Professional Documents

Culture Documents

Hiren

Uploaded by

Hiren M ChauhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hiren

Uploaded by

Hiren M ChauhanCopyright:

Available Formats

Analysis of Investment Through Broking & Consultancy HIREN

HIREN M CHAUHAN

CHAPTER 01

INTRODUCTION

VISION

“We seek to emerge as the most credible financial services company serving the varied

needs of every kind of investor by being thought leaders, innovative solution providers and

ethical financial partners”

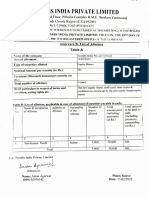

Month &

Activity

Year

October 1994 Acquired NSE Membership in individual name of our Promoter which was

later transformed to a Corporate Membership in the name of Niche

Brokerage Private Limited in the year 2000.

November 1999 Acquired BSE Membership in the name of Yogesh Securities Private

Limited, which was merged with Niche Brokerage Private Limited in July

2006.

January 2001 Acquired license to operate Depository from NSDL

September Acquired PMS License

2005

December 2006 Acquired AMFI certification

January 2007 Acquired MCX License

March 2007 Acquired NCDEX License

April 2007 Started online trading service

July 2007 Acquired Merchant Banking License

July 2007 Name changed from Niche Brokerage Private Limted to India Capital

Markets Private Limited.

October 2007 Acquired license to operate Depository from CDSL

September Started Currency derivatives

2008

Mumbai Institute of Management & Research 1

Analysis of Investment Through Broking & Consultancy HIREN

India Capital Markets Membership In NSE

There are no entry/exit barriers to the membership in NSE. Anybody can become member by

complying with the prescribed eligibility criteria and exit by surrendering membership

without any hidden/overt cost.

The standards for admission of members laid down by the Exchange stress on factors such as,

corporate structure, capital adequacy, track rescord, education, experience, etc. and reflect a

conscious effort on the part of NSE to ensure quality broking services so as to build and

sustain confidence among investors in the Exchange’s operations.

Benefits to the trading membership of NSE include:

1) Access to a nation-wide trading facility for equities, derivatives, debt and hybrid

instruments / products,

2) Ability to provide a fair, efficient and transparent securities market to the investors,

3) Use of state-of-the-art electronic trading systems and technology,

4) Dealing with an organization which follows strict standards for trading & settlement at par

with those available at the top international bourses,

5) A demutualised Exchange which is managed by independent and experienced

professionals, and

6) Dealing with an organization which is constantly striving to move towards a global

marketplace in the securities industry.

Mumbai Institute of Management & Research 2

Analysis of Investment Through Broking & Consultancy HIREN

Membership Recommendation Committee (previously known as

Membership Approval Committee)

Mumbai Institute of Management & Research 3

Analysis of Investment Through Broking & Consultancy HIREN

The Membership Recommendation Committee (MRC) consists of seven persons from

various disciplines, including the Managing Director of the Exchange. The MRC conducts

interviews with the applicants for trading membership.

The following persons have to appear for the interview:

(i) Corporates - A dominant shareholder and a Whole-time Director

(ii) Individuals – individual himself

(iii) Partnership Firms – Two partners

The purpose of the interview is to gain knowledge about the prospects as to their capability &

commitment to carry on stock broking activities, financial standing and integrity.

The MRC is only a recommendatory body about the admissibility of the prospect or

otherwise to the Board of Directors of the Exchange. It recommends the names of the

prospects it deems fit to the Board for their approval.

AsianStockWorld.com is a online venture of Asian Corporate Consultancy which began its

operations in the year 1998. Asian corporate consultancy provides total corporate

and investment consultancy. It has a panel of expert corporate and technical analysts in its

fold which provides a solid foundation for research. Asian corporate consultancy is well

known for corporate seminars, group debates and company visits.

Asian corporate consultancy provides daily updates to its clients on investments through e-

mail, sms and circulars. Asian Corporate Consultancy also provides our clients audio-visual

aids in the form of pre-recorded cassettes and DDS of Investment seminars to learn and

understand investment strategies.

Asian corporate consultancy is headed by Mr. Dilip Desai (B. Com., LLB, DLLP) who has

Mumbai Institute of Management & Research 4

Analysis of Investment Through Broking & Consultancy HIREN

vast experience in corporate field. He has been instrumental in taking the Asian Group

amongst the top five consulting houses in the country. He has been serving the group since

the last 12 years.

Vision

“To become the most preferred investment adviser to the individual investor."

Mission

“We believe that information can neither be suppressed by nor held ransom to market

inefficiencies. It needs to be disseminated at greater speed to all participants, especially

small investors for a better price discovery and lesser volatility in the marketplace.

Otherwise, it makes some people more equal than others which is a basic violation of the

universal principle of equality which we believe is unfair.”

Rich Experience

Our dedicated team of professional traders and analysts has over 15 years of successful &

profitable trading experience. This experience is put together to produce trading systems and

publish several stock trading and investing newsletters for the day trader, swing trader,

position trader & the long term investor in Indian Stocks & Indices. Our goal is to help our

readers achieve above-average returns from the markets and create wealth for the client and

their families.

PROCEDURE TO BECOME

SUB-BROKERS

Mumbai Institute of Management & Research 5

Analysis of Investment Through Broking & Consultancy HIREN

The trading members of the Exchange may appoint sub-brokers to act as agents of the

concerned trading member for assisting the investors in buying, selling or dealing in

securities. The sub-brokers would be affiliated to the trading members and are required to be

registered with SEBI. A sub-broker would be allowed to be associated with only one trading

member of the Exchange.

Trading members desirous of appointing sub-brokers are required to

submit,

The following documents to the Membership Department of the Exchange:

1) Copy of sub-broker - broker agreement duly certified by the trading Members.

2) Application form for registration as a sub-broker with Securities and Exchange Board

of India (Form B).

3) Recommendation letter to be given by the trading member with whom the sub-broker

is affiliated (Form C).

4) Individual client registration application form.

5) Non-individual client registration application form.

6) Sub-broker client agreement.

7) Purchase/Sale Note issued by Sub-brokers acting for constituents.

Mumbai Institute of Management & Research 6

Analysis of Investment Through Broking & Consultancy HIREN

Mumbai Institute of Management & Research 7

Analysis of Investment Through Broking & Consultancy HIREN

Eligibility

A sub-broker may be an individual, a partnership firm or a corporate. In case of corporate or

partnership firm, the directors or partners and in the case of an individual sub-broker

applicant, each of them shall comply with the following requirements:

(1) They shall not be less than 21 years of age.

(2) They shall not have been convicted of any offence involving fraud or dishonesty.

(3) They shall have at least passed 12th standard equivalent examination from an institution

recognized by the Government.

(4) They should not have been debarred by SEBI

(5) The corporate entities applying for sub-brokership shall have a Minimum paid up capital

of Rs. 5 Lakh and it shall identify a dominant shareholder who holds a minimum of 51%

shares either singly or with the unconditional support of his/her spouse.

Registration

No sub-broker is allowed to buy, sell or deal in securities, unless he or she holds a certificate

of registration granted by SEBI. Sub-brokers are required to obtain certificate of registration

from SEBI in accordance with SEBI (Stock Brokers & Sub-brokers) Rules and Regulations,

1992, without which they are not permitted to buy, sell or deal in securities.

