Professional Documents

Culture Documents

IED Jason - Rework

IED Jason - Rework

Uploaded by

anajana0 ratings0% found this document useful (0 votes)

8 views1 pagedigital

Original Title

4.FRIED Jason - Rework

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdigital

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageIED Jason - Rework

IED Jason - Rework

Uploaded by

anajanadigital

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

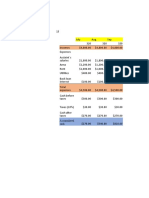

EFFECTS OF FINANCIAL LEVERAGE

VARIABLES INPUT INPUT INPUT

Debt % Enter

Decimal 20.00% 50.00% 80.00%

Interest Rate on Increases 4% per year if

Debt Enter Decimal 10.00% 14.00% 18.00% Debt Ratio Increases

Sales Between

$5,000 and $50,000 $12,000 $12,000 $12,000

Variable Cost Ratio

Enter Decimal 30.00% 30.00% 30.00%

Income Tax Rate

Enter Decimal 40.00% 40.00% 40.00%

Sales Growth Rate

Enter .0 or Decimal 0.00% 0.00% 0.00%

GIVEN DATA INPUT

Fixed Costs Enter

Number $ 6,800

MODEL PRODUCES FOLLOWING OUTPUT

Cash $ 300 $ 300 $ 300

Receivables $ 1,200 $ 1,200 $ 1,200

Inventories $ 1,400 $ 1,400 $ 1,400

Plant (Net) $ 3,000 $ 3,000 $ 3,000

Equipment (Net) $ 4,100 $ 4,100 $ 4,100

Total Assets $ 10,000 $ 10,000 $ 10,000

Total Liabilities $ 2,000 $ 5,000 $ 8,000

Stock ($10) $ 8,000 $ 5,000 $ 2,000

Tot. Liab./Equity $ 10,000 $ 10,000 $ 10,000

Sales $ 12,000 $ 12,000 $ 12,000

Fixed Costs $ 6,800 $ 6,800 $ 6,800

Variable Costs %

Sales $ 3,600 $ 3,600 $ 3,600

Total Costs $ 10,400 $ 10,400 $ 10,400

Earnings Before

Interest and Taxes $ 1,600 $ 1,600 $ 1,600

Less: Interest $ 200 $ 700 $ 1,440 Increases if Debt Ratio

Increases (.04/year) on All

Liabilities

Earnings Before

Taxes

$ 1,400 $ 900 $ 160

Less: Income Taxes

$ 560 $ 360 $ 64

Net Income $ 840 $ 540 $ 96

EPS Number of Shares Equals

$1.05 $1.08 $0.48 Stock / $10

ROE 10.50% 10.80% 4.80%

ROA 8.40% 5.40% 0.96%

WACC 10.80% 10.20% 11.04%

VF $14,815 $15,686 $14,493

You might also like

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- 3-Statement Model PracticeDocument6 pages3-Statement Model PracticeWill SkaloskyNo ratings yet

- FcffvsfcfeDocument2 pagesFcffvsfcfePro ResourcesNo ratings yet

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- Advanced Excel Training ExercisesDocument40 pagesAdvanced Excel Training ExercisesArun83% (6)

- The Food Pantry: 2800 E. Jefferson Ave. Eau Claire, WI 54701 (715) 555-0457Document1 pageThe Food Pantry: 2800 E. Jefferson Ave. Eau Claire, WI 54701 (715) 555-0457ArunNo ratings yet

- AFN MINI CASE STUDY CLASS Excel SAMPLEDocument6 pagesAFN MINI CASE STUDY CLASS Excel SAMPLEMuhammad Ali SamarNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- FM Homework6Document18 pagesFM Homework6subinamehtaNo ratings yet

- Long-Term Financial Planning and GrowthDocument37 pagesLong-Term Financial Planning and GrowthNauryzbek MukhanovNo ratings yet

