Professional Documents

Culture Documents

Chapter 5 Final Withholding Tax Handouts

Uploaded by

Ivy Salise0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

Chapter 5 final withholding tax handouts.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageChapter 5 Final Withholding Tax Handouts

Uploaded by

Ivy SaliseCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

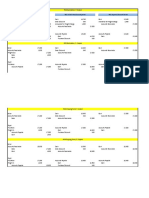

Chapter 5: Final Withholding Tax tax – free

- Imposes on person upon the person making income corporate

payments the responsibility to withhold covenant

- Taxpayer receives the amount net of tax. bonds TAX ON PRE-TERMINATION

- Applies only to certain passive income EARNED

FROM SOURCES WITHIN THE PHIL.

Non-resident persons not engaged in business in the

Philippines and Non-resident Foreign Corp.

- All income earned within the Phil whether active or

passive income are subject to final tax

Taxpayer General Final Rate

NRA – NETB 25%

NRFC 30%

PASSIVE INCOME subject to Final Tax

Interest or

yield from SOURCES RECIPIENT

bank Individuals Corp

deposits or Short term deposits 20% 20%

deposits (below 5 yrs)

substitutes Long term deposits Exempt 20%

(LOCAL (5 yrs and above) (except

CURRENCY) NRA-

NETB)

Tax on Pre-termination of Long-term deposits

of individual

Holding Period Final Tax

Less than 3 yrs 20%

3 yrs – 4 yrs 12%

4 yrs – 5 yrs 5%

5 yrs or more 0%

Domestic

dividends,

in general

Dividend

income

from a Real

Estate

Investment

Trust

Share in Net

Income of a

business

partnership,

taxable

association,

JV or co-

ownership

Royalties

Prizes

Winnings

Informer’s

tax reward

Interest

Income on

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Course Guide Course Title: Accounting For Government and Non-Profit Organization Course Code: Credit Units: Course DescriptionDocument2 pagesCourse Guide Course Title: Accounting For Government and Non-Profit Organization Course Code: Credit Units: Course DescriptionIvy SaliseNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Law On Sales 01 DiscussionDocument13 pagesLaw On Sales 01 DiscussionIvy SaliseNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- SaleDocument2 pagesSaleIvy SaliseNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Book Value Per Share TQDocument6 pagesBook Value Per Share TQIvy SaliseNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Inventories QuizDocument4 pagesInventories QuizIvy Salise100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- TaxationDocument1 pageTaxationIvy SaliseNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- OPT SummaryDocument5 pagesOPT SummaryIvy SaliseNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- TAXDocument1 pageTAXIvy SaliseNo ratings yet

- Shipping Entries PDF 12345Document2 pagesShipping Entries PDF 12345Ivy SaliseNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 5-Year Development Plan GuideDocument2 pages5-Year Development Plan GuideIvy SaliseNo ratings yet

- Acctg1 HandoutsDocument3 pagesAcctg1 HandoutsIvy SaliseNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)