Professional Documents

Culture Documents

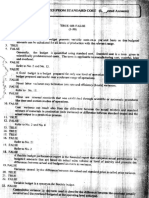

Securities Regulation Code PDF

Uploaded by

joyjoyjoy0 ratings0% found this document useful (0 votes)

13 views11 pagesOriginal Title

Securities Regulation Code.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views11 pagesSecurities Regulation Code PDF

Uploaded by

joyjoyjoyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

Securities Regulation Code (R.A.

8799) necessary for the proper disposition of the

cases before it, subject to the provisions of

A. Implementing Agency of Securities Regulation Code –

existing laws;

The law shall be implemented by Security and Exchange

13. Suspend, or revoke, after proper notice and

Commission which is a collegial body, composed of a

hearing the franchise or certificate of

chairperson and (4) Commissioners

registration of corporations, partnership or

i. Powers and Functions of the Securities and

associations, upon any of the grounds provided

Exchange Commission

by law; and

1. Have jurisdiction and supervision over all

14. Exercise such other powers as may be provided

corporations, partnership or associations who

by law as well as those which may be implied

are the grantees of primary franchises and/or a

from, or which are necessary or incidental to

license or a permit issued by the Government;

the carrying out of, the express powers granted

2. Formulate policies and recommendations on

the Commission to achieve the objectives and

issues concerning the securities market, advise

purposes of these laws

Congress and other government agencies on all

ii. Jurisdiction of Security and Exchange Commission to

aspect of the securities market and propose

Intra-Corporate Disputes

legislation and amendments thereto;

The Commission’s jurisdiction over all cases

3. Approve, reject, suspend, revoke or require

enumerated under section 5 of Presidential Decree

amendments to registration statements, and

No. 902-A is hereby transferred to the Courts of

registration and licensing applications;

general jurisdiction or the appropriate Regional Trial

4. Regulate, investigate or supervise the activities

Court: Provided, That the Supreme Court in the

of persons to ensure compliance;

exercise of its authority may designate the Regional

5. Supervise, monitor, suspend or take over the

Trial Court branches that shall exercise jurisdiction

activities of exchanges, clearing agencies and

over these cases a.k.a. Special Commercial Courts.

other SROs;

iii. Four Principal Departments of Securities and

6. Impose sanctions for the violation of laws and

Exchange Commission

rules, regulations and orders, and issued

1. The Markets and Securities Regulation

pursuant thereto;

Department develops the registration criteria for

7. Prepare, approve, amend or repeal rules,

all market participants and supervises them to

regulations and orders, and issue opinions and

ensure compliance with registration

provide guidance on and supervise compliance

requirements and endorses infractions of the

with such rules, regulation and orders;

Code and rules and regulations to the

8. Enlist the aid and support of and/or deputized

Enforcement and Investor Protection

any and all enforcement agencies of the

Department. It registers equity securities and

Government, civil or military as well as any

debt instruments, or recommends their

private institution, corporation, firm,

exemption from registration before they are

association or person in the implementation of

sold, offered for sale, or distributed to the public

its powers and function under its Code;

and ensures that full, timely and accurate

9. Issue cease and desist orders to prevent fraud

information is available about the said securities.

or injury to the investing public;

2. The Corporate Governance and Finance

10. Punish for the contempt of the Commission,

Department registers mutual funds, including

both direct and indirect, in accordance with the

exchange-traded funds, membership certificates,

pertinent provisions of and penalties

club shares, both proprietary and non-

prescribed by the Rules of Court;

proprietary, and time shares before they are

11. Compel the officers of any registered

offered for sale or sold to the public and ensures

corporation or association to call meetings of

that adequate information is available about the

stockholders or members thereof under its

said securities. It also ensures that investors have

supervision;

access to all material disclosures regarding the

12. Issue subpoena duces tecum and summon

said offering and the securities of public

witnesses to appear in any proceedings of the

companies. The department also monitors

Commission and in appropriate cases, order

compliance by the above issuers with the Code

the examination, search and seizure of all

and rules and regulations adopted thereunder

documents, papers, files and records, tax

and compliance of financing, lending companies

returns and books of accounts of any entity or

and foundations with existing laws, rules and

person under investigation as may be

regulations and endorse infractions thereof to

Page 1 of 11

the Enforcement and Investor Protection 3. The registration statement shall be signed by the

Department. It monitors covered companies’ issuer’s executive officer, its principal operating

compliance with the Revised Code of Corporate officer, its principal financial officer, its

Governance and other corporate governance comptroller, its principal accounting officer, its

issuances of the Commission. corporate secretary, or persons performing

3. The Company Registration and Monitoring similar functions accompanied by a duly verified

Department registers domestic corporations, resolution of the board of directors of the issuer

partnerships and associations, including corporation. The written consent of the expert

representative offices and foreign corporations named as having certified any part of the

intending to do business in the Philippines. It also registration statement or any document used in

supervises and monitors such entities relative to connection therewith shall also be filed. Where

their compliance with law, rules and regulations the registration statement shares to be sold by

administered by the Commission. selling shareholders, a written certification by

4. The Enforcement and Investor Protection such selling shareholders as to the accuracy of

Department ensures compliance by all market any part of the registration statement

participants, issuers and individuals, and takes contributed to by such selling shareholders shall

appropriate enforcement action against them for be filed.

legal infraction of the Code and other relevant 4. Upon filing of the registration statement, the

laws, rules and regulations administered by the issuer shall pay to the Commission a fee of not

