Professional Documents

Culture Documents

CMO-20-2008 Amended Guidelines in Computing Redemption Value

Uploaded by

Mary Ann Farcon Velasco0 ratings0% found this document useful (0 votes)

12 views3 pagesRedemption Value

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRedemption Value

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views3 pagesCMO-20-2008 Amended Guidelines in Computing Redemption Value

Uploaded by

Mary Ann Farcon VelascoRedemption Value

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

Republic of the Philippines

Department of Finazce

Bureau of Customs

1099 Manila

CUSTOMS MEMORANDUM ORDER

NO. 20- 200P

TO: All Service Chiefs

Alll District Collectors of Customs

All Division/Section/unit Chiefs

And All Others Concerned

SUBJECT: Amended Guidelines in the Computation of the

Redemption Value of Imported Forfeited Articles

The following guidelines in the computation of the redemption value of

imported forfeited articles under Section 2307 are hereby issued,

|. OBJECTIVES

1) To establish a uniform and transparent system of determining

the redemption value of forfeited imported articles.

2) To serve as a guide to the different offices and officers of the

Bureau of Customs in computing the redemption value of

imported forfeited articles

IL SCOPE

This Order shall cover the disposition of forfeited imported goods

when the owner, importer, exporter or consignee or his agent offers to pay

to the Collector the domestic market value of the forfeited article/s

pursuant to Section 2307 of the TCCP as amended.

IL ADMINISTRATIVE PROVISIONS

1) The District Collector, after the shipment has been declared

forfeited and within the period of appeal, may accept the offer

‘of the owner, importer, exporter, consignee or his agent to

redeem the articlels.

Oe orkyy

Ade Lor3. paces

3)

Ue 20.2 FU K

All Orders/Decisions of the District Collector for release of the

shipments by way of redemption, settiement, or quashalllifting

of the WSD, shall be subject to the approval of the

‘Commissioner of Customs

No redemption shall be allowed where the decision of

forfeiture nas become final and executory or where the

importation is absolutely prohibited or where the release of the

arlicles would be contrary to law

IV. COMPUTATION OF REDEMPTION VALUE

1)

2y

The redemption vatue shall be the domestic market value of

forfeited articles using the following formula:

Domestic Market Value/Redemption Value = Total Landed

Cost + Applicable Tax + Nominal Allowance per Standard

‘Trade Practice for profit and general expenses which shall not

be lower than 10% mark-up from the total landed costs.

Total Landed Cost is the Sum of the Customs Value.

Applicable Duty and Other Taxable Charges

In case of damage, obsolescence, spoilage, losses or

depreciation as reflected in the inventory of the forfeited

atticie/s subject of redemption, a Cerlification to this effect

shall _be issued by the assigned examiner and a

standard/reasonable percentage may be allowed depending

‘on the facts obtaining in each particular case.

A canvass of the wholesale price of the forfeited article/s from

at least three (3) establishments selling the same, like or

similar articles must be conducted for the purpose of test

checking the integrity of the redemption value arrived at. Such

conduct of canvass shail not exceed a period of ten (10) days

from date of receipt of the request for computation. In case no

establishment sells the same, like or similar articles, a

Certification to this effect shall be issued by the Customs

Valuation Officer who made the canvass.

PAGE: Jaf? PAGES

CMO - 20-903

Vv. REPEALING CLAUSE

CMO 34-2002 and other customs orders, rules, and regulations

OF part thereof inconsistent with this Order are hereby deemed

repealed/amended accordingly.

EFFECTIVITY.

This Order shall take effect immediately,

NAPOLEOP J. MORALES

Cor joner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2.4 SEC Opinion Re Power of The Board To Enter Into Suretyship Agreements and To Issue Corporate Guarantees PDFDocument3 pages2.4 SEC Opinion Re Power of The Board To Enter Into Suretyship Agreements and To Issue Corporate Guarantees PDFAira Mae LayloNo ratings yet

- Energy Regulatory Commissi: Llocumt'Document18 pagesEnergy Regulatory Commissi: Llocumt'Mary Ann Farcon VelascoNo ratings yet

- I.R.R. 9048Document6 pagesI.R.R. 9048Mary Ann Farcon VelascoNo ratings yet

- Event Space Rental Agreement and Contract 5aab99851723ddbd6a79429bDocument5 pagesEvent Space Rental Agreement and Contract 5aab99851723ddbd6a79429bMary Ann Farcon VelascoNo ratings yet

- Blank Reception ContractDocument6 pagesBlank Reception ContractMary Ann Farcon VelascoNo ratings yet

- RR No. 4-2018Document9 pagesRR No. 4-2018NewCovenantChurchNo ratings yet

- DOJ Department Circular 05-2015Document8 pagesDOJ Department Circular 05-2015Liz ZubiriNo ratings yet

- RMO - 9-2014 - Request For Tax Rulings PDFDocument4 pagesRMO - 9-2014 - Request For Tax Rulings PDFMary Ann Farcon VelascoNo ratings yet

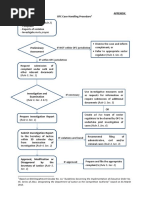

- APPENDIX - Case-Handling Procedure Flowchart PDFDocument1 pageAPPENDIX - Case-Handling Procedure Flowchart PDFMary Ann Farcon VelascoNo ratings yet

- RMO No. 17-2016Document7 pagesRMO No. 17-2016leeNo ratings yet

- Legal EducationDocument25 pagesLegal EducationMary Ann Farcon VelascoNo ratings yet

- Legal EducationDocument25 pagesLegal EducationMary Ann Farcon VelascoNo ratings yet