Professional Documents

Culture Documents

Mclr-W.e.f. 15.03.2019 PDF

Mclr-W.e.f. 15.03.2019 PDF

Uploaded by

Mir Javed QuadriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mclr-W.e.f. 15.03.2019 PDF

Mclr-W.e.f. 15.03.2019 PDF

Uploaded by

Mir Javed QuadriCopyright:

Available Formats

Retail Lending Division - HO

Corp Scheme-Interest Rates - applicable w.e.f 15.03.2019

3 Months MCLR (%) 8.50

One Year MCLR (%) 8.90

Effective Processing Fees w.e.f. 15.03.2019

SCHEMES SPREAD

Rate % (Excluding GST)

For Employees of Central / State Govt & Defence 100 % Waiver

Personnel (3M MCLR + Spread) upto Rs 2.00 Crore

0.10 8.60 (only in case of Govt. employees as per HOC 625/2017)

CORP HOME

FLOATING RATE Upto 2 Crore 0.10 9.00

1 Above 2 Crores 0.35 9.25

0.50% of loan amount (Max Rs.50,000/‐)

CORP HOME Upto 25 Lakhs 3.10 12.00

FIXED RATE Above 25 Lakhs 3.60 12.50

EWC/LIG-> Loan amount upto 6 Lakh : Nil

MIG-I-> Loan amount upto 9 Lakh : Nil

MIG-II-> Loan amountupto 12 Lakh : Nil

Pradhan Mantri Awas Yojana (CPMAY) 0.10 9.00

0.50% of the Loan amount(Max Rs.50,000/-)

beyond threshold limits mentioned above in each

category

2 CORP GHAR SHOBHA 0.50 9.40 0.50 %, Min of Rs.1000/-

3 CORP GHAR SANSAR 0.50 9.40 1.00 %, Max. of Rs.10000/-

Two Wheeler Loan [personal use] [CVEHI] 3.60 12.50 Two/Three-wheeler: 0.50% Min. Rs.500/-

Personal Vehicles upto Rs 50 Lakhs [personal use] 1% of the loan amount subject to minimum

[CVEHI]

0.65 9.55 Rs.1000/‐

4

Personal Vehicles Above Rs 50 Lakhs [Personal use]

[CVEHI]

1.15 10.05 1.00 % Min. Rs 1000/-

CORP VEHICLE 100 % Waiver

For Employees of Central / State Govt & Defence

Personnel, Upto Rs 50 lakhs (1 Yr MCLR)

0.00 8.90 (only in case of Govt. employees as per HOC

625/2017)

Commercial Vehicles /Vehicles used for commercial

purposes, irrespective of loan amount & CGTMSE cover 2.35 11.25 0.75%, Min. of Rs.2000/-

[CCVL]

a] Where both, the salary is routed & undertaking

letter is available b] Pensioners drawing pension 4.00 12.90

CORP PERSONAL through the Branch 1.50% Min. of Rs.500/-

5

For others 5.00 13.90

Upto 7.50 lakhs 2.00 10.90

6 Above 7.50 lakhs 2.35 11.25 Studies in India – Nil Studies abroad: Rs. 2000/‐

CORP VIDYA Refundable on availment.

Educational loans under Vocational & Skill

development courses [CVDVC]

1.50 10.40

Term Loan/Demand Loan: 1% of limit sanctioned.

Upto 5 crores 1.45 10.35 Running a/c: 0.50% of limit sanctioned to be

7

CORP VYAPAR

collected on sanction

Above 5 crores 2.95 11.85 and at the time of renewal every year

8 CORP APNI DUKAN 3.25 12.15 1.00 % of Loan Amount

9 CORP PROFESSIONAL 2.35 11.25 0.75% Min. of Rs.5000/-

10 Upto 5 crores 2.00 10.90 0.50% of the loan amount subject to a minimum of

CORP DOCTOR PLUS Rs.1000/‐

Above 5 crores 2.75 11.65

for MSME (CMORS / CMTSC) 2.45 11.35 Term Loan : 1.00 %, Running a/c: 0.50% on

CORP MORTGAGE sacntion & at the time of renewal every year.

11 For Others (CMORT/CMTCC) 4.45 13.35

12 CORP SURYA RASHMI Upto Rs 5.00 Lakhs only 0.10 9.00 0.50% Min of Rs 500/-

13 CORP SHUBHA VIVAH 4.00 12.90 1.00% Max. of Rs.5,000/-

14 CORP DEMAT 3.35 12.25 0.50%, min. Rs 500/- & max Rs 5000/-

Demand Loan: 1.00 % , Min. Rs.500/- Running a/c:

15 CORP MITRA 4.00 12.90 0.50% ,Min.Rs.250/- on sanction and at the time of

renewal every year.

16 Where Bank is Lessee 1.75 10.65

CORP RENTAL 1.00%

All others 3.25 12.15

Application money: Rs.500/- irrespective of loan amount

17 CORP SITE 5.75 14.65 Allotment money: 0.50%, subject to a minimum of Rs.1000/-

Floating 1.35 10.25

18 CORP SHELTER NIL

Fixed 1.85 10.75

LOAN AGAINST GOVT. SECURITIES / Life. Policies 2.85 11.75 NIL

Please refer to Interest Rate Circular issued by HO-CPPS for details.

You might also like

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- J2EE Ashok PDFDocument189 pagesJ2EE Ashok PDFMir Javed QuadriNo ratings yet

- Control of Documents of External OriginDocument3 pagesControl of Documents of External Originazamyn86% (7)

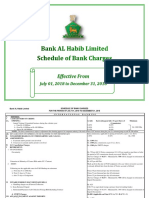

- Schedule of Bank Charges Bank Al HabibDocument11 pagesSchedule of Bank Charges Bank Al HabibLala JanNo ratings yet

- Rapid Developer - Module 1Document11 pagesRapid Developer - Module 1junemrsNo ratings yet

- Lux Marketing MixDocument36 pagesLux Marketing MixAmol Jain33% (3)

- MSME SchemesDocument53 pagesMSME SchemesKalyani BorkarNo ratings yet

- Credit Process Manual For Lending Against GoldDocument28 pagesCredit Process Manual For Lending Against GoldAmit SinghNo ratings yet

- Acct Statement XX0862 06012023Document5 pagesAcct Statement XX0862 06012023Shri PrakashNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- Interest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)Document1 pageInterest Rate Chart: 3 Months MCLR (%) One Year MCLR (%)akrmbaNo ratings yet

- Corp Bank Monsoon Offer PDFDocument2 pagesCorp Bank Monsoon Offer PDFMasroorHussainNo ratings yet

- Service Charges Final - 03.06.2017for Circular IssuingDocument39 pagesService Charges Final - 03.06.2017for Circular IssuingshivaNo ratings yet

- IOB9540Foot Service Charges 01.07.2017 PDFDocument39 pagesIOB9540Foot Service Charges 01.07.2017 PDFHarishPratabhccNo ratings yet

- Information On Interest Rates and Sercice Charges As Per Rbi FormatDocument1 pageInformation On Interest Rates and Sercice Charges As Per Rbi Formatthiyagu_advNo ratings yet

- Advances Related Service Charges W.E.F. 01.04.2019 A PDFDocument11 pagesAdvances Related Service Charges W.E.F. 01.04.2019 A PDFSudhakar BataNo ratings yet

- BOI MSME Loan ProductsDocument95 pagesBOI MSME Loan ProductsganpatigajanandganeshNo ratings yet

- RBI Format ROI PCDocument6 pagesRBI Format ROI PCSandesh ManeNo ratings yet

- Loan Guideline and DetailDocument1 pageLoan Guideline and DetailIbu SiddiqNo ratings yet

- Latepayment BFL 1222Document1 pageLatepayment BFL 1222Junaid ShaikNo ratings yet

- 03.01.2024 Consolidated Ser. ChargesDocument63 pages03.01.2024 Consolidated Ser. ChargesNadeem KhanNo ratings yet

- Example of Loan To Hav From AgifDocument4 pagesExample of Loan To Hav From AgifJatinder SinghNo ratings yet

- BOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)Document5 pagesBOI MCLR 8.35 % W.E.F. 10.08.2019 & RBLR 8.25 % W.E.F. 01.09.2019 (All Charges Are Exclusive of GST)AvunNo ratings yet

- Msme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Document4 pagesMsme Loan - Upto 2lakhs: NF-546 NF-998 NF-588 NF-855 NF-803 NF-482 NF-373 NF-368Santosh KumarNo ratings yet

- CGTMSE SchemesDocument20 pagesCGTMSE SchemesarulbankofindiaNo ratings yet

- Iob Micro OneDocument2 pagesIob Micro Oneranjan.rjofficialNo ratings yet

- Commercial Banking AssignmentDocument9 pagesCommercial Banking AssignmentDinesh KumarNo ratings yet