CHAPTER 02

TYPES OF INVESTMENT OFFERED BY

Mumbai Institute of Management & Research 8

Analysis of Investment Through Broking & Consultancy HIREN

ASIAN CORPORATE CONSULTANCY [ACC]

Some of the Following are the investments directed by ACC according to

the risk appetite of the Investors.

1) EQUITY

Equity market can be split into two main sectors: the primary and secondary market. The

primary market is where new issues are first offered. Any subsequent trading takes place in

the secondary market.

Equity market in which shares are issued and traded, either through exchanges or over-the-

counter markets. Also known as the stock market, it is one of the most vital areas of a market

economy because it gives companies access to capital and investors a slice of ownership in a

company with the potential to realize gains based on its future performance.

2) COMMODITIES

A basic good used in commerce that is interchangeable with other commodities of the same

type. Commodities are most often used as inputs in the production of other goods or services.

The quality of a given commodity may differ slightly, but it is essentially uniform across

producers. When they are traded on an exchange, commodities must also meet specified

minimum standards, also known as a basis grade.

The sale and purchase of commodities is usually carried out through futures contracts on

exchanges that standardize the quantity and minimum quality of the commodity being traded.

For example, the Chicago Board of Trade stipulates that one wheat contract is for 5,000

bushels and also states what grades of wheat can be used to satisfy the contract.

3) MUTUAL FUNDS

A Mutual Fund is a trust that pools the savings of a number of investors who share a common

Mumbai Institute of Management & Research 9

Analysis of Investment Through Broking & Consultancy HIREN

financial goal. The money thus collected is then invested in capital market instruments such

as shares, debentures and other securities. The income earned through these investments and

the capital appreciations realized are shared by its unit holders in proportion to the number of

units owned by them. Thus a Mutual Fund is the most suitable investment for the common

man as it offers an opportunity to invest in a diversified, professionally managed basket of

securities at a relatively low cost. The flow chart below describes broadly the working of a

mutual fund:

Mutual Fund Operation Flow Chart

4) OTHER INVESTMENTS

a. BONDS

The indebted entity (issuer) issues a bond that states the interest rate (coupon) that will be

paid and when the loaned funds (bond principal) are to be returned (maturity date). Interest

on bonds is usually paid every six months (semi-annually). The main categories of bonds are

corporate bonds, municipal bonds. Treasury bonds, notes and bills, which are collectively

referred to as simply "Treasuries".

Two features of a bond - credit quality and duration - are the principal determinants of a

bond's interest rate. Bond maturities range from a 90-day Treasury bill to a 30-year

government bond. Corporate and municipals are typically in the three to 10-year range

A debt investment in which an investor loans money to an entity (corporate or governmental)

that borrows the funds for a defined period of time at a fixed interest rate. Bonds are used by

companies, municipalities and states to finance a variety of projects and activities.

Mumbai Institute of Management & Research 10

Analysis of Investment Through Broking & Consultancy HIREN

Bonds are commonly referred to as fixed-income securities and are one of the three main

asset classes, along with stocks and cash equivalents

b. COMMERCIAL PAPERS

Commercial papers (CP) are unsecured money market instruments issued in the form

of a promissory note by large corporate houses in order to diversify their sources of short-

term borrowings and to provide additional investment avenues to investors. Issuing

companies are required to obtain investment-grade credit ratings from approved rating

agencies and in some cases, these papers are also backed by a bank line of credit. CPs are

also issued at a discount to their face value. In India, CPs can be issued by companies,

primary dealers (PDs), satellite dealers (SD) and other large financial institutions, for

maturities ranging from 15 days period to 1-year period from the date of issue. CP

denominations can be Rs. 500,000 or multiples thereof. Further, CPs can be issued either in

the form of a promissory note or in dematerialized form through any of the approved

depositories.

SHORT TERM:-

Short Term investments are the investments which may last for a day, for some weeks

and couple of months. It also includes day Trading stocks and futures.

MEDIUM TERM:-

Medium Term investments are the investments which may last for 6 months to 12

months.

LONG TERM:-

Long Term Investments are the investments which may last for more than 1 year.

LIFE CYCLE STAGE

LIFE FEATURES PRIORITY CHOICE OF

CYCLE INVESTMENT

Mumbai Institute of Management & Research 11

Analysis of Investment Through Broking & Consultancy HIREN

STAGE

This is a period of Long term investment No immediate need.

dependency which of money received in Long term investments.

lasts till the full time the form of gift at

Childhood education finishes. various occasions.

Stage Most of the

requirement are

fulfilled by parents or

relatives.

Might still depends to They might not have Liquid plans & short

some extent on any dependents & term investments.

parents. hence might not need Investments for long

Relatively lower insurance. Main need term plans when

Young income & would not is to protect their adequate short term

be able to afford large earnings against any savings is achieved.

Unmarried

amount to financial disability or long-

planning. sickness.

More risk taking More immediate &

ability. short term needs.

Two incomes to meet To secure income loss Medium to long term

costs & save. of any partner against investments. Ability to

Sufficient surplus to any disability or long- take risks.

Young meet financial sickness. Fixed income, insurance

married planning needs. Life insurance so that & equity products.

stage: both Short & intermediate in unfortunate event

partners term Housing & of any partners death

insurance needs that part of income

earn

Consumer finance may be replaced.

need. Need for emergency

fund

Young Two or more Life assurance of Medium to long term

Mumbai Institute of Management & Research 12

Analysis of Investment Through Broking & Consultancy HIREN

dependent on just one earning member is investments. Lesser

earner. must. ability to save & take

married

Less potential to save. Need to start for risk.

stage: one

pension provision at

partner earn

an early stage is

immense.

Arrival of kids Life assurance of Medium to long term

changes the scenario. earning member is investments.

The expenditure starts must. Ability to take risks.

Young rising at a faster rate Consumer finance Portfolio of products,

married with then income. needs are high. for growth & long term.

Children’s education,

children Financial planning

holidays & consumer

needs are highest as

finance.

this stage is ideal for

disciplining.

Housing Individuals Spending and saving Medium term

are in Mid-career and regularly investments with high

family has become Higher Saving ratios liquidity needs.

bigger with more recommended. Portfolio of products

children including equity, debt

Priority would shift

Improved finances and from protection needs and pension plans Major

better life style to investment needs contributions to pension

Medium term needs because of pension products.

for children’s needs. Contribution to health

education and insurance.

Because of load

Married with marriage.

repayment needs

older Need for pension, requirement for

children insurance and medical intermittent cash

cover higher. flows is higher.

Mumbai Institute of Management & Research 13

Analysis of Investment Through Broking & Consultancy HIREN

Children have become Adequate income & Maximum investment in

independent. Savings pension products.

Last chance to ensure

adequate income to

maintain the standards

Post of living after

retirement.

Family/Pre-

Retirement

stage

As a thumb rule, after After Retirement the The need would

retirement individuals savings rate decline correspond to the

need2/3 rd of their substantially categories 1),2) and 3)

final years incomes. of the previous column:

In general people 1) Continue to

would fall in one of work and/or

the following three produce fixed

categories: income with no

1) Low pension risk at all.

income and low 2) Invest capital to

capital to supplement produce

it additional

Retirement income and can

2) Relatively low

Stage pension income plus take any risk

some accumulated 3) Wise People.

capital. Need to preserve

the value of

savings against

3) Sufficient Pension

inflation.

income plus

substantial assets and

capital.

