Professional Documents

Culture Documents

Florida Taxpayer's Bill of Rights

Uploaded by

druliacOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Florida Taxpayer's Bill of Rights

Uploaded by

druliacCopyright:

Available Formats

GT-800039

Florida Taxpayer’s Bill of R. 09/18

Rights

Do you know your rights under Florida law?

The Department of Revenue (Department) is responsible for administering the tax laws of Florida

in a fair and efficient manner. Promoting voluntary compliance, which ensures that all taxpayers

pay their applicable taxes, is an important part of the Department’s mission. The Department also

has an obligation to monitor compliance and to take action when taxpayers fail to comply with

relevant tax laws. The provisions in the Taxpayer’s Bill of Rights protect taxpayers’ privacy and

assets during any actions taken by the Department of Revenue.

The 1992 Florida Legislature passed legislation creating the Taxpayer’s Bill of Rights. It is a single

document that explains, in simple and non-technical terms, the rights and obligations of both the

taxpayer and the Department. The basic rights, as granted by section (s.) 213.015, Florida

Statutes (F.S.), are outlined in this brochure.

1. The right to available information and prompt, accurate responses to questions and requests for

tax assistance.

2. The right to request assistance from a taxpayers’ rights advocate, who shall be responsible for

facilitating the resolution of taxpayer complaints and problems not resolved through the normal

administrative channels within the Department, including any taxpayer complaints regarding

unsatisfactory treatment by Department employees. The taxpayers’ rights advocate may issue a

stay order if a taxpayer has suffered or is about to suffer irreparable loss as a result of an action

by the Department (see ss. 20.21(3) and 213.018, F.S.).

3. The right to be represented or advised by counsel or other qualified representatives at any time

in administrative interactions with the Department, the right to procedural safeguards with

respect to recording of interviews during tax determination or collection processes conducted by

the Department, the right to be treated in a professional manner by Department personnel and

the right to have audits, inspections of records, and interviews conducted at a reasonable time

and place except in criminal and internal investigations (see ss. 198.06, 199.218, 201.11(1),

203.02, 206.14, 211.125(3), 211.33(3), 212.0305(3), 212.12(5)(a), (6)(a), and (13), 212.13(5),

213.05, 213.21(1)(a) and (c), 213.34, F.S.).

4. The right to freedom from penalty attributable to any taxes administered by the Department of

Revenue; freedom from payment of uncollected sales, use, motor or diesel fuel, or other

transaction-based excise taxes administered by the Department of Revenue; and to abatement

of interest attributable to any taxes administered by the Department of Revenue, when the

taxpayer reasonably relies upon binding written advice furnished to the taxpayer by the

Department through authorized representatives in response to the taxpayer’s specific written

request which provided adequate and accurate information (see ss. 120.565 and 213.22, F.S.).

5. The right to obtain simple, nontechnical statements which explain the reason for audit selection

and the procedures, remedies, and rights available during audit, appeals, and collection

proceedings. These rights include, but are not limited to, the rights pursuant to this Taxpayer’s

Bill of Rights and the right to be provided with a narrative description which explains the basis of

audit changes, proposed assessments, assessments, and denials of refunds; identifies any

amount of tax, interest, or penalty due; and states the consequences of the taxpayer’s failure to

comply with the notice.

Florida Department of Revenue, Florida Taxpayer’s Bill of Rights, Page 1

6. The right to be informed of impending collection actions which require sale or seizure of

property or freezing of assets, except jeopardy assessments, and the right to at least 30

days’ notice in which to pay the liability or seek further review (see ss. 198.20, 199.262,

201.16, 206.075, 206.24, 211.125(5), 212.03(5), 212.0305(3)(j), 212.04(7), 212.14(1),

213.73(3), 213.731, and 220.739, F.S.).

7. The right to have all other collection actions attempted before a jeopardy assessment unless

delay will endanger collection and, after a jeopardy assessment, the right to have an

immediate review of the jeopardy assessment (see ss. 212.15, 213.73(3), 213.732, and

220.719(2), F.S.).

