Professional Documents

Culture Documents

Late Charges in R12 PDF

Late Charges in R12 PDF

Uploaded by

jyothirmaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Late Charges in R12 PDF

Late Charges in R12 PDF

Uploaded by

jyothirmaiCopyright:

Available Formats

Specialized. Recognized. Preferred.

The right partner makes all

the difference.

Late Charges in R12

By: Ranga Santhanam

AST Corporation

March 17, 2014

Applications Software Technology Corporation

1755 Park Street, Suite 100 | Naperville, Illinois 60563 | 1.888.278.0002 | www.astcorporation.com

Contents

INTRODUCTION ...................................................................... 1

THE BUSINESS CASE FOR LATE CHARGES ................................. 1

INTRODUCTION OF LATE CHARGES INTO ORACLE EBS R12 ...... 1

IMPLEMENTING LATE CHARGES IN R12 ................................... 1

DEFINING AN ORGANIZATIONAL POLICY FOR LATE CHARGES2

CONFIGURING LATE CHARGE DOCUMENTS ............................. 3

DEFINING A TRANSACTION TYPE FOR LATE CHARGES .......... 3

DEFINING A BATCH SOURCE .................................................. 3

DEFINING A FINANCE CHARGE ACTIVITY............................... 4

ENABLE LATE CHARGES FOR YOUR ORGANIZATION ............. 5

DEFINING TIERS AND CHARGE SCHEDULES ........................... 5

CONFIGURING LATE CHARGES IN CUSTOMER PROFILE CLASSES6

IMPLEMENTING LATE CHARGES AT THE CUSTOMER LEVEL ...... 8

ADDITIONAL CONFIGURATIONS FOR ENABLING/DISABLING LATE

CHARGES ................................................................................ 9

PROCESSING LATE CHARGE DOCUMENTS ................................ 9

CONCLUSION ........................................................................ 10

Late Charges in R12

Page i

Introduction

While it is common for Customers to default or delay payments on their

invoices, it is not uncommon that organizations implement policies that

compensate the missing cash flows. Typical collection policies include

imposing a late charge or a penalty on the customer for being delinquent.

This paper will detail the configuration options that R12 offers an

organization to implement its late charges and penalty policies.

Throughout this paper, we will provide examples from an organization

successfully using this feature. The unique requirements of the

organization and how they were fulfilled will be cited to support the

validity of the solution.

The Business Case for Late Charges

What happens to an organization having customers that miss due dates

on their payments? The situation gives rise to the problem of delayed

cash flow, and the accompanying issue of foregoing the interest that

would have accrued if the revenue had been timely realized.

Late charges are levied on customers, as a fine for overdue payments, or

payments made beyond the due date. This measure is designed to

encourage customers to stay on track with their payment obligations and

to cover any additional costs endured because of missed payments.

Introduction of Late Charges into

Oracle EBS R12

The Late Charge functionality in Receivables R12, replaces the Interest

Invoice feature available in Release 11i. While the 11i functionality of

Interest Invoices fulfilled the need, it lacked flexibility. R12 Late Charge

functionality gives organizations an opportunity to implement their

delinquency-related polices at a much more granular level. Late Charges

are applicable to past due debit items for each customer, account, or site.

Also, Oracle Receivables calculates Late Charges independent of

dunning and statements in Advanced Collections.

Implementing Late Charges in R12

This part of the document details the steps required to implement the

Late Charges feature in Oracle Receivables R12.

Late Charges in R12

Page 1

D EFINING AN O RGANIZATIONAL P OLICY FOR

L ATE C HARGES

An organization must consider the following decision points to establish

their Late Charge policies:

1. Are all customers levied a penalty for missing their due date? Oracle

Receivables is flexible enough to implement the Late Charges at the

Customer level. Late Charges considerations are defined at the

Customer Profile Class level, allowing Organizations to choose the

type of customers that should be penalized.

2. Are all types of invoices eligible for late charges and penalty?

Again, Oracle Receivables is flexible enough to override the Late

Charges functionality at the Invoice Type level. This is ideal for

customers who have Late Charges enabled on their profiles but not

all types of invoices are eligible for late charges.

3. Should customers be paying a penalty for missing their due date and

making a late payment with or without a grace period and with or

without a tolerance amount for delinquency? If there is a grace

period allowed, is it the same for all customers or does it vary?

Similarly, if there is a minimum due tolerance, is it the same for all

customers or does it vary? Oracle Receivables can be configured to

suit each of these scenarios and this white paper will cover the

possible configurations.