Commission. more than one-tenth (1/10) of one per centum

(1%) of the maximum aggregate price at which

B. Requirement for Registration of Securities Prior to such securities are proposed to be offered.

Disposal in Public 5. Within forty-five (45) days after the date of filing

i. No securities shall be sold or offered for sale, or of the registration statement, or by such later

distributed by any person or entity within the date to which the issuer has consented, the

Philippines unless such securities are duly registered Commission shall declare the registration

with the Securities and Exchange Commission statement effective or rejected, unless the

ii. No information relating to an offering of securities applicant is allowed to amend the registration

shall be disseminated unless a registration statement statement.

has been filed with the Securities and Exchange 6. Upon affectivity of the registration statement,

Commission and the written communication the issuer shall state under oath in every

proposed to be released contains the required prospectus that all registration requirements

information under SRC. have been met and that all information are true

iii. No person shall offer, sell or enter into commodity and correct as represented by the issuer or the

futures contracts except in accordance with the one making the statement. Any untrue

rules, regulations and orders the SEC may prescribe statement of fact or omission to state a material

in the public interest. The SEC shall promulgate rules fact required to be stated herein or necessary to

and regulations involving commodity futures make the statement therein not misleading shall

contracts to protect investors to ensure the constitute fraud.

development of a fair and transparent commodities 7. If a registration statement is on its face

market. incomplete or inaccurate in any material respect,

iv. Requirements for Registration of Securities the SEC shall issue an order directing the

1. All securities required to be registered under amendment of the registration statement.

Subsection 8. I shall be registered through the v. Grounds for Rejection or Revocation of Registration

filing by the issuer in the main office of the of Securities

Commission, of a sworn registration statement 1. The issuer:

with the respect to such securities, in such form a. Has been judicially declared insolvent.

and containing such information and document b. Has violated any of the provision of this

as the Commission prescribe. The registration Code, the rules promulgate pursuant

statement shall include any prospectus required. thereto, or any order of the Commission of

2. The information required for the registration of which the issuer has notice in connection

any kind, and all securities, shall include, among with the offering for which a registration

others, the effect of the securities issue on statement has been filed

ownership, on the mix of ownership, especially c. Has been or is engaged or is about to engage

foreign and local ownership. in fraudulent transactions;

Page 2 of 11

d. Has made any false or misleading the issuer of the securities, to the Exchange where the

representation of material facts in any security is traded, and to the Commission a sworn

prospectus concerning the issuer or its statement containing (1) personal information of

securities; purchaser (2) purpose of purchase (3) Number of shares

e. Has failed to comply with any requirements beneficially owned and (4) other information.

that the Commission may impose as a

condition for registration of the security for C. Kinds of Securities under Securities Regulation Code

which the registration statement has been i. Definition of Securities - "Securities" are shares,

filed; or participation or interests in a corporation or in a

2. The registration statement is on its face commercial enterprise or profit-making venture and

incomplete or inaccurate in any material respect evidenced by a certificate, contract, instruments,

or includes any untrue statements of a material whether written or electronic in character.

fact required to be stated therein or necessary to 1. Commodity futures contract means a contract

make the statement therein not misleading; or providing for the making or taking delivery at a

3. The issuer, any officer, director or controlling prescribed in the future of a specific quantity

person performing similar functions, or any under and quality of a commodity or the cash value

writer has been convicted, by a competent judicial thereof, which is customarily offset prior to the

or administrative body, upon plea of guilty, or delivery date, and includes standardized

otherwise, of an offense involving moral turpitude contracts having the indicia of commodities

and /or fraud or is enjoined or restrained by the futures, commodity options and commodity

Commission or other competent or administrative leverage, or margin contracts.

body for violations of securities, commodities, and 2. Commodity means any goods, articles,

other related laws. agricultural and mineral products, services,

vi. Grounds for Suspension of Registration of Securities rights and interests, financial instruments,

1. If at any time, the information contained in the foreign currencies, including any group or index

registration statement filed is or has become of any of the foregoing, in which commodity

misleading, incorrect, inadequate or incomplete interest contracts are presently or in the future

in any material respect, or the sale or offering for dealt in.

sale of the security registered thereunder may 3. Forward means a contract interest between a

work or tend to work a fraud. buyer and a seller whereby the buyer is

2. Refusal to furnish information required by the obligated to take delivery and the seller is

SEC obliged to deliver a fixed amount of an

vii. Entities required to submit Financial Statements underlying commodity at a predetermined

within the period prescribed by SEC price and date. Payment in full is due at the

1. An issuer which has sold a class of its securities time of delivery.

which are required to be registered. 4. Warrant Certificate – means the certificate

2. An issuer with a class of securities listed for representing the right to a Warrant, which may

trading on an Exchange Market or may not be detachable, that is issued by an

3. An issuer with assets of at least Fifty million Issuer to a Warrant holder.

pesos (50,000,000.00) or such other amount as 5. Warrant Instrument – means the written

the Commission shall prescribe, and having two document or deed containing the terms and

hundred (200) or more holder each holding at conditions of the issue and exercise of a

least one hundred (100) share of a class of its Warrant whose terms and conditions shall

equity securities: Provided, however, That the include (i) the maximum underlying shares that

obligation of such issuer to file report shall be can be purchased upon exercise, (ii) the

terminate ninety (90) days after notification to exercise period, and (iii) such other terms and

the Commission by the issuer that the number of conditions as the Commission may require.

its holders holding at least one hundred (100) 6. Detachable Warrant – means a Warrant that

share reduced to less than one hundred (100). may be sold, transferred or assigned to any

In every case in which an issuer satisfies the person by the Warrant holder separate from,

requirements for Financial Statements submission, any and independent of, the corresponding

person who acquires directly or indirectly the beneficial Beneficiary Securities.

