Professional Documents

Culture Documents

Data Analysis and Interpretation

Data Analysis and Interpretation

Uploaded by

Anshika TyagiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Data Analysis and Interpretation

Data Analysis and Interpretation

Uploaded by

Anshika TyagiCopyright:

Available Formats

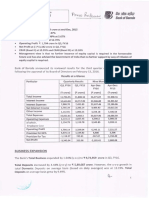

DATA ANALYSIS AND INTERPRETATION

Financials of ICICI Bank

Capital adequacy

The Bank's capital adequacy at December 31, 2009 as per Reserve Bank India's revised

guidelines on Basel II norms was 15.6% and Tier-I capital adequacy was 12.1% well above

RBI's requirement of total capital adequacy of 9.0% and Tier-I capital adequacy of 6.0%.

Assets quality

At December 31, 2008, the bank's net non performing assets ratio was 1.95% on an

unconsolidated basis. The consolidated net NPA ratio of the bank and ikt6s subsidiaries was

1.6%. The specific provisions for non performing assets (excluding the impact of farm loan

waiver) were Rs. 868 crore (US$ 185 Million) in Q2-2009 compared to Rs. 878 crore (US$ 187

million) in Q1-2009.

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Financial Performance of Public Sector Banks Versus Private Sector BanksDocument23 pagesFinancial Performance of Public Sector Banks Versus Private Sector BanksgullybabaNo ratings yet

- Project 1Document2 pagesProject 13037 Vishva RNo ratings yet

- Results Press Release For December 31, 2015 (Result)Document3 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- ICICI Bank Sees 18% Credit Growth in 2010-11Document5 pagesICICI Bank Sees 18% Credit Growth in 2010-11arshsing143No ratings yet

- Macro-Economics Assignment: Npa of Indian Banks and The Future of BusinessDocument9 pagesMacro-Economics Assignment: Npa of Indian Banks and The Future of BusinessAnanditaKarNo ratings yet

- Burning Desires IPO Outlook RBL BankDocument14 pagesBurning Desires IPO Outlook RBL BankYogesh V GabaniNo ratings yet

- AFinancialanalysisof IDBIBankDocument7 pagesAFinancialanalysisof IDBIBankJai patelNo ratings yet

- Axis Bank Limited: (ICRA) AAA (Stable) Assigned To The Infrastructure Bonds Programme Summary of Rating ActionDocument10 pagesAxis Bank Limited: (ICRA) AAA (Stable) Assigned To The Infrastructure Bonds Programme Summary of Rating ActionCH NAIRNo ratings yet

- Financials: State-Owned Banks: FY12 Annual Report AnalysisDocument32 pagesFinancials: State-Owned Banks: FY12 Annual Report AnalysisCarla TateNo ratings yet

- Study On Non Performing AssetsDocument6 pagesStudy On Non Performing AssetsHarshal RavankarNo ratings yet

- Capital Adequecy2Document6 pagesCapital Adequecy2meetkamal3No ratings yet

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDocument8 pagesBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNo ratings yet

- Report On Trend and Progress of Banking in India 2019Document6 pagesReport On Trend and Progress of Banking in India 2019Jobin JohnNo ratings yet

- Nepal: Management Performance Indicators ForDocument9 pagesNepal: Management Performance Indicators ForAtul AgrawalNo ratings yet

- AlmDocument5 pagesAlmNitish JoshiNo ratings yet

- Get Moneylife's Top Stories by Email: SubscribeDocument12 pagesGet Moneylife's Top Stories by Email: SubscribeVn KulkarniNo ratings yet

- Non-Performing Asset of Public and Private Sector Banks in India: A Descriptive StudyDocument8 pagesNon-Performing Asset of Public and Private Sector Banks in India: A Descriptive StudySujata MansukhaniNo ratings yet

- Indradhanush - Banking Setor Reforms - 20 January 2016Document14 pagesIndradhanush - Banking Setor Reforms - 20 January 2016costbrNo ratings yet

- Source: RBI Report On Trends & Progress of Banking in India 2011-12Document10 pagesSource: RBI Report On Trends & Progress of Banking in India 2011-12Aishwarya Satish ShettyNo ratings yet

- Top 5 Banks With Highest Capital Adequacy RatioDocument3 pagesTop 5 Banks With Highest Capital Adequacy Ratioabcdef1985No ratings yet

- Swati Raju Final ReportDocument62 pagesSwati Raju Final Reportshubham kumarNo ratings yet

- Financial ProfileDocument1 pageFinancial ProfileSuresh KumarNo ratings yet

- A Financial Analysis of I DB I BankDocument6 pagesA Financial Analysis of I DB I BankJai patelNo ratings yet

- January 11, 2012 Mumbai CRISIL Reaffirms Rating On Punjab National BankDocument3 pagesJanuary 11, 2012 Mumbai CRISIL Reaffirms Rating On Punjab National Bankashwini.krs80No ratings yet

- State Bank of India - Fast Catching Up With Private Banks: Step 1: Quick-Check Stock AnalysisDocument3 pagesState Bank of India - Fast Catching Up With Private Banks: Step 1: Quick-Check Stock Analysisaayushgoel88No ratings yet