4. What will be the organization’s optimal method of computing the

penalty amount that would cover the marginal costs that were

incurred due to the missed payment? Oracle Receivables offers three

(3) different ways of computing the interest: Simple, Compound and

Flat Rate.

5. Will the interest rates be charged at a Fixed Rate, a Fixed Amount, or

be based on a tier structure with interest rates dependent on the

duration of delinquency? Again, all three options are supported in

R12.

6. Will the interest be accrued daily or on a monthly basis?

7. As of which date will the late charges be computed? Oracle offers

the calculation to be based on the Run Date or the Due Date.

8. Will there be any interest calculation over and above the Late

Charges calculated?

9. Are the customers sent a new “Penalty Charges” invoice or are the

original invoices adjusted to include the penalty amount? Again, is

this policy across all customers or does it vary with different

customer types?

10. Oracle Receivables does prevent organizations from implementing

different methods of penalty computation for late charge invoices

and interest invoices. One customer’s requirement was to implement

a flat rate charges for overdue invoices, the late payments were

Late Charges in R12

Page 2

penalized using a compound formula. This requirement required a

simple customization.

Configuring Late Charge Documents

D EFINING A T RANSACTION T YPE FOR L ATE

C HARGES

If your organization decides to create an invoice for penalty invoices,

then create a Transaction Type and a batch source for Late Charges

generated by the system.

D EFINING A B ATCH S OURCE

A Late Charges Batch Source needs to be defined, as a pre-requisite.

The Source Type should be set to “Imported”.

Late Charges in R12

Page 3

D EFINING A F INANCE C HARGE A CTIVITY

If your Organization decides to adjust the overdue invoice, then create a

Receivable Activity of type Finance Charge/Late Charge.

Late Charges in R12

Page 4

E NABLE L ATE C HARGES FOR YOUR

O RGANIZATION

The first step to enable Late Charges comes from enabling this feature in

the System Options. Enable Assess Late Charges and complete the

section as per your organization’s needs.

D EFINING T IERS AND C HARGE S CHEDULES

If the organization’s decision is to penalize based on the delinquency

duration, this configuration would support that. Just like aging buckets, a

multi-tier range must to be defined and then associated with different

rates and different durations.

Late Charges in R12

Page 5

Having defined the Tiers, we need to associate the interest charge

amounts or percentages, to the tiers. This is achieved by defining a

Charge Schedule.

Configuring Late Charges in Customer

Profile Classes

The simplest way to start producing late charges would be to enable the

late charges in the Customer Profile. By doing this, the organization can

selectively include and exclude customers. If the organization’s policy is

to charge all customers a late charge, then all customer profiles would

have this feature enabled.

Late Charges in R12

Page 6

The Enable Late Charges checkbox here works at the level of that

specific Profile Class. So, if there is a business need to define more than

one Late Charge Policy, such that each policy can be applied to a specific

set of customers, then the Profile Class serves as the tool to implement

that business requirement.

The Charge Calculation field is pivotal to determining the scope of Late

Charge calculation. Here, we have to choose, if Late Charges will be

based on the Average Daily Balance, or on Overdue Invoices, or on Late

Payments, or on both Overdue Invoices as well as Late Payments.

The Interest Calculation Formula has the option of Simple, Compound or

Flat. The Interest Calculation Period can be Daily or Monthly.

Finally, the Charge Schedule defined above, is attached to the Profile

Class. The configuration in the Interest Class region of the Profile Class

Amounts tab, impacts the Late Charge calculation. The configuration in

the Penalty Charge region of the Profile Class Amounts tab impacts the

calculation of the interest due on the Late Charge. Also, the Minimum

Charge Per Invoice should be set to a non-zero value.

Late Charges in R12

Page 7

Implementing Late Charges at the

Customer Level

Like any other customer profile attribute, the late charges definition can

also be overwritten at the Customer level. The Enable Late Charges

checkbox here works for the specific customer. Hence by enabling this

box, we enable Late Charge Calculation for all transactions belonging to

this customer. Conversely, keeping this box unchecked would exclude

all transactions of this customer from the Late Charge calculation.

Also, in the above screen, we can selectively choose to have only Late

Payments or Overdue Invoices brought under the purview of Late

Charges. Here we see both as selected for Late Charge calculation. This

is the impact of applying the Profile Class with the same configuration to

the Customer.

The Charge Schedule is applied to the customer, through the application

of the Profile Class.

Late Charges in R12

Page 8

Additional Configurations for

Enabling/Disabling Late Charges

To exclude a set of invoices from late charges, it can be disabled at the

Transaction Type level. Typically organizations do not accrue late

charges for Penalty Invoices.

And finally, an individual Invoice can be exempted from Late Charges.

Processing Late Charge Documents

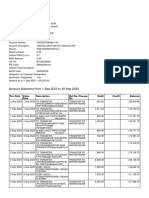

Oracle Receivables requires generation of late charges through

submission of the “Late Charges Generate” concurrent program.

Receivables agents can run this program in Draft mode and keep making

corrections until the list is finalized. Once the application identifies all

delinquent invoices per the configuration rules, it allows collection

Late Charges in R12

Page 9

agents to browse through the customers and invoices that were included

as part of the run. Receivables agents are given more opportunities to

exclude and include invoices and customers before finalizing the batch.

They also have the flexibility of deleting the batch completely and

starting all over.

Late Charge Documents screen.

Conclusion

Organizations can now leverage R12’s robust Late Charges functionality

to implement their collection policy for delinquent customers.

Late Charges in R12

Page 10

Late Charges in R12

March 17, 2014

AST Corporation

1755 Park Street, Suite 100

Naperville, Illinois 60563

Phone: 888-278-0002

Fax: 630-778-1179

www.astcorporation.com

Copyright © 2014 AST Corporation

AST Corporation is a privately held company

founded in 1995 to serve commercial and public

sector organizations in utilizing the full potential of

their investment in Oracle Applications and

Technologies. We have built our practice by

providing top quality full life cycle and turn-key

consulting services for Oracle Applications

implementation and upgrade projects, among

other specific services.

Our mission is to insure that you, as a valued

client, receive the highest level of expertise and

personalized service for your Enterprise

Applications. We endeavor to help you realize

the full benefit from your investment in software

applications and integrate them seamlessly to

your business processes.

You might also like

- UCC ChecklistDocument5 pagesUCC Checklistajordan23100% (2)

- Oracle Payment Processing Request (PPR) in AP - R12Document9 pagesOracle Payment Processing Request (PPR) in AP - R12manukleoNo ratings yet

- Auditing Problems v.1 - 2018Document18 pagesAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- Encumbrance Accounting Purchasing PDFDocument41 pagesEncumbrance Accounting Purchasing PDFNaved Ahmed KhanNo ratings yet

- Oracle Fusion Example of Consigned Inventory AccountingDocument5 pagesOracle Fusion Example of Consigned Inventory AccountingrowentanNo ratings yet

- Consolidations GLDocument50 pagesConsolidations GLNikhil YadavNo ratings yet

- SCG - Example - Offering MemorandumDocument18 pagesSCG - Example - Offering MemorandumHammad KhanNo ratings yet

- Oracle Iexpenses FlowDocument25 pagesOracle Iexpenses FlowVivekanand Pandey100% (1)

- COGS and DCOGS WorkflowDocument48 pagesCOGS and DCOGS Workflowptameb10% (1)

- MD70 PDFDocument20 pagesMD70 PDFadnanykhanNo ratings yet

- How We Can Approve Terms Templates or Clauses Through Auto ApprovalDocument3 pagesHow We Can Approve Terms Templates or Clauses Through Auto Approvalsanjeev19_ynrNo ratings yet

- Retained Earnings FAQDocument6 pagesRetained Earnings FAQnachuthan_1No ratings yet

- End To End Configuration of AR in R12Document19 pagesEnd To End Configuration of AR in R12강태민No ratings yet

- R12Projects White Paper Part IIDocument137 pagesR12Projects White Paper Part IIrahuldisyNo ratings yet

- Auto Invoice Setup - R12Document55 pagesAuto Invoice Setup - R12Saravana SudhanNo ratings yet

- Dictionary of Business CollocationsDocument50 pagesDictionary of Business CollocationsMaria Macovei0% (1)

- AP Suppliers in R12Document51 pagesAP Suppliers in R12Abhilash KarappankuttyNo ratings yet

- R12 Features and Late Charges FunctionalityDocument6 pagesR12 Features and Late Charges FunctionalitysivaramsvNo ratings yet

- Checklist For Configuring Withholding Tax For IndiaDocument3 pagesChecklist For Configuring Withholding Tax For IndiaSrinivas Girnala100% (1)

- R12 EtaxDocument66 pagesR12 Etaxsatya_raya8022No ratings yet

- How To Setup EBTax So Tax Is Calculated On Payables InvoiceDocument21 pagesHow To Setup EBTax So Tax Is Calculated On Payables InvoiceFajar S YogiswaraNo ratings yet