Mumbai Institute of Management & Research 14

Analysis of Investment Through Broking & Consultancy HIREN

DIFFERENT PHASES OF INVESTMENT LIFE-CYCLE

FINANCIAL INVESTMENT

PHASES FEATURES

NEEDS PREFERENCES

In this phase, Investors Investing for long Growth options and long

look to build wealth for term identified term products.

their financial goals, financial goals High – risk appetite.

Accumulation

which are still sometime

Phases away. Their primary aim

is long term wealth

accumulation.

This stage is one where He needs to plan in Liquid and medium term

one or more of the goals advance by investments.

of investors are adjusting his Investor has lower risk

Transition approaching about to be investments. Short appetite

Phases approached in clear term needs for

short-term future. funds as the dates

for objectives is

coming closer.

This stage means that Need to spend Liquid and medium term

the goal for which the money on investments. Preference

investor was objectives for income and debt

Reaping accumulating wealth has Higher liquidity products.

Phases arrived, and therefore requirements

this is a stage of

spending the money of

utilizes the goal.

This is a stage where Long term Low liquidity needs.

Inter- investors start to think investment of Ability to take risk and

of ways to share their inheritance invest for the long term

generational wealth to near ones or to

transfer transfer in favor of

different beneficiary.

Mumbai Institute of Management & Research 15

Analysis of Investment Through Broking & Consultancy HIREN

This stage is one where Medium to long Wealth preservation.

due to certain event term Preference for low risk

investors receives products.

sudden cash flow, which

Sudden wealth increases their wealth

surge significantly. These

events may be like

winning lottery,

inheriting estate, huge

appreciation of shares

held, etc.

RECOMMENDED MODEL PORTFOLIO

Mumbai Institute of Management & Research 16

Analysis of Investment Through Broking & Consultancy HIREN

Mumbai Institute of Management & Research 17

Analysis of Investment Through Broking & Consultancy HIREN

Mumbai Institute of Management & Research 18

Analysis of Investment Through Broking & Consultancy HIREN

CHAPTER 03

FUNDAMENTAL & TECHNICAL ANALYSIS

Technical analysis and fundamental analysis are the two main schools of

thought in the financial markets. As we've mentioned, technical analysis looks

at the price movement of a security and uses this data to predict its future price

movements. Fundamental analysis, on the other hand, looks at economic

factors, known as fundamentals. Let's get into the details of how these two

approaches differ, and how technical and fundamental analysis can be used

together to analyze securities.

What Does Fundamental Analysis Mean?

Fundamental analysis is about using real data to evaluate a security's value. Although most

analysts use fundamental analysis to value stocks, this method of valuation can be used

for just about any type of security.

For example, an investor can perform fundamental analysis on a bond's value by looking at

economic factors, such as interest rates and the overall state of the economy, and information

about the bond issuer, such as potential changes in credit ratings. For assessing stocks, this

method uses revenues, earnings, future growth, return on equity, profit margins and other

data to determine a company's underlying value and potential for future growth. In terms of

stocks, fundamental analysis focuses on the financial statements of the company being

evaluated.

The end goal of performing fundamental analysis is to produce a value that an investor can

compare with the security's current price, with the aim of figuring out what sort of position to

take with that security (underpriced = buy, overpriced = sell or short).

This method of security analysis is considered to be the opposite of technical analysis.

Mumbai Institute of Management & Research 19

Analysis of Investment Through Broking & Consultancy HIREN

The Very Basics

When talking about stocks, fundamental analysis is a technique that attempts to determine a Security’s value by

focusing on underlying factors that affect a company's actual business and its future prospects. On a broader

scope, you can perform fundamental analysis on industries or the economy as a whole. The term simply

refers to the analysis of the economic well-being of a financial entity as opposed to only its price movements

Fundamental analysis serves to answer questions, such as:

Is the company’s revenue growing?

Is it actually making a profit?

Is it in a strong-enough position to beat out its competitors in the future?

Is it able to repay its debts?

Is management trying to "cook the books"?

Of course, these are very involved questions, and there are literally hundreds of others you might have about a

company. It all really boils down to one question: Is the company’s stock a good investment? Think of

fundamental analysis as a toolbox to help you answer this question.

The factor that suppose to go through while Analyzing

Fundamentally

A. QUALITATIVE FACTORS

Business Model

Even before an investor looks at a company's financial statements or does any research, one of the most

important questions that should be asked is: What exactly does the company do? This is referred to as a

company's business model – it's how a company makes money. You can get a good overview of a company's

business model by checking out its website.

Competitive Advantage

Mumbai Institute of Management & Research 20

Analysis of Investment Through Broking & Consultancy HIREN

Another business consideration for investors is competitive advantage. A company's long-term success is driven

largely by its ability to maintain a competitive advantage - and keep it. Powerful competitive advantages, such as

Coca Cola's brand name and Microsoft's domination of the personal computer operating system, create a moat

around a business allowing it to keep competitors at bay and enjoy growth and profits. When a company can

achieve competitive advantage, its shareholders can be well rewarded for decades.

Management

Just as an army needs a general to lead it to victory, a company relies upon management to steer it towards

financial success. Some believe that management is the most important aspect for investing in a company. It

makes sense - even the best business model is doomed if the leaders of the company fail to properly execute the

plan.

So how does an average investor go about evaluating the management of a company?

This is one of the areas in which individuals are truly at a disadvantage compared to professional investors. You

can't set up a meeting with management if you want to invest a few thousand Rupees. On the other hand, if you

are a fund manager interested in investing millions of Rupees, there is a good chance you can schedule a face-

to-face meeting with the upper brass of the firm.

Market Share

Understanding a company's present market share can tell volumes about the company's business. The fact that

a company possesses an 85% market share tells you that it is the largest player in its market by far. Furthermore,

this could also suggest that the company possesses some sort of "economic moat," in other words, a

competitive barrier serving to protect its current and future earnings, along with its market share. Market share

is important because of economies of scale. When the firm is bigger than the rest of its rivals, it is in a better

position to absorb the high fixed costs of a capital-intensive industry.

Industry Growth

One way of examining a company's growth potential is to first examine whether the amount of customers in the

overall market will grow. This is crucial because without new customers, a company has to steal market share in

order to grow.

B. QUANTITAVE FACTORS

Mumbai Institute of Management & Research 21

Analysis of Investment Through Broking & Consultancy HIREN

The Income Statement

The income statement is basically the first financial statement you will come across in an annual report or

quarterly Security & Exchange Board of India (SEBI) filing.

It also contains the numbers most often discussed when a company announces its results - numbers such as

revenue, earnings and earnings per share. Basically, the income statement shows,

a. How much money the company generated (revenue).

b. How much it spent (expenses) and

c. The difference between the two (profit) over a certain time period.

When it comes to analyzing fundamentals, the income statement lets investors know how well the

company’s business is performing - or, basically, whether or not the company is making money. Generally

speaking, companies ought to be able to bring in more money than they spend or they don’t stay in business for

long. Those companies with low expenses relative to revenue - or high profits relative to revenue - signal strong

fundamentals to investors.

