Professional Documents

Culture Documents

Credit Card Operations Policy

Uploaded by

Sawon0 ratings0% found this document useful (0 votes)

34 views4 pagesCredit card details

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCredit card details

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views4 pagesCredit Card Operations Policy

Uploaded by

SawonCredit card details

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

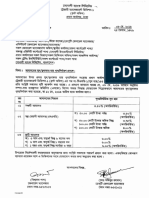

3 NRB Bank Credit Cards Operations Policy

Not et Another Bank fe eter een

%& NRB Bank

Not Just Another Bank

Credit Cards Operations Policy

(To Publish in NRB Bank Website: www.nrbbankbd.com)

Version Web 1.0

18” December 2017

IT & ADC Operations Department

NRB Bank Limited

Corporate Head Office, 89, Gulshan Avenue

Simple Tree Anarkali, Gulshan-1, Dhaka

ales of

3 NRB Bank Credit Cards Operations Policy

Not rt Another Bank Version: web 1.0

Introduction:

The purpose of this document is to describe the life cycle credit card from new file process to Card

Delivery, Dispute Management and collection and recovery. This document will also help the card

holder to understand the internal process and policies of NRB Bank Limited.

Preface:

Version | Description ‘Author Supervisor

Ma. Khirul islam Ashraf Siddique

Web 1.0 SPO, IT 8 ADC Operations, SAVP, IT & ADC Operations

Mad Zakir Hossain |

| | | sPo, card Division

Process included the below Credit Card Operation Policies:

+ New Credit Card Application Process

+ Customer Service Operations process

+ Disputes Management process

+ Collection & Recovery Policy

Information/Help:

Guest / Customer can communicate with us for any assistance through below channels:

1. 24/7 Call Center:

‘a. Long Code : +880 966645 6000

b. Short Code: 16568

2. Email

a. CallCenter@nrbbankbd.com

b. Info@nrbbankbd.com

3. Outlet:

a. Any NRB Bank's Branch,

For further details guest/customer can visit the below web URL

http://www nrbbankbd.com/credit-card)

fie

36 NRB Bank rd 05 Poli

Or nee eter Ba : Version: web 1.0

‘New Credit Card Application Process

‘Steps | Descriptions ‘Owner

Customer |= Customer wiling to have NRBB Credit Cards, submit a request to NRBB Card Card

Request Business team (Sales Executive/ Branch) with properly filled up the application form | Business

poe along with mandatory documents. For detail dial 16568 or visit Team

www.nrbbankd.com

+ Card business team checked and verify the application file and documents and

submit the file to CRM after duly signed by sourcing Officer and Manager.

cre * CRM review the file, check documents authenticity, conduct the customers CPV | CRM

Card Limit | through third party orin house and ensure other formalities etc.

Beprovel te ion passed all the necessary requirements as per approved PPG, CRM

or that file and sent the file to ADC Ops. |

Card |= ADC Operation received the approved application from CRM and create acardin | ADC

Creation | CMSandassigned Limit. Operations

& Deliver |. aDC Operations print the card and arrange to deliver the card & PIN to cardholder's

requested address through courier

Card |* Cardholder call at NRBB Call center from his/her registered phone number to Call Center

Activation | activate the card after receiving from courier

+ Call center agents verity cardholder's necessary informations and activate the card

in system once confirmed genuineness of the customer

Customer Service Operations process

Steps | Descriptions ‘Owner

Cardholde |= Cardholder submit Card service request to NRBB branch or Call center Branch, |

Pemce 4 BranchjCall Center forward the Card service request to ADC operations through | SU Center |

eques ADC Operations Service Desk system with a tracking 1D |

Request |* ADC Operations received the request from ADC Operations Service Desk system and | ADC |

Execution | arrange to execute the request within shortest possible time. Operations |

+ ADC Operations will execute the request within 2 to 5 working days and update

status with resolve remarks. |

* Branch/Call center will be automatically informed via reply mail through ADC |

Operations Service Desk system once request is resolve/clased in system |

2IPage

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Freft: QFR (: ODocument1 pageFreft: QFR (: OSawonNo ratings yet

- Privacy Policy - Rider: Who Is The Data Controller?Document9 pagesPrivacy Policy - Rider: Who Is The Data Controller?SawonNo ratings yet

- Heading 2: "Quote"Document1 pageHeading 2: "Quote"SawonNo ratings yet

- Intt Rates PDFDocument7 pagesIntt Rates PDFMilon MahmudNo ratings yet

- 1814 01884499330 Bar24693401856410005 9AC40UQKFIDocument1 page1814 01884499330 Bar24693401856410005 9AC40UQKFISawonNo ratings yet

- Emailing Panasonic Door Operator AAD0302DKT01 NSFC01 01 PDFDocument14 pagesEmailing Panasonic Door Operator AAD0302DKT01 NSFC01 01 PDFاحمد المقرمي100% (1)

- RFQ 5446-25-03-2019 - Servicing of Refrigeration EquimentDocument12 pagesRFQ 5446-25-03-2019 - Servicing of Refrigeration EquimentSawonNo ratings yet

- NICE3000Document322 pagesNICE3000SawonNo ratings yet

- Stamford AVR SX460 PDFDocument4 pagesStamford AVR SX460 PDFNasredine AlainNo ratings yet

- IGV Lift Service KitDocument3 pagesIGV Lift Service KitSawonNo ratings yet

- Number of ElevatorDocument1 pageNumber of ElevatorSawonNo ratings yet

- IGV DomusLift Service Kit PDFDocument4 pagesIGV DomusLift Service Kit PDFSawon0% (1)

- Inverter TG e 1 1 PDFDocument10 pagesInverter TG e 1 1 PDFSawonNo ratings yet

- Preliminary AdmitCard 2016 2017 PRELE 3264532Document2 pagesPreliminary AdmitCard 2016 2017 PRELE 3264532SawonNo ratings yet

- Application Form: National UniversityDocument1 pageApplication Form: National UniversitySawonNo ratings yet

- Baublys Messeflyer 2seitig BL3000 EN PDFDocument2 pagesBaublys Messeflyer 2seitig BL3000 EN PDFSawonNo ratings yet

- Application Form: National UniversityDocument1 pageApplication Form: National UniversitySawonNo ratings yet

- Baublys Messeflyer 2seitig BL3000 EN PDFDocument2 pagesBaublys Messeflyer 2seitig BL3000 EN PDFSawonNo ratings yet

- Number of ElevatorDocument1 pageNumber of ElevatorSawonNo ratings yet

- J12-1000 A 07-3.1Document99 pagesJ12-1000 A 07-3.1SawonNo ratings yet

- Wildcat (BL2000) : User's ManualDocument94 pagesWildcat (BL2000) : User's ManualSawonNo ratings yet

- SIEP-C710617 - 05 GA700 Technical ManualDocument940 pagesSIEP-C710617 - 05 GA700 Technical ManualSawon100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)