Professional Documents

Culture Documents

LRTA V CBAA Report

Uploaded by

Agatha Bernice MacalaladOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LRTA V CBAA Report

Uploaded by

Agatha Bernice MacalaladCopyright:

Available Formats

Agatha Bernice G.

Macalalad December 10, 2013

11186569 Taxation Law II

LIGHT RAIL TRANSIT AUTHORITY, petitioner, vs. CENTRAL BOARD OF ASSESSMENT APPEALS,

BOARD OF ASSESSMENT APPEALS OF MANILA and the CITY ASSESSOR OF

MANILA, respondents.

[G.R. No. 127316. October 12, 2000, PANGANIBAN, J.:]

FACTS:

Light Rail Transit Authority (LRTA) is a government-owned and controlled corporation created and

organized under E.O. No. 603. It provides that LRTA is responsible for the construction, operation,

maintenance and/or lease of light rail transit system in the Philippines. It fulfilment of its purpose it

acquired real properties and eventually constructed structural improvements including buildings,

carriageways, passenger terminal stations, and installed various kinds of machinery and equipment and

facilities in order to operate.

In 1984, the City Assessor of Manila assessed the real properties of LRTA including the

improvements it constructed and installed, as provided in the Real Property Tax Code, commencing with

the year 1985. LRTA paid almost all the real property taxes except the taxes for the carriageways and

passenger terminal stations. It reasoned that those properties are not real properties under the Real

Property Tax Code being for public use or purpose, but the City Assessor denied the claim.

LRTA appealed with the Local Board of Assessment Appeals of Manila (LBAA-Manila) but was

also denied by the latter. LBAA-Manila held that the carriageways and passenger terminal stations are

improvements; thus they are real property under the Real Property Tax Code. The Court of Appeals (CA)

also denied the appeal of LRTA. CA added to the ruling of the LBAA-Manila that the properties in question

were not owned by the government; thus no exemption should be given. The CA also held that LRTA is a

taxable entity and it uses the LRT system for its benefit. Lastly the CA explained that LRTA is a profit-

oriented enterprise who only serves those paying the fare.

ISSUE: Whether LRTA’s carriageways and passenger terminal stations are subject to real property taxes.

HELD:

Both carriageways and passenger terminal stations are subject to real property taxes. The

Supreme Court raised three points in its ruling:

First, the improvements in question are real property due to its characteristics. For tax purposes

the concept of industrial accession as pointed out by LRTA is not important, rather it should be

determined based on the real property’s incidents and from its natural and legal effects. As illustrated in

the case, the carriageways and passenger terminal stations despite its attachment to public roads still

shows its physical separability being elevated structures and inaccessible to the public. The Court further

pointed out that the accessibility of public roads are different from the improvements since the latter are

accessible to the train and its passengers.

Second, the basis of assessment or its actual use of the properties are for those who can afford

the fare. The LRT is different with public roads as to its actual use. Public roads are freely utilized by all

types of vehicles and people, but the improvements made by are only accessible to trains and those who

can afford the fare imposed.

Third, LRTA failed to show proof that it can claim exemption from real property tax. An important law

pointed out by the Court was E.O. No. 603 which created and organized LRTA, but it did not state that it

can claim exemption from real property taxes. Article 4 of E.O. No. 603 only provides exemption as to

direct and indirect taxes, duties or fees in connection with the importation of equipment not locally

available. The Court also held at this point that pretending that the national government owns the

improvements, LRTA cannot be granted exemption because it operates like a private corporation

engaged in mass transport industry; wherein it is clothed with corporate status and power in fulfilment of

its proprietary purpose. Thus LRTA is a taxable entity.

Given all the points raised by Supreme Court, it only goes to shows that the City Assessor of

Manila was correct in including the carriageways and passenger terminal stations in the assessment for

real property taxes.