The Balance Sheet

Investors often overlook the balance sheet. Assets and liabilities aren't nearly as sexy as revenue and

earnings. While earnings are important, they don't tell the whole story

The balance sheet highlights the financial condition of a company and is an integral part of the financial

statements.

The Balance Sheet's Main Three

Assets, liability and equity are the three main components of the balance sheet. Carefully analyzed, they can tell

investors a lot about a company's fundamentals.

o Assets

Mumbai Institute of Management & Research 22

Analysis of Investment Through Broking & Consultancy HIREN

There are two main types of assets:

1) Current Assets

2) Non-Current Assets

1. Current assets are likely to be used up or converted into cash within one business cycle usually treated

as twelve months. Three very important current asset items found on the balance sheet are: cash,

inventories and accounts receivables.

Investors normally are attracted to companies with plenty of cash on their balance sheets. After all, cash

offers protection against tough times, and it also gives companies more options for future growth.

Growing cash reserves often signal strong company performance. Indeed, it shows that cash is

accumulating so quickly that management doesn't have time to figure out how to make use of it. A

dwindling cash pile could be a sign of trouble. That said, if loads of cash are more or less a permanent

feature of the company's balance sheet, investors need to ask why the money is not being put to use.

Cash could be there because management has run out of investment opportunities or is too short-

sighted to know what to do with the money.

Inventories are finished products that haven't yet sold. As an investor, you want to know if a company

has too much money tied up in its inventory. Companies have limited funds available to invest in

inventory. To generate the cash to pay bills and return a profit, they must sell the merchandise they

have purchased from suppliers. Inventory turnover (cost of goods sold divided by average

inventory) measures how quickly the company is moving merchandise through the warehouse to

customers. If inventory grows faster than sales, it is almost always a sign of deteriorating fundamentals.

Receivables are outstanding (uncollected bills). Analyzing the speed at which a company collects

what it's owed can tell you a lot about its financial efficiency. If a company's collection period is growing

longer, it could mean problems ahead. The company may be letting customers stretch their credit in

order to recognize greater top-line sales and that can spell trouble later on, especially if customers face

a cash crunch. Getting money right away is preferable to waiting for it - since some of what is owed may

never get paid. The quicker a company gets its customers to make payments, the sooner it has cash to

pay for salaries, merchandise, equipment, loans, and best of all, dividends and growth opportunities.

2. Non-Current Assets are defined as anything not classified as a current asset. This includes items that

are fixed assets, such as property, plant and equipment (PP&E). Unless the company is in

financial distress and is liquidating assets, investors need not pay too much attention to fixed assets.

Since companies are often unable to sell their fixed assets within any reasonable amount of time they

are carried on the balance sheet at cost regardless of their actual value. As a result, it's is possible for

Mumbai Institute of Management & Research 23

Analysis of Investment Through Broking & Consultancy HIREN

companies to grossly inflate this number, leaving investors with questionable and hard-to-compare

asset figures.

o LIABILITIES

There are current liabilities and non-current liabilities. Current liabilities are obligations the firm must pay

within a year, such as payments owing to suppliers. Non-current liabilities, meanwhile, represent what the

company owes in a year or more time. Typically, non-current liabilities represent bank and bondholder debt.

You usually want to see a manageable amount of debt. When debt levels are falling, that's a good sign.

Generally speaking, if a company has more assets than liabilities, then it is in decent condition. By contrast, a

company with a large amount of liabilities relative to assets ought to be examined with more diligence. Having too

much debt relative to cash flows required to pay for interest and debt repayments is one way a company can go

bankrupt.

o EQUITY

Equity represents what shareholders own, so it is often called shareholder's equity. The two important equity

items are paid-in capital and retained earnings. Paid-in capital is the amount of money shareholders paid

for their shares when the stock was first offered to the public. It basically represents how much money the firm

received when it sold its shares. In other words, retained earnings are a tally of the money the company has

chosen to reinvest in the business rather than pay to shareholders. Investors should look closely at how a

company puts retained capital to use and how a company generates a return on it.

The Cash Flow Statement

The cash flow statement shows how much cash comes in and goes out of the company over the quarter or

the year. At first glance, that sounds a lot like the income statement in that it records financial performance

over a specified period. But there is a big difference between the two.

What distinguishes the two is accrual accounting, which is found on the income statement. Accrual

accounting requires companies to record revenues and expenses when transactions occur, not when cash is

Mumbai Institute of Management & Research 24

Analysis of Investment Through Broking & Consultancy HIREN

exchanged. At the same time, the income statement, on the other hand, often includes non-cash revenues or

expenses, which the statement of cash flows does not include.

Three Sections of the Cash Flow Statement

Companies produce and consume cash in different ways, so the cash flow statement is divided into three

Sections: cash flows from operations, financing and investing. Basically, the Sections on operations and

financing show how the company gets its cash, while the investing Section shows how the company spends its

cash.

o Cash Flows from Operating Activities

This Section shows how much cash comes from sales of the company's goods and services, less the amount of

cash needed to make and sell those goods and services. Investors tend to prefer companies that produce a net

positive cash flow from operating activities. High growth companies, such as technology firms, tend to show

negative cash flow from operations in their formative years. At the same time, changes in cash flow from

operations typically offer a preview of changes in net future income. Normally it's a good sign when it goes up.

Watch out for a widening gap between a company's reported earnings and its cash flow from operating activities.

If net income is much higher than cash flow, the company may be speeding or slowing its booking of income or

costs.

o Cash Flows from Investing Activities

This Section largely reflects the amount of cash the company has spent on capital expenditures, such as new

equipment or anything else that needed to keep the business going. It also includes acquisitions of other

businesses and monetary investments such as money market funds.

You want to see a company re-invest capital in its business by at least the rate of depreciation expenses each

year. If it doesn't re-invest, it might show artificially high cash inflows in the current year which may not be

sustainable.

o Cash Flow From Financing Activities

Mumbai Institute of Management & Research 25

Analysis of Investment Through Broking & Consultancy HIREN

This Section describes the goings-on of cash associated with outside financing activities. Typical sources of cash

inflow would be cash raised by selling stock and bonds or by bank borrowings. Likewise, paying back a bank loan

would show up as a use of cash flow, as would dividend payments and common stock repurchases.

RATIO’S

The ratios are further divided into three types:-

RATIOS

Income Statement Ratio Balance Sheet Ratio Combined Ratio

a. Gross Profit Ratio a. Current Ratio a. Earnings Per Share

Mumbai Institute of Management & Research 26

Analysis of Investment Through Broking & Consultancy HIREN

b. Operating Profit Ratio b. Quick Ratio b. Book Value

c. Net Profit Ratio c. Total Debt to Equity c. Dividend per Share

Ratio

d. Return on Net-worth

e. Return on Capital

Employed

I. Income Statement Ratio

a. Gross Profit Ratio:- Gross Profit x 100

Sales

Standard Ratio- Should be compared with gross profit ratio of past few years or with other

companies

This ratio shows the profitability of the company.

