Professional Documents

Culture Documents

Decision Trees Example Credit History PDF

Decision Trees Example Credit History PDF

Uploaded by

M A DiptoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Decision Trees Example Credit History PDF

Decision Trees Example Credit History PDF

Uploaded by

M A DiptoCopyright:

Available Formats

DECISION TREES - EXAMPLE

Prof. Carolina Ruiz

Department of Computer Science

Worcester Polytechnic Institute

Consider the following table (adapted from [LS98])

EXAMPLE CREDIT HISTORY DEBT COLLATERAL INCOME RISK

1 bad low none 0–15 high

2 unknown high none 15–35 high

3 unknown low none 15–35 moderate

4 bad low none 0–15 high

5 unknown low adequate >35 low

6 unknown low none >35 low

7 unknown high none 0–15 high

8 bad low adequate >35 moderate

9 good low none >35 low

10 good high adequate >35 low

11 good high none 0–15 high

12 good high none 15–35 moderate

13 good high none >35 low

14 bad high none 15–35 high

Constructing Decision Trees

Solution (By C. Ruiz)

I. Selecting the first attribute:

RISK: Low Moderate High

x/14*[-y/x log2(y/x) -z/x log2(z/x) -w/x log2(w/x) ]

----------------------------------------------------------------------

CREDIT HISTORY

Entropy(Credit,S)

= Entropy([0,1,3],[2,1,2],[3,1,1])

= (4/14)*Entropy([0,1,3]) + (5/14)*Entropy([2,1,2]) + (5/14)*Entropy([3,1,1])

Bad 4/14*[-0 -1/4 log2(1/4) -3/4 log2(3/4) ]

+Unknown 5/14*[-2/5 log2(2/5) -1/5 log2(1/5) -2/5 log2(2/5) ]

+Good 5/14*[-3/5 log2(3/5) -1/5 log2(1/5) -1/5 log2(1/5) ]

= 1.265

----------------------------------------------------------------------

DEBT

Entropy(Debt,S) = Entropy([3,3,2],[2,1,4])

= (7/14)*Entropy([3,3,2])+ (7/14)*Entropy([2,1,4])

Low 7/14*[-3/7 log2(3/7) -2/7 log2(2/7) -2/7 log2(2/7) ]

+ High 7/14*[-2/7 log2(2/7) -1/7 log2(1/7) -4/7 log2(4/7) ]

=1.467

----------------------------------------------------------------------

COLLATERAL

Entropy(Collateral,S) = Entropy([3,2,6],[2,1,0])

= (11/14)* Entropy([3,2,6],[2,1,0]) + (3/14)* Entropy([3,2,6],[2,1,0])

None 11/14*[-3/11 log2(3/11) -2/11 log2(2/11) -6/11 log2(6/11)]

+Adequate 3/14*[-2/3 log2(2/3) -1/3 log2(1/3) -0 ]

=1.324

----------------------------------------------------------------------

INCOME

Entropy(Income,S) = Entropy([0,0,4],[0,2,2],[5,1,0])

= (4/14)*Entropy([0,0,4]) +(4/14)*Entropy([0,2,2]) +(6/14)*Entropy([5,1,0])

[0-15] 4/14*[-0 -0 -4/4 log2(4/4) ]

+[15-35] 4/14*[-0 -2/4 log2(2/4) -2/4 log2(2/4) ]

+[>35] 6/14*[-5/6 log2(5/6) -1/6 log2(1/6) -0 ]

=0.564

----------------------------------------------------------------------

Hence, INCOME should be selected as the root of the decision tree.

The partial tree would look like:

INCOME

0-15 / 15-35 | \ >35

HIGH

1,4,7,11

II. Now we need to select an attribute (among Credit History,

Debt, and Collateral) to subdivide the case when

income ranges from $15 to $35.

For this, we restrict our analysis to examples S’ = 2, 3, 12, 14.

Hence n_t = 4.

RISK: Low Moderate High

x/4*[-y/x log2(y/x) -z/x log2(z/x) -w/x log2(w/x) ]

----------------------------------------------------------------------

CREDIT HISTORY

Entropy(Credit,S’) = Entropy([0,0,1],[0,1,1],[0,1,0])

= (1/4)*Entropy([0,0,1]) + (2/4)*Entropy([0,1,1]) + (1/4)*Entropy([0,1,0])

Bad 1/4*[-0 -0 -1/1 log2(1/1) ]

+Unknown 2/4*[-0 -1/2 log2(1/2) -1/2 log2(1/2) ]

+Good 1/4*[-0 -1/1 log2(1/1) -0 ]

=0.5

----------------------------------------------------------------------

DEBT

Entropy(Debt,S’) = Entropy([0,1,0],[0,1,2])

= (1/4)*Entropy([0,1,0]) + (3/4)*Entropy([0,1,2])

Low 1/4*[-0 -1/1 log2(1/1) -0 ]

+ High 3/4*[-0 -1/3 log2(1/3) -2/3 log2(2/3) ]

= 0.688

----------------------------------------------------------------------

COLLATERAL

Entropy(Collateral,S’) = Entropy([0,2,2],[0,0,0])

= (4/4)*Entropy([0,2,2]) + (0/4)*Entropy([0,0,0])

None 4/4*[-0 -2/4 log2(2/4) -2/4 log2(2/4) ]

+Adequate 0/4*[-0 -0 -0 ]

=1

----------------------------------------------------------------------

So Credit History is selected to subdivide Income $15-$35

INCOME

0-15 / 15-35 | \ >35

| |

HIGH CREDIT

1,4,7,11 bad/ |unknown \good

| |

HIGH MODERATE

14 12

Now we need to select an attribute (among Debt, and Collateral)

to subdivide the case when income ranges from $15 to $35 and the

Credit History is unknown.

For this, we restrict our analysis to examples S" = 2, 3.

Hence n_t = 2.

RISK: Low Moderate High

x/2*[-y/x log2(y/x) -z/x log2(z/x) -w/x log2(w/x) ]

----------------------------------------------------------------------

DEBT

Entropy(Debt,S") = Entropy([0,1,0],[0,0,1])

= (1/2)*Entropy([0,1,0]) + (1/2)*Entropy([0,0,1])

Low 1/2*[-0 -1/1 log2(1/1) -0 ]

+ High 1/2*[-0 -0 -1/1 log2(1/1) ]

= 0

----------------------------------------------------------------------

COLLATERAL

Entropy(Collateral,S") = Entropy([0,1,1],[0,0,0])

= (2/2)*Entropy([0,1,1]) + (0/2)*Entropy([0,0,0])

None 2/2*[-0 -1/2 log2(1/2) -1/2 log2(1/2) ]

+Adequate 0/2*[-0 -0 -0 ]

=1

----------------------------------------------------------------------

Hence, Debt is selected as the attribute to subdivide the case when

income ranges from $15 to $35 and the Credit History is unknown.

III. Now we need to select an attribute (among Credit History,

Debt, and Collateral) to subdivide the case when income >$35.

For this, we restrict our analysis to examples S"’ = 5, 6, 8, 9, 10, 13.

Hence n_t = 6.

RISK: Low Moderate High

x/6*[-y/x log2(y/x) -z/x log2(z/x) -w/x log2(w/x) ]

----------------------------------------------------------------------

CREDIT HISTORY

Entropy(Credit,S"’)= Entropy([0,1,0],[2,0,0],[3,0,0])

= (1/6)*Entropy([0,1,0]) + (2/6)*Entropy([2,0,0]) + (3/6)*Entropy([3,0,0])

Bad 1/6*[-0 -1/1 log2(1/1) -0 ]

+Unknown 2/6*[-2/2 log2(2/2) -0 -0 ]

+Good 3/6*[-3/3 log2(3/3) -0 -0 ]

=0

----------------------------------------------------------------------

Since the average disorder for Credit History is 0, we don’t even

need to consider the other two attributes.

Then the final tree is the following:

INCOME

0-15 / 15-35 | \ >35

| |

HIGH CREDIT CREDIT

1,4,7,11 bad/ |unknown \good bad/ |unknown \good

| | | | | |

HIGH DEBT MODERATE MODERATE LOW LOW

14 / \ 12 8 5,6 9,10,13

| |

high| |low

HIGH MODERATE

2 3

------------------------------------------------------------------------------

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Federal ReserveDocument315 pagesFederal Reservejuliusevola1100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AccountingDocument62 pagesAccountingRashid W QureshiNo ratings yet

- Oracle ASCP Success StoriesDocument31 pagesOracle ASCP Success Storiesboddu2450% (2)

- DocxDocument15 pagesDocxmarieieiemNo ratings yet

- Full Assignment Tax RPGTDocument19 pagesFull Assignment Tax RPGTVasant SriudomNo ratings yet

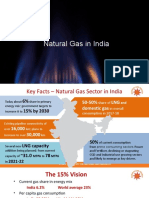

- Natural Gas in IndiaDocument19 pagesNatural Gas in IndiaAnkit PandeyNo ratings yet

- K Means 1 PDFDocument4 pagesK Means 1 PDFM A DiptoNo ratings yet

- Rao EHS SurveyDocument19 pagesRao EHS SurveyM A DiptoNo ratings yet

- A Dynamic Trust Model Based On Naive Bayes Classifier For Ubiquitous EnvironmentsDocument10 pagesA Dynamic Trust Model Based On Naive Bayes Classifier For Ubiquitous EnvironmentsM A DiptoNo ratings yet

- Machine Learning & Data MiningDocument108 pagesMachine Learning & Data MiningM A DiptoNo ratings yet

- Zenia 2016Document25 pagesZenia 2016M A DiptoNo ratings yet

- Physics QsDocument2 pagesPhysics QsM A DiptoNo ratings yet

- Hypothesis Text ExDocument11 pagesHypothesis Text ExM A DiptoNo ratings yet

- Subjective Logic: Audun JøsangDocument69 pagesSubjective Logic: Audun JøsangM A DiptoNo ratings yet

- 2 - SpineDocument1 page2 - SpineM A DiptoNo ratings yet

- LDPCDocument5 pagesLDPCM A DiptoNo ratings yet

- Django 1Document5 pagesDjango 1M A DiptoNo ratings yet

- 21 Ekim-11 KasımDocument32 pages21 Ekim-11 KasımElif KAVASNo ratings yet

- Sharol Isneidy Velasco: Logistics TechnologistDocument3 pagesSharol Isneidy Velasco: Logistics TechnologistSHAROL ISNEIDY VELASCO BAYONANo ratings yet

- Year Ahead Asia 2011Document92 pagesYear Ahead Asia 2011rezurektNo ratings yet

- EPIC Systems: Best Quality Smart Digital Door LockDocument16 pagesEPIC Systems: Best Quality Smart Digital Door LockHuong Quynh NguyenNo ratings yet

- Gmail - Your Air France Booking Is Pending Payment 2Document5 pagesGmail - Your Air France Booking Is Pending Payment 2shawn alexNo ratings yet

- The International Journal of Human Resource ManagementDocument25 pagesThe International Journal of Human Resource Managementkashif salmanNo ratings yet

- Project Report Shopper StopDocument62 pagesProject Report Shopper Stopjyot singh khannaNo ratings yet

- Section OneDocument5 pagesSection OneYemi Ade100% (1)

- A Study On Focussing Retaining The Employees in Big Bazaar Private LimitedDocument11 pagesA Study On Focussing Retaining The Employees in Big Bazaar Private LimitedGauthem RajNo ratings yet

- 2021 OFW GIS With Logo Orig 1Document2 pages2021 OFW GIS With Logo Orig 1Alexis OrganisNo ratings yet

- Class 12 Business Studies Chapter 12 MCQ'sDocument41 pagesClass 12 Business Studies Chapter 12 MCQ'sPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Credit Rating: Need, Process and LimitationsDocument24 pagesCredit Rating: Need, Process and LimitationsRupam Aryan BorahNo ratings yet

- Pharmaceutical MarketingDocument2 pagesPharmaceutical MarketingNandha KumarNo ratings yet

- Mutual Fund ProjectDocument45 pagesMutual Fund ProjectRaghavendra WaghmareNo ratings yet

- Section A-MCQ (15 Marks) : Good LuckDocument3 pagesSection A-MCQ (15 Marks) : Good Luckhuzaifa anwarNo ratings yet

- Statergic Human Resource ManagementDocument249 pagesStatergic Human Resource Managementnaveenkumar193100% (2)

- Variations and Change Orders On Construction Projects: ForumDocument8 pagesVariations and Change Orders On Construction Projects: ForumAizel JoannaNo ratings yet

- AFM Capital Structure Cp5Document61 pagesAFM Capital Structure Cp5drmsellan7No ratings yet

- A Study On Effectiveness of Training and Development Programs Adopted by KPCL, BangaloreDocument7 pagesA Study On Effectiveness of Training and Development Programs Adopted by KPCL, BangaloreShaheda ShariffNo ratings yet

- Nguyen-Ngoc-Quynh-Nhung - Apply For An AccountantDocument8 pagesNguyen-Ngoc-Quynh-Nhung - Apply For An AccountantNguyen RyanNo ratings yet

- Finstreet - Finance Committee, Kjsimsr: Where Knowledge & Learning Are Key To SuccessDocument7 pagesFinstreet - Finance Committee, Kjsimsr: Where Knowledge & Learning Are Key To SuccessShalu PurswaniNo ratings yet

- E-Business Unit 3Document5 pagesE-Business Unit 3Danny SathishNo ratings yet

- Leading and Managing ChangeDocument15 pagesLeading and Managing ChangeazmiikptNo ratings yet

- Detailed Training Program - HasibDocument10 pagesDetailed Training Program - HasibKaziRashidulAzamNo ratings yet