Professional Documents

Culture Documents

Adv Acc

Uploaded by

oliver0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

AdvAcc.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesAdv Acc

Uploaded by

oliverCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

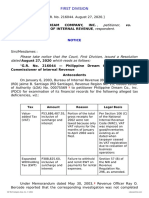

CI from own operations - P Company

(Excluding dividend income) ₱ 480,000.00

Realized CI - S Company:

CI from own operations - S Company ₱ 180,000.00

Unrealized gain {[76,000/(1 1/3)]X1/3} - 19,000.00

Realized gain {[60,000/(1 1/3)]X1/3} 15,000.00 ₱ 176,000.00

Consolidated CI 656,000.00

Less: Attributable to NCI (176,000 X 25%) 44,000.00

Attributable to Parent ₱ 612,000.00

Problem 17-2

a. CI from own operations - P Company ₱ 200,000.00

Unrealized gain - Downstream sale - 30,000.00

Realized CI - P Company ₱ 170,000.00

CI from own operations - S Company 180,000.00

Consolidated CI ₱ 350,000.00

b. CI from own operations - S Company ₱ 180,000.00

NCI Proportionate Share 20%

NCI in CI of Subsisiary ₱ 36,000.00

c. Net Assets - 01/01/17- S Company ₱ 900,000.00

Increase in earnings (180,000-60,000) 120,000.00

Net Assets - Dec. 31, 2017 - S Company ₱ 1,020,000.00

NCI (1,020,000 X 20%) ₱ 204,000.00

Problem 17-4

a. CI from own operations - P Company ₱ 300,000.00

Realized CI - S Company:

CI from own operations - S Company ₱ 150,000.00

Unrealized gain - 4/1/17 - 30,000.00

Realized gain - 12/31/17

[(30,000/5)X9/12] 4,500.00 ₱ 124,500.00

Consolidated CI ₱ 424,500.00

Attributable to NCI (124,500X20%) - 24,900.00

Attributable to Parent ₱ 399,600.00

b. Net Assets - Jan. 1, 2017 - S Company ₱ 800,000.00

Increase in earnings:

Ci from own operations ₱ 150,000.00

Dividends paid - 50,000.00

Unrealized gain (30,000-4,500) - 25,500.00 ₱ 74,500.00

Net Assets - Dec. 31, 2017 ₱ 874,500.00

NCI (874,500X20%) ₱ 174,900.00

You might also like

- Bills CoinsDocument1 pageBills CoinsoliverNo ratings yet

- Adv AccDocument2 pagesAdv AccoliverNo ratings yet

- Advanced Accounting-Volume 2Document4 pagesAdvanced Accounting-Volume 2ronnelson pascual25% (16)

- Audit Plan To Be EditedDocument9 pagesAudit Plan To Be EditedoliverNo ratings yet

- Care and MaintenanceDocument1 pageCare and MaintenanceoliverNo ratings yet

- Formation and Attributes of CorporationsDocument30 pagesFormation and Attributes of CorporationsEnges Formula83% (23)

- Endorsement LetterDocument1 pageEndorsement LetteroliverNo ratings yet

- Managing The Internal Auditing ActivityDocument32 pagesManaging The Internal Auditing Activityoliver50% (2)

- I. Nature and Form of The Contract Sources of The Law On SalesDocument15 pagesI. Nature and Form of The Contract Sources of The Law On SalesoliverNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocument11 pages35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNo ratings yet

- Lease and HPDocument27 pagesLease and HPpreetimaurya100% (1)

- The Honeymoon Guys Credit Card Tracking Spreadsheet Rev 04Document5 pagesThe Honeymoon Guys Credit Card Tracking Spreadsheet Rev 04Robert Glen Murrell JrNo ratings yet

- Receivables Mock QuizDocument5 pagesReceivables Mock QuizChester CariitNo ratings yet

- Purchase OrderDocument1 pagePurchase Ordervipulfegade484No ratings yet

- Ganesh and Mahavir surgical instrument dealersDocument1 pageGanesh and Mahavir surgical instrument dealersomkar daveNo ratings yet

- Shop Building Tax ReceiptDocument1 pageShop Building Tax ReceipttalentoNo ratings yet

- SalQuo BARSQ394Document1 pageSalQuo BARSQ394Qatar Pride 2022No ratings yet

- Jazeera Airways Itinerary ChennaiDocument2 pagesJazeera Airways Itinerary ChennaiKarthikeya MandavaNo ratings yet

- Chase Bank StatementDocument1 pageChase Bank Statementruby calde0% (1)

- Wa0000.Document2 pagesWa0000.Hiral JoshiNo ratings yet

- Form 704Document704 pagesForm 704Dhananjay KulkarniNo ratings yet

- Tax Audit ChecklistDocument1 pageTax Audit ChecklistSwapnil S DeshpandeNo ratings yet

- PB 113Document45 pagesPB 113CLEAH MARYELL LLAMASNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- 18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestDocument15 pages18 Tan V Del Rosario 237 SCRA 324 (1994) - DigestKeith BalbinNo ratings yet

- Summer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Document60 pagesSummer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Sumit Ranjan100% (6)

- Munch Catering LTD Whose Financial Year Runs From 1 DecemberDocument1 pageMunch Catering LTD Whose Financial Year Runs From 1 DecemberMiroslav GegoskiNo ratings yet

- C7 TaxDocument4 pagesC7 TaxaskermanNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDDiwakar DNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- F 706Document31 pagesF 706Bogdan PraščevićNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- Individual Customer Relation Form: ApplicationDocument7 pagesIndividual Customer Relation Form: ApplicationJay JaniNo ratings yet

- Advantages of Direct TaxesDocument3 pagesAdvantages of Direct TaxesIryna HoncharukNo ratings yet

- Quantity Description Category Weight (LB) Length (CM) Width (CM) Height (CM) Weight Vol. (LB)Document1 pageQuantity Description Category Weight (LB) Length (CM) Width (CM) Height (CM) Weight Vol. (LB)Ardiyansyah NugrahaNo ratings yet

- Paxum Personal Account FeesDocument5 pagesPaxum Personal Account FeesFarid PrimadiNo ratings yet

- TAX REGULATION IMPACT ON INDONESIA HOSPITALITYDocument14 pagesTAX REGULATION IMPACT ON INDONESIA HOSPITALITYDiana RahayuNo ratings yet

- RTGS Form WorkingDocument3 pagesRTGS Form Workingsanind12No ratings yet

- Ingles IIDocument6 pagesIngles IIReport JunglaNo ratings yet