ownership of more than five of per centum (5%) of such 7. Non-detachable Warrant – means a Warrant

class or in within ten (10) days after such acquisition or that may not be sold, transferred or assigned to

such reasonable time as fixed by Commission, submit to any person by the Warrant holder separate

Page 3 of 11

from, and independent of, the Beneficiary regulation of the Office of the Insurance

Securities. Commission, Housing and Land Use Rule

8. Beneficiary Securities – means the shares of Regulatory Board, or the Bureau of Internal

stock and other securities of the Issuer which Revenue.

form the basis of entitlement in a Warrant. 5. Any security issued by a bank except its own

9. Underlying Shares – means the unissued shares of stock.

shares of a corporation that may be purchased iv. Exempted Transactions from Requirement of

by the Warrant holder upon the exercise of the Registration with SEC

right granted under the Warrant. 1. At any judicial sale, or sale by an executor,

10. Pre-need plans are contracts which provide for administrator, guardian or receiver or trustee

the performance of future services of or the in insolvency or bankruptcy.

payment of future monetary considerations at 2. By or for the account of a pledge holder, or

the time actual need, for which plan holders mortgagee or any of a pledge lien holder selling

pay in cash or installment at stated prices, with of offering for sale or delivery in the ordinary

or without interest or insurance coverage and course of business and not for the purpose of

includes life, pension, education, interment, avoiding the provision of this Code, to liquidate

and other plans which the Commission may a bonafide debt, a security pledged in good

from time to time approve. faith as security for such debt.

ii. Securities Required to be Registered to SEC 3. An isolated transaction in which any security is

1. Shares of stocks, bonds, debentures, notes sold, offered for sale, subscription or delivery

evidences of indebtedness, asset-backed by the owner therefore, or by his

securities; representative for the owner’s account, such

2. Investment contracts, certificates of interest or sale or offer for sale or offer for sale,

participation in a profit sharing agreement, subscription or delivery not being made in the

certifies of deposit for a future subscription; course of repeated and successive transaction

3. Fractional undivided interests in oil, gas or other of a like character by such owner, or on his

mineral rights; account by such representative and such owner

4. Derivatives like option and warrants; or representative not being the underwriter of

5. Certificates of assignments, certificates of such security.

participation, trust certificates, voting trust 4. The distribution by a corporation actively

certificates or similar instruments engaged in the business authorized by its

6. Proprietary or nonproprietary membership articles of incorporation, of securities to its

certificates in corporations; and stockholders or other security holders as a

7. Other instruments as may in the future be stock dividend or other distribution out of

determined by the Commission. surplus.

iii. Exempted Securities from Requirement of 5. The sale of capital stock of a corporation to its

Registration with SEC own stockholders exclusively, where no

1. Any security issued or guaranteed by the commission or other remuneration is paid or

Government of the Philippines, or by any political given directly or indirectly in connection with

subdivision or agency thereof, or by any person the sale of such capital stock.

controlled or supervised by, and acting as an 6. The issuance of bonds or notes secured by

instrumentality of said Government. mortgage upon real estate or tangible personal

2. Any security issued or guaranteed by the property, when the entire mortgage together

government of any country with which the with all the bonds or notes secured thereby are

Philippines maintains diplomatic relations, or by sold to a single purchaser at a single sale.

any state, province or political subdivision 7. The issue and delivery of any security in

thereof on the basis of reciprocity: Provided, exchange for any other security of the same

That the Commission may require compliance issuer pursuant to a right of conversion

with the form and content for disclosures the entitling the holder of the security surrendered

Commission may prescribe. in exchange to make such conversion:

3. Certificates issued by a receiver or by a trustee in Provided, That the security so surrendered has

bankruptcy duly approved by the proper been registered under this Code or was, when

adjudicatory body. sold, exempt from the provision of this Code,

4. Any security or its derivatives the sale or transfer and that the security issued and delivered in

of which, by law, is under the supervision and exchange, if sold at the conversion price, would

Page 4 of 11

at the time of such conversion fall within the equity securities of an associate or related company

class of securities entitled to registration under of such public company which controls the said

this Code. Upon such conversion the par value public company.

of the security surrendered in such exchange ii. Issuer Tender Offers – means a publicly announced

shall be deemed the price at which the intention by an Issuer to reacquire any of its own

securities issued and delivered in such class of equity securities, or by an associate of such

exchange are sold. Issuer to acquire such securities.

8. Broker’s transaction, executed upon customer’s iii. “Tender offer materials” means: (i) the Offeror’s

orders, on any registered Exchange or other formal offer, including all the material terms and

trading market. conditions of the tender offer and all their

9. Subscriptions for shares of the capitals stocks amendments; (ii) the related transmittal letter

of a corporation prior to the incorporation (whereby equity securities of the target company

thereof or in pursuance of an increase in its that are sought in the tender offer may be

authorized capital stocks under the Corporation transmitted to the Offeror or its depository) and all

Code, when no expense is incurred, or no their amendments; and (iii) press releases,

commission, compensation or remuneration is advertisements, letters and other documents

paid or given in connection with the sale or published by the Offeror or sent or given by the

disposition of such securities, and only when Offeror to security holders which, directly or

the purpose for soliciting, giving or taking of indirectly, solicit, invite or request tenders of the

such subscription is to comply with the equity securities being sought in the tender offer.

requirements of such law as to the percentage iv. Instances of Mandatory Tender Offers

of the capital stock of a corporation which 1. Any person or group of persons acting in concert,

should be subscribed before it can be who intends to acquire fifteen percent (15 %) of

registered and duly incorporated, or its equity securities in a public company in one or

authorized, capital increase. more transactions within a period of twelve (12)

