Professional Documents

Culture Documents

Malaysia 2018 Government Budget Shows RM276 Billion Deficit

Uploaded by

Lingeshweren0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

Answer Kerajaan Para Kata.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageMalaysia 2018 Government Budget Shows RM276 Billion Deficit

Uploaded by

LingeshwerenCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

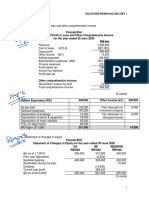

(a)

Government Para Kata

Operational Budget

For the Year 2018

Codes Items RM’000 RM’000

60000 Tax Revenue 440,000,000

61000 Direct Tax 196,000,000

62000 Indirect Tax 244,000,000

70000 Non Tax Revenue 136,000,000

71000 Licenses & Permits 72,000,000

72000 Service Charges 20,000,000

74000 Rental 44,000,000

80000 Non Revenue Receipts 383,564,000

81000 Return Back Expenditures 200,080,000

82000 Receipts from Government

Agencies 183,484,000

90000 Revenue from Federal -

Territories

Total Estimated Revenue 959,564,000

10000 Emolument 361,029,600

20000 Services & Supplies 149,737,300

30000 Assets 40,404,800

40000 Grant and Fixed Charges 663,568,000

50000 Other Expenditures 21,608,000

Total Estimated Operating 1,236,347,700

Expenditure

Surplus/(Deficit) (276,783,700)

(b)

1. The government implements deficit budget amounted RM276,783,700,000

2. Deficit budget means a government aims to spend more than its revenue earning.

3. The deficit is expected to be covered by bonds/borrowing, thus, such budget is a source

of government debts.

4. It is suitable for countries experiencing recession/depression (high unemployment and

low output).

5. Tax revenue is the main source of the Government income and the highest estimated

expenditure is grant and fixed charges amounted RM663,568,000,000

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Budget ExerciseDocument5 pagesBudget ExerciseNick Lee HomNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Abs 2023 24Document30 pagesAbs 2023 24sports galoreNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- General-Annual-Fund-Budget-2022Document7 pagesGeneral-Annual-Fund-Budget-2022Richard MendezNo ratings yet

- 21far460 Ss Set 1 Jun21 - StudentDocument9 pages21far460 Ss Set 1 Jun21 - StudentRuzaikha razaliNo ratings yet

- Annual Budget StatementDocument22 pagesAnnual Budget StatementFunkaarNo ratings yet

- Barangay Budget Form No. 6Document3 pagesBarangay Budget Form No. 6DennisEstrellosoAlbiso67% (3)

- Case Study FinalDocument47 pagesCase Study FinalVan Errl Nicolai SantosNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- Financial Position of IRDocument55 pagesFinancial Position of IRjeya chandranNo ratings yet

- Assets AmountsDocument6 pagesAssets Amountsaashir chNo ratings yet

- Exercise Lecture 2 Cash FlowDocument2 pagesExercise Lecture 2 Cash Flowdebbie intanNo ratings yet

- Activity 1Document4 pagesActivity 1Lezi WooNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisKimberly AsanteNo ratings yet

- Public Sector Accounting and Finance Revision Day 1Document5 pagesPublic Sector Accounting and Finance Revision Day 1Esther AkpanNo ratings yet

- Acc 2112: Accounting Theory and Practice Assignment (February 2021)Document6 pagesAcc 2112: Accounting Theory and Practice Assignment (February 2021)Ranson MerciecaNo ratings yet

- FINANCIAL RATIO ANALYSISDocument8 pagesFINANCIAL RATIO ANALYSISFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Tutorial - BudgetingDocument7 pagesTutorial - BudgetingKimberly AsanteNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Financial planning case study for property developerDocument25 pagesFinancial planning case study for property developerJesse Rielle CarasNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- TsefaDocument4 pagesTsefaAhmed SaeedNo ratings yet

- TM PQsDocument10 pagesTM PQsAnooshayNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Cash Flow Part 2 For ClassDocument9 pagesCash Flow Part 2 For ClassKgothatso ArnanzaNo ratings yet

- Seminar 12.2 Outline - Auditing of Group Financial Statements IIDocument6 pagesSeminar 12.2 Outline - Auditing of Group Financial Statements IIJasmine TayNo ratings yet

- Comparative and Common Size StatementsDocument10 pagesComparative and Common Size Statementsvanshikagoswami25No ratings yet

- Total Project Cost Fixed Assets/ Capital InvestmentsDocument8 pagesTotal Project Cost Fixed Assets/ Capital InvestmentsLorna BacligNo ratings yet

- Tri-Star Company Financial Statement AnalysisDocument10 pagesTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNo ratings yet

- 2023 Introduced Budget - Wayne Township NJDocument74 pages2023 Introduced Budget - Wayne Township NJMichelle Rotuno-JohnsonNo ratings yet

- Accounting ProjectDocument7 pagesAccounting ProjectMuskan SeherNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- AFM-CFS ProblemsDocument10 pagesAFM-CFS ProblemskanikaNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Project Payback & IRR AnalysisDocument5 pagesProject Payback & IRR AnalysisYashwini KomagenNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Tutorial 2 A212 QuestionDocument10 pagesTutorial 2 A212 QuestionFatinNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- Inato Sauce Financial ForecastDocument5 pagesInato Sauce Financial ForecastRamir SamonNo ratings yet

- annual 2 2024Document7 pagesannual 2 2024blguadlawan2012No ratings yet

- Balance Sheet of Reliance IndustriesDocument12 pagesBalance Sheet of Reliance IndustriesMohit Kumar SinghNo ratings yet

- Red Chilli WorkingsDocument10 pagesRed Chilli WorkingsImran UmarNo ratings yet