8. The right to seek review, through formal or informal proceedings, of any adverse decisions

relating to determinations in the audit or collections processes and the right to seek a

reasonable administrative stay of enforcement actions while the taxpayer pursues other

administrative remedies available under Florida law (see ss. 120.80(14)(b), 213.21(1),

220.717, and 220.719(2), F.S.).

9. The right to have the taxpayer’s tax information kept confidential unless otherwise specified

by law (see s. 213.053, F.S.).

10. The right to procedures for retirement of tax obligations by installment payment agreements

which recognize both the taxpayer’s financial condition and the best interests of the state,

provided that the taxpayer gives accurate, current information and meets all other tax

obligations on schedule (see s. 213.21(4), F.S.).

11. The right to procedures for requesting cancellation, release, or modification of liens filed by

the Department and for requesting that any lien which is filed in error be so noted on the lien

cancellation filed by the Department, in public notice, and in notice to any credit agency at the

taxpayer’s request (see ss. 198.22, 199.262, 212.15(4), 213.733, and 220.819, F.S.).

12. The right to procedures which assure that the individual employees of the Department are not

paid, evaluated, or promoted on the basis of the amount of assessments or collections from

taxpayers (see s. 213.30(2), F.S.).

13. The right to an action at law within the limitations of s. 768.28, F.S., relating to sovereign

immunity, to recover damages against the state or the Department of Revenue for injury

caused by the wrongful or negligent act or omission of a Department officer or employee

(see s. 768.28, F.S.).

14. The right of the taxpayer or the Department, as the prevailing party in a judicial or

administrative action brought or maintained without the support of justiciable issues of fact or

law, to recover all costs of the administrative or judicial action, including reasonable

attorney’s fees, and of the Department and taxpayer to settle such claims through

negotiations (see ss. 57.105 and 57.111, F.S.).

15. The right to have the Department begin and complete its audits in a timely and expeditious

manner after notification of intent to audit (see s. 95.091, F.S.).

16. The right to have the Department actively identify and review multistate proposals that offer

more efficient and effective methods for administering the revenue sources of this state (see

s. 213.256, F.S.).

17. The right to have the Department actively investigate and, where appropriate, implement

automated or electronic business methods that enable the Department to more efficiently

and effectively administer the revenue sources of this state at less cost and effort for

taxpayers.

18. The right to waiver of interest that accrues as the result of errors or delays caused by a

Department employee (see s. 213.21(3), F.S.).

19. The right to participate in free educational activities that help the taxpayer successfully

comply with the revenue laws of this state.

Florida Department of Revenue, Florida Taxpayer’s Bill of Rights, Page 2

20. The right to pay a reasonable fine or percentage of tax, whichever is less, to reinstate an

exemption from any tax which a taxpayer would have been entitled to receive but which was

lost because the taxpayer failed to properly register as a tax dealer in this state or obtain the

necessary certificates entitling the taxpayer to the exemption (see s. 212.07(9), F.S.).

21. The right to fair and consistent application of the tax laws of this state by the Department of

Revenue.

Florida Taxpayers’ Rights Advocate

The Florida Taxpayer’s Bill of Rights provides protection for taxpayers’ privacy and assets during

their interactions with Department employees. Florida’s Taxpayers’ Rights Advocate can help

ensure that those rights are protected during the tax assessment, collection, refund denial, and

enforcement processes.

Please keep in mind that the Taxpayers’ Rights Advocate is not a substitute for the Department’s

normal administrative procedures for appealing a tax assessment. Taxpayers who believe that

they have not been treated fairly by the Department should attempt to resolve their problems

though normal channels. Taxpayers who have taken these steps, but still believe that their

concerns have not been timely or fairly addressed, should contact the Taxpayers’ Rights

Advocate.

To contact the Taxpayers’ Rights Advocate, call 850-617-8168 or write to:

Office of Taxpayers’ Rights Advocate

PO Box 5906

Tallahassee FL 32314-5906

For more information about Florida’s Taxpayers’ Rights Advocate, visit

floridarevenue.com/taxpayersrights.

Information, forms, and tutorials are available on the Department’s website at floridarevenue.com.

To speak with a Department of Revenue representative, call Taxpayer Services at

850-488-6800, Monday through Friday (excluding holidays).

For a written reply to tax questions, write:

Taxpayer Services MS 3-2000

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0112

Subscribe to Receive Updates by Email

Visit floridarevenue.com/dor/subscribe to sign up to receive an email when the Department posts:

• Tax Information Publications (TIPs)

• Proposed rules, including notices of rule development workshops and emergency

rulemaking

• Due date reminders for reemployment tax, and sales and use tax

Florida Department of Revenue, Florida Taxpayer’s Bill of Rights, Page 3

You might also like

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- CIR vs. Eastern Telecommunications, 624 SCRA 340Document12 pagesCIR vs. Eastern Telecommunications, 624 SCRA 340Machida AbrahamNo ratings yet

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDocument32 pagesBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaNo ratings yet

- Re: Marie, Et Al., v. Mosier, Et Al., Case No. 14-cv-2518-DDC-TJJDocument23 pagesRe: Marie, Et Al., v. Mosier, Et Al., Case No. 14-cv-2518-DDC-TJJEquality Case FilesNo ratings yet

- FL Voluntary Disclosure ProgramDocument3 pagesFL Voluntary Disclosure Programmcampo7No ratings yet

- Tax Alert BIR Ruling 142 2011 PDFDocument3 pagesTax Alert BIR Ruling 142 2011 PDFJm CruzNo ratings yet

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationDocument3 pagesJustice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationNicco AcaylarNo ratings yet

- Tax Syllabus (Spit) 2015Document15 pagesTax Syllabus (Spit) 2015Anonymous XvwKtnSrMRNo ratings yet

- Form 1023 - Original Submission - West Long-Term RecoveryDocument77 pagesForm 1023 - Original Submission - West Long-Term RecoveryThe Dallas Morning News100% (2)

- Defend RMC 12-2018Document4 pagesDefend RMC 12-2018John Evan Raymund BesidNo ratings yet

- TAXING AUTHORITY POWERS AND FUNCTIONSDocument8 pagesTAXING AUTHORITY POWERS AND FUNCTIONSRonellie Marie TinajaNo ratings yet

- Verified Statement Regarding IRS Form W-4 or W-9 (Voluntary AgreementsDocument5 pagesVerified Statement Regarding IRS Form W-4 or W-9 (Voluntary Agreementsroyalarch13100% (1)

- Commissioner of Internal Revenue VDocument11 pagesCommissioner of Internal Revenue VMelanie CabanlasNo ratings yet

- US Internal Revenue Service: n-98-58Document10 pagesUS Internal Revenue Service: n-98-58IRSNo ratings yet

- Object 1 Object 2Document5 pagesObject 1 Object 2icccNo ratings yet

- Civil Law CasesDocument23 pagesCivil Law CasesRaymund Christian Ong AbrantesNo ratings yet

- Tax Alert BIR Ruling 142-2011Document3 pagesTax Alert BIR Ruling 142-2011Ia Bolos0% (1)

- BIR's Tax Ruling Process ExplainedDocument3 pagesBIR's Tax Ruling Process ExplainedConnieAllanaMacapagaoNo ratings yet

- Streamline Business Permits with RA 11032Document13 pagesStreamline Business Permits with RA 11032Max Ellison OconNo ratings yet

- 7 LG Electronics Philippines, Inc. vs. CIRDocument33 pages7 LG Electronics Philippines, Inc. vs. CIRJoanna ENo ratings yet

- Alana - Self-Assessment Module 2Document3 pagesAlana - Self-Assessment Module 2kate trishaNo ratings yet

- G.R. No. 109289 Tan V Del Rosario October 3, 1994 DigestDocument3 pagesG.R. No. 109289 Tan V Del Rosario October 3, 1994 DigestRafie Bonoan100% (1)

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- Critical Areas in TaxationDocument41 pagesCritical Areas in TaxationAndro Julio QuimpoNo ratings yet

- Cir V CaDocument8 pagesCir V CaOscar Ryan SantillanNo ratings yet

- Alvin Stjernholm and Elsie I. Stjernholm v. Commissioner of Internal Revenue, 933 F.2d 1019, 10th Cir. (1991)Document4 pagesAlvin Stjernholm and Elsie I. Stjernholm v. Commissioner of Internal Revenue, 933 F.2d 1019, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- LEVY Irs - Gov Irm Part5 Ch17s08Document14 pagesLEVY Irs - Gov Irm Part5 Ch17s08gkernanNo ratings yet

- Tax AdministrationDocument31 pagesTax AdministrationEryn GabrielleNo ratings yet

- Tax II (Final)Document196 pagesTax II (Final)Jia FriasNo ratings yet

- Legal MemorandumDocument3 pagesLegal MemorandumFrances Angelie NacepoNo ratings yet

- Taxation - Ramen NotesDocument8 pagesTaxation - Ramen NotesborgyambuloNo ratings yet

- CIR vs. SMARTDocument14 pagesCIR vs. SMARTRhona MarasiganNo ratings yet

- Abakada Group Party List VsDocument7 pagesAbakada Group Party List VsHarhar HereraNo ratings yet

- Proctor and GambleDocument64 pagesProctor and GambleAnonymous sBdR2FxYQjNo ratings yet

- AbakadaDocument7 pagesAbakadaJayzell Mae FloresNo ratings yet

- Taxation Law Reviewer by Abelardo DomondonDocument89 pagesTaxation Law Reviewer by Abelardo DomondonSotero Rodrigo Jr.100% (1)

- Sison v. Ancheta, 130 SCRA 654Document7 pagesSison v. Ancheta, 130 SCRA 654d-fbuser-49417072100% (1)

- Abakada Guro Party List Vs Executive SecretaryDocument8 pagesAbakada Guro Party List Vs Executive SecretaryshelNo ratings yet

- Last Minute Taxation Law TipsDocument17 pagesLast Minute Taxation Law TipsJoyce LapuzNo ratings yet

- Taxation Law - Case Digest (Part 1)Document64 pagesTaxation Law - Case Digest (Part 1)Miro100% (3)

- Form 1023 Checklist: (Revised June 2006)Document44 pagesForm 1023 Checklist: (Revised June 2006)huffpostNo ratings yet

- Tax 2 (Assignment 1)Document19 pagesTax 2 (Assignment 1)Lenette LupacNo ratings yet

- EPA Confidential Financial Disclosure Form For Environmental Protection Agency Special Government Employees - EPA Form 3110-48Document10 pagesEPA Confidential Financial Disclosure Form For Environmental Protection Agency Special Government Employees - EPA Form 3110-48Environment_ScienceNo ratings yet

- Tax evasion, avoidance, planning & managementDocument6 pagesTax evasion, avoidance, planning & managementRhea SharmaNo ratings yet

- NPC Tax Exemption Withdrawn by LGCDocument5 pagesNPC Tax Exemption Withdrawn by LGCEmNo ratings yet

- Tax Remedies Under The NircDocument119 pagesTax Remedies Under The NircCaliNo ratings yet

- Cases On TaxDocument8 pagesCases On TaxRonin RosanaNo ratings yet

- Commissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Document11 pagesCommissioner of Internal Revenue v. Procter and Gamble G.R. L-66838Dino Bernard LapitanNo ratings yet

- Cir V P&GDocument30 pagesCir V P&Gvmanalo16No ratings yet

- Taxation Cases No 21 To 25Document6 pagesTaxation Cases No 21 To 25Alkhadri H MuinNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativepreston_402003No ratings yet

- LG-Electronics-vs.-CIR-digestDocument21 pagesLG-Electronics-vs.-CIR-digestDarrel John SombilonNo ratings yet

- TriMed Consent JudgmentDocument9 pagesTriMed Consent JudgmentKristina KoppeserNo ratings yet

