Professional Documents

Culture Documents

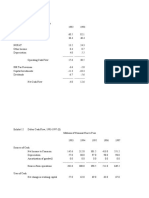

Certificate of Compensation Payment/Tax Withheld

Certificate of Compensation Payment/Tax Withheld

Uploaded by

Escalation ACN Whirlpool0 ratings0% found this document useful (0 votes)

104 views1 pageOriginal Title

2316.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

104 views1 pageCertificate of Compensation Payment/Tax Withheld

Certificate of Compensation Payment/Tax Withheld

Uploaded by

Escalation ACN WhirlpoolCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

DLN:

BIR Form No.

Republika ng Pilipinas

Certificate of Compensation

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Compensation Payment With or Without Tax Withheld

Payment/Tax Withheld 2316

July 2008 (ENCS)

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Year 2 For the Period

2018 02/02 12/31

( YYYY ) From (MM/DD) To (MM/DD)

Part I Employee Information Part IV-B Details of Compensation Income and Tax Withheld from Present Employer

3 Taxpayer Amount

226 883 681 000

Identification No. A. NON-TAXABLE/EXEMPT COMPENSATION INCOME

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO Code

32 Basic Salary/ 32

Rodriguez, Rufus Thomas Balagtas 00.00

Statutory Minimum Wage

6 Registered Address 6A Zip Code Minimum Wage Earner (MWE)

c/o Accenture Inc.

1554

33 Holiday Pay (MWE) 33 00.00

6B Local Home Address 6C Zip Code

7th Floor Robinsons Cybergate 1 Pioneer Street, 34 Overtime Pay (MWE) 34

Mandaluyong City, Metro Manila 00.00

6D Foreign Address 6E Zip Code 35

35 Night Shift Differential (MWE) 00.00

7 Date of Birth (MM/DD/YYYY) 8 Telephone Number 36 Hazard Pay (MWE) 36 00.00

10/12/1976

37 13th Month Pay 37

79,889.67

9 Exemption Status and Other Benefits

X Single Married

9A Is the wife claiming the additional exemption for qualified dependent children? 38 De Minimis Benefits 38 50,504.77

Yes No

10 Name of Qualified Dependent Children 11 Date of Birth (MM/DD/YYYY)

39 SSS, GSIS, PHIC & Pag-ibig 39 13,544.30

Contributions, & Union Dues

(Employee share only)

40 Salaries & Other Forms of 40 00.00

12 Statutory Minimum Wage rate per day 12 Compensation

00.00

13 Statutory Minimum Wage rate per month 13 00.00 41 Total Non-Taxable/Exempt 41 143,938.74

Compensation Income

14 Minimum Wage Earner whose compensation is exempt from

00.00

withholding tax and not subject to income tax B. TAXABLE COMPENSATION INCOME

Part II Employer Information (Present) REGULAR

15 Taxpayer

000 845 543 000

Identification No. 42 Basic Salary 42 825,573.89

16 Employer's Name

ACCENTURE, INC. 43 Representation 43

00.00

17 Registered Address 17A Zip Code

7th Floor Robinsons Cybergate 1 Pioneer Street, 44 Transportation 44 00.00

Mandaluyong City, Metro Manila 1554

X Main Employer Secondary Employer 45 Cost of Living Allowance 45 00.00

Part III Employer Information (Previous)

18 Taxpayer 46 Fixed Housing Allowance 46 00.00

Identification No.

19 Employer's Name 47 Others (Specify)

47A 47A 00.00

0.00

20 Registered Address 20A Zip Code 47B 47B

0.00 00.00

SUPPLEMENTARY

Part IV-A Summary 48 Commission 48

21 00.00

21 Gross Compensation Income from

Present Employer (Item 41 plus Item 55) 1,204,957.72

22 Less: Total Non-Taxable/ 22 49 Profit Sharing 49 00.00

Exempt (Item 41)

143,938.74

23 Taxable Compensation Income 23

1,061,018.98

from Present Employer (Item 55) 50 Fees Including Director's 50 00.00

24 Add: Taxable Compensation 24 Fees

Income from Previous Employer 0.00

25 Gross Taxable 25 51 Taxable 13th Month Pay 51 0.00

1,061,018.98

Compensation Income and Other Benefits

26 Less: Total Exemptions 26

00.00 52 Hazard Pay 52 00.00

27 Less: Premium Paid on Health 27

and/or Hospital Insurance (If applicable) 0.00

28 Net Taxable 28 53 Overtime Pay 53

1,061,018.98 00.00

Compensation Income

29 Tax Due 29 54 Others (Specify)

208,305.69

30 Amount of Taxes Withheld 54A 0.00 54A 235,445.09

30A Present Employer 30A 208,305.69

54B 0.00 54B 00.00

30B Previous Employer 30B 0.00

31 Total Amount of Taxes Withheld 31 55 Total Taxable Compensation 55 1,061,018.98

208,305.69

As adjusted Income

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and correct

pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

56 Jennifer P. Agcaoili Date Signed 01/31/2019

Present Employer/ Authorized Agent Signature Over Printed Name

CONFORME:

