0% found this document useful (0 votes)

318 views7 pagesIGNOU MCA MCS-035 Exam Study Guide

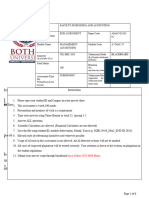

This document provides study materials for the IGNOU MCA MCS-035 3rd semester term-end examination on Accountancy and Financial Management. It includes 5 sets of notes covering topics like journal entries, ratio analysis, funds flow statements, inventory management, accounting concepts, and more. The notes also contain examples and practice problems. Additional downloads mentioned include assignments, books, study materials, exam notes and sample papers for BCA and MCA programs.

Uploaded by

AshikCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

318 views7 pagesIGNOU MCA MCS-035 Exam Study Guide

This document provides study materials for the IGNOU MCA MCS-035 3rd semester term-end examination on Accountancy and Financial Management. It includes 5 sets of notes covering topics like journal entries, ratio analysis, funds flow statements, inventory management, accounting concepts, and more. The notes also contain examples and practice problems. Additional downloads mentioned include assignments, books, study materials, exam notes and sample papers for BCA and MCA programs.

Uploaded by

AshikCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd