Professional Documents

Culture Documents

Soal PR CHP 7 AMBL

Soal PR CHP 7 AMBL

Uploaded by

anon_4596984490 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

Soal PR CHP 7 AMBL.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesSoal PR CHP 7 AMBL

Soal PR CHP 7 AMBL

Uploaded by

anon_459698449Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF or read online from Scribd

You are on page 1of 2

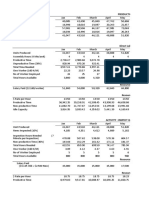

Problem 7.36 Direct Method, Reciprocal Method, Overhead Rates

Macalister Corporation is developing departmental overhead rates based on direct labor hours

for its two production depastments—Molding and Assembly. The Molding Department

employs 20 people, and the Assembly Department employs 80 people. Each person in these two

departments works 2,000 hours per year. The production-related overhead costs for the Molding

Department are budgeted at $190,000, and the Assembly Department costs are budgeted at

$580,000. Two support departments—Engineering and General Factory—direetly support the

‘two production departments and have budgeted costs of $216,000 and $370,000, respectively.

The production departments’ overhead rates cannot be determined until the support depart-

ments’ costs are properly allocated. The following schedule reflects the use of the Engineering

Department's and General Factory Department's output by the various departments.

Engineering General Factory Molding __Assembly

Engineering hours 2,000 2,000

‘Square feet 120,000 — 420,000

For all requirements, round allocation ratios to four significant digits and round allocated

costs to the nearest dollar.

Required:

1. Calculate the overhead rates per direet labor hour for the Molding Department and the As-

"sembly Department using the direct allocation method to charge the production depart-

rents for support department costs.

2. Calculate the overhead rates per direct labor hour for the Molding Department and the As-

sembly Department using the reciprocal method to charge support department costs to each

other and to the production departments.

3. Explain the difference between the methods, and indicate the arguments generally presented

to support the reciprocal method over the direct allocation method. (CMA adapted)

OBJECTIVE @ Problem 7.39 Physical Units Method, Relative

CMA. Bllable Value Method, Decision Making

ossecrie @E

CMA

les-Value-at-Split-off Method, Net

Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and proceses

them into the following three types of lumber products:

1. Studs for residential construction (e.g., walls and ceilings)

2. Decorative pieces (e.g, fireplace mantels and beams for cathedral ceilings)

3. Posts used as support braces (e.g., mine support braces and braces for exterior fences

around ranch properties)

‘These products are the result of a joint sawmill process that involves removing bark from the

logs, cutting the logs into a workable size (ranging from 8 to 16 feet in length), and then cutting

the individual products from the logs, depending upon the type of wood (pine, oak, walnut, oF

‘maple) and the size (diameter) of the log

The joint process results in the following costs and output of products during a typical

month:

Joint production costs

Materials (rough timber logs)

Debarking (labor and overhead)

Sizing (labor and overhead)

Product cutting (labor and overhead)

Total joint costs

Product yield and average sales value on a per-unit basis from the joint process are as follows:

Monthly Fully Processed

Product ‘Output Sales Price

Studs 75,000 $8

Decorative pieces 5,000 100

Posts 20,000 20

The studs are sold as rough-cut lumber after emerging from the sawmill operation without fur-

ther processing by SSI. Also, the posts require no further processing. The decorative pieces must

be planed and further sized after emerging from the SSI sawmill. This additional processing

costs SSI $100,000 per month and normally results in a loss of 10 percent of the units entering

the process. Without this planing and sizing process, there is still an active intermediate market

for the unfinished decorative pieces where the sales price averages $60 per unit.

Required:

1. Based on the information given for Sonimad Sawmill, Ine., allocate the joint processing

costs of $1,000,000 to each of the three product lines using the:

a. Relative sales-value-at-split-off method

b. Physical units method at split-off

©. Estimated net realizable value method

2. Prepare an analysis for Sonimad Sawmill, Inc., to compare processing the decorative pieoes

further as it presently does, with selling the rough-cut product immediately at split-off. Be

sure to provide all calculations.

3. Assume Sonimad Sawmill, Inc., announced that in six months it will sell the rough-cut prod-

uct at split-off due to increasing competitive pressure. Identify at least three types of likely

behavior that will be demonstrated by the skilled labor in the planing and sizing process as

a result of this announcement. Explain how this behavior could be improved by manage-

ment. (CMA adapted)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Amazon Case Study Update FinalDocument14 pagesAmazon Case Study Update Finalanon_459698449No ratings yet

- Amazon Case Study Update FixDocument12 pagesAmazon Case Study Update Fixanon_459698449No ratings yet

- LVMH 6-7Document3 pagesLVMH 6-7anon_459698449No ratings yet

- Soal 6-7Document5 pagesSoal 6-7anon_459698449No ratings yet

- Production BudgetDocument17 pagesProduction Budgetanon_459698449No ratings yet

- Problem 18 - 18 18 - 31 and 18 - 32Document5 pagesProblem 18 - 18 18 - 31 and 18 - 32anon_459698449No ratings yet

- TUGAS AKUNTANSI MANAJEMEN DAN BIAYA DakotaDocument2 pagesTUGAS AKUNTANSI MANAJEMEN DAN BIAYA Dakotaanon_459698449No ratings yet

- Problem 4 - 34 and 4 - 36Document8 pagesProblem 4 - 34 and 4 - 36anon_459698449No ratings yet

- Persetujuan DisidangkanDocument1 pagePersetujuan Disidangkananon_459698449No ratings yet

- Analysis of Debtor Information System Development Through Sistem Layanan Informasi Keuangan (Slik) Using Method Model View Controler (MVC)Document6 pagesAnalysis of Debtor Information System Development Through Sistem Layanan Informasi Keuangan (Slik) Using Method Model View Controler (MVC)anon_459698449No ratings yet

- Kartu Bimbingan TesisDocument2 pagesKartu Bimbingan Tesisanon_459698449No ratings yet

- Author's Own Work Muhammad Haikal Al Wahaby 10/9/2018Document1 pageAuthor's Own Work Muhammad Haikal Al Wahaby 10/9/2018anon_459698449No ratings yet

- Soal PR CHP 7 AMBLDocument2 pagesSoal PR CHP 7 AMBLanon_459698449No ratings yet