- Effects of Financial Leverage: Model Produces Following OutputDocument1 pageEffects of Financial Leverage: Model Produces Following OutputanajanaNo ratings yet

- Profit and Loss StatementDocument3 pagesProfit and Loss StatementAli TekinNo ratings yet

- Measuring Economic Value Added (EVA)Document4 pagesMeasuring Economic Value Added (EVA)Paulo NascimentoNo ratings yet

- Payback Schedule Year Beginning Unrecovered Investment Cash InflowDocument4 pagesPayback Schedule Year Beginning Unrecovered Investment Cash InflowMaisamNo ratings yet

- Stonehill College BUS320-4bDocument33 pagesStonehill College BUS320-4bsuck my cuntNo ratings yet

- 01 03 Accretion Dilution AfterDocument3 pages01 03 Accretion Dilution AfterДоминик КоббNo ratings yet

- EVA Tree Analysis of Financial Statement (Deb Sahoo)Document3 pagesEVA Tree Analysis of Financial Statement (Deb Sahoo)Deb SahooNo ratings yet

- Economic Value AddedDocument4 pagesEconomic Value AddedZaenal FananiNo ratings yet

- Capital Structure Extra NotesDocument29 pagesCapital Structure Extra NotesleighannNo ratings yet

- Based On Accounting Profit: Reak-VEN NalysisDocument5 pagesBased On Accounting Profit: Reak-VEN NalysisgiangphtNo ratings yet

- HubSpot - Financial Planning TemplatesDocument11 pagesHubSpot - Financial Planning TemplatesdigiowlmedialabNo ratings yet

- The Following Data Are Available For Wasserman.Document2 pagesThe Following Data Are Available For Wasserman.laur33nNo ratings yet

- A8ZUYZ9tReL58evU5E2S EXCEL Stock Analysis Spreadsheet 10YR 2021 Vers 3.1Document13 pagesA8ZUYZ9tReL58evU5E2S EXCEL Stock Analysis Spreadsheet 10YR 2021 Vers 3.1Santhosh KumarNo ratings yet

- Ch17 Financial Planning and Forecasting English - StudentDocument46 pagesCh17 Financial Planning and Forecasting English - StudentThiện NhânNo ratings yet

- Input Sheet: Merger & Lbo Valuation: STEP 1: Estimate The Total Cost of The DealDocument9 pagesInput Sheet: Merger & Lbo Valuation: STEP 1: Estimate The Total Cost of The DealMehmet IsbilenNo ratings yet

- Profit Analysis Worksheet: ProductionDocument18 pagesProfit Analysis Worksheet: ProductionhariveerNo ratings yet

- Documento 3Document2 pagesDocumento 3aimarylorenzoizquierdoNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Academic Version: PheonixDocument16 pagesAcademic Version: Pheonixkrukruch1602No ratings yet

- Business Start-Up Financial Plan 1Document6 pagesBusiness Start-Up Financial Plan 1Pubg MaxNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Running Head: Budget AnalysisDocument5 pagesRunning Head: Budget AnalysisCarlos AlphonceNo ratings yet

- Motor Vehicle Tax CalculatorforimportationDocument4 pagesMotor Vehicle Tax Calculatorforimportationshan singhNo ratings yet

- GSMN Priormonth 1Document1 pageGSMN Priormonth 1api-255333441No ratings yet

- Computation of Income Tax FormatDocument12 pagesComputation of Income Tax FormatMADHAV JOSHINo ratings yet

- Samuel Christian Lianto: Sebelum Uas Assignment 1Document6 pagesSamuel Christian Lianto: Sebelum Uas Assignment 1Sam ChrisNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- PDF 3 PDFDocument2 pagesPDF 3 PDFPatricia RodriguesNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Book 1Document4 pagesBook 1NathalieHernandezNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Facebook IPO caseHBRDocument29 pagesFacebook IPO caseHBRCrazy Imaginations100% (1)

- Millers' Tax Computati: Known ParametersDocument2 pagesMillers' Tax Computati: Known ParametersYadav_BaeNo ratings yet