- Punjan-National-Bank Oct-09 IPDI 7bl RationaleDocument10 pagesPunjan-National-Bank Oct-09 IPDI 7bl Rationaleash aNo ratings yet

- What Is Statutory Liquidity Ratio (SLR) ?: Which Institutions Are Required To Keep SLR?Document2 pagesWhat Is Statutory Liquidity Ratio (SLR) ?: Which Institutions Are Required To Keep SLR?Tanujit SahaNo ratings yet

- State Bank of India SBI: ANALYSIS: Here's How NDF Factor Works For Rupee/dollar RateDocument3 pagesState Bank of India SBI: ANALYSIS: Here's How NDF Factor Works For Rupee/dollar RateAkchat JainNo ratings yet

- 2011 11 Presentation For CLSA ConferenceDocument45 pages2011 11 Presentation For CLSA Conferenceankur9usNo ratings yet

- An Analysis of Public Sector Banks PerfoDocument14 pagesAn Analysis of Public Sector Banks PerfoMurali Balaji M CNo ratings yet

- Q3 and 9M, FY2012 Performance Review and OutlookDocument19 pagesQ3 and 9M, FY2012 Performance Review and OutlookpvinayakamNo ratings yet

- Implementation of Basel II and Basel IIIDocument11 pagesImplementation of Basel II and Basel IIIMd MirazNo ratings yet

- Annapurna Finance R 10092018Document10 pagesAnnapurna Finance R 10092018NIBOX MEDIA CENTERNo ratings yet

- Non Performing AssetsDocument12 pagesNon Performing Assetsrahul singhNo ratings yet

- Karnataka Bank Limited-R-16092019 PDFDocument8 pagesKarnataka Bank Limited-R-16092019 PDFamit malaghanNo ratings yet

- Shankar IAS 2022 Full Mock 02 00000000Document82 pagesShankar IAS 2022 Full Mock 02 00000000Mishra Alokranjan RameshNo ratings yet

- Management of Non-Performing Assets in Andhra Bank: CommerceDocument3 pagesManagement of Non-Performing Assets in Andhra Bank: CommerceManoj KumarNo ratings yet

- Axis Bank Q4FY12 Result 30-April-12Document8 pagesAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNo ratings yet

- Banks Have Ability To Withstand Stress: Also ReadDocument22 pagesBanks Have Ability To Withstand Stress: Also Readpriya2210No ratings yet

- 5 A Critical Review of Basel-Iii Norms For Indian Psu Banks PDFDocument8 pages5 A Critical Review of Basel-Iii Norms For Indian Psu Banks PDFDhiraj MeenaNo ratings yet

- General Banking NewsDocument14 pagesGeneral Banking NewsShraddha GhagNo ratings yet

- Summary Report OF Dena Bank: Prepared ByDocument6 pagesSummary Report OF Dena Bank: Prepared BySahil ShahNo ratings yet

- Soumik Sen 12PGDM055 Section ADocument15 pagesSoumik Sen 12PGDM055 Section ASoumik SenNo ratings yet

- Hotel MGNT SyllabusDocument25 pagesHotel MGNT SyllabusShubhajoy DasNo ratings yet

- Indian Banks Note (Revised)Document19 pagesIndian Banks Note (Revised)zainab bharmalNo ratings yet

- BMS 1a - Parangat Kapur - 18100Document22 pagesBMS 1a - Parangat Kapur - 18100Parangat KapurNo ratings yet

- Non-Performing Assets in Indian Public Sector Banks: An Analytical StudyDocument7 pagesNon-Performing Assets in Indian Public Sector Banks: An Analytical StudyHitesh ChawlaNo ratings yet

- FIN 405 Banking ProblemDocument6 pagesFIN 405 Banking ProblemAfrin ZahraNo ratings yet

- NCDs Rating RationalesDocument5 pagesNCDs Rating RationalesSrinivasNo ratings yet

- 1939IIBF Vision April 2012Document8 pages1939IIBF Vision April 2012Shambhu KumarNo ratings yet

- Determinants of Return On Assets of Public Sector Banks in India: An Empirical StudyDocument6 pagesDeterminants of Return On Assets of Public Sector Banks in India: An Empirical StudytamirisaarNo ratings yet

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBDocument4 pagesIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeNo ratings yet

- Market Reports News, Analysis & Researches Recommendations & Price Targets Companies ListDocument19 pagesMarket Reports News, Analysis & Researches Recommendations & Price Targets Companies ListumenarunaNo ratings yet

- Banking SectorDocument7 pagesBanking SectorHarsha Vardhan KambamNo ratings yet

- Press Release - 20 January, 2012: ST STDocument7 pagesPress Release - 20 January, 2012: ST STNimesh MomayaNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Performance Evaluation of BanksDocument6 pagesPerformance Evaluation of BanksAroop Kumar MohapatraNo ratings yet

- AssignmentDocument14 pagesAssignmentAbhiNo ratings yet

- M.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniDocument2 pagesM.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniAmandeep Singh MankuNo ratings yet