You might also like

- Santos Vs LumbaoDocument2 pagesSantos Vs LumbaoAgz Macalalad100% (1)

- City Assessor of Cebu City vs. Association of Benevola de Cebu 152904Document1 pageCity Assessor of Cebu City vs. Association of Benevola de Cebu 152904magenNo ratings yet

- CIR Vs de La SalleDocument2 pagesCIR Vs de La SalleOlenFuerte100% (6)

- 1 Case Digest of Nursery Care Vs AcevedoDocument2 pages1 Case Digest of Nursery Care Vs AcevedoChrissy Sabella100% (2)

- CIR vs. Pilipinas ShellDocument3 pagesCIR vs. Pilipinas ShellArchie Torres88% (8)

- City of Lapu-Lapu Vs PezaDocument3 pagesCity of Lapu-Lapu Vs PezaAerwin Abesamis100% (2)

- Jurisdiction Tax CaseDocument13 pagesJurisdiction Tax CaseCharmila SiplonNo ratings yet

- NARIC v. MACADAEG G. R. No. L-9025 - September 27 - 1957Document4 pagesNARIC v. MACADAEG G. R. No. L-9025 - September 27 - 1957poppo1960100% (2)

- CIR V Liquigaz Philippines CorporationDocument3 pagesCIR V Liquigaz Philippines CorporationAya BaclaoNo ratings yet

- Howden BrochureDocument14 pagesHowden BrochureBrent Collins100% (1)

- 4971326Document4 pages4971326franklin97250% (2)

- Railway Projects AfricaDocument23 pagesRailway Projects Africarjkmehta100% (1)

- LRTA vs. CBAADocument2 pagesLRTA vs. CBAAKath LeenNo ratings yet

- Rcpi VS Provincial AssessorDocument3 pagesRcpi VS Provincial AssessorKath LeenNo ratings yet

- Pepsi-Cola Vs Municipality of Tanauan DigestDocument3 pagesPepsi-Cola Vs Municipality of Tanauan DigestRyan Acosta100% (1)

- 10 OCEANIC WIRELESS NETWORK Vs CIRDocument3 pages10 OCEANIC WIRELESS NETWORK Vs CIRIsh100% (1)

- Oceanic Wireless v. CIRDocument2 pagesOceanic Wireless v. CIRlesterjethNo ratings yet

- #33 CIR Vs British Overseas Airways CorporationDocument2 pages#33 CIR Vs British Overseas Airways CorporationTeacherEliNo ratings yet

- NPC V Province of Quezon - TAX 2 - GR 171586 - Exemption From Real Property TaxDocument2 pagesNPC V Province of Quezon - TAX 2 - GR 171586 - Exemption From Real Property TaxJoyceNo ratings yet

- Cir vs. Dash Engineering Philippines, IncDocument2 pagesCir vs. Dash Engineering Philippines, InclexxNo ratings yet

- Allied Banking Vs The Quezon City Government, Et Al. (G.R. No. 154126, OCTOBER 11, 2005) FactsDocument1 pageAllied Banking Vs The Quezon City Government, Et Al. (G.R. No. 154126, OCTOBER 11, 2005) FactsHonorio Bartholomew Chan100% (1)

- Meralco vs. BarlisDocument3 pagesMeralco vs. BarlisMari Erika Joi BancualNo ratings yet

- CIR vs. PHILEXDocument2 pagesCIR vs. PHILEXBarem Salio-anNo ratings yet

- CIR v. MarubeniDocument9 pagesCIR v. MarubeniMariano RentomesNo ratings yet

- TRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSDocument2 pagesTRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSNFNLNo ratings yet

- Chamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloDocument2 pagesChamber of Real Estate and Builders' Assoc. Vs Hon. Exec. Sec. Alberto RomuloRhea Mae Lasay-Sumpiao100% (1)

- CIR vs. ST Lukes DigestDocument2 pagesCIR vs. ST Lukes DigestKath Leen100% (4)

- Case Digest CIR v. DashDocument2 pagesCase Digest CIR v. DashLIERANo ratings yet

- Cir V CTA and PetronDocument2 pagesCir V CTA and PetronRia Evita Revita100% (1)

- Hagonoy Market Vendor Association Vs Municipality of HagonoyDocument3 pagesHagonoy Market Vendor Association Vs Municipality of HagonoyRaymond Roque100% (2)

- Mannasoft v. CirDocument2 pagesMannasoft v. CirluckyNo ratings yet

- Herrera vs. Quezon City Board of Assessment AppealsDocument1 pageHerrera vs. Quezon City Board of Assessment AppealsGeoanne Battad Beringuela100% (3)