- Manajemen Keuangan - 20 Nov 2021 - BDocument24 pagesManajemen Keuangan - 20 Nov 2021 - Bmuhammad nurNo ratings yet

- Stock Analysis Spreadsheet (5YR, 2021) (Vers 4.0) PUBLICDocument17 pagesStock Analysis Spreadsheet (5YR, 2021) (Vers 4.0) PUBLICSakib AhmedNo ratings yet

- Assumptions/Data: Unit Price Unit Variable CostDocument7 pagesAssumptions/Data: Unit Price Unit Variable CostHannan yusuf KhanNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Financial Planning Working Capital Management Cash ManagementDocument22 pagesFinancial Planning Working Capital Management Cash ManagementDeniz OnalNo ratings yet

- Cash Flow 10.10.56Document10 pagesCash Flow 10.10.56Katherine PandoNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Group Project Financial Data Analysis - OkDocument16 pagesGroup Project Financial Data Analysis - Okrosaliaanne95No ratings yet

- Financial Statement Analysis FormulasDocument10 pagesFinancial Statement Analysis FormulasKarl LuzungNo ratings yet

- CH 15Document28 pagesCH 15RSNo ratings yet

- Accounting Worksheet (WWW - crafTI.pro)Document2 pagesAccounting Worksheet (WWW - crafTI.pro)abwdigital01No ratings yet

- Ch04solution ProbDocument13 pagesCh04solution ProbdenisNo ratings yet

- Price $4.00 Demand 29000 Unit Cost $0.45 Fixed Cost $45,000.00 Revenue $116,000.00 Variable Cost $13,050.00 Profit $57,950.00Document16 pagesPrice $4.00 Demand 29000 Unit Cost $0.45 Fixed Cost $45,000.00 Revenue $116,000.00 Variable Cost $13,050.00 Profit $57,950.00Subhasish PattnaikNo ratings yet

- READ ME: Spreadsheet Guide: Only WhiteDocument17 pagesREAD ME: Spreadsheet Guide: Only WhiteNicholas LutfiNo ratings yet

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StoreNo ratings yet

- Programming in C Language Question and AnswersDocument19 pagesProgramming in C Language Question and Answersarvinvit100% (2)

- Calculate Circle Area Using Java ExampleDocument2 pagesCalculate Circle Area Using Java ExampleArunNo ratings yet

- Christian Testimonies From IndiaDocument339 pagesChristian Testimonies From IndiaArunNo ratings yet

- More Functions & FormulasDocument9 pagesMore Functions & FormulasArunNo ratings yet

- Sale Date Order ID Product Units Sales Salesperson RegionDocument3 pagesSale Date Order ID Product Units Sales Salesperson RegionArunNo ratings yet

- Celebrity Marriage - Function QuestionDocument1 pageCelebrity Marriage - Function QuestionArunNo ratings yet

- Region Salesperson Product Brand Regular Price Discount %Document15 pagesRegion Salesperson Product Brand Regular Price Discount %ArunNo ratings yet

- Application Form-IpcDocument3 pagesApplication Form-IpcrameshNo ratings yet

- Tally PDFDocument185 pagesTally PDFArunNo ratings yet

- Biography and Portrait of Sadhu Sundar SinghDocument5 pagesBiography and Portrait of Sadhu Sundar Singhindyy2007No ratings yet

- GR - Worksheet PrepfeesDocument7 pagesGR - Worksheet PrepfeesArunNo ratings yet

- Unveiled Mysteries of QurmanDocument192 pagesUnveiled Mysteries of QurmanArunNo ratings yet

- Infinite LoveDocument2 pagesInfinite LoveArun100% (1)

- Advanced Microsoft Excel BrochureDocument6 pagesAdvanced Microsoft Excel BrochureArunNo ratings yet

- Return of God S Glory by Bakht SinghDocument112 pagesReturn of God S Glory by Bakht SinghArunNo ratings yet