10. The exchange of securities by the issuer with months, shall file a declaration to that effect with

the existing security holders exclusively, where the SEC.

no commission or other remuneration is paid 2. Any person or group of persons acting in concert,

or given directly or indirectly for soliciting such who intends to acquire thirty five percent (35%)

exchange. of the outstanding voting shares or such

11. The sale of securities by an issuer to fewer than outstanding voting shares that is sufficient to

twenty (20) persons in the Philippines during gain control of the board in a public company in

any twelve-month period. one or more transactions within a period of

12. The sale of securities to any number of the twelve (12) months, shall disclose such intention

following qualified buyers: (i) Bank; (ii) and contemporaneously make a tender offer for

Registered investment house; (iii) Insurance the percentage sought to all holders of such

company; (iv) Pension fund or retirement plan securities within the said period. If the tender

maintained by the Government of the offer is oversubscribed, the aggregate amount of

Philippines or any political subdivision thereof securities to be acquired at the close of such

or manage by a bank or other persons tender offer shall be proportionately distributed

authorized by the Bangko Sentral to engage in across selling shareholders with whom the

trust functions; (v) Investment company or; (vi) acquirer may have been in private negotiations

Such other person as the Commission may rule and other shareholders. For purposes of SRC

by determine as qualified buyers, on the basis Rule 19.2.2, the last sale that meets the

of such factors as financial sophistication, net threshold shall not be consummated until the

worth, knowledge, and experience in financial closing and completion of the tender offer.

and business matters, or amount of assets 3. Any person or group of persons acting in concert,

under management. who intends to acquire thirty five percent (35%)

of the outstanding voting shares or such

D. Protection of Shareholders Interest outstanding voting shares that is sufficient to

i. Tender Offer – means a publicly announced gain control of the board in a public company

intention by a person acting alone in concert with through the Exchange trading system shall not be

other persons (hereinafter referred to a “person”) to required to make a tender offer even if such

acquire outstanding equity securities of a public person or group of persons acting in concert

company as defined in SRC Rule 3, or outstanding acquire the remainder through a block sale if,

Page 5 of 11

after acquisition through the Exchange trading 1. To implement a stock option or stock purchase

system, they fail to acquire their target of thirty plan;

five percent (35%) or such outstanding voting 2. To meet short-term obligations which can be

shares that is sufficient to gain control of the settled by the re-issuance of the repurchased

board shares;

4. Any person or group of persons acting in concert, 3. To pay dissenting or withdrawing stockholders

who intends to acquire thirty five percent (35%) entitled to payment for their securities under the

of the outstanding voting shares or such Corporation Code; and

outstanding voting shares that is sufficient to 4. Such other legitimate corporate purposes.

gain control of the board in a public company vii. Dissemination Requirements of Tender Offer

directly from one or more stockholders shall be 1. An Offeror or Issuer shall publish the terms and

required to make a tender offer for all the conditions of the tender offering in two (2)

outstanding voting shares. The sale of shares national newspapers of general circulation in

pursuant to the private transaction or block sale the Philippines on the date of commencement

shall not be completed prior to the closing and of the tender offer and for two (2) consecutive

completion of the tender offer. days after compliance with SRC Rule 19.7.1.

5. If any acquisition that would result in ownership 2. If a material change occurs in the information

of over fifty percent (50%) of the total published, sent or given to security holders, the

outstanding equity securities of a public Offeror shall disseminate promptly a disclosure

company, the acquirer shall be required to make of such change in a manner reasonably

a tender offer under this Rule for all the calculated to inform security holders of such

outstanding equity securities to all remaining change.

stockholders of the said company at a price viii. Period and Manner of Making Tender Offers

supported by a fairness opinion provided by an 1. Expiration Period of Tender Offer - A tender

independent financial advisor or equivalent third offer shall, unless withdrawn, remain open

party. The acquirer in such a tender offer shall be until the expiration of:

required to accept all securities tendered. a. At least twenty (20) business days from its

v. Transactions Exempted from Mandatory Tender commencement; Provided, that an offer

Offers should as much as possible be completed

1. Any purchase of securities from the unissued within sixty (60) business days from the date

capital stock; Provided, the acquisition will not the intention to make such offer is publicly

result to a fifty percent (50%) or more ownership announced; or

of securities by the purchaser or such percentage b. At least ten (10) business days from the date

that is sufficient to gain control of the board; the notice of a change in the percentage of

2. Any purchase of securities from an increase in the class of securities being sought or in the

authorized capital stock; consideration offered is first published, sent

3. Purchase in connection with foreclosure or given to security holders.

proceedings involving a duly constituted pledge 2. In a mandatory tender offer, the Offeror shall

or security arrangement where the acquisition is be compelled to offer the highest price paid by

made by the debtor or creditor; him for such securities during the preceding six

4. Purchases in connection with a privatization (6) months. If the offer involves payment by

undertaken by the government of the transfer or allotment of securities, such

Philippines; securities must be valued on an equitable basis.

5. Purchases in connection with corporate 3. In case of a tender offer other than by an

rehabilitation under court supervision; Issuer, the subject of the tender offer (“the

6. Purchases in the open market at the prevailing target company”) shall not engage in any of the

market price; and following transactions during the course of a

7. Merger or consolidation. tender offer, or before its commencement if its

vi. Tender offer by an Issuer or Buy Back - A board has reason to believe that an offer might

reacquisition or repurchase by an Issuer of its own be imminent, except if such transaction is

securities shall only be made if such Issuer has pursuant to a contract entered into earlier, or

unrestricted retained earnings in its books to cover with the approval of the shareholders in a

the amount of shares to be purchased, and is general meeting or, where special

undertaken for any of the following purposes: circumstances exist, the Commission’s approval

has been obtained:

Page 6 of 11

a. Issue any authorized but unissued shares; a. To employ any device, scheme or artifice to

b. Issue or grant options in respect to any defraud any person;

unissued shares; b. To make any untrue statement of a material

c. Create or issue, or permit the creation or fact or to omit to state a material fact

issuance of, any securities carrying rights of necessary in order to make the statements

conversion into, or subscription to, shares; made, in the light of the circumstances

d. Sell, dispose of or acquire, or agree to under which they were made, not

acquire, any asset whose value amounts to misleading; or

five percent (5 %) or more of the total value c. To engage in any act, practice or course of

of the assets prior to acquisition; or business which operates or would operate

e. Enter into contracts that are not in the as a fraud or deceit upon any person.

ordinary course of business. d. If a person shall become aware of a potential

4. The Offeror in a tender offer shall permit the tender offer before the tender offer has

securities tendered to be withdrawn (i) at any been publicly announced, such person shall

time during the period such tender offer not buy or sell, directly or indirectly, the

remains open; and(ii) if not yet accepted for securities of the target company until the

payment, after the expiration of sixty (60) tender offer shall have been publicly

business days from the commencement of the announced. Such buying or selling shall

tender offer. constitute insider trading under Section 27.4

5. If the tender offer shall be for less than the of the Code.

total outstanding securities of a class, but a i. Manipulation of Security Prices, Devices and

greater number of securities is tendered, the Practices (Unlawful Acts Involving Manipulation of

Offeror shall be obliged to accept and pay the Security Prices, Devices and Practices). It shall be

securities on a pro rata basis, disregarding unlawful for any person acting for himself or through

fractions, according to the number of securities a dealer or broker, directly or indirectly:

tendered by each security holder during the a. To create a false or misleading appearance of

period the offer was open. active trading in any listed security traded in an

6. In the event the Offeror in a tender offer Exchange of any other trading market (hereafter

increases the consideration offered after the referred to purposes of this Chapter as

tender offer has commenced, the Offeror shall "Exchange"):

pay such increased consideration to all security i. By effecting any transaction in such security

holders whose tendered securities have been which involves no change in the beneficial

accepted for payment by such Offeror, whether ownership thereof;

or not the securities were tendered prior to the ii. By entering an order or orders for the

variation of the tender offer’s terms. purchase or sale of such security with the

7. The Offeror in a tender offer shall either pay knowledge that a simultaneous order or orders

the consideration offered, or return the of substantially the same size, time and price,

tendered securities, not later than ten (10) for the sale or purchase of any such security,

business days after the termination or the has or will be entered by or for the same or

withdrawal of the tender offer. different parties; or

8. No tender offer shall be made unless: iii. By performing similar act where there is no

9. Unless with the prior approval of the change in beneficial ownership.

Commission, if an offer has been announced b. To affect, alone or with others, a securities or

but has not become unconditional in all transactions in securities that: (I) Raises their

respects and has been withdrawn or has price to induce the purchase of a security,

lapsed, neither the Offeror nor any person who whether of the same or a different class of the

acted in concert with it in the course of the same issuer or of controlling, controlled, or

offer may, within six (6) months from the date commonly controlled company by others; or (iii)

on which such offer has been withdrawn or has Creates active trading to induce such a purchase

lapsed, announce an offer for the target or sale through manipulative devices such as

company nor acquire any securities of the marking the close, painting the tape, squeezing

target company which would require such the float, hype and dump, boiler room

person to make a mandatory tender offer operations and such other similar devices.

under this Rule and Section 19.1 of the Code. c. To circulate or disseminate information that the

10. Prohibited Acts in any Tender Offer price of any security listed in an Exchange will or

Page 7 of 11

is likely to rise or fall because of manipulative defined in Subsection 3.8, or such insider’s spouse or

market operations of any one or more persons relatives by affinity or consanguinity within the

conducted for the purpose of raising or second degree, legitimate or common-law, shall be

depressing the price of the security for the presumed to have been effected while in possession

purpose of inducing the purpose of sale of such of material nonpublic information if transacted after

security. such information came into existence but prior to

d. To make false or misleading statement with dissemination of such information to the public and

respect to any material fact, which he knew or the lapse of a reasonable time for market to absorb

had reasonable ground to believe was so false such information: Provided, however, That this

or misleading, for the purpose of inducing the presumption shall be rebutted upon a showing by

purchase or sale of any security listed or traded the purchaser or seller that he was aware of the

in an Exchange. material nonpublic information at the time of the

e. To effect, either alone or others, any series of purchase or sale.

transactions for the purchase and/or sale of any a. For purposes of this Section, information is

security traded in an Exchange for the purpose "material nonpublic" if: (a) It has not been

of pegging, fixing or stabilizing the price of such generally disclosed to the public and would

security; unless otherwise allowed by this Code likely affect the market price of the security

or by rules of the Commission. after being disseminated to the public and the

f. No person shall use or employ, in connection lapse of a reasonable time for the market to

with the purchase or sale of any security any absorb the information; or (b) would be

manipulative or deceptive device or considered by a reasonable person important

contrivance. Neither shall any short sale be under the circumstances in determining his

effected nor any stop-loss order be executed in course of action whether to buy, sell or hold a

connection with the purchase or sale of any security.

security except in accordance with such rules b. It shall be unlawful for any insider to

and regulations as the Commission may communicate material nonpublic information

prescribe as necessary or appropriate in the about the issuer or the security to any person

public interest for the protection of investors. who, by virtue of the communication, becomes

ii. Fraudulent Transactions - It shall be unlawful for any an insider as defined in Subsection 3.8, where

person, directly or indirectly, in connection with the the insider communicating the information

purchase or sale of any securities to: knows or has reason to believe that such person

a. Employ any device, scheme, or artifice to will likely buy or sell a security of the issuer

defraud; whole in possession of such information.

