0% found this document useful (0 votes)

172 views1 pageSample Notes Financial Statements

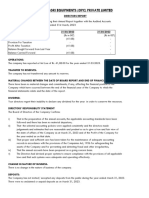

This document contains the notes to the financial statements for [ENTITY NAME] for the year ended 30 June [YEAR]. It states that the financial statements were prepared on a non-reporting special purpose basis according to accounting policies selected by the directors/trustees/partners to meet user needs. The statements were prepared using the [accrual/cash] basis, historical cost, and going concern assumptions. Specific accounting policies are also noted.

Uploaded by

MayenyenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

172 views1 pageSample Notes Financial Statements

This document contains the notes to the financial statements for [ENTITY NAME] for the year ended 30 June [YEAR]. It states that the financial statements were prepared on a non-reporting special purpose basis according to accounting policies selected by the directors/trustees/partners to meet user needs. The statements were prepared using the [accrual/cash] basis, historical cost, and going concern assumptions. Specific accounting policies are also noted.

Uploaded by

MayenyenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd