Professional Documents

Culture Documents

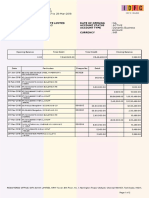

Boi Hosur Shipl Statement 1.4.2015 To 29.3.2016

Boi Hosur Shipl Statement 1.4.2015 To 29.3.2016

Uploaded by

SURANA19730 ratings0% found this document useful (0 votes)

11 views24 pagesBOI

Original Title

Boi Hosur Shipl Statement 1.4.2015 to 29.3.2016

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBOI

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views24 pagesBoi Hosur Shipl Statement 1.4.2015 To 29.3.2016

Boi Hosur Shipl Statement 1.4.2015 To 29.3.2016

Uploaded by

SURANA1973BOI

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 24

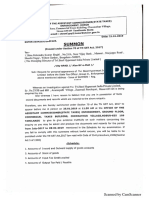

GSTIN: 33ABGFM8067J1ZX/2018-2019 Office of the

INS No.09/2018-2019 Assistant Commissioner (ST ) ,

Tax period : JUNE.2018 to Jan.2019 (Enforcement ), Hosur

( 02-06-2018 to 09-01-2019) Dated : 11-04-2019.

Notice under Section .122(1) of Tamil Nadu Goods and Services tax Act, 2017

122(1) of the Central Goods and Service Tax Act’2017

Notice under Section .

read with Section .6 of The Central ‘Goods and Services Tax Act,2017 and

Notice under Section 20 of the Integrated Goods and Service Tax Act2017-

1. Take notice that , your business premises in the name and style of business

as Tvi.Metal Craft (herein after referred as dealers ), at Shop No.2, Sy. No.

21/1A, Anumepalli Agraharam Village , Zuzuvadi Panchayat , Hosur —

635126 a migrated Tax payer under Goods and Service Tax Act 2017 in

GSTIN ; 33ABGFM8067J1ZX_ has been inspected on 09-01-2019 by the

undersigned along with the officials assigned for the inspection as per the

authorization issued by the Joint Commissioner (ST ),(Salem ) in INS 1

SI No.09/2018-2019 dated : 08-01-2019 for the reason to believe that , the

dealers have generated fake/false Tax invoices and e waybills without

movement of goods. During the course of inspection at the business

premises was found locked. Subsequently, the custodian of the business

premises has came down and open the business premises at 5.30 PM . since

books of accounts were not maintained and produced as required under

Section .35 of Tamil Nadu Goods and Service Act.2017 read with Rule .56

‘of Tamil Nadu Goods and Services Tax Rules .2017 .During the course of

inspection on 09-01-2019 statement also obtained from the person in

charge of the business premises.

2

2. The dealers have filed self assessed monthly returns in the return in Form

GSTR | and GSTR 3B for the Tax period from April.2018 to Feb .2019 as

required under section .39 of Tamil Nadu Goods and Service Tax Act.2017

Read with Rule.59 of Tamil Nadu Goods and Service Tax Rules.2017 .

3. The turnover reported as per the self assessed tax return in Form GSTR 3B

for the Tax period from April .2018 to Feb.2019 is summarized as under .

1, | Total Taxable turnover reported for the Tax | Rs.412,69,20,338-

period from April .2018 to Feb.2019

2. | Tax due

IGST Rs.19,35,74,546-

SGST Rs.27,46,35,583-

CGST Rs.27,46,35,583-

Total Tax due Rs.74,28,45,712-

3._| Input tax credit claimed

IGST Rs.19,23,48,445-

SGST Rs.27,46,35,583-

CGST Rs.27,45,39,456-

Total Input tax credit claimed Rs.74,15,23,484-

Net payable Rs.13,22,228-

Paid Rs.13,22,228-

Balance payable as per self assessed return __| Nil

4, In support of the above self assessed return , the dealers ought to have

maintain the following books of accounts at the principal place of business

as enumerated under Section .35 of Tamil Nadu Goods and Service Tax

Act.2019,

“ Every Registered person shall keep and maintain , at his principal business

as mentioned in the certificate of registration , a true and correct account of —

> a, Production or manufacture of Goods

> b. Inward and outward supply of goods or services or both

> c. Stock of goods

> d.Input tax credit availed

> e, Out put tax payable and paid and

> f. Such other particulars as may be prescribed .

