Professional Documents

Culture Documents

12 Accountancy Ch03 Test Paper 02 Treatment of Goodwill

Uploaded by

Sachin AlmalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Accountancy Ch03 Test Paper 02 Treatment of Goodwill

Uploaded by

Sachin AlmalCopyright:

Available Formats

Test Papers Designed By : Dr. Vinod Kumar (e-mail : authorcbse@gmail.

com)

Dr. Vinod Kumar is a great name in the field of Accountancy.

He is author of very popular book “Ultimate Book of Accountancy” class 12th and 11th.

Contact Detail : Vishvas Publications 09216629576 and 09256657505

Website : http://bestaccountancybook.in/ and http://vishvasbooks.com/

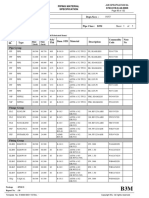

CBSE TEST PAPER-02

Class - XII Accountancy (Admission of a New Partner)

Topic : Treatment of Goodwill

1. What do you mean by Hidden Goodwill? [1]

2. What compensation is paid by a new partner to the sacrificing partners for sacrificing their [1]

share in favour of him?

3. Vinod and Raj are partner in a firm sharing profits in the ratio of 3:2. They admit Mohan [3]

into the partnership for 1/5th share. Mohan brings Rs.60,000 as capital and Rs.20,000 as

premium for goodwill. New profit sharing ratio of partners will be 5:3:2. Pass necessary

journal entries.

4. X and Y were partners in a firm sharing profits in the ratio of 3:2. They admitted Z and M [3]

as new partners. The new profit sharing ratio will be 2:2:1:1. Z and M brought in

Rs.11,00,000 each for their respective capitals and also necessary amount of premium for

goodwill in cash. Goodwill was valued at Rs.9,60,000 for the firm. Calculate the

sacrificing ratio of X and Y and pass necessary journal entries for the above transactions in

the books of the firm.

5. (a) Ashu and Bindu are partners in a firm sharing profits in the ratio of 3 : 2. Chameli is [3]

admitted as a partner. Ashu and Bindu surrender 1/2 of their respective shares in favour of

Chameli. Find the new profit sharing ratio and also the sacrificing ratio.

(b) Chameli is to bring his share of premium for goodwill in cash. The goodwill of the

firm is estimated at Rs.80,000. Pass necessary entries for the record of goodwill in the

above case.

6. AK and BK are partners in a firm sharing profits in the ratio of 5 : 3. They admit CK into [3]

the partnership for 3/10th share in profits, which he takes 1/10th from AK and 1/10th from

BK. CK brings in Rs.15,000 as premium in cash out of his share of Rs.39,000. Goodwill

account does not appear in the books of AK and BK. Give necessary journal entries.

7. Ram, Shyam and Mohan were partners in a firm sharing profits in the ratio of 3:2:1. They [3]

admitted Vinod as a new partner for 1/7th share in the profits. The new profit sharing ratio

will be 2:2:2:1 respectively. Vinod brought Rs.6,00,000 for his capital and Rs.90,000 for

his 1/7th share of goodwill. Give necessary journal entries.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

8. A and B were partners in a firm sharing profits and losses in the ratio of 3:2. They [3]

admitted C as a new partner for 3/7th share in the profits and the new profit sharing ratio

will be 2:2:3. C brought Rs.4,00,000 as his capital and Rs.3,00,000 as premium for

goodwill. Half of their share of premium was withdrawn by A and B from the firm.

Calculte sacrificing ratio and give necessary journal entries.

9. X and Y are partners in a firm sharing profits in 3:2 ratio. They admitted Z as a new (3)

partner and the new profit sharing ratio will be 2:1:1. Z brought Rs.20,000 for her share of

goodwill. Goodwill already appeared in the books at Rs.10,000. Give necessar journal

entries.

10. Vinod and David are partners in a firm sharing profits in the ratio of 3:2. On January (3)

1, 2014 they admit Kumar as a new partner for 1/6th share in the future profits.

Kumar brought Rs.1,00,000 for his capital but could not bring any amount for

goodwill. The firm’s goodwill on Kumar’s admission was valued at Rs.75,000. Give

necessary journal entries.

11. VK and KK are partners in a firm sharing profits in the ratio of 2:3. On January 1, 2014 (3)

they admit PK as a new partner for 1/4th share in the profits. PK brought Rs.80,000 as

capital and Rs.18,000 for his 1/4th share in profits. The new profit sharing ratio of VK, KK

and PK will be 3:3:2. VK and KK decided to withdraw the premium paid by PK. Record

necessary journal entries.

12. EK and FK were partners in a firm sharing profits in the ratio of 3 : 1. They admitted GK (3)

as a new partner on 1.3.2005 for 1/3rd share. It was decided that EK, FK and GK will share

future profits equally. GK brought Rs.50,000 in cash and Machinery worth Rs.70,000 for

his share of profit as premium for goodwill. Showing your working clearly, give necessary

entries.

13. Vinod and Mohan are partners in a firm sharing profits in the ratio of 3:2. On April 1, 2014 (3)

they admit Sohan as a new partner for 3/13 share in the profits. The new ratio will be

5:5:3. Sohan contributed the following assets towards his capital and for his share of

goodwill: Stock Rs.20,000; Debtors Rs.30,000; Land Rs.50,000; Plant and Machinery

Rs.30,000. On the date of admission of Sohan, the goodwill of the firm was valued at

Rs.2,60,000. Give necessary entries.

14. (Hidden Goodwill) VK and GK are partners in a firm sharing profits in the ratio of 3:2. (3)

Their capitals were Rs.40,000 and Rs.25,000 resepectively. They admitted MK on January

1, 2014 as a new partner for 1/5th share in the future profits. MK brought Rs.30,000 as

capital. Calculate the value of Goodwill of the firm and record necessary journal entries.

15. (Hidden Goodwill) X and Y are partners with capitals of Rs.1,30,000 and Rs.1,10,000 (3)

respectively. They admit Z as a partner with 1/4th share in profits of the firm. Z brings

Rs.1,30,000 as his share of capital. Give journal entries.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

Accountancy Challenge

Challenge : 1

Vinod and Ram are partners respectively sharing profits in the ratio of 7:3. Their capitals on 1st

January 2014 were Rs.1,60,000 and Rs.1,20,000 respectively. They admitted Kumar into the

partnership on that date giving him a 1/5th share in the future profits., which he acquired equally from

Vinod and Ram. Kumar is to bring in Rs.1,00,000 as his share of capital. Find the new profit sharing

ratio, value of goodwill and give entries.

Challenge : 2

Vinod and Simran were partners in a firm sharing profits in the ratio of 3:1. They admitted Yuvraj as a

new partner on 01 April 2013 for 1/3rd share. It was decided that future profit sharing ratio of all

partners will be equal. Yuvraj brought Rs.40,000 in cash; Stock Rs.16,000; Furniture Rs.44,000 and

Machinery worth Rs.1,40,000 for his share of profit as premium for goodwill. Give necessary entries

and show your working clearly.

Material downloaded from http://myCBSEguide.com and http://onlineteachers.co.in

Portal for CBSE Notes, Test Papers, Sample Papers, Tips and Tricks

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Event Managment Project MbaDocument26 pagesEvent Managment Project Mbasuruchi100% (1)

- Capacity Management in Service FirmsDocument10 pagesCapacity Management in Service FirmsJussie BatistilNo ratings yet

- Admission of A Partner: Other Educational PortalsDocument31 pagesAdmission of A Partner: Other Educational Portalskkaur4No ratings yet

- Accounting For Partnership Firms: Short Answer Type QuestionsDocument8 pagesAccounting For Partnership Firms: Short Answer Type QuestionssalumNo ratings yet

- Class XII Commerce (1) GGBDocument10 pagesClass XII Commerce (1) GGBAditya KocharNo ratings yet

- Assignment 3 AdmissionDocument8 pagesAssignment 3 AdmissionKavyashri PNo ratings yet

- Admission of Partner PDFDocument6 pagesAdmission of Partner PDFBHUMIKA JAINNo ratings yet

- 12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationDocument3 pages12 Accountancy Ch01 Test Paper 01 Profit and Loss AppropriationHari SharmaNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Accounting QuestionsDocument16 pagesAccounting QuestionsPrachi ChananaNo ratings yet

- 7 HOTS Questions PDFDocument33 pages7 HOTS Questions PDFNishant ShyaraNo ratings yet

- Assignment On Admission of A Partner - 2: Class: Xii SUB: Accounts Date: 7Document4 pagesAssignment On Admission of A Partner - 2: Class: Xii SUB: Accounts Date: 7Manish SainiNo ratings yet

- 12 Accountancy ch01 Test Paper 04 Past Adjestments PDFDocument3 pages12 Accountancy ch01 Test Paper 04 Past Adjestments PDFRicha SharmaNo ratings yet

- Accountancy Test 2Document2 pagesAccountancy Test 2dixa mathpalNo ratings yet

- Admission of A Partner-1Document1 pageAdmission of A Partner-1Hema AnanthNo ratings yet