Higher ratio means greater profitability & lower ratio means indicates lower profitability.

b. Operating Profit Ratio:-Operating Profit x100

Sales

Operating Profit= Sales- Cost of Goods Sold- Operating Exp

Similar to net profit ratio but is a better judge of companies profitability as it excludes non-

operating exp & non-operating incomes.

c. Net Profit Ratio:- Net Profit x100

Sales

It measures overall profitability. It should be studied along with Gross Profit Ratio.

Higher ratio means greater profitability & lower ratio means indicates lower profitability.

II. Balance Sheet Ratio

a. Current Ratio:- Current Assets Standard Ratio=2:1

Current Liabilities

Current Assets = Debtors, Stock, Loose Tools, Accrued Income, B/R, Cash, Bank.

Current Liabilities = Creditors, B/P, O/S Exp, Bank O/D, Proposed Dividend.

Mumbai Institute of Management & Research 27

Analysis of Investment Through Broking & Consultancy HIREN

This ratio measures the short term solvency of the business by comparing current assets with

current liabilities. It is expressed in the form of a pure ratio. This ratio shows whether

company is able to meet its short term obligations.

b. Quick Ratio:- Quick Assets Standard Ratio=1:1

Quick Liabilities

Quick Assets = Current Assets-Stock-Prepaid Exp

Quick Liabilities = Current Liabilities-Bank O/D-Advance Income

This ratio takes into account only those current assets, which can be very quickly converted

into cash & only those liabilities, which have to be paid immediately.

Higher ratio indicates sound financial position. But too high ratio may also indicate idle

investment in quick assets.

Lower ratio indicates dangerous financial position.

c. Debt Equity Ratio:- Debt Standard Ratio=2:1

Equity

This ratio indicates the long term solvency of the company. It compares the loan funds i.e.

debt with the proprietor’s i.e. equity. It indicates that for every rupee of proprietor’s fund

there is a particular amount of borrowed funds.

III. Combined Ratio

a. Earning per Share:- Profit After Tax-Preference Dividend

No. of Equity Shares

This ratio measures the earnings per equity share i.e. it measures the profitability of the firm

on a per share basis.

EPS is one of the most commonly quoted & widely publicized ratio.

It has been made mandatory in nature by the ICAI.

b. Book Value:- Equity (+) Reserve & Surplus

No. of Equity

Mumbai Institute of Management & Research 28

Analysis of Investment Through Broking & Consultancy HIREN

If the book value per shares is 150% of the face value then it is good for investment & if it is

more than that its consider to be best for investment.

c. Return on Net-Worth:- Net Profit After Tax

Proprietor’s fund

Standard ratio – Should be compared with similar ratio of other companies.

It shows earning power of proprietors fund. This ratio is helpful to future investor.

Higher ratio means growing & prosperous company. Lower is unfavorable.

d. Return on Capital Employed:- Net Profit Before Interest & Tax x100

Capital Employed

Standard ratio – Should be compared with similar ratio of other companies.

This ratio shows the profitability & productivity of the company. It is the broadest measure

of performance. It combines the effect of Net Profit Ratio & Capital Turnover Ratio.

Turnover ratio measures productivity & Net Profit Ratio measures profitability.

What Does Technical Analysis Mean?

A method of evaluating securities by analyzing statistics generated by market activity, such

as past prices and volume. Technical analysts do not attempt to measure a security's intrinsic

value, but instead use charts and other tools to identify patterns that can suggest future

activity.

Technical analysts believe that the historical performance of stocks and markets are

indications of future performance.

For example, In a shopping mall, a fundamental analyst would go to each store, study the

product that was being sold, and then decide whether to buy it or not. By contrast, a technical

analyst would sit on a bench in the mall and watch people go into the stores. Disregarding the

intrinsic value of the products in the store, the technical analyst's decision would be based on

the patterns or activity of people going into each store.

Mumbai Institute of Management & Research 29

Analysis of Investment Through Broking & Consultancy HIREN

The Use Of Trend

One of the most important concepts in technical analysis is that of trend. The meaning in

finance isn't all that different from the general definition of the term - a trend is really nothing

more than the general direction in which a security or market is headed. Take the look at the

chart below:

Types of Trend

There are three types of trend:

1• Uptrends

2• Downtrends

3• Sideways/Horizontal Trends

As the names imply, when each successive peak and trough is higher, it's referred to as an

upward trend. If the peaks and troughs are getting lower, it's a downtrend. When there is little

movement up or down in the peaks and troughs, it's a sideways or horizontal trend. If you

want to get really technical, you might even say that a sideways trend is actually not a trend

on its own, but a lack of a well-defined trend in either direction. In any case, the market can

really only trend in these three ways: up, down or nowhere.

Mumbai Institute of Management & Research 30

Analysis of Investment Through Broking & Consultancy HIREN

Trend Lengths

Along with these three trend directions, there are three trend classifications. A trend of any

direction can be classified as a long-term trend, intermediate trend or a short-term trend. In

terms of the stock market, a major trend is generally categorized as one lasting longer than a

year. An intermediate trend is considered to last between one and three months and a near-

term trend is anything less than a month. A long-term trend is composed of several

intermediate trends, which often move against the direction of the major trend. If the major

trend is upward and there is a downward correction in price movement followed by a

continuation of the uptrend, the correction is considered to be an intermediate trend. The

short-term trends are components of both major and intermediate trends.

When analyzing trends, it is important that the chart is constructed to best reflect the type of

trend being analyzed. To help identify long-term trends, weekly charts or daily charts

spanning a five-year period are used by chartists to get a better idea of the long-term trend.

Daily data charts are best used when analyzing both intermediate and short-term trends. It is

also important to remember that the longer the trend, the more important it is; for example, a

one-month trend is not as significant as a five-year trend.

Trend Lines

A trendline is a simple charting technique that adds

a line to a chart to represent the trend in the market

or a stock. Drawing a trendline is as simple as

drawing a straight line that follows a general trend.

These lines are used to clearly show the trend and

are also used in the identification of trend reversals.

As you can see in Figure 5, an upward trendline is drawn at the lows of an upward trend. This

line represents the support the stock has every time it moves from a high to a low. Notice

how the price is propped up by this support. This type of trendline helps traders to anticipate

the point at which a stock's price will begin moving upwards again. Similarly, a downward

trendline is drawn at the highs of the downward trend. This line represents the resistance level

that a stock faces every time the price moves from a low to a high.

Mumbai Institute of Management & Research 31

Analysis of Investment Through Broking & Consultancy HIREN

Channels

A channel, or channel lines, is the addition of two parallel trendlines that act as strong areas

of support and resistance. The upper trendline connects a series of highs, while the lower

trendline connects a series of lows. A channel can slope upward, downward or sideways but,

regardless of the direction, the interpretation remains the same. Traders will expect a given

security to trade between the two levels of support and resistance until it breaks beyond one

of the levels, in which case traders can expect a

sharp move in the direction of the break. Along with

clearly displaying the trend, channels are mainly

used to illustrate important areas of support and

resistance.

The Importance of Trend

It is important to be able to understand and identify

trends so that you can trade with rather than against

them. Two important sayings in technical analysis are "the trend is your friend" and "don't

buck the trend," illustrating how important trend analysis is for technical traders.

Support And Resistance

Once you understand the concept of a trend, the

next major concept is that of support and

resistance. You'll often hear technical analysts

talk about the ongoing battle between the bulls

and the bears, or the struggle between buyers

(demand) and sellers (supply). This is revealed

by the prices a security seldom moves above (resistance) or below (support).