57 Rodriguez, Rufus Thomas Balagtas Date Signed

CTC No. Employee Signature Over Printed Name Amount Paid

of Employee Place of Issue Date of Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury, that the information herein stated are reported I declare,under the penalties of perjury that I am qualified under substituted filing of

under BIR Form No. 1604CF which has been filed with the Bureau of Internal Revenue. Income Tax Returns(BIR Form No. 1700), since I received purely compensation income

from only one employer in the Phils. for the calendar year; that taxes have been

correctly withheld by my employer (tax due equals tax withheld); that the BIR Form

58 Jennifer P. Agcaoili No. 1604CF filed by my employer to the BIR shall constitute as my income tax return;

Present Employer/ Authorized Agent Signature Over Printed Name and that BIR Form No. 2316 shall serve the same purpose as if BIR Form No. 1700

(Head of Accounting/ Human Resource or Authorized Representative) had been filed pursuant to the provisions of RR No. 3-2002, as amended.

59 Rodriguez, Rufus Thomas Balagtas

Employee Signature Over Printed Name

You might also like

- Bir 2303Document1 pageBir 2303Melissa Baday80% (5)

- 2019 SEC Cover Sheet For Financial StatementsDocument1 page2019 SEC Cover Sheet For Financial StatementsKim Balauag74% (19)

- Globe BillDocument3 pagesGlobe BillJL D CT0% (1)

- CONVERGE Proof of Internet SubscriptionDocument1 pageCONVERGE Proof of Internet SubscriptionJayrald Delos SantosNo ratings yet

- Credit Card - COE 198141Document1 pageCredit Card - COE 198141Richmon Felix Trance67% (3)

- Authorization Letter - QC FormDocument2 pagesAuthorization Letter - QC FormCharina Marie Cadua78% (9)

- Bir 1701Document2 pagesBir 1701RAYNAN MARCELO100% (1)

- 2316 Jan 2018 ENCS FinalDocument2 pages2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- E SalesDocument58 pagesE Salesgrini gunayan50% (2)

- Pagibig Member's Data Form (MDF)Document2 pagesPagibig Member's Data Form (MDF)wawawiwap71% (73)

- Schedules For Non-Stock, Non-Profit Organizations Sworn StatementDocument8 pagesSchedules For Non-Stock, Non-Profit Organizations Sworn StatementKateNo ratings yet

- BIR Form No. 1701Document4 pagesBIR Form No. 1701blesypNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- Certificate of Deposit (Metrobank)Document2 pagesCertificate of Deposit (Metrobank)Westly Juco100% (2)

- Requirements For Summary List of Sales and PurchasesDocument2 pagesRequirements For Summary List of Sales and PurchasesMary Joy Villanueva100% (2)

- Noel Redding Estate v. Sony Music EntertainmentDocument4 pagesNoel Redding Estate v. Sony Music EntertainmentBillboardNo ratings yet

- (Revised) Barings Bank CaseDocument12 pages(Revised) Barings Bank CaseMansi ParmarNo ratings yet

- BIR Form 1903Document2 pagesBIR Form 1903Earl LarroderNo ratings yet

- Letter of Retirement Brgy LevelDocument1 pageLetter of Retirement Brgy Leveljayar medicoNo ratings yet

- MayniladDocument1 pageMayniladTheo AmadeusNo ratings yet

- Jerry Gray - Jazz Czerny - PianoDocument32 pagesJerry Gray - Jazz Czerny - Pianovnnw100% (43)

- 2316 139520 PDFDocument1 page2316 139520 PDFAnonymous EVdPq3NlNo ratings yet

- 2316 (1) 1Document2 pages2316 (1) 1dolores100% (1)

- DocumentDocument2 pagesDocumentZandie Garcia0% (1)

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- SM TAYTAY - New Tenant Profile Form PDFDocument2 pagesSM TAYTAY - New Tenant Profile Form PDFtokstutonNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleErick Echual75% (4)

- How To File Form 2316 and Annex FDocument4 pagesHow To File Form 2316 and Annex FIvan Benedicto100% (1)

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Bir 2Q 2020Document4 pagesBir 2Q 2020Leo Archival ImperialNo ratings yet

- COEDocument1 pageCOEChristian Casalan100% (2)

- Certification of EmploymentDocument2 pagesCertification of EmploymentArafat Tocalo100% (1)

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax Withheldjarra andrea jacaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGeorgia HolstNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldTrish CalumaNo ratings yet

- Bir Form 2316Document2 pagesBir Form 2316Benjie T Madayag100% (1)

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldLency FelarcaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldGjianne PeñaredondoNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Itr Rosare RobertoDocument8 pagesItr Rosare RobertoRafael ZamoraNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldIan Jay BahiaNo ratings yet

- 2316 Sep 2021 ENCS - Final - CorrectedDocument1 page2316 Sep 2021 ENCS - Final - Correctedchelleabogado27No ratings yet

- Form 2316 Eb Chairperson RegularDocument1 pageForm 2316 Eb Chairperson Regularmha anneNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 2012 ItrDocument1 page2012 Itrregin pioNo ratings yet

