Professional Documents

Culture Documents

Donors-Tax A PDF

Uploaded by

Paul Christian Lopez Fiedacan0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

Donors-Tax_A.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesDonors-Tax A PDF

Uploaded by

Paul Christian Lopez FiedacanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

ReSA

‘The Review School of Accountancy

Bei, No. 735-0807 & 734-3080

TAXATION ‘TAMAYO/LIM/CAIGA/MANUEL

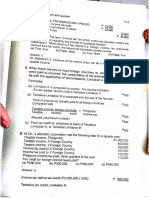

‘VK201. A: DRILILIN DONOR’S TAX

TRUE OR FALSE: Write the word True when the stateurent is correct and the word False when the statement

18 incorrect. When your answer Is Faise, under the word or phrase that made the statement incorrect

and make the corrections to make it true.

“whe: False 1. Donation mortis caus is subject to donor's tax. 2

Inter vivos

ROSS GIETS

| Donation i an act of liberalty whereby 0 person disposes gratuitously of a thing oF right in favor of anther who

accepts t

Donation safer vis happens when the danor iniendls that the donation shal take effect du

the soperty shall be delivered till after his death,

"he donation #5 perfected the moment the donor kriows of the acceptance by the donee.

4. For the donation to be considered vali, «cceptance of the donation must be made during the Ifetime of the donor

and the donee,

‘he donor's tax shall not apply unless and until there is a completed gift.

Donation 1s completed the moment the thing donated is «ctually delivered to the donee.

‘aft that 1s incomplete because of reserved powers, becomes complete when te donor renounce’ the power oF his

Maht to exercise the reserved power ceases because of some event oF contingency or the fulfilment of some

condition, other than the donors death.

8. The law in force at the time of the completion of the donation shall govern the imposition of donor's tax.

8. The donation of a movable may be made only in writing.

10. An oral donation requires simultaneous delivery of the thing or of the document representing the right donated.

11. If the value of the personal property donates e«cted: three thousand pesos, the donation and acceptance shall be

made in wnting to be consideted a valid donation.

12. Donation of immovable property requires that the donation be made in @ pubic document specifying therein the

Property donated and the value ofthe characs which the donee must satisty

1B. The acceptance of a donated immovable property may be made in the same Deed of Donation or ina separate public

document, but shall not take effect unless tf done during the ietime of the donor.

14, If the acceptance of the donated immovable property is made in a separate instrument, the donor shail be notified

thereof in an authentic form, and this step shall not be noted in both Deed of Donation and Deed of Acceptance.

15, The donor’ tax shall apply whether the transfer isn trust or otherwrse, whether the gif 1s direct or indirect, and

whether the property is real or personal, tanaible or itanaibie

16, Donation made between business organizations and those made Between an individual and a business organization

shall be considered as donation made to a strange

17, Any provision of law to the contrary notwthsiandino, zy contnbution in cash or in kind to any candidate or politcal

party or coalition of parties for campaign purposes duly ceported to the COMELEC shall not be subject to the payment

of any aift tax.

18. Renuncation by the surviving spouse of his/her share: sn the conjugal partnership or absolute community after the

dissolution of the mariage in favor of the heirs of the deceased spouse or any other person/s is not subject to

donor's tax.

19. General renunciation by an heir, Including the surviving spouse, of hisyher share inthe hereditary estate left by, the

deceased 1s not subject to donor's tax, unless specifically and categorically done in favor of identified heit/s te the

exclusiot or disadvantage of the co-heirs in the hereditary estate.

20. A transfer ts gratuitous oF without consideration and accordinaly qualifies 4s a donation, if no economic benefit

measurable in money or money's worth Foweds to ine transferor from the transferee.

21. The gross gifts of a donor who is a citizen, whether resident or non-resident of the Philippines, wil include alt

properties wherever situated,

22. The gross gifts of a donor who is an alien, wheter resident or non-resktent of the Phiippines, wil include only

broperties situated in the Philippines.

23, The rule of reciprocity that applies to estate tax also applies to non-resident alien donor as far as donation of

intangible personal property situated in the Philippines.

24, With the exception of moderate donations for charity or on occasions of family rejoicing, neither spouse may donate

any community property or conjugal property without the consent of the other.