b. Obtain money or property by means of any c. It shall be unlawful where a tender offer has

untrue statement of a material fact of any commenced or is about to commence for: (i)

omission to state a material fact necessary in Any person (other than the tender offeror) who

order to make the statements made, in the light is in possession of material nonpublic

of the circumstances under which they were information relating to such tender offer, to buy

made, not misleading; or or sell the securities of the issuer that are

c. Engage in any act, transaction, practice or sought or to be sought by such tender offer if

course of business which operates or would such person knows or has reason to believe that

operate as a fraud or deceit upon any person. the information is nonpublic and has been

iii. Insider Trading - It shall be unlawful for an insider to acquired directly or indirectly from the tender

sell or buy a security of the issuer, while in offeror, those acting on its behalf, the issuer of

possession of material information with respect to the securities sought or to be sought by such

the issuer or the security that is not generally tender offer, or any insider of such issuer; and

available to the public, unless: (a) The insider proves (ii) Any tender offeror, those acting on its

that the information was not gained from such behalf, the issuer of the securities sought or to

relationship; or (b) If the other party selling to or be sought by such tender offer, and any insider

buying from the insider (or his agent) is identified, of such issuer to communicate material

the insider proves: (I) that he disclosed the nonpublic information relating to the tender

information to the other party, or (ii) that he had offer to any other person where such

reason to believe that the other party otherwise is communication is likely to result in a violation of

also in possession of the information. A purchase or Subsection 27.4.

sale of a security of the issuer made by an insider

Page 8 of 11

E. Regulation of Pre-Need Plans in order that no director or small group of

No person shall sell or offer for sale to the public any directors can dominate the decision making

pre-need plan except in accordance with rules and process.

regulations which the Commission shall prescribe. Such rules 4. The non-executive directors should possess such

shall regulate the sale of pre-need plans by, among other qualifications and stature that would enable

things, requiring the registration of pre-need plans, licensing them to effectively participate in the

persons involved in the sale of pre- need plans, requiring deliberations of the Board.

disclosures to prospective plan holders, prescribing v. Additional Qualifications of Directors of

advertising guidelines, providing for uniform accounting Corporations covered by Revised Code of Corporate

system, reports and recording keeping with respect to such Governance. In addition to the qualifications for

plans, imposing capital, bonding and other financial membership in the Board provided for in the

responsibility, and establishing trust funds for the payment Corporation Code, Securities Regulation Code and

of benefits under such plans. other relevant laws, the Board may provide for

additional qualifications which include, among

F. Code of Corporate Governance (Revised Code of others, the following:

Corporate Governance) 1. College education or equivalent academic degree;

i. Companies covered by the Revised Code of 2. Practical understanding of the business of the

Corporate Governance corporation;

1. Corporations that sell equity and/or debt 3. Membership in good standing in relevant industry,

securities to the public that are required to be business or professional organizations; and

registered with the Commission, or 4. Previous business experience.

2. Corporations that have assets in excess of Fifty vi. Grounds for Permanent Disqualifications of

Million Pesos and at least two hundred (200) Directors of Corporations covered by Revised Code

stockholders who own at least one hundred (100) of Corporate Governance

shares each of equity securities, or 1. Any person convicted by final judgment or order

3. Corporations whose equity securities are listed on by a competent judicial or administrative body of

an Exchange; or any crime that (a) involves the purchase or sale

4. Corporations that are grantees of secondary of securities, as defined in the Securities

licenses from the Commission. Regulation Code; (b) arises out of the person’s

ii. Corporation Governance refers to the framework of conduct as an underwriter, broker, dealer,

rules, systems and processes in the corporation that investment adviser, principal, distributor, mutual

governs the performance by the Board of Directors fund dealer, futures commission merchant,

and Management of their respective duties and commodity trading advisor, or floor broker; or (c)

responsibilities to the stockholders. arises out of his fiduciary relationship with a

iii. Board of Directors refers to the governing body bank, quasi-bank, trust company, investment

elected by the stockholders that exercises the house or as an affiliated person of any of them;

corporate powers of a corporation, conducts all its 2. Any person who, by reason of misconduct, after

business and controls its properties; hearing, is permanently enjoined by a final

iv. Composition of the Board of Directors of judgment or order of the Commission or any

Corporations covered by Revised Code of Corporate court or administrative body of competent

Governance jurisdiction from: (a) acting as underwriter,

1. The Board shall be composed of at least five (5), broker, dealer, investment adviser, principal

but not more than fifteen (15), members who distributor, mutual fund dealer, futures

are elected by the stockholders. commission merchant, commodity trading

2. All companies covered by this Code shall have at advisor, or floor broker; (b) acting as director or

least two (2) independent directors or such officer of a bank, quasi-bank, trust company,

number of independent directors that investment house, or investment company; (c)

constitutes twenty percent (20%) of the engaging in or continuing any conduct or practice

members of the Board, whichever is lesser, but in in any of the capacities mentioned in sub-

no case less than two (2). All other companies paragraphs (a) and (b) above, or willfully

are encouraged to have independent directors in violating the laws that govern securities and

their boards. banking activities.