- BIR Access to Taxpayer Records UpheldDocument3 pagesBIR Access to Taxpayer Records UpheldCareenNo ratings yet

- Lexoterica Cases 2013Document36 pagesLexoterica Cases 2013Yvet KatNo ratings yet

- G.R. No. 165451. December 3, 2014. LG ELECTRONICS PHILIPPINES, INC., Petitioner, vs. Commissioner of Internal Revenue, RespondentDocument31 pagesG.R. No. 165451. December 3, 2014. LG ELECTRONICS PHILIPPINES, INC., Petitioner, vs. Commissioner of Internal Revenue, RespondentJessica mabungaNo ratings yet

- US Internal Revenue Service: fs-97-20Document3 pagesUS Internal Revenue Service: fs-97-20IRSNo ratings yet

- Abakada Guro Party List Vs Executive SecretaryDocument8 pagesAbakada Guro Party List Vs Executive SecretaryAndrea TiuNo ratings yet

- Tax Dabu Rev.-Notes-2022Document32 pagesTax Dabu Rev.-Notes-2022april75No ratings yet

- Sample ContractDocument3 pagesSample ContractApreuteseiCostelNo ratings yet

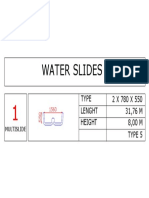

- Water Slide Dimensions and Types GuideDocument1 pageWater Slide Dimensions and Types GuidedruliacNo ratings yet

- Star BurnDocument1 pageStar BurnJ SELVA ANTONY SANTOSHNo ratings yet

- Ios Mat 0003Document39 pagesIos Mat 0003druliac100% (1)

- Electrophoretic (Cathodic) Painting PDFDocument2 pagesElectrophoretic (Cathodic) Painting PDFdruliacNo ratings yet

- High Protein Fish Meal for Aquaculture & Livestock FeedDocument1 pageHigh Protein Fish Meal for Aquaculture & Livestock FeeddruliacNo ratings yet

- 100% Pure Steam Dried Fish Meal Is A Thick Powder Obtained From Cooking, Drying, Grinding Raw FishDocument1 page100% Pure Steam Dried Fish Meal Is A Thick Powder Obtained From Cooking, Drying, Grinding Raw FishdruliacNo ratings yet

- Fish Feed Gold FishDocument1 pageFish Feed Gold FishdruliacNo ratings yet

- High-Quality Floating Fish Feed Pellets for AquacultureDocument1 pageHigh-Quality Floating Fish Feed Pellets for AquaculturedruliacNo ratings yet

- Fish Meal PowderDocument2 pagesFish Meal PowderdruliacNo ratings yet

- Feed GroupDocument1 pageFeed GroupdruliacNo ratings yet

- ADM RefillingDocument2 pagesADM RefillingdruliacNo ratings yet

- Specification of Surface Coating and CoveringDocument6 pagesSpecification of Surface Coating and CoveringdruliacNo ratings yet

- VOLVO V50 2007 User ManualDocument272 pagesVOLVO V50 2007 User Manualkir0iNo ratings yet

- For FO's IPCR Form 1 For Sppos, Sr. Ppos, Ppoii, PpoiDocument2 pagesFor FO's IPCR Form 1 For Sppos, Sr. Ppos, Ppoii, PpoilavNo ratings yet

- Contract Agreement FormDocument2 pagesContract Agreement FormLeoriza DelgadoNo ratings yet

- Rural Bank of Sta. Catalina, Inc. vs. Land Bank of The PhilippinesDocument3 pagesRural Bank of Sta. Catalina, Inc. vs. Land Bank of The PhilippinesAnonymous SuujlHvfqNo ratings yet

- CPC 2 2021Document3 pagesCPC 2 2021Sarthak SabbarwalNo ratings yet

- Law 126: Evidence Ma'am Victoria Avena: Drilon1Document65 pagesLaw 126: Evidence Ma'am Victoria Avena: Drilon1cmv mendoza100% (1)