25. Every donation between the spouses dunng the marriage shall be vod except for moderate gifts, which the spouse

‘may give each other on the occasion of any famiy rejorcing, and donation morts causa,

26. Husband and wife are considered as Joint tixpaye! for purposes of donor's tax.

27. If what was donated 1s @ conjugal or community property and only the husband signed the deed of donation, there is

jonly one donor for donor's tax purposes, without prejudice to the right of the wife to question the validity of the

donation without her consent pursuant to the pertinent provisions of the Civil Cade of the Philippines and the Family

Code of the Philippines,

28. If properties are gwen as a git, they shail be appraised atts fair market value as of the time of donation.

TX-201A

19 hes lfeume, though

ReSA: The Review School of Accountancy Page 2 of 3

20. In showing gross gifts the donors ta. return, real property should be valued at the current and fair market value,

sshow' in the assessment rots, oF the fair marke? vali, as determined by the Commissioner of Internal Revenue,

awinchever 15 higher

40, I ahowing gross gifts n the donor's tax return, personal property should be valued at current fair market value oF at

cost, whichever 1s lower:

31 Wheve property, other than veal property subject to capital gains tax, is transferred for less than an adequate and full

considerabon in money of money's worth, then the amount by which the fair market value of the property exceeded

the value of the consideration shall, for the purse of donor's tax, be deemed a gift, and shall be included 19

computing the amount of gifts made during the caters cau

32. Asale, exchange, or other transferct prooerty :nac in the ordinary course of business (a transaction which is 2

ona dat arslength, ad ee ror any dative tent le conse as made for an adequate and full

nsaderation 1n money oF Taoney's Wo

e concept of an arm’s length transaction assures that beth parties in the deal are acting in their own self

cyesi aud are not subject to any pressure or duress from the other party and there is no collusion between

the ouyer and the seller

34 Belore TRAIN (R.A. No. 10963), when the donee or beneficiary is stranger, the tax payable by the donor shall be

thirty percent (30%) of the gross gifts.

36, Under the TRAIN (R.A, No, 10963), the tax for eaci calendar year shall be sbx percent (6%) computed on the

basis of the total gifts in excess of Two hundred fifty thousand pesos (P250,000)exempt gift made during the

sndiar year whether the donee is a reletive or a stranger

1 Tne

2 Tre

3. True

4. True

5. True

= [i subject to dono

‘whether. resdent_or —non-resi ‘non-resident aien only

| Phiippines

4 joint taxpayers __. _

7 at curent fair market vale ora cost

__| whichever is lower

gross gifts:

“| Separate and distinct taxpayers

| at current fair market value

MPTIONS OF CERTAIN M FTSAN

eat gift shall mean the net economic beneft Irom the transfer tnat accrues to the

Fret PRAIN (RA. NO. 10963), the amount of dowry that can be glen by @ doncr to 2 donee cannot exceed

10,000.

4, Befire TRAIN (PLA. No, 10963), 2 gift given by a parent to his legttmate, natural or adopted chid isnot ented to

10,000 dowry exemption unless given on account of mariage.

4, Before TRAIN(RA, No, 10963), an aunt who naturally alopted her niece can claim dowry exemption on gts made

‘on account of marriage.

5, before TRAIN (RA. NO, 10963), a dowry given beyond one year after the celebration of mariage shall be alowed as

Geductionfexemption ifthe total exempt dowry dimed has not yet exceeded P10,000

6, Sefeee TRAIN (A, No. 10963), in case where 2 property dovated comes from common properties, the husband and

the wife can claim dowry exempbon being canurs of cane-half each of the common property

7, Before TRAIN (RA. No. 10963), 2 father-doncr donated properues on account of mariage to his two (2) sons, he can

cdaim a maximum of 20,000 dowry exemption

8, Unies the TRAIN (R.A. No. 10963), downes or gifts on account of marriage are no longer alowed to be deducted

from the gross gits of all donors.

9, Cath dorar ee required to file 2 separate donors tax retum except married donors who are required to fle @ jont

donor's tax return,

10. Gifts made to or for the use of the National Government cr any entity created by any ofits agencies whether o* not

Conducted for prof, or to any poitical subsivision of the Said Government is @ deduction from gross aits of all

donors, whether resident or not.

11, Dgovekion inter vivos to a charitable organization 1s deductible from the gross gifts of both resident alien and nion-

resident alien donors.

12. Rdosation inter vivos to a parish church, the same being 2 religious organization, js allowed as deduction from the

gross oft

13, A denstion inter vivos to non-profit research organization 1s a deduction from the gross gifts provided not more than -

30% of said gifts shall be used by such donee for administration purposes.

14. An unpard mortgage on the donated property assuined by the donee is a deduction from the gross gifts of the donor

TAXATION: DRILL IN DONOR’S TAX TX-201 A

ReSA: The Review School of Accountancy Page 3 of 3

15. A diminution on the property donated specifically provided by the doncr 1s a deduction from the gross gifts of the

donor

genation to the Integrated Bar of the Phiippines (IB) ic exempted from donor's tax.