- CIR V St. Luke's G.R. No. 195909, 195960Document2 pagesCIR V St. Luke's G.R. No. 195909, 195960Emmanuel Yrreverre100% (1)

- BPI v. CIR, G.R. No. 139736Document2 pagesBPI v. CIR, G.R. No. 139736shookt panboi100% (3)

- St. Luke's Medical Center Vs CIR G.R. No. 203514: Sec 22 To 30Document1 pageSt. Luke's Medical Center Vs CIR G.R. No. 203514: Sec 22 To 30Anonymous MikI28PkJcNo ratings yet

- Yamane Vs BA Lepanto DIGESTDocument1 pageYamane Vs BA Lepanto DIGESTJazem Ansama100% (1)

- City of Pasig v. RepublicDocument1 pageCity of Pasig v. RepublicAiza OrdoñoNo ratings yet

- CIR v. Univation, GR 231581, 10 Apr 2019Document4 pagesCIR v. Univation, GR 231581, 10 Apr 2019Dan Millado100% (2)

- City of Pasig vs. PCGG (G.r. No. 185023)Document3 pagesCity of Pasig vs. PCGG (G.r. No. 185023)Ray John Uy-Maldecer AgregadoNo ratings yet

- Vat Part IDocument37 pagesVat Part IXhin CagatinNo ratings yet

- Part C 1 - CIR Vs Avon Products ManufacturingDocument4 pagesPart C 1 - CIR Vs Avon Products ManufacturingCyruz Tuppal75% (4)

- (TAX) Matalin Coconut vs. Municipal Council of MalabangDocument1 page(TAX) Matalin Coconut vs. Municipal Council of Malabangthornapple25100% (1)

- BIR vs. CA, Spouses ManlyDocument1 pageBIR vs. CA, Spouses ManlyMich PadayaoNo ratings yet

- 10) MIAA Vs CA GR No. 163072Document2 pages10) MIAA Vs CA GR No. 163072123abc456defNo ratings yet

- Provincial Assessor of Marinduque vs. Court of AppealsDocument4 pagesProvincial Assessor of Marinduque vs. Court of AppealsiwamawiNo ratings yet

- MIAA Vs - CIty of ParanaqueDocument3 pagesMIAA Vs - CIty of ParanaqueKath Leen100% (2)

- CIR vs. Enron Subic Power CorporationDocument1 pageCIR vs. Enron Subic Power CorporationArthur Archie TiuNo ratings yet

- 3.s No. 24 Aratuc V Comelec, 88 Scra 251Document2 pages3.s No. 24 Aratuc V Comelec, 88 Scra 251Jun Jun0% (1)

- Smart Vs Municipality of Malvar - Case DigestDocument2 pagesSmart Vs Municipality of Malvar - Case DigestPrieti HoomanNo ratings yet

- Taxation 2017 Bar Q ADocument18 pagesTaxation 2017 Bar Q AImma Foosa50% (2)

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Asia Trust V CIRDocument2 pagesAsia Trust V CIRReena Ma100% (1)

- Petron v. TiangcoDocument1 pagePetron v. TiangcoCates013No ratings yet

- Spouses Pacquiao vs. Court of Tax AppealsDocument1 pageSpouses Pacquiao vs. Court of Tax AppealsMaja ConcioNo ratings yet

- Cir v. Febtc DigestDocument2 pagesCir v. Febtc DigestNelly HerreraNo ratings yet

- Tax Rev Digest Mindanao II Geothermal Partnership V CirDocument4 pagesTax Rev Digest Mindanao II Geothermal Partnership V CirCalypso75% (4)

- Lepanto ConsolidatedDocument2 pagesLepanto ConsolidatedFreah Genice TolosaNo ratings yet

- Tax Finals ReviewerDocument51 pagesTax Finals ReviewerCelestino Law100% (2)

- Figuerres v. CADocument3 pagesFiguerres v. CAkathrynmaydevezaNo ratings yet

- LRTA v. CBAADocument1 pageLRTA v. CBAAIaxe Guinsatao AbadNo ratings yet

- Light Rail Transit Authority Central Board of Assessment AppealsDocument11 pagesLight Rail Transit Authority Central Board of Assessment AppealsPatatas SayoteNo ratings yet