Mumbai Institute of Management & Research 32

Analysis of Investment Through Broking & Consultancy HIREN

support is the price level through which a

stock or market seldom falls (illustrated by

the blue arrows). Resistance, on the other

hand, is the price level that a stock or market

seldom surpasses (illustrated by the red

arrows).

Role Reversal

Once a resistance or support level is broken,

its role is reversed. If the price falls below a support level, that level will become resistance.

If the price rises above a resistance level, it will often become support. As the price moves

past a level of support or resistance, it is thought that supply and demand has shifted, causing

the breached level to reverse its role. For a true reversal to occur, however, it is important that

the price make a strong move through either the support or resistance.

In almost every case, a stock will have both a level of support and a level of resistance and

will trade in this range as it bounces between these levels. This is most often seen when a

stock is trading in a generally sideways manner as the price moves through successive peaks

and troughs, testing resistance and support.

The Importance of Support and Resistance

Support and resistance analysis is an important part of trends because it can be used to make

trading decisions and identify when a trend is reversing. For example, if a trader identifies an

important level of resistance that has been tested several times but never broken, he or she

may decide to take profits as the security moves toward this point because it is unlikely that it

will move past this level.

Support and resistance levels both test and confirm trends and need to be monitored by

anyone who uses technical analysis. As long as the price of the share remains between these

levels of support and resistance, the trend is likely to continue. It is important to note,

however, that a break beyond a level of support or resistance does not always have to be a

Mumbai Institute of Management & Research 33

Analysis of Investment Through Broking & Consultancy HIREN

reversal. For example, if prices moved above the resistance levels of an upward trending

channel, the trend has accelerated, not reversed. This means that the price appreciation is

expected to be faster than it was in the channel.

What is Volume?

Volume is simply the number of shares or

contracts that trade over a given period of time,

usually a day. The higher the volume, the more

active the security. To determine the movement of

the volume (up or down), chartists look at the

volume bars that can usually be found at the

bottom of any chart. Volume bars illustrate how

many shares have traded per period and show

trends in the same way that prices do.

Why Volume is Important

Volume is an important aspect of technical analysis because it is used to confirm trends and

chart patterns. Any price movement up or down with relatively high volume is seen as a

stronger, more relevant move than a similar move with weak volume. Therefore, if you are

looking at a large price movement, you should also examine the volume to see whether it tells

the same story.

Volume should move with the trend. If prices are moving in an upward trend, volume should

increase (and vice versa). If the previous relationship between volume and price movements

starts to deteriorate, it is usually a sign of weakness in the trend. For example, if the stock is

Mumbai Institute of Management & Research 34

Analysis of Investment Through Broking & Consultancy HIREN

in an uptrend but the up trading days are marked with lower volume, it is a sign that the trend

is starting to lose its legs and may soon end.

Chart Types

There are Three main types of charts that are used by

investors and traders depending on the information that

they are seeking and their individual skill levels. The

chart types are:

i. The Line Chart

ii. The Bar Chart

iii. The Candlestick Chart

Line Chart:-

The most basic of the four charts is the line chart because it represents only the closing prices

over a set period of time. The line is formed by connecting the closing prices over the time

frame. Line charts do not provide visual information of the trading range for the individual

points such as the high, low and opening prices. However, the closing price is often

considered to be the most important price in stock data compared to the high and low for the

day and this is why it is the only value used in line charts.

Bar Charts:-

Mumbai Institute of Management & Research 35

Analysis of Investment Through Broking & Consultancy HIREN

The bar chart expands on the line chart by adding several more key pieces of information to

each data point. The chart is made up of a series of vertical lines that represent each data

point. This vertical line represents the high and low for the trading period, along with the

closing price. The close and open are represented on the vertical line by a horizontal dash.

The opening price on a bar chart is illustrated by the dash that is located on the left side of the

vertical bar. Conversely, the close is represented by the dash on the right. Generally, if the

left dash (open) is lower than the right dash (close) then the bar will be shaded black,

representing an up period for the stock, which means it has gained value. A bar that is colored

red signals that the stock has gone down in value over that period. When this is the case, the

dash on the right (close) is lower than the dash on the left (open).

Candlestick Charts:-

The candlestick chart is similar to a bar chart,

but it differs in the way that it is visually constructed. Similar to the bar chart, the candlestick

also has a thin vertical line showing the period's trading range. The difference comes in the

formation of a wide bar on the vertical line, which illustrates the difference between the open

and close. And, like bar charts, candlesticks

also rely heavily on the use of colors to explain

what has happened during the trading period. A

major problem with the candlestick color

configuration, however, is that different sites

use different standards; therefore, it is

important to understand the candlestick

configuration used at the chart site you are

working with. There are two color constructs for days up and one for days that the price falls.

When the price of the stock is up and closes above the opening trade, the candlestick will

usually be white or clear. If the stock has traded down for the period, then the candlestick will

usually be red or black, depending on the site. If the stock's price has closed above the

previous day’s close but below the day's open, the candlestick will be black or filled with the

color that is used to indicate an up day.

Mumbai Institute of Management & Research 36

Analysis of Investment Through Broking & Consultancy HIREN

Conclusion

Charts are one of the most fundamental aspects of technical analysis. It is important that you

clearly understand what is being shown on a chart and the information that it provides. Now

that we have an idea of how charts are constructed, we can move on to the different types of

chart patterns.

Chart Patterns

A chart pattern is a distinct formation on a stock chart that creates a trading signal, or a sign

of future price movements. Chartists use these patterns to identify current trends and trend

reversals and to trigger buy and sell signals

The theory behind chart patters is based on this assumption. The idea is that certain patterns

are seen many times, and that these patterns signal a certain high probability move in a stock.

While there are general ideas and components to every chart pattern, there is no chart pattern

that will tell you with 100% certainty where a security is headed.

There are two types of patterns within this area of technical analysis, reversal and

continuation. A reversal pattern signals that a prior trend will reverse upon completion of the

pattern. A continuation pattern, on the other hand, signals that a trend will continue once the

pattern is complete.

Head and Shoulders

Mumbai Institute of Management & Research 37

Analysis of Investment Through Broking & Consultancy HIREN

This is one of the most popular and reliable chart patterns in technical analysis. Head and

shoulders is a reversal chart pattern that when formed, signals that the security is likely to

move against the previous trend. there are two versions of the head and shoulders chart

pattern. Head and shoulders top (shown on the left) is a chart pattern that is formed at the

high of an upward movement and signals that the upward trend is about to end. Head and

shoulders bottom, also known as inverse head and shoulders (shown on the right) is the lesser

known of the two, but is used to signal a reversal in a downtrendBoth of these head and

shoulders patterns are similar in that there are four main parts: two shoulders, a head and a

neckline. Also, each individual head and shoulder is comprised of a high and a low. For

example, in the head and shoulders top image shown on the left side, the left shoulder is

made up of a high followed by a low. In this pattern, the neckline is a level of support or

resistance. Remember that an upward trend is a period of successive rising highs and rising

lows.