Rule.56 of Tamil Nadu Goods and Service Tax Rules.2017 enumerates that

Rules .56 (4) :- Every registered person, other than a person paying tax under

section .10, shall keep and maintain an account containing , the details of Tax

payable ( including tax payable in accordance with the provision of sub —

section (3) and Sub Section (4) of Section (9) ) , tax collected and paid , input

tax , input tax credit claimed , together with a register of tax invoice , credit

notes , debit notes , delivery challan issued or received during any tax period .

Rule.56(5) : - Every Registered person shall keep the particulars of :-

(a)Name and complete address of supplies from whom he has received the

goods or services chargeable to tax under the Act;

(b)Name and complete address of the person to whom he has supplied goods or

services , where required under the provision of this chapter ;

(c) The complete address of the premises where goods are stored by him ,

including goods stored during transit along with particulars of the stock

stored therein ,

Rule.56(7):- Every registered person shall keep the books of accounts at the

principal of place of business and books of accounts relating to additional

place of business mentioned in his certificate of registration and such books

of accounts shall include any electronic form of data stored on any electronic

device .

5.But the dealers have failed to keep and maintain the above books

of accounts at the business premises . In the absence of books of accounts ,

the documents filed by the dealers was taken up for verifications . The

dealers has filed monthly retums in GSTR 1 , 3B and also they have

generated E way bills for the tax period from June .2018 to Jan .2019 .

(02-06-2018 to 09-01-2019 ) These documents were filed by the dealers

themselves and verification of those self assessed records was carried out .

And also a complete verification of E waybills was done in order to cross

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Indian Bank CC 3 MontsDocument44 pagesIndian Bank CC 3 MontsSURANA1973No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IDFC Bank StatementDocument2 pagesIDFC Bank StatementSURANA197367% (3)

- Indian CC Jan 2019Document6 pagesIndian CC Jan 2019SURANA1973No ratings yet

- Statement To DepartmentDocument10 pagesStatement To DepartmentSURANA1973No ratings yet

- GP Sheet Stock HosurDocument4 pagesGP Sheet Stock HosurSURANA1973No ratings yet

- Sales April 15 ShiplDocument27 pagesSales April 15 ShiplSURANA1973No ratings yet

- Client Clarification Steel Hypermart TNDocument2 pagesClient Clarification Steel Hypermart TNSURANA1973No ratings yet

- Vijaya Oct To Nov 2018Document8 pagesVijaya Oct To Nov 2018SURANA1973No ratings yet

- SBM Under Taking OkDocument1 pageSBM Under Taking OkSURANA1973No ratings yet

- BangaloreDocument95 pagesBangaloreSURANA1973No ratings yet

- SHIPL Authorisation Letter For DESK AuditDocument1 pageSHIPL Authorisation Letter For DESK AuditSURANA1973No ratings yet

- Ferrus 17 18 SaleDocument2,849 pagesFerrus 17 18 SaleSURANA1973No ratings yet

- Dhruv Granites: (Mukesh Surana) Membership No. 077745Document4 pagesDhruv Granites: (Mukesh Surana) Membership No. 077745SURANA1973No ratings yet

- SDP Stone Term Laon MarbleDocument72 pagesSDP Stone Term Laon MarbleSURANA1973No ratings yet

- Profile Company Shipl Buildtech 29-12-2018Document18 pagesProfile Company Shipl Buildtech 29-12-2018SURANA1973No ratings yet

- Mar 2018 CCDocument14 pagesMar 2018 CCSURANA1973No ratings yet

- RejectedDocument5 pagesRejectedSURANA1973No ratings yet

- SBM Due Deligency Report by CADocument34 pagesSBM Due Deligency Report by CASURANA1973No ratings yet

- Bank StatmentDocument73 pagesBank StatmentSURANA1973No ratings yet

- KRS 16 RevDocument19 pagesKRS 16 RevSURANA1973No ratings yet

- KRS 16 RevDocument19 pagesKRS 16 RevSURANA1973No ratings yet

- Shipl - MD SummonDocument2 pagesShipl - MD SummonSURANA1973No ratings yet

- Audit Report AY15-16Document10 pagesAudit Report AY15-16SURANA1973No ratings yet

- Ferrum Merchant 3 CD 2017-18Document2 pagesFerrum Merchant 3 CD 2017-18SURANA1973No ratings yet

- Ferrum Merchant Balance Sheet 2017-18Document4 pagesFerrum Merchant Balance Sheet 2017-18SURANA1973No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961SURANA1973No ratings yet