- LRTA Vs CBAADocument5 pagesLRTA Vs CBAAMarc Cedric CaabayNo ratings yet

- Pascual Vs Secretary of Works Refer To ShekinaDocument5 pagesPascual Vs Secretary of Works Refer To ShekinaNorman jOyeNo ratings yet

- LRTA Vs CBAADocument7 pagesLRTA Vs CBAAJennifer Marie Columna BorbonNo ratings yet

- Ando V DFA (Family Code - Marriage - Foreign Marriages and Divorce)Document2 pagesAndo V DFA (Family Code - Marriage - Foreign Marriages and Divorce)Agz MacalaladNo ratings yet

- Authorization Letter SampleDocument1 pageAuthorization Letter SampleAgz MacalaladNo ratings yet

- Petition For Notarial SampleDocument3 pagesPetition For Notarial SampleAgz MacalaladNo ratings yet

- PERSONS 38.catalan Vs BasaDocument2 pagesPERSONS 38.catalan Vs BasaAgz MacalaladNo ratings yet

- 178 Verdad Vs CADocument2 pages178 Verdad Vs CAAgz MacalaladNo ratings yet

- Echavez V Dozen CorporationDocument1 pageEchavez V Dozen CorporationAgz MacalaladNo ratings yet

- Alliance For Nationalism and Democracy (Anad) Vs ComelecDocument2 pagesAlliance For Nationalism and Democracy (Anad) Vs ComelecAgz Macalalad100% (1)

- Asia Brewery Vs SMCDocument2 pagesAsia Brewery Vs SMCAgz MacalaladNo ratings yet

- PERSONS 14. Yinlu Bicol Vs TransAsiaDocument3 pagesPERSONS 14. Yinlu Bicol Vs TransAsiaAgz Macalalad100% (1)

- Mentholatum v. MangalimanDocument2 pagesMentholatum v. MangalimanAgz Macalalad100% (2)

- Teves Vs ComelecDocument3 pagesTeves Vs ComelecAgz MacalaladNo ratings yet

- CRIMPRO - Jurisdiction - Escobal v. GarchitorenaDocument2 pagesCRIMPRO - Jurisdiction - Escobal v. GarchitorenaAgz MacalaladNo ratings yet

- Grapilon V Municipal Council of CarigaraDocument2 pagesGrapilon V Municipal Council of CarigaraAgz MacalaladNo ratings yet

- Heirs of Gabatan V CADocument2 pagesHeirs of Gabatan V CAAgz MacalaladNo ratings yet

- Remrev - Crimpro Rule 120 Judgment People Vs AsisDocument2 pagesRemrev - Crimpro Rule 120 Judgment People Vs AsisAgz MacalaladNo ratings yet

- Estate of Hilario Ruiz Vs CADocument2 pagesEstate of Hilario Ruiz Vs CAAgz MacalaladNo ratings yet

- Carlos Lim Kalaw Died IntestateDocument1 pageCarlos Lim Kalaw Died IntestateAgz MacalaladNo ratings yet

- Malayan Insurance V CADocument2 pagesMalayan Insurance V CAAgz MacalaladNo ratings yet

- MLPAI V AlmendrasDocument2 pagesMLPAI V AlmendrasAgz Macalalad100% (2)

- Sps Cha Vs CADocument1 pageSps Cha Vs CAAgz MacalaladNo ratings yet

- Fluemer V Hix - DigestDocument1 pageFluemer V Hix - DigestAgz MacalaladNo ratings yet

- PNB V CADocument1 pagePNB V CAAgz MacalaladNo ratings yet

- Natcher V CA DigestDocument2 pagesNatcher V CA DigestAgz Macalalad100% (1)

- Figuracion-Gerilla V Vda. Figuracion - DigestDocument2 pagesFiguracion-Gerilla V Vda. Figuracion - DigestAgz Macalalad100% (1)

- Arbolario V CA - DigestDocument2 pagesArbolario V CA - DigestAgz MacalaladNo ratings yet

- Pereira V CA - DigestDocument1 pagePereira V CA - DigestAgz Macalalad100% (2)

- Alaban V CA - DigestDocument2 pagesAlaban V CA - DigestAgz MacalaladNo ratings yet