3. The membership of the Board may be a 3. The disqualification shall also apply if such

combination of executive and non-executive person is currently the subject of an order of the

directors (which include independent directors) Commission or any court or administrative body

Page 9 of 11

denying, revoking or suspending any registration, is due to illness, death in the immediate family or

license or permit issued to him under the serious accident. The disqualification shall apply

Corporation Code, Securities Regulation Code or for purposes of the succeeding election.

any other law administered by the Commission 3. Dismissal or termination for cause as director of

or Bangko Sentral ng Pilipinas (BSP), or under any any corporation covered by this Code. The

rule or regulation issued by the Commission or disqualification shall be in effect until he has

BSP, or has otherwise been restrained to engage cleared himself from any involvement in the

in any activity involving securities and banking; cause that gave rise to his dismissal or

or such person is currently the subject of an termination.

effective order of a self-regulatory organization 4. If the beneficial equity ownership of an

suspending or expelling him from membership, independent director in the corporation or its

participation or association with a member or subsidiaries and affiliates exceeds two percent of

participant of the organization; its subscribed capital stock. The disqualification

4. Any person convicted by final judgment or order shall be lifted if the limit is later complied with.

by a court or competent administrative body of 5. If any of the judgments or orders cited in the

an offense involving moral turpitude, fraud, grounds for permanent disqualification has not

embezzlement, theft, estafa, counterfeiting, yet become final.

misappropriation, forgery, bribery, false 6. A temporarily disqualified director shall, within

affirmation, perjury or other fraudulent acts; sixty (60) business days from such

5. Any person who has been adjudged by final disqualification, take the appropriate action to

judgment or order of the Commission, court, or remedy or correct the disqualification. If he fails

competent administrative body to have willfully or refuses to do so for unjustified reasons, the

violated, or willfully aided, abetted, counseled, disqualification shall become permanent.

induced or procured the violation of any viii. Specific Duties and Responsibilities of a Director - A

provision of the Corporation Code, Securities director’s office is one of trust and confidence. A

Regulation Code or any other law administered director should act in the best interest of the

by the Commission or BSP, or any of its rule, corporation in a manner characterized by

regulation or order; transparency, accountability and fairness. He should

6. Any person earlier elected as independent also exercise leadership, prudence and integrity in

director who becomes an officer, employee or directing the corporation towards sustained

consultant of the same corporation; progress.

7. Any person judicially declared as insolvent; 1. Conduct fair business transactions with the

8. Any person found guilty by final judgment or corporation, and ensure that his personal

order of a foreign court or equivalent financial interest does not conflict with the interests of

regulatory authority of acts, violations or the corporation.

misconduct similar to any of the acts, violations 2. Devote the time and attention necessary to

or misconduct enumerated in sub-paragraphs (i) properly and effectively perform his duties and

to (v) above; responsibilities.

9. Conviction by final judgment of an offense 3. Act judiciously.

punishable by imprisonment for more than six 4. Exercise independent judgment.

(6) years, or a violation of the Corporation Code 5. Have a working knowledge of the statutory and

committed within five (5) years prior to the date regulatory requirements that affect the

of his election or appointment. corporation, including its articles of

vii. Grounds for Temporary Disqualification of Directors incorporation and by-laws, the rules and

of Corporations covered by Revised Code of regulations of the Commission and, where

Corporate Governance applicable, the requirements of relevant

1. Refusal to comply with the disclosure regulatory agencies.

requirements of the Securities Regulation Code 6. Observe confidentiality.

and its Implementing Rules and Regulations. The ix. Establishment of Audit Committee

disqualification shall be in effect as long as the 1. Audit Committee shall assist the Board in the

refusal persists. performance of its oversight responsibility for

2. Absence in more than fifty (50) percent of all the financial reporting process, system of

regular and special meetings of the Board during internal control, audit process, and monitoring of

his incumbency, or any twelve (12) month period compliance with applicable laws, rules and

during the said incumbency, unless the absence regulations

Page 10 of 11

2. The Audit Committee shall consist of at least

three (3) directors, who shall preferably have

accounting and finance backgrounds, one of

whom shall be an independent director and

another with audit experience. The chair of the

Audit Committee should be an independent

director.

x. Appointment of Compliance Officer - The Board

shall appoint a Compliance Officer who shall report

directly to the Chair of the Board. He shall perform

the following duties:

1. Monitor compliance by the corporation with this

Code and the rules and regulations of regulatory

agencies and, if any violations are found, report

the matter to the Board and recommend the

imposition of appropriate disciplinary action on

the responsible parties and the adoption of

measures to prevent a repetition of the violation;

2. Appear before the Commission when summoned

in relation to compliance with this Code; and

3. Issue a certification every January 30th of the

year on the extent of the corporation’s

compliance with this Code for the completed

year and, if there are any deviations, explain the

reason for such deviation.

G. Period for Filing of Annual Financial Statements and

General Information Sheet (SEC Circular No. 2 Series of

2017)

i. Corporation whose fiscal year ends on a date other

than December 31, 2016 – The audited financial

statements shall be filed within 120 calendar days

from the end of fiscal year.

ii. Corporation whose fiscal year ends on December 31,

2016 – The SEC issues a specific schedule or specific

date depending on the license number of the

corporation for the submission of audited financial

statements. There are various date provided in the

circular.

iii. The audited financial statements shall have the

stamped “received by the BIR or its authorized

banks.”

iv. All corporations shall filed their General Information

Sheet within 30 calendar days from

1. Stock Corporation – date of actual annual

stockholder’s meeting

2. Non-stock Corporation – date of actual annual

member’s meeting

3. Foreign Corporation – Anniversary date of the

issuance of the SEC License.