- Offset Taxes in EBTax PDFDocument9 pagesOffset Taxes in EBTax PDFFco Jav RamNo ratings yet

- AME OverviewDocument30 pagesAME Overviewakhil reddyNo ratings yet

- Oracle Projects Invoice FlowDocument5 pagesOracle Projects Invoice FlowAjit Kumar Panigrahi100% (1)

- AR Late Charges Calculation and Set UpDocument9 pagesAR Late Charges Calculation and Set UpMohamed ElsbaghNo ratings yet

- BR100 General Ledger PDFDocument82 pagesBR100 General Ledger PDFArun ThummaNo ratings yet

- Oracle SOA BPEL Process Manager 11gR1 A Hands-on TutorialFrom EverandOracle SOA BPEL Process Manager 11gR1 A Hands-on TutorialRating: 5 out of 5 stars5/5 (1)

- Practice 3: How To Override Tax Using User-Defined Fiscal Classification?Document5 pagesPractice 3: How To Override Tax Using User-Defined Fiscal Classification?Syed Mustafa100% (1)

- The Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11From EverandThe Business Analyst's Guide to Oracle Hyperion Interactive Reporting 11Rating: 5 out of 5 stars5/5 (1)

- Oracle EBtax - Tax Reporting LedgerDocument13 pagesOracle EBtax - Tax Reporting Ledgerorafinr12docsNo ratings yet

- Complete PPR Setup PDFDocument93 pagesComplete PPR Setup PDFArtham PradeepNo ratings yet

- O2C and P2P CyclesDocument40 pagesO2C and P2P CyclesJagannath SarvepalliNo ratings yet

- R12 India Localization Technical OverviewDocument86 pagesR12 India Localization Technical OverviewRamesh Babu Pallapolu100% (2)

- DS 030 Purchasing Setup Document 1 Satish 1Document68 pagesDS 030 Purchasing Setup Document 1 Satish 1manukleoNo ratings yet

- Setup Tax On Freight in R12 E-Business Tax (EBTax) Order To Cash PDFDocument7 pagesSetup Tax On Freight in R12 E-Business Tax (EBTax) Order To Cash PDFnachuthan_1No ratings yet

- How To Set Up Oracle IexpensesDocument6 pagesHow To Set Up Oracle Iexpensesbiswals100% (1)

- E Business Tax Flow in Oracle R12Document17 pagesE Business Tax Flow in Oracle R12murali.kasuru100% (1)

- OLFM Training9Document29 pagesOLFM Training9SrinibasNo ratings yet

- Lease MGMTDocument31 pagesLease MGMTsen2985100% (1)

- What Is The Difference Between Oracle EAM and FADocument2 pagesWhat Is The Difference Between Oracle EAM and FARamesh GarikapatiNo ratings yet

- OLFM Training6Document15 pagesOLFM Training6SrinibasNo ratings yet

- OLFM FundingDocument5 pagesOLFM FundingutkarhNo ratings yet

- Bar Answer 2016Document10 pagesBar Answer 2016merren bloom100% (1)

- OLFM Training10Document15 pagesOLFM Training10SrinibasNo ratings yet

- FAQ On ProjectsDocument5 pagesFAQ On ProjectsDhaval GandhiNo ratings yet

- Deferred COGS: How To Use This Feature of Oracle Apps R12Document3 pagesDeferred COGS: How To Use This Feature of Oracle Apps R12Asif SayyedNo ratings yet

- Translation ErrorDocument84 pagesTranslation ErrorGurram SrihariNo ratings yet

- Oracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)Document17 pagesOracle 11i and R12 Time and Labor (OTL) Timecard Configuration (Doc ID 304340.1)krishnaNo ratings yet

- 19D Receitables v551 PDFDocument63 pages19D Receitables v551 PDFFernanda Gerevini PereiraNo ratings yet

- Atch Ayment: Posted by Raju ERP inDocument16 pagesAtch Ayment: Posted by Raju ERP indevender143No ratings yet

- Oracle Bank ChargesDocument16 pagesOracle Bank ChargesSudheer SanagalaNo ratings yet

- Oracle Financials For India (OFI) TCS Data Model Deep Dive: Author: Creation Date: 05-Apr-2016 Document Ref: 1.0Document55 pagesOracle Financials For India (OFI) TCS Data Model Deep Dive: Author: Creation Date: 05-Apr-2016 Document Ref: 1.0Niraj TiwariNo ratings yet