- Fule V CA - Net DigestDocument2 pagesFule V CA - Net DigestAgz MacalaladNo ratings yet

- Digital Twin Manuf ResearchDocument10 pagesDigital Twin Manuf ResearchG U RajuNo ratings yet

- Evolving Benchmarking Practices: A Review For Research PerspectivesDocument20 pagesEvolving Benchmarking Practices: A Review For Research PerspectivesYiwen Low0% (1)

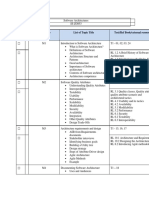

- Content Structure Module No List of Topic Title Text/Ref Book/external ResourceDocument3 pagesContent Structure Module No List of Topic Title Text/Ref Book/external ResourcereaderNo ratings yet

- Cafco 300 UL N800 - BeamDocument3 pagesCafco 300 UL N800 - BeamTanmay GorNo ratings yet

- Structural Civil Engineer - Sample CV 2Document3 pagesStructural Civil Engineer - Sample CV 2ArnabNo ratings yet

- DuopolyDocument25 pagesDuopolyVishalGuptaNo ratings yet

- 1TechnicalBid T6 PDFDocument340 pages1TechnicalBid T6 PDFKanha GargNo ratings yet

- Offshore Cargo HandlingDocument51 pagesOffshore Cargo HandlingAnonymous n5yCH2SNo ratings yet

- PPI Technical Guide 01 Five LeversDocument21 pagesPPI Technical Guide 01 Five LeversMilagros PortugalNo ratings yet

- MilkoScan FTplus Datasheet - GBDocument2 pagesMilkoScan FTplus Datasheet - GBAndreea AlecsandraNo ratings yet

- PROJECT REPORT ON Streamlining The Sewing Floor LayoutDocument44 pagesPROJECT REPORT ON Streamlining The Sewing Floor LayoutApurv Sinha100% (3)

- Chapter 1Document84 pagesChapter 1CharleneKronstedtNo ratings yet

- SP-2000 Version 3Document122 pagesSP-2000 Version 3Arun YesodharanNo ratings yet

- Automotive Industry Sustainability Reports: A Comparison of Brazilian and German FactoriesDocument21 pagesAutomotive Industry Sustainability Reports: A Comparison of Brazilian and German FactoriesnelnunvidNo ratings yet

- November/December 2016Document72 pagesNovember/December 2016Dig DifferentNo ratings yet

- TeB1 TEB2Document4 pagesTeB1 TEB2Luiz AlmeidaNo ratings yet

- Kmet SHDocument1 pageKmet SHJ B PatelNo ratings yet

- GPS WorldDocument52 pagesGPS Worldegsamir1075No ratings yet

- How To Change ASM SYS Password and Creating SYSASM User 11gDocument10 pagesHow To Change ASM SYS Password and Creating SYSASM User 11gbaraka08No ratings yet

- SATIP-H-100-01 Rev 7Document2 pagesSATIP-H-100-01 Rev 7Satheesh Rama SamyNo ratings yet

- European Pressure Equipment Directive 97-23-ECDocument3 pagesEuropean Pressure Equipment Directive 97-23-ECYavuzRNo ratings yet

- Tissot CatalogDocument92 pagesTissot CatalogcabrerocNo ratings yet

- 33 - TDS - Thoro WaterplugDocument3 pages33 - TDS - Thoro WaterplugOgbedande Awo OrunmilaNo ratings yet

- Quotation: No.21/1B, Block E, Anumepalli, Zuzuvadi, Sipcot - (Post) Hosur. Tamilnadu - 635126 9948998400Document8 pagesQuotation: No.21/1B, Block E, Anumepalli, Zuzuvadi, Sipcot - (Post) Hosur. Tamilnadu - 635126 9948998400dilipNo ratings yet

- Manual Baño Refrigerante Polystat Cole ParmerDocument116 pagesManual Baño Refrigerante Polystat Cole Parmerlacarito94No ratings yet

- Project Report On Hero BikesDocument53 pagesProject Report On Hero Bikeshariom sharmaNo ratings yet

- Waterproofing SystemsDocument4 pagesWaterproofing SystemsfairmatechemicalNo ratings yet