Page 11 of 11

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Book Speos 2023 R2 Users GuideDocument843 pagesBook Speos 2023 R2 Users GuideCarlos RodriguesNo ratings yet

- Barista Skills Foundation Curriculum enDocument4 pagesBarista Skills Foundation Curriculum enCezara CarteșNo ratings yet

- FAR Preboard SolutionsDocument4 pagesFAR Preboard SolutionsHikariNo ratings yet

- MethodsDocument6 pagesMethodsHikariNo ratings yet

- Reorganization of DOHDocument9 pagesReorganization of DOHHikariNo ratings yet

- P2 105 Agency Home Office and Branch Accounting Key AnswersDocument6 pagesP2 105 Agency Home Office and Branch Accounting Key AnswersHikari100% (1)

- The Audit Process: Health Research & Informat Ion Division, ESRI, Dublin, July 2008Document36 pagesThe Audit Process: Health Research & Informat Ion Division, ESRI, Dublin, July 2008HikariNo ratings yet

- Intellectual Property Law (R.A. No. 8293 A.K.A. Intellectual Property Code of The Philippines)Document5 pagesIntellectual Property Law (R.A. No. 8293 A.K.A. Intellectual Property Code of The Philippines)HikariNo ratings yet

- Strategik 8Document64 pagesStrategik 8HikariNo ratings yet

- SALESBA Study Guide SalesDocument15 pagesSALESBA Study Guide SalesHikariNo ratings yet

- Auditing Theory Solution Manual by Salosagcol (Posted)Document4 pagesAuditing Theory Solution Manual by Salosagcol (Posted)HikariNo ratings yet

- Analysis of Variances From Standard Costs - Solutions PDFDocument39 pagesAnalysis of Variances From Standard Costs - Solutions PDFHikariNo ratings yet

- Valuation of Ordinary Equity Shares As A Source of FundsDocument8 pagesValuation of Ordinary Equity Shares As A Source of FundsHikariNo ratings yet

- Liabilities Deferred TaxDocument3 pagesLiabilities Deferred TaxHikari0% (1)

- Business Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiDocument6 pagesBusiness Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiMuzammil DeshmukhNo ratings yet

- Negative Feedback AmplifierDocument31 pagesNegative Feedback AmplifierPepNo ratings yet

- Report-Smaw Group 12,13,14Document115 pagesReport-Smaw Group 12,13,14Yingying MimayNo ratings yet

- MPT EnglishDocument5 pagesMPT Englishkhadijaamir435No ratings yet

- Friday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDocument3 pagesFriday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDONI ARTANo ratings yet

- CL200 PLCDocument158 pagesCL200 PLCJavierRuizThorrensNo ratings yet

- Heirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseDocument2 pagesHeirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseAlvin Dela CruzNo ratings yet

- FDD Spindle Motor Driver: BA6477FSDocument12 pagesFDD Spindle Motor Driver: BA6477FSismyorulmazNo ratings yet

- PNGRB - Electrical Safety Audit ChecklistDocument4 pagesPNGRB - Electrical Safety Audit ChecklistKritarth SrivastavNo ratings yet

- Nyambe African Adventures An Introduction To African AdventuresDocument5 pagesNyambe African Adventures An Introduction To African AdventuresKaren LeongNo ratings yet

- Advantages Renewable Energy Resources Environmental Sciences EssayDocument3 pagesAdvantages Renewable Energy Resources Environmental Sciences EssayCemerlang StudiNo ratings yet

- JCIPDocument5 pagesJCIPdinesh.nayak.bbsrNo ratings yet

- 2011-11-09 Diana and AtenaDocument8 pages2011-11-09 Diana and AtenareluNo ratings yet

- B0187 B0187M-16Document9 pagesB0187 B0187M-16Bryan Mesala Rhodas GarciaNo ratings yet

- Perturbation MethodsDocument29 pagesPerturbation Methodsmhdr100% (1)

- Brochure GM Oat Technology 2017 enDocument8 pagesBrochure GM Oat Technology 2017 enArlette ReyesNo ratings yet

- Lifting PermanentmagnetDocument6 pagesLifting PermanentmagnetShekh Muhsen Uddin Ahmed100% (1)

- Strategic Capital Management: Group - 4 Jahnvi Jethanandini Shreyasi Halder Siddhartha Bayye Sweta SarojDocument5 pagesStrategic Capital Management: Group - 4 Jahnvi Jethanandini Shreyasi Halder Siddhartha Bayye Sweta SarojSwetaSarojNo ratings yet

- Taxation Law 1Document7 pagesTaxation Law 1jalefaye abapoNo ratings yet

- 6 Uec ProgramDocument21 pages6 Uec Programsubramanyam62No ratings yet

- DOST-PHIVOLCS Presentation For The CRDRRMC Meeting 15jan2020Document36 pagesDOST-PHIVOLCS Presentation For The CRDRRMC Meeting 15jan2020RJay JacabanNo ratings yet

- Sanskrit Lessons: �丘��恆� � by Bhikshuni Heng HsienDocument4 pagesSanskrit Lessons: �丘��恆� � by Bhikshuni Heng HsiendysphunctionalNo ratings yet

- Smart Plug Installation GuideDocument9 pagesSmart Plug Installation GuideFrancisco GuerreroNo ratings yet

- Saif Powertec Limited Project "Standard Operating Process" As-Is DocumentDocument7 pagesSaif Powertec Limited Project "Standard Operating Process" As-Is DocumentAbhishekChowdhuryNo ratings yet

- Generator ControllerDocument21 pagesGenerator ControllerBrianHazeNo ratings yet

- LSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDocument2 pagesLSL Education Center Final Exam 30 Minutes Full Name - Phone NumberDilzoda Boytumanova.No ratings yet

- English For General SciencesDocument47 pagesEnglish For General Sciencesfauzan ramadhanNo ratings yet

- Course DescriptionDocument54 pagesCourse DescriptionMesafint lisanuNo ratings yet