- Oracle EbsDocument4 pagesOracle EbsMuhammad NadeemNo ratings yet

- Why Reimplement An Eprentise White PaperDocument27 pagesWhy Reimplement An Eprentise White PaperSowjanyaPatwari0% (1)

- AutoInvoice Errors and Solutions - FreaksDocument12 pagesAutoInvoice Errors and Solutions - FreaksRaman RajputNo ratings yet

- EBiz Tax Training NotesDocument75 pagesEBiz Tax Training NotesAnilkumar NalumachuNo ratings yet

- 1Z0 1056 22Document15 pages1Z0 1056 22rodolfocalvilloNo ratings yet

- Oracle Financials Test No.12 DT: 18 Feb 2006 Receivables - 1Document15 pagesOracle Financials Test No.12 DT: 18 Feb 2006 Receivables - 1praveen.ariniNo ratings yet

- Dissertation On Revenue RecognitionDocument7 pagesDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- 03 - Business TransactionDocument28 pages03 - Business TransactionLeandro FariaNo ratings yet

- PDDDocument3 pagesPDDRegis NemezioNo ratings yet

- 2 D. Problems RevaluationDocument77 pages2 D. Problems RevaluationPia Shannen OdinNo ratings yet

- Assignment 2 - With Answer2022Document6 pagesAssignment 2 - With Answer2022Wai Lam HsuNo ratings yet

- Accounting Equation RemovalDocument3 pagesAccounting Equation RemovallabsavilesNo ratings yet

- Far-1 2Document6 pagesFar-1 2tygurNo ratings yet

- Class 5Document39 pagesClass 5Geoffrey MwangiNo ratings yet

- Z Rbup Alp 9 D Ahmc 4 PDocument5 pagesZ Rbup Alp 9 D Ahmc 4 Ppranay.suriNo ratings yet

- Konverter CSV - Batch UploaddDocument20 pagesKonverter CSV - Batch UploaddDevi Merry Sonia Sitepu50% (2)

- BH - 20 21 - Syllabus 32 49Document18 pagesBH - 20 21 - Syllabus 32 49Avila VarshiniNo ratings yet

- Property Tax ExemptionsDocument1 pageProperty Tax ExemptionsLexi CortesNo ratings yet

- Ch. 1 - GST (Goods and Services Tax)Document15 pagesCh. 1 - GST (Goods and Services Tax)Natasha SinghNo ratings yet

- Sample Test Chap04Document9 pagesSample Test Chap04Niamul HasanNo ratings yet

- Financial Procedure Act 1957Document18 pagesFinancial Procedure Act 1957Dhia Jeff100% (5)

- Financial Services Compensation Scheme: Information SheetDocument2 pagesFinancial Services Compensation Scheme: Information SheetmikeionaNo ratings yet

- Consolidations - Subsequent To The Date of AcquisitionDocument42 pagesConsolidations - Subsequent To The Date of AcquisitionAla'aEQahwajiʚîɞNo ratings yet

- Importance of Money MarketDocument1 pageImportance of Money MarketchandranilNo ratings yet

- Victoria Care Indonesia Billingual 30 Jun 2021 Q2Document111 pagesVictoria Care Indonesia Billingual 30 Jun 2021 Q2Sugiarto ChasNo ratings yet

- My Investing Notebook - Jim Chanos - The Power of Negative Thinking (CFA Annual Conference 2010)Document3 pagesMy Investing Notebook - Jim Chanos - The Power of Negative Thinking (CFA Annual Conference 2010)mhaftelNo ratings yet

- Taxation Law Mock BarDocument4 pagesTaxation Law Mock BarKrizzy GayleNo ratings yet

- TITAN Whitepaper enDocument8 pagesTITAN Whitepaper enAli ShahNo ratings yet

- VWAPDocument26 pagesVWAPgursharan.singh.bandeshaNo ratings yet

- ch15 - Harestya - SentDocument42 pagesch15 - Harestya - SentBenedict MihoyoNo ratings yet

- Strategic Management Competitiveness and Globalisation 6th Edition Manson Test BankDocument11 pagesStrategic Management Competitiveness and Globalisation 6th Edition Manson Test Bankkiethanh0na91100% (25)

- Otbc Cap TableDocument6 pagesOtbc Cap TableKojiro FuumaNo ratings yet

- Financial Ratios of HulDocument21 pagesFinancial Ratios of HulVaibhav Trivedi0% (1)

- AFAR - Corp LiqDocument1 pageAFAR - Corp LiqJoanna Rose Deciar0% (1)