Professional Documents

Culture Documents

GST 18 Percent CPWD Order

Uploaded by

mymagzine0 ratings0% found this document useful (0 votes)

2K views1 pageGST Order

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGST Order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views1 pageGST 18 Percent CPWD Order

Uploaded by

mymagzineGST Order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

g

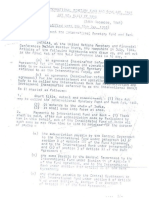

OFFICE MEMORANDUM

No, DGISE/GST! | 6

ISSUED BY AUTHORITY OF DIRECTOR GENERAL, CPWD

NIRM, NEW DELHI ated:

Sub:- Clarification of GST — Regarding.

In continuation to OM SE/TAS/GST/O7 dated 8-11-2017 it has been decided to adopt the following guidelines in

case applicable GST on works contract is 18 %

[[EiNo.__| Work Position ‘Action to be taken ]

1. | Method of calculation oF | The agency will submit the detail of statement along with Analysis

market rates (wherever | of rates as per model calculation sheet along with necessary

applicable) for extra | authenticated documentary proofs of Engineer- in ~ charge

| items/substitute items —/ | Model Calculation Sheet

| deviation items beyond the |{ 1. | Bare rate (without GST) OF Material

| permissible limit, justification Labour, Sundries POL and T&P ete.

etc executed after the || 2, | Add 1% water charges on “W" 7x

commencement of GST with |3.—['Sum after adding Water Charges @1 | "WO=IW =A)

effect from 01/07/2017. (This %on"w"

model calculation is || 18% GST applicable on work contract | "B=(0.2127°WO)

applicable only where the by reversible method (multiplying

GST is @ 18% on Work factor 0.2127)

\contracts:)) 5._| Sum after adding GST “X"=(WC+B)

6. | 15%CP&OHon "x" “Cc

7._| Sum after adding 15 % CPROH “Y"=(X+C)

B.__| Labour cess @1% on 70"

9. | Gross total after adding 1 % labour | “Z”=(¥+D)

Note :-1.Multiplying factor 0.2127 considered for reversible calculation of GST so that 18 %/GST on gross

amount excluding 1 % labour cess is worked out.

LK

Superintending @neeTTAS)

CSQ,CPWO, Nirman Bhawan

New Delhi

Dated 9

Noi58/GST/SE(TAS)/CPWo/2018/ && Sofie

Efile Not 9043757

Copy to:-

All the SOGs all the ADGs All the CEs CPWO/€ & C(PWOJGNCTD through CPWD web site for information

please,

Superintending Engineer (TAS)

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Kanhaiya Lal Sahu VDocument8 pagesKanhaiya Lal Sahu VmymagzineNo ratings yet

- Covid 19 Ebook PDFDocument22 pagesCovid 19 Ebook PDFRabi Sankar SahaNo ratings yet

- COVID-19 Healthcare Planning ChecklistDocument11 pagesCOVID-19 Healthcare Planning ChecklistGav4saxNo ratings yet

- Kanhaiya Lal Sahu VDocument8 pagesKanhaiya Lal Sahu VmymagzineNo ratings yet

- COVID 19 Crisis PDFDocument4 pagesCOVID 19 Crisis PDFmymagzineNo ratings yet

- PDFDocument1 pagePDFmymagzineNo ratings yet

- PDFDocument1 pagePDFmymagzineNo ratings yet

- 001 PptarDocument13 pages001 PptarmymagzineNo ratings yet

- PDFDocument1 pagePDFmymagzineNo ratings yet

- Tendernotice 1Document80 pagesTendernotice 1mymagzineNo ratings yet

- Adb1 - 0Document72 pagesAdb1 - 0mymagzineNo ratings yet

- IMFbankAct1945 SW 0Document8 pagesIMFbankAct1945 SW 0mymagzineNo ratings yet

- PPR Help File OnlineDocument2 pagesPPR Help File OnlinemymagzineNo ratings yet

- Ifcmiga - 0Document7 pagesIfcmiga - 0mymagzineNo ratings yet

- Ida 0Document9 pagesIda 0mymagzineNo ratings yet

- Continuance of 108 - 95 Ce10-2017Document1 pageContinuance of 108 - 95 Ce10-2017mymagzineNo ratings yet

- Project Readiness Checklist For Projects Aided by Multi-Lateral Financing Institutions (MFI)Document3 pagesProject Readiness Checklist For Projects Aided by Multi-Lateral Financing Institutions (MFI)mymagzineNo ratings yet

- Handbook On GST Rules - 3rd Edn - CA Pritam MahureDocument138 pagesHandbook On GST Rules - 3rd Edn - CA Pritam Mahureminushastri33No ratings yet

- Adb1 - 0Document72 pagesAdb1 - 0mymagzineNo ratings yet

- Procurement Risk Framework WBDocument78 pagesProcurement Risk Framework WBmymagzineNo ratings yet

- Report CIAampCCS of Beas Sub Basin in HP CompressedDocument664 pagesReport CIAampCCS of Beas Sub Basin in HP CompressedmymagzineNo ratings yet

- Cabinet Ministers 2016Document4 pagesCabinet Ministers 2016saurabh887No ratings yet

- Test DocumentDocument1 pageTest DocumentmymagzineNo ratings yet

- Continuance of 108 - 95 Ce10-2017Document1 pageContinuance of 108 - 95 Ce10-2017mymagzineNo ratings yet

- Jan Dhan UpdatesDocument1 pageJan Dhan UpdatesmymagzineNo ratings yet

- Test DocumentDocument1 pageTest DocumentmymagzineNo ratings yet

- Test DocumentDocument1 pageTest DocumentmymagzineNo ratings yet

- Test DocumentDocument1 pageTest DocumentmymagzineNo ratings yet

- MTDC - Projects - Tender Notice-Nerurpar Luxury House Boat (FRP)Document12 pagesMTDC - Projects - Tender Notice-Nerurpar Luxury House Boat (FRP)mymagzineNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)