- Partnership Fundamentals - WorksheetDocument7 pagesPartnership Fundamentals - WorksheetMihika GunturNo ratings yet

- The Indian Public School, ErodeDocument3 pagesThe Indian Public School, ErodeMadhumithaa SvNo ratings yet

- Account 12th ClassDocument4 pagesAccount 12th ClassMandeep KaurNo ratings yet

- Worksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore KumarDocument1 pageWorksheet Class Xii Accountancy Chapter 3 Admission of A Partner Module - 2 June Aecs Narora SH Kishore Kumarkratikj368No ratings yet

- Worksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerDocument14 pagesWorksheet - 1 Unit 1 - Accounting For Partnership Firm Chapter 4 - Admission of A PartnerRica Jane LlorenNo ratings yet

- Adjustment of Goodwill-Admission PDFDocument2 pagesAdjustment of Goodwill-Admission PDFarnav trivediNo ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuNo ratings yet

- Holidays Home Work Xii 2023-24Document5 pagesHolidays Home Work Xii 2023-24Akshat TiwariNo ratings yet

- AccountsDocument59 pagesAccountsrajat0% (1)

- Admission of PartnerDocument7 pagesAdmission of Partneradarshrathore12341234No ratings yet

- Accounts CH 2 Admission of PartnerDocument5 pagesAccounts CH 2 Admission of Partnerapsonline8585No ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- 12 Accountancy Ch01 Test Paper 04 Past AdjustmentsDocument2 pages12 Accountancy Ch01 Test Paper 04 Past AdjustmentsSACHIN YADAV100% (1)

- 12 Accountancy Lyp 2014 Compt Outside Delhi Set1Document25 pages12 Accountancy Lyp 2014 Compt Outside Delhi Set1Ashish GangwalNo ratings yet

- PT-1 Accountancy 2022-23Document3 pagesPT-1 Accountancy 2022-23Ajit HuidromNo ratings yet

- Acc Class 12 Admission of PartnerDocument20 pagesAcc Class 12 Admission of Partnermaverickxxx1029No ratings yet

- GoodwillDocument4 pagesGoodwilldivyarwt0No ratings yet

- Xii Acc WorksheetssDocument55 pagesXii Acc WorksheetssUnknown patelNo ratings yet

- Xii Acc Worksheetss-1-29Document29 pagesXii Acc Worksheetss-1-29Unknown patelNo ratings yet

- 2016 12 SP Accountancy Solved 01Document8 pages2016 12 SP Accountancy Solved 01Sto BreakerNo ratings yet

- Screenshot 2023-03-11 at 12.52.38 PM PDFDocument56 pagesScreenshot 2023-03-11 at 12.52.38 PM PDFpalak sanghviNo ratings yet

- Commerce Fundamental: Class 12 - AccountancyDocument9 pagesCommerce Fundamental: Class 12 - AccountancySACHIN KumarNo ratings yet

- 7730239-Retirement of A Partner - WS 1Document2 pages7730239-Retirement of A Partner - WS 1Sandra SanthoshNo ratings yet

- Sample Paper 2 G 12 - Accountancy - SUMMER BREAKDocument9 pagesSample Paper 2 G 12 - Accountancy - SUMMER BREAKpriya longaniNo ratings yet

- QP Test 5 AdmissionDocument6 pagesQP Test 5 AdmissionSumanyuu NNo ratings yet

- Accounting For Partnership Firms Fundamental PDFDocument10 pagesAccounting For Partnership Firms Fundamental PDFMarivisiasNo ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- Accounting For Partnership FirmDocument11 pagesAccounting For Partnership FirmNeha AhilaniNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- REVISION 2022 Part A - CH. 2Document5 pagesREVISION 2022 Part A - CH. 2ADAM ABDUL RAZACKNo ratings yet

- Chapter 4 - Admission of A PartnerDocument110 pagesChapter 4 - Admission of A Partnerakshaya sangeethaNo ratings yet

- Class 12th Accountancy Set ADocument6 pagesClass 12th Accountancy Set AjashanjeetNo ratings yet

- Reconstitution of Partnership FirmDocument36 pagesReconstitution of Partnership FirmjdsiNo ratings yet

- Change in PSRDocument7 pagesChange in PSRBHUMIKA JAINNo ratings yet

- Retirement and Death (Revision) PDFDocument7 pagesRetirement and Death (Revision) PDFBHUMIKA JAINNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- 12a PP-01 (1N2) AfpDocument6 pages12a PP-01 (1N2) AfpA.c. GuptaNo ratings yet