A donation to the Philippine Insvtute of Certified Public Accountants (PICPA) is exempted from donor's tax

15, Tax credit for foredgn donor's taxes paid by a donor, including non-resident alien donor, is allowed as deduction trom

mneippine donor's tax due.

\able donor's 12x credit 1s lower between the statutory limit and the actual foreign donor's tax.

vy individual who makes any transfer by gift (except those which are exempt from donor's tax) shall, for the

se OF doner’s tax, make a retum under oath at feast in duplicate.

The donor's tax return shall be fled within 30 dys after the date the gift is made.

‘The donor's tax due shail be paid at the time of filing of donor's tax return,

n case of resident donors, the donor's tax return shal be filed with authorized agent bank, Revenue District Officer,

Sevenue Collecton Officer of duly authorized Treasurer of the city or muniapalty where the donor was domiciled at

the tme of the transfer

24. Ih case of both non-resident citizen anc non-resident alten donors, the donor's tax retum shall be filed wath Philippine

1s5y oF Consulate where they are domiciled at the time of the transfer, or Office of the Commissioner.

‘The donor engaged in business shall give «nati of donacon on every donation worth at least PS0,000 to the ROO

which has jurisdicbon over his place of business within 30 days after receipt of the qualified donee institubon's duly

sued Certificate of Donation, which shall Le attached to the said Notice of Donation, stating that not more than 30%

of the said donabons/aifts for the taxable year shell be used for administration purposes.

| he amount of dowry can excoed PIODD. Rie

| emit ey om ewe a |

ratrally aopea er race cannot Gai Gowy |

_| exemption, must be legally adopted —_ J

"Sen ne year rm he een of

|

1

Exempted from donee’ tax Not exempted from donor's tax

~Trincluding non-resident atien donor excluding non-resident af

“18. False

‘THOT: It is not what one has that makes him generous, it is his attitude. - Tamthewise

TAXATION: DRILL IN DONOR’S TAX TX-201 A

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- DerivativesDocument79 pagesDerivativesPaul Christian Lopez FiedacanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Pdic LawDocument28 pagesPdic LawPaul Christian Lopez Fiedacan100% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Obligations 2Document20 pagesObligations 2Paul Christian Lopez FiedacanNo ratings yet

- Commisioner of Internal Revenue Vs Standard Insurance Co., IncDocument2 pagesCommisioner of Internal Revenue Vs Standard Insurance Co., IncPaul Christian Lopez FiedacanNo ratings yet

- New Doc 2019 04 22 2 PDFDocument6 pagesNew Doc 2019 04 22 2 PDFPaul Christian Lopez FiedacanNo ratings yet

- Format PB-CompilationDocument1 pageFormat PB-CompilationPaul Christian Lopez FiedacanNo ratings yet

- New Doc 2019 04 22 2 PDFDocument6 pagesNew Doc 2019 04 22 2 PDFPaul Christian Lopez FiedacanNo ratings yet

- CompiDocument28 pagesCompiPaul Christian Lopez FiedacanNo ratings yet

- Paul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingDocument2 pagesPaul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingPaul Christian Lopez FiedacanNo ratings yet

- ProspectusDocument25 pagesProspectusPaul Christian Lopez FiedacanNo ratings yet

- National Mock Board Examination 2019: General GuidelinesDocument12 pagesNational Mock Board Examination 2019: General GuidelinesPaul Christian Lopez FiedacanNo ratings yet

- Paul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingDocument2 pagesPaul Christian L. Fiedacan 37304 Iac Advanced Financial Accounting and ReportingPaul Christian Lopez FiedacanNo ratings yet

- Consent NotarypublicDocument1 pageConsent NotarypublicPaul Christian Lopez FiedacanNo ratings yet

- Aud - Cis Syll Sem1 Sy2018 2019 PDFDocument7 pagesAud - Cis Syll Sem1 Sy2018 2019 PDFPaul Christian Lopez FiedacanNo ratings yet

- Sales Procedure: Internal Control (COSO) Internal Control WeaknessDocument2 pagesSales Procedure: Internal Control (COSO) Internal Control WeaknessPaul Christian Lopez FiedacanNo ratings yet

- ReyesDocument3 pagesReyesPaul Christian Lopez FiedacanNo ratings yet

- Batas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesDocument28 pagesBatas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesPaul Christian Lopez FiedacanNo ratings yet

- Open Gapps LogDocument2 pagesOpen Gapps LogPaul Christian Lopez FiedacanNo ratings yet

- PV Examples S10Document6 pagesPV Examples S10Paul Christian Lopez FiedacanNo ratings yet