Double Tops and Bottoms

This chart pattern is another well-known pattern that signals a trend reversal - it is considered

to be one of the most reliable and is commonly used. These patterns are formed after a

sustained trend and signal to chartists that the trend is about to reverse. The pattern is created

when a price movement tests support or resistance levels twice and is unable to break

through. This pattern is often used to signal intermediate and long-term trend reversals.

Mumbai Institute of Management & Research 38

Analysis of Investment Through Broking & Consultancy HIREN

A double top pattern is shown on the left, while a double bottom pattern is shown on the

right. In the case of the double top pattern in Figure 3, the price movement has twice tried to

move above a certain price level. After two unsuccessful attempts at pushing the price higher,

the trend reverses and the price heads lower. In the case of a double bottom (shown on the

right), the price movement has tried to go lower twice, but has found support each time. After

the second bounce off of the support, the security enters a new trend and heads upward.

Triple Tops and Bottoms

Triple tops and triple bottoms are another type of reversal chart pattern in chart analysis.

These are not as prevalent in charts as head and shoulders and double tops and bottoms, but

they act in a similar fashion. These two chart patterns are formed when the price movement

tests a level of support or resistance three times and is unable to break through; this signals a

reversal of the prior trend Confusion can form with triple tops and bottoms during the

formation of the pattern because they can look similar to other chart patterns. After the first

two support/resistance tests are formed in the price movement, the pattern will look like a

double top or bottom, which could lead a chartist to enter a reversal position too soon

Mumbai Institute of Management & Research 39

Analysis of Investment Through Broking & Consultancy HIREN

Moving Averages

Most chart patterns show a lot of variation in price movement. This can make it difficult for

traders to get an idea of a security's overall trend. One simple method traders use to combat

this is to apply moving averages . A moving average is the average price of a security over a

set amount of time. By plotting security's average price, the price movement is smoothed out.

Once the day-to-day fluctuations are removed, traders are better able to identify the true trend

and increase the probability that it will work in their favor.

Types of Moving Averages

There are a number of different types of moving averages that vary in the way they are

calculated, but how each average is interpreted remains the same. The calculations only differ

in regards to the weighting that they place on the price data, shifting from equal weighting of

Mumbai Institute of Management & Research 40

Analysis of Investment Through Broking & Consultancy HIREN

each price point to more weight being placed on recent data. The three most common types of

moving averages are simple , linear and exponential.

Simple Moving Average (SMA)

This is the most common method used to calculate the moving average of prices. It simply

takes the sum of all of the past closing prices over the time period and divides the result by

the number of prices used in the calculation. For example, in a 10-day moving average, the

last 10 closing prices are added together and then divided by 10. As you can see in Figure

below a trader is able to make the average less responsive to changing prices by increasing

the number of periods used in the calculation.

Many individuals argue that the usefulness of this type of average is limited because each

point in the data series has the same impact on the result regardless of where it occurs in the

sequence. The critics argue that the most recent data is more important and, therefore, it

should also have a higher weighting. This type of criticism has been one of the main factors

leading to the invention of other forms of moving averages.

Linear Weighted Average

This moving average indicator is the least common out of the three and is used to address the

problem of the equal weighting. The

linear weighted moving average is

calculated by taking the sum of all the

closing prices over a certain time period

and multiplying them by the position of

the data point and then dividing by the

sum of the number of periods. For

example, in a five-day linear weighted

average, today's closing price is

multiplied by five, yesterday's by four

and so on until the first day in the period range is reached. These numbers are then added

together and divided by the sum of the multipliers.

Mumbai Institute of Management & Research 41

Analysis of Investment Through Broking & Consultancy HIREN

Exponential Moving Average (EMA)

This moving average calculation uses a smoothing factor to place a higher weight on

recent data points and is regarded as much more efficient than the linear weighted

average. Having an understanding of the

calculation is not generally required for most

traders because most charting packages do the

calculation for you. The most important thing

to remember about the exponential moving

average is that it is more responsive to new

information relative to the simple moving

average. This responsiveness is one of the key

factors of why this is the moving average of choice among many technical traders. As you

can see in side, a 15-period EMA rises and falls faster than a 15-period SMA. This slight

difference doesn’t seem like much, but it is an important factor to be aware of since it can

affect returns.

Major Uses of Moving Averages

Moving averages are used to identify current trends and trend reversals as well as to set up

support and resistance levels. Moving averages can be used to quickly identify whether a

security is moving in an uptrend or a downtrend depending on the direction of the moving

average. As you can see in Figure below, when a moving average is heading upward and the

price is above it, the security is in an uptrend. Conversely, a downward sloping moving

average with the price below can be used to signal a downtrend.

Another method of determining momentum is to look at the order of a pair of moving

averages. When a short-term average is above a longer-term average, the trend is up. On the

other hand, a long-term average above a shorter-term average signals a downward movement

in the trend

Mumbai Institute of Management & Research 42

Analysis of Investment Through Broking & Consultancy HIREN

Relative Strength Index – RSI

The relative strength index (RSI) is another one of the most frequently used and well known

momentum indicators in technical analysis. It is

used to signal overbought and oversold

conditions in a security.

The indicator is plotted between a range of zero

to 100 where 100 is the highest overbought

condition and zero is the highest oversold

condition. The RSI helps to measure the strength

of a security's recent up moves compared to the

strength of its recent down moves. This helps to indicate whether a security has seen more

buying or selling pressure over the trading period.

The standard calculation uses 14 trading periods as the basis for the calculation which can be

adjusted to meet the needs of the user. If the trading periods used is lowered then the RSI will

be more volatile and is used for shorter term trades.

The technique is to use overbought and sold lines to generate buy-and-sell signals. In the RSI,

the overbought line is typically set at 70 and when the RSI is above this level the security is

considered to be overbought. The security is seen as oversold when the RSI is below 30.

These values can be adjusted to either increase or decrease the amount of signals that are

formed by the RSI.

A buy signal is generated when the RSI breaks the oversold line in an upward direction,

which means that it goes from below the oversold line to moving above it. A sell signal is

formed when the RSI breaks the overbought line in a downward direction crossing from

above the line to below the line. A more conservative approach can be used by setting the

overbought and oversold levels at 80 and 20, respectively.

Conclusion

The RSI is a standard component on any basic technical chart. The relative strength indicator

focuses on the momentum underlying the security and is a great secondary measure to be

Mumbai Institute of Management & Research 43

Analysis of Investment Through Broking & Consultancy HIREN

used by traders. It is important to note that the RSI is often not used as the sole generation of

buy-and-sell signals but used in conjunction with other indicators and chart patterns.

CHAPTER 04

Fundamental & Technical Analysis of INFOSYS & TECH

MAHINDRA &its comparison.

Fundamentals of IT companies INFOSYS with TECH MAHINDRA

Current Price (BSE): h 2867

Market cap: h 164,459.51 cr

Mumbai Institute of Management & Research 44

Analysis of Investment Through Broking & Consultancy HIREN

INFOSYS Technologies Ltd.

Current Price (BSE) h 2867

Market cap h 1,64,459.51 cr

Industry Computer –

Software Tech Mahindra Ltd.