- G.O.Ms - No.60 - Other AdvancesDocument5 pagesG.O.Ms - No.60 - Other AdvancesMahendar ErramNo ratings yet

- Revision of Service Charges Wef 01042023Document53 pagesRevision of Service Charges Wef 01042023kkrandy01No ratings yet

- RBI Format ROI PCDocument8 pagesRBI Format ROI PCom vermaNo ratings yet

- Indian Overseas BankDocument7 pagesIndian Overseas BankElora NandyNo ratings yet

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- 20667corpbankloanscheme PDFDocument2 pages20667corpbankloanscheme PDFSamraat ChaturvediNo ratings yet

- Annexure 2Document77 pagesAnnexure 2Maheshkumar AmulaNo ratings yet

- PDFDocument49 pagesPDFSreedhar SrdNo ratings yet

- Global Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Document9 pagesGlobal Credit Policy 2021 and Further Modifications KEDAR - 21.04.2022Rajkot academyNo ratings yet

- RBI Format ROI PC PDFDocument9 pagesRBI Format ROI PC PDFmohana sundaram pNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- Is On Retail LoansDocument5 pagesIs On Retail LoansDipti NagarNo ratings yet

- Service Charges On Retail & MSMEDocument6 pagesService Charges On Retail & MSMELakamkkmjamNo ratings yet

- Boi Service ChargeDocument11 pagesBoi Service ChargeBharat ChatrathNo ratings yet

- Cgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Document16 pagesCgtmse (Credit Guarantee Fund Trust For Micro & Small Enterprises)Abinash MandilwarNo ratings yet

- Advance Related Service Charges (C&I, SME and AGL Segments)Document24 pagesAdvance Related Service Charges (C&I, SME and AGL Segments)Richa GuptaNo ratings yet

- SME Credit: Loans at Low Interest To Fuel Your Sme BusinessDocument5 pagesSME Credit: Loans at Low Interest To Fuel Your Sme Businessnishaantdec13No ratings yet

- Priority-Q-A-18 12 22Document64 pagesPriority-Q-A-18 12 22specilist officer marketingNo ratings yet

- CGMSEDocument28 pagesCGMSEAREAMANAGER MADURAINo ratings yet

- Schedule of Charges - English - July To DecemberDocument15 pagesSchedule of Charges - English - July To DecemberBurairNo ratings yet

- Promopedia - MSME Products Special 2020Document23 pagesPromopedia - MSME Products Special 2020Ananda Shingade100% (1)

- RBI Format ROI PDocument8 pagesRBI Format ROI PSrikanth ReddyNo ratings yet

- Updates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIDocument11 pagesUpdates On Global Credit Exposure Policy 2020 - KEDAR KULKARNIShilpa JhaNo ratings yet

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Document24 pagesDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdNo ratings yet

- AdvancesDocument174 pagesAdvancests pavanNo ratings yet

- RBI - ROI FormatDocument9 pagesRBI - ROI Formatranajoy biswasNo ratings yet

- Wa0004 PDFDocument8 pagesWa0004 PDFDrChandan IngoleNo ratings yet

- Housing Loan DetailsDocument9 pagesHousing Loan DetailsPandurangbaligaNo ratings yet

- Socjul Dec 2016Document15 pagesSocjul Dec 2016iukhanNo ratings yet

- Rules For Statutory Deductions Exemptions Perquisites-PayrollDocument4 pagesRules For Statutory Deductions Exemptions Perquisites-PayrollSiba MishraNo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- LoanDocument1 pageLoanPrateek SoniNo ratings yet

- SBIDocument45 pagesSBILakisha GriffinNo ratings yet

- Soc 2018 (Finall)Document15 pagesSoc 2018 (Finall)Engr Hafiz Qasim AliNo ratings yet

- RBI ROI FormatDocument11 pagesRBI ROI FormatSandeep SandyNo ratings yet

- Canara Bank ChargesDocument8 pagesCanara Bank Chargesaca_trader100% (1)

- IoclDocument2 pagesIoclMohd Asif RazaNo ratings yet

- Siddhartha Pradhan: Professional SummeryDocument2 pagesSiddhartha Pradhan: Professional SummeryMir Javed QuadriNo ratings yet

- LAMBDA EXPRESSIONS (JDK - 1.8 Feature) : ExampleDocument7 pagesLAMBDA EXPRESSIONS (JDK - 1.8 Feature) : ExampleMir Javed QuadriNo ratings yet