- Related Case LawsDocument12 pagesRelated Case LawsNikita HasijaNo ratings yet

- Ballatan Vs CADocument17 pagesBallatan Vs CAQuennie Jane SaplagioNo ratings yet

- Ignacio Grande, Et Al Vs CA G.R. No. L-17652Document2 pagesIgnacio Grande, Et Al Vs CA G.R. No. L-17652Joanna Grace LappayNo ratings yet

- Land Use ConversionDocument2 pagesLand Use ConversionMarianne Grace de VeraNo ratings yet

- Charles Creekmore v. C.L. Crossno, 259 F.2d 697, 10th Cir. (1958)Document3 pagesCharles Creekmore v. C.L. Crossno, 259 F.2d 697, 10th Cir. (1958)Scribd Government DocsNo ratings yet

- Business Law Tutorial 5Document2 pagesBusiness Law Tutorial 5Wenyi67 LimNo ratings yet

- Philippine Spring Water v CA Ruling on Regular Employment StatusDocument3 pagesPhilippine Spring Water v CA Ruling on Regular Employment StatusEdeline CosicolNo ratings yet

- Anti Money Laundering NotesDocument2 pagesAnti Money Laundering NotesMarjorie MayordoNo ratings yet

- Prevention and Combating of Corruption Act (Oaths) en SWDocument9 pagesPrevention and Combating of Corruption Act (Oaths) en SWMAJALIWA NGURUTI SEBASTIANNo ratings yet

- Not of Filing Supp ExhibitsDocument4 pagesNot of Filing Supp ExhibitsJohn S KeppyNo ratings yet

- Department of Labor: CVR1 FillableDocument2 pagesDepartment of Labor: CVR1 FillableUSA_DepartmentOfLaborNo ratings yet

- Torts and DamagesDocument63 pagesTorts and DamagesStevensonYuNo ratings yet

- Atty. Ferrer Vs Sps. Diaz, GR 165300Document5 pagesAtty. Ferrer Vs Sps. Diaz, GR 165300sophiaNo ratings yet

- Special Features in SFoC For Maintenance and Renovation Works by K C Tang (20200427a)Document56 pagesSpecial Features in SFoC For Maintenance and Renovation Works by K C Tang (20200427a)Siu EricNo ratings yet

- People vs. QuiachonDocument7 pagesPeople vs. QuiachonJonimar Coloma QueroNo ratings yet

- CA erred in applying Best Evidence RuleDocument2 pagesCA erred in applying Best Evidence RuleBelen Aliten Sta MariaNo ratings yet

- Joaquin v. Reyes and Quiro v. QuiroDocument3 pagesJoaquin v. Reyes and Quiro v. QuiroJulie AnnNo ratings yet

- CrimPro Salvador - Search and SeizureDocument41 pagesCrimPro Salvador - Search and SeizureJohn VillaverNo ratings yet

- United States v. Lance Hensley, 11th Cir. (2009)Document3 pagesUnited States v. Lance Hensley, 11th Cir. (2009)Scribd Government DocsNo ratings yet

- Co-ownership of Land and Statutory TrustsDocument4 pagesCo-ownership of Land and Statutory TrustsYugenndraNaiduNo ratings yet

- Unlawful Detainer Case Over Unpaid Rent of Php120kDocument3 pagesUnlawful Detainer Case Over Unpaid Rent of Php120kneo_tristan185678No ratings yet

- Warning Letter for Excessive AbsenteeismDocument4 pagesWarning Letter for Excessive AbsenteeismCecille BalberonaNo ratings yet

- SUBSIDIARY RULES OF INTERPRETATION NotesDocument14 pagesSUBSIDIARY RULES OF INTERPRETATION NotesShivani ChoudharyNo ratings yet

- People V DoriaDocument3 pagesPeople V Doriaboks9s.9escaladaNo ratings yet

- THREE KEY PRINCIPLES OF TORRENS TITLE SYSTEMDocument3 pagesTHREE KEY PRINCIPLES OF TORRENS TITLE SYSTEMbellamarieumipig67% (9)