CEO Mr. S

Gopalakrishna Current Price (BSE) h 725.05

Face Value 5

Market cap h 8,891.45 cr

Industry Computer – Software

CEO Mr. Vineet Nayyar

Face Value 10

Financials (g in crores) Financials (f in crores)

Operating Income 21,140.00 Operating Income 4,483.80

Net Profit 5,803.00 Net Profit 742.80

Net Worth 21,982.00 Net Worth 2,673.00

No. of Shares(f in 57.28 No. of Shares(f in crs) 12.23

crs)

Adjusted EPS (g) 100.47 Adjusted EPS (f) 56.90

Book value Per 384.69 Book value Per Shares (f) 234.34

Shares (f)

Dividend Per 25.00 Dividend Per Share(f) 3.50

Share(f)

Net Profit Margin 26.31 Net Profit Margin (%) 16.43

(%)

Current Ratio 4.28 Current Ratio 2.17

Lt Debt Equity 0.00 Lt Debt Equity 0.61

Mumbai Institute of Management & Research 45

Analysis of Investment Through Broking & Consultancy HIREN

Ratios: -

Infosys Technologies Ltd. Tech Mahindra Ltd. (2010)

(2010)

Adjusted EPS (f) 100.47 56.9

Cash EPS (f) 114.55 67.52

Book value (f) 384.69 234.34

Dividend Per Share (f) 25 3.5

Return On Networth (%) 26.33 25.91

Return On Capital Employed 33.9 21.57

(%)

Operating Profit Margin (%) 34.85 24.38

Gross Profit Margin (%) 31.04 21.49

Net Profit Margin (%) 26.31 16.43

Current Ratio 4.28 2.17

Quick Ratio 4.2 2.14

Assets Turnover Ratio 5.59 4.06

Bonus Component 93.26 86.13

Profit & Loss Account

Infosys Technologies Ltd. Tech Mahindra Ltd. (2010)

(2010)

Operating Income 21140.00 4483.80

Manufacturing Expenses 2317.00 1176.00

Personal Expenses 10,356.00 1598.70

Selling Expenses 215.00 9.80

Administrative Expenses 883.00 605.80

Cost of Sales 13771.00 3390.30

PBDIT 7369.00 1093.00

Other Recurring Income 910.00 35.60

Adjusted PBDIT 8279.00 1129.10

Depreciation 807.00 129.90

Adjusted PBIT 7472.00 999.20

Adjusted Profit before Tax 7472.00 827.40

Tax Charges 1717.00 131.40

Adjusted PAT 5755.00 696.00

Non Recurring Item 48.00 22.90

Net Profit 5803.00 742.00

Mumbai Institute of Management & Research 46

Analysis of Investment Through Broking & Consultancy HIREN

Equity Dividend 1434.00 42.80

Balance Sheet

Infosys Technologies Ltd. Tech Mahindra Ltd. (2010)

(2010)

Equity Share Capital 287.00 122.30

Reserved & Surplus 21749.00 2744.20

Secured Loans 0.00 1517.70

Unsecured Loans 0.00 617.20

TOTAL 22036.00 5002.60

Gross Block 3779.00 1112.80

Accumulated Depreciation 0.00 518.80

Net Block 3779.00 594.00

Capital Work in Progress 409.00 320.00

Investments 4636.00 3113.00

Current Assets, Loans, 17242.00 1807.00

Advances

Less-Current Liabilities & 4030.00 824.90

Provision

Total Net Current Assets 13212.00 972.90

TOTAL 22036.00 5001.60

Number Of Equity Shares 57.28 12.23

Outstanding

Bonus Component In Equity 267.66 105.35

Capital

Book Value Of Unquoted 4636.00 3113.90

Investment

Contingent Liabilities 295.00 335.50

TECHNICAL ANALYSIS comparison of INFOSYS & TECH

MAHINDRA

Introduction of INFOSYS & TECH MAHINDRA with the help of TREND

Analysis

Mumbai Institute of Management & Research 47

Analysis of Investment Through Broking & Consultancy HIREN

“The trend technical analysis is the movement of the highs and lows that

constitutes a trend. UPTREND is classified as a higher highs & higher lows, while

DOWNTREND is one of lower lows and lower highs.”

The above chart shows the technical analysis LINE CHART of INFOSYS

As mention in the chart GREEN line shows the uptrend in the script.

Mumbai Institute of Management & Research 48

Analysis of Investment Through Broking & Consultancy HIREN

The above chart shows the technical analysis LINE CHART of TECH MAHINDRA

As mention in the chart RED line shows the downtrend in the script but in this case in short

run it is showing the uptrend.

TECHNICAL ANALYSIS comparison of INFOSYS & TECH

MAHINDRA

With the help of RSI Indicator

Mumbai Institute of Management & Research 49

Analysis of Investment Through Broking & Consultancy HIREN

Above chart shows the RSI indicators when this particular script reached over bought & over

sold level. The white line in this chart shows the time when there were over bought situation & at

the same time it is visible enough that price of script fell down after the indication.

Mumbai Institute of Management & Research 50

Analysis of Investment Through Broking & Consultancy HIREN

Above chart shows the RSI indicators when this particular script reached over bought & over

sold level. The white line in this chart shows the time when there were over bought situation & at

the same time it is visible enough that price of script fell down after the indication but again at the

end of MAY it is showing the oversold situation & currently it is in uptrend as mentioned in the

trend analysis

Mumbai Institute of Management & Research 51

Analysis of Investment Through Broking & Consultancy HIREN

Moving averages of INFOSYS

Mumbai Institute of Management & Research 52

Analysis of Investment Through Broking & Consultancy HIREN

Moving Averages of TECH MAHIDRA

Mumbai Institute of Management & Research 53

Analysis of Investment Through Broking & Consultancy HIREN

Following chart shows the comparison of two scripts together & clearly specifies the

performance of the scripts where Infosys completely outperforms and tech Mahindra is slowly

recovering from its downtrend.

Mumbai Institute of Management & Research 54

Analysis of Investment Through Broking & Consultancy HIREN

Mumbai Institute of Management & Research 55

Analysis of Investment Through Broking & Consultancy HIREN

Mumbai Institute of Management & Research 56

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ADMINISTRATIVE AND ELECTION LAW DIGESTS First BatchDocument131 pagesADMINISTRATIVE AND ELECTION LAW DIGESTS First BatchzzzNo ratings yet

- Panay Autobus v. Public Service Commission (1933)Document2 pagesPanay Autobus v. Public Service Commission (1933)xxxaaxxxNo ratings yet

- Administering Payroll For The United StatesDocument332 pagesAdministering Payroll For The United StatesJacob WorkzNo ratings yet

- Share-Based Payments With Answer PDFDocument9 pagesShare-Based Payments With Answer PDFAyaka FujiharaNo ratings yet

- Invoice: VAT No: IE6364992HDocument2 pagesInvoice: VAT No: IE6364992HRajNo ratings yet

- Federal Lawsuit Against Critchlow For Topix DefamationDocument55 pagesFederal Lawsuit Against Critchlow For Topix DefamationJC PenknifeNo ratings yet

- Afu 08504 - International Capital Bdgeting - Tutorial QuestionsDocument4 pagesAfu 08504 - International Capital Bdgeting - Tutorial QuestionsHashim SaidNo ratings yet

- 4.31 T.Y.B.Com BM-IV PDFDocument7 pages4.31 T.Y.B.Com BM-IV PDFBhagyalaxmi Raviraj naiduNo ratings yet