- 039 Functions Study Material 2Document13 pages039 Functions Study Material 2Mir Javed QuadriNo ratings yet

- System Architecture Real - TimeDocument26 pagesSystem Architecture Real - TimeMir Javed QuadriNo ratings yet

- Benefits of Ajax: Client-Side Script Postback Javascript XmlhttprequestDocument5 pagesBenefits of Ajax: Client-Side Script Postback Javascript XmlhttprequestMir Javed QuadriNo ratings yet

- Impact of Covid-19 On International Trade Law: Rijuka Naresh JainDocument4 pagesImpact of Covid-19 On International Trade Law: Rijuka Naresh JainJinal ShahNo ratings yet

- Bangladesh Association of Construction Industry (BACI)Document3 pagesBangladesh Association of Construction Industry (BACI)saimunNo ratings yet

- SSPTE Service Report 1Document1 pageSSPTE Service Report 1JEET ARUMUGAMNo ratings yet

- (Susan E. L. Lake, Karen Bean) Digital Desktop PubDocument415 pages(Susan E. L. Lake, Karen Bean) Digital Desktop PubAubreyNo ratings yet

- Lab - 1st - Semester 2017-18 Class IX ICTDocument10 pagesLab - 1st - Semester 2017-18 Class IX ICTrahimuddinNo ratings yet

- Brand Management - Session PlanDocument3 pagesBrand Management - Session PlanJe RomeNo ratings yet

- Accounting Imp 100 Q'sDocument159 pagesAccounting Imp 100 Q'sVijayasri KumaravelNo ratings yet

- Coursera - 6 Sigma Black BeltDocument51 pagesCoursera - 6 Sigma Black Beltmusmansalim101No ratings yet

- Session 01 M2 NDTHRDDocument33 pagesSession 01 M2 NDTHRDArujunaNo ratings yet

- Rollers, Bearing, Needle, Ferrous, Solid: Standard Specification ForDocument6 pagesRollers, Bearing, Needle, Ferrous, Solid: Standard Specification ForAhmad Zubair RasulyNo ratings yet

- Spring 2017 Micro Final PracticeDocument15 pagesSpring 2017 Micro Final PracticeAnanyaPochirajuNo ratings yet

- List of Cooperatives in India / Lista de Cooperativas en India / Indiako Kooperatiben ZerrendaDocument76 pagesList of Cooperatives in India / Lista de Cooperativas en India / Indiako Kooperatiben ZerrendaEKAI Center100% (1)

- Knowledge Management Tata SteelDocument33 pagesKnowledge Management Tata Steelprudhvi shankarNo ratings yet

- Strategic Model Haseeb Asm56Document5 pagesStrategic Model Haseeb Asm56Wazeeer AhmadNo ratings yet

- International Financial Management 13th Edition Madura Test BankDocument25 pagesInternational Financial Management 13th Edition Madura Test BankMichaelSmithspqn100% (53)

- Office Accomodation AND Work EnvironmentDocument15 pagesOffice Accomodation AND Work EnvironmentanshulNo ratings yet

- The WARC Guide To Marketing in TDocument79 pagesThe WARC Guide To Marketing in Ttushar2308No ratings yet

- Deloitte NL Fsi Chatbots Adopting The Power of Conversational UxDocument24 pagesDeloitte NL Fsi Chatbots Adopting The Power of Conversational UxOliverNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- Print - Udyam Registration CertificateDocument2 pagesPrint - Udyam Registration CertificateDatta MarneNo ratings yet

- Issues in Economics Today 7th Edition Guell Solutions ManualDocument25 pagesIssues in Economics Today 7th Edition Guell Solutions ManualSamuelBrowntwbkx100% (18)

- Fflanila: L/epublic of Tbe IlbilippinesDocument45 pagesFflanila: L/epublic of Tbe IlbilippinesMonocrete Construction Philippines, Inc.No ratings yet

- Impirical Study On HRM Vs Business Strategy in Indian BankDocument18 pagesImpirical Study On HRM Vs Business Strategy in Indian Bankparesh00017No ratings yet

- Linked inDocument27 pagesLinked inRemya R SNo ratings yet

- TDS - Fischer XRF SystemDocument48 pagesTDS - Fischer XRF SystemSRANNo ratings yet

- Etr401 FullDocument145 pagesEtr401 FullTrung NguyenNo ratings yet