Question Pack of Learn SignalJayshree ArumugamNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- FFA MockDocument4 pagesFFA MockGeeta LalwaniNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Revision Exam Questions and Marking GuidesDocument11 pagesRevision Exam Questions and Marking GuidesAamir SaeedNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- Quiz 1 Final PeriodDocument10 pagesQuiz 1 Final PeriodCmNo ratings yet

- Paper - 1: Advanced Accounting: TH STDocument22 pagesPaper - 1: Advanced Accounting: TH STapi-26288410No ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- T4 AkuntansiDocument3 pagesT4 AkuntansiYusuf HadiNo ratings yet

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocument14 pagesMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasNo ratings yet

- IAS 8 TestDocument3 pagesIAS 8 TestPervaiz AkhterNo ratings yet

- Ch10 ProblemDocument2 pagesCh10 ProblempalashndcNo ratings yet

- Unit 1 2018 Paper 2Document9 pagesUnit 1 2018 Paper 2Pettal BartlettNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Review Questions Ias 1 & Ias 7Document7 pagesReview Questions Ias 1 & Ias 7hajiraj504No ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- Q.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Document11 pagesQ.1) The Following Trial Balance Has Been Extracted From The Books of Rajesh On 31st December, 2016Aarya Khedekar100% (2)

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Document6 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Shubham KuberkarNo ratings yet

- ACCT 101 - Assignment Question (13861)Document5 pagesACCT 101 - Assignment Question (13861)Aneziwe ShangeNo ratings yet

- Drafting Financial Statements (International Stream) : Monday 1 December 2008Document9 pagesDrafting Financial Statements (International Stream) : Monday 1 December 2008salaam7860No ratings yet

- Topic Test-RatioDocument4 pagesTopic Test-RatioGodfreyFrankMwakalingaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Tak Mungkin MencariDocument3 pagesTak Mungkin Mencarishesqa_903684No ratings yet

- TABB Group Report - Institutional Brokerage ProfitabilityDocument21 pagesTABB Group Report - Institutional Brokerage ProfitabilityMarlon WeemsNo ratings yet

- Health and Safety Policy DocumentDocument4 pagesHealth and Safety Policy DocumentbnmqweNo ratings yet

- The AtekPC PMO CaseDocument2 pagesThe AtekPC PMO Casefervenegas2012100% (1)

- Lesson 1 AP: Minimum Composition of The SFP and Some Audit NotesDocument14 pagesLesson 1 AP: Minimum Composition of The SFP and Some Audit NotesAireese0% (1)

- Jay Abraham May 2006 Presentation SlidesDocument169 pagesJay Abraham May 2006 Presentation SlidesLeon Van Tubbergh100% (4)

- Strategic Management Model ExamDocument82 pagesStrategic Management Model ExamSidhu Asesino86% (7)

- MATH Practice With Answer (Besavilla)Document121 pagesMATH Practice With Answer (Besavilla)aj100% (1)

- Case Study On Rural Marketing - Ravi From P.b.siddhartha, VijayawadaDocument20 pagesCase Study On Rural Marketing - Ravi From P.b.siddhartha, VijayawadaRavi75% (4)

- TATA - STEEL - Group 5Document7 pagesTATA - STEEL - Group 5Sidhant NayakNo ratings yet

- 8963 36Document37 pages8963 36OSDocs2012No ratings yet

- Tara Machines BrochureDocument8 pagesTara Machines BrochureBaba Jee Shiva ShankarNo ratings yet

- R26 CFA Level 3Document12 pagesR26 CFA Level 3Ashna0188No ratings yet

- Quantitative TechiniquesDocument38 pagesQuantitative TechiniquesJohn Nowell Diestro100% (3)

- Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Document5 pagesHalf Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 201 Half Yearly Examination, 2018 8 8 8 - 19 19 19 19Krish BansalNo ratings yet

- 00 Tapovan Advanced Accounting Free Fasttrack Batch BenchmarkDocument144 pages00 Tapovan Advanced Accounting Free Fasttrack Batch BenchmarkDhiraj JaiswalNo ratings yet

- Testimonial YakultDocument3 pagesTestimonial YakultRahmanTigerNo ratings yet

- Contoh CLDocument1 pageContoh CLsuciatyfaisalNo ratings yet

- Satyam Cnlu Torts RoughdraftDocument4 pagesSatyam Cnlu Torts RoughdraftSatyam OjhaNo ratings yet

- Financial Accounting Reviewer - Chapter 60Document15 pagesFinancial Accounting Reviewer - Chapter 60Coursehero Premium100% (1)

- Paytm Payment Solutions - Feb15Document30 pagesPaytm Payment Solutions - Feb15AlienOnEarth123100% (1)

- Test Code: ME I/ME II, 2009Document15 pagesTest Code: ME I/ME II, 2009paras hasijaNo ratings yet

- FEBRUARY 2020 Surplus Record Machinery & Equipment DirectoryDocument717 pagesFEBRUARY 2020 Surplus Record Machinery & Equipment DirectorySurplus RecordNo ratings yet

- Article 1822, 1823, and 1824Document3 pagesArticle 1822, 1823, and 1824maria cruzNo ratings yet

- Some Moderating Effects On The Service Quality-Customer Retention LinkDocument19 pagesSome Moderating Effects On The Service Quality-Customer Retention Linksajid bhattiNo ratings yet

- Horasis Global India Business Meeting 2010 - Programme BrochureDocument32 pagesHorasis Global India Business Meeting 2010 - Programme BrochuresaranshcNo ratings yet

- NIT PMA NagalandDocument15 pagesNIT PMA NagalandBasantNo ratings yet

- 0.1 ADMIN1GMBH CallCenter PDFDocument5 pages0.1 ADMIN1GMBH CallCenter PDFKent WhiteNo ratings yet

- Organizational Behavior: Nimra WaseemDocument32 pagesOrganizational Behavior: Nimra Waseemaditya tripathiNo ratings yet

- Invoice INV-0030Document1 pageInvoice INV-0030Threshing FlowNo ratings yet