- Blk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesBlk.36 Welafareville Comd. Mand. City: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldJohnleis R. AdarayanNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- 28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Document4 pages28/feb/99 354 053 462 1/mar/99 123-456-789 123 456 789Kenneth Vallejos CesarNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldED'z SantosNo ratings yet

- 2316 Jan 2018 ENCS Final2Document1 page2316 Jan 2018 ENCS Final2Rafael DizonNo ratings yet

- BIR Form 2316Document1 pageBIR Form 2316Angelique MasupilNo ratings yet

- 2316 Chairman Public School TeacherDocument1 page2316 Chairman Public School TeacherCASUNCAD, GANIE MAE T.No ratings yet

- Bir Form 2316 BlankDocument296 pagesBir Form 2316 BlankRomeda ValeraNo ratings yet

- New 2316 Annex ADocument1 pageNew 2316 Annex AGeram ConcepcionNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- New Bir 2316 Ebs Members DesoDocument5 pagesNew Bir 2316 Ebs Members DesoEMELYN COSTALESNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- 2316 EB Pollclerk EB Member and DESODocument1 page2316 EB Pollclerk EB Member and DESOyeiwjwjsNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldSafferon SaffronNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Aluad Vs AluadDocument1 pageAluad Vs AluadSachuzen23No ratings yet

- Pol 214Document3 pagesPol 214JulianNo ratings yet

- Recruitment Fair (Document4 pagesRecruitment Fair (Paolo Pantanosas FerrerNo ratings yet

- Entry of Foreign Law Firms in IndiaDocument9 pagesEntry of Foreign Law Firms in IndiaRohan S G SahayNo ratings yet

- Shaarei Teshuvah - en - Sefaria 2020 Edition, Translated by R. Francis NatafDocument88 pagesShaarei Teshuvah - en - Sefaria 2020 Edition, Translated by R. Francis NatafRaziel Ben AvrahamNo ratings yet

- Child Justice Act 75 of 2008: (English Text Signed by The President)Document89 pagesChild Justice Act 75 of 2008: (English Text Signed by The President)Aldrin ZlmdNo ratings yet

- MR8MDocument6 pagesMR8MAna MacarroneNo ratings yet

- James Holmes Order To Limit Pre Trial PublicityDocument4 pagesJames Holmes Order To Limit Pre Trial PublicityNickNo ratings yet

- Petition For Notarial CommissionDocument2 pagesPetition For Notarial CommissionStewart Paul TorreNo ratings yet

- Administration Guide DLP - v5.5Document206 pagesAdministration Guide DLP - v5.5SherwinLRBNo ratings yet

- Revue Des Études Juives. 1880. Volume 48.Document370 pagesRevue Des Études Juives. 1880. Volume 48.Patrologia Latina, Graeca et Orientalis100% (1)

- EXERCISE Skill 3-5Document3 pagesEXERCISE Skill 3-5ChacaNo ratings yet

- Coe Bail MemoDocument11 pagesCoe Bail MemoKGW NewsNo ratings yet

- RomaniaDocument94 pagesRomaniaLazr MariusNo ratings yet

- Pepsi CoDocument6 pagesPepsi CoRyan Patrick GlennNo ratings yet

- NetflixDocument8 pagesNetflixRejitha Raman100% (1)

- Private & Confidential Page 1 of 34Document34 pagesPrivate & Confidential Page 1 of 34Er. Rajesh ChatterjeeNo ratings yet

- WI Tools Guide 19.1.0Document260 pagesWI Tools Guide 19.1.0Loganathan KarthickNo ratings yet

- City Schools Division of Antipolo City Lores Elementary SchoolDocument2 pagesCity Schools Division of Antipolo City Lores Elementary SchoolDomingo Olano JrNo ratings yet

- Profile Summary: Ca Vaibhav KumarDocument3 pagesProfile Summary: Ca Vaibhav KumarThe Cultural CommitteeNo ratings yet

- Electric Charge and Static Section SummaryDocument1 pageElectric Charge and Static Section Summaryapi-261954479No ratings yet

- Taliban - Wikipedia PDFDocument56 pagesTaliban - Wikipedia PDFrickyNo ratings yet

- Attention: Karen W. Makamson Pillow Academy 69601 Highway 82 West Greenwood, MS 38930Document4 pagesAttention: Karen W. Makamson Pillow Academy 69601 Highway 82 West Greenwood, MS 38930Cottonians IndiaNo ratings yet

- Law 245Document11 pagesLaw 245ifaNo ratings yet

- Format For Authorising The Person(s) For Taking The Delivery From The WarehouseDocument1 pageFormat For Authorising The Person(s) For Taking The Delivery From The WarehouseSid RoyNo ratings yet

- Invoice OD607234730047437000Document1 pageInvoice OD607234730047437000kramski india100% (1)

- COA CIRCULAR LETTER NO. 2004-004 - October 5, 2004Document2 pagesCOA CIRCULAR LETTER NO. 2004-004 - October 5, 2004KeleeNo ratings yet