- Puc 2 - 4Document13 pagesPuc 2 - 4Sumesh MirashiNo ratings yet

- Retirement and Death of A Partner WorksheetDocument4 pagesRetirement and Death of A Partner WorksheettherealsadbroccoliNo ratings yet

- Sample Question Paper 2022-23 Acc XiiDocument12 pagesSample Question Paper 2022-23 Acc XiiTûshar ThakúrNo ratings yet

- Wa0011.Document6 pagesWa0011.Pieck AckermannNo ratings yet

- Term One Accountancy 12 QP & MSDocument13 pagesTerm One Accountancy 12 QP & MSVarun HurriaNo ratings yet

- Ethics Assignment 1 - Dedglis DuarteDocument6 pagesEthics Assignment 1 - Dedglis DuarteAnonymous I03Wesk92No ratings yet

- Project ProposalDocument7 pagesProject Proposalrehmaniaaa100% (3)

- Invitation To Bid: Dvertisement ArticularsDocument2 pagesInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsNo ratings yet

- Berkshire Blueprint 2.0Document82 pagesBerkshire Blueprint 2.0iBerkshires.com100% (1)

- Economy of BangladeshDocument22 pagesEconomy of BangladeshRobert DunnNo ratings yet

- Chapter 01 Ten Principles of EconomicsDocument30 pagesChapter 01 Ten Principles of EconomicsTasfia Rahman Riva100% (1)

- Building Economics For Architecture PPT (F)Document54 pagesBuilding Economics For Architecture PPT (F)vaidehi vakil100% (2)

- Doku - Pub - Insight-Intermediate-Sbpdf (Dragged)Document7 pagesDoku - Pub - Insight-Intermediate-Sbpdf (Dragged)henry johnsonNo ratings yet

- Worldwide Service Network: Middle EastDocument3 pagesWorldwide Service Network: Middle EastRavi ShankarNo ratings yet

- Astronacci Notes - 1 AnomaliesDocument2 pagesAstronacci Notes - 1 AnomaliesSatrio SuryadiNo ratings yet

- Answers Governmental Accounting ExercisesDocument10 pagesAnswers Governmental Accounting Exerciseswerewolf2010No ratings yet

- We Control The World's Wealth Twitter1.2.19Document19 pagesWe Control The World's Wealth Twitter1.2.19karen hudesNo ratings yet

- PPSAS 28 - Financial Instruments - Presentation 3-18-2013Document3 pagesPPSAS 28 - Financial Instruments - Presentation 3-18-2013Christian Ian LimNo ratings yet

- Origin and Theoretical Basis of The New Public Management (NPM)Document35 pagesOrigin and Theoretical Basis of The New Public Management (NPM)Jessie Radaza TutorNo ratings yet

- B5M ElDocument3 pagesB5M ElBALAKRISHNANNo ratings yet

- SsDocument8 pagesSsAnonymous cPS4htyNo ratings yet

- Wilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Document2 pagesWilson Go V. Estate of Late Felisa Tamio de Buenaventura GR No. 211972, Jul 22, 2015Alvin Ryan KipliNo ratings yet

- Bank Guarantee BrochureDocument46 pagesBank Guarantee BrochureVictoria Adhitya0% (1)

- 2013b Blanchard Latvia CrisisDocument64 pages2013b Blanchard Latvia CrisisrajaytNo ratings yet

- DWM LaguertaDocument27 pagesDWM LaguertaWater MelonNo ratings yet

- Bata FactsDocument3 pagesBata FactsPrashant SantNo ratings yet

- Spanish Velocity of Money Circulation - Ratio Nominal GDP To Cash Plus DepositsDocument1 pageSpanish Velocity of Money Circulation - Ratio Nominal GDP To Cash Plus DepositsLuis Riestra DelgadoNo ratings yet

- Nama Peserta BPPDocument53 pagesNama Peserta BPPInge Syahla KearyNo ratings yet

- Eurocontrol European Aviation Overview 20230602Document20 pagesEurocontrol European Aviation Overview 20230602Neo PilNo ratings yet

- Financial and Physical Performance Report FORMATDocument9 pagesFinancial and Physical Performance Report FORMATJeremiah TrinidadNo ratings yet

- Mesopartner Working Paper 08 / 2005: How To Promote ClustersDocument50 pagesMesopartner Working Paper 08 / 2005: How To Promote ClustersChaowalit LimmaneevichitrNo ratings yet

- Responsive Essay 1 ATM 634Document2 pagesResponsive Essay 1 ATM 634Aditi BakshiNo ratings yet