Professional Documents

Culture Documents

Estate Tax

Estate Tax

Uploaded by

chocoberriesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Tax

Estate Tax

Uploaded by

chocoberriesCopyright:

Available Formats

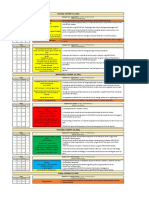

The estate tax is based on the value of the net estate as follows:

1. If not over P200,000, it is exempt

2. If over P200,000 but not over P500,000, then tax is 5% of the excess over P200,000

3. If over P500,000 but not over P2,000,000, then tax is P15,000 PLUS 8% of the excess over

P500,000

4. If over P2,000,000 but not over P5,000,000, then tax is P135,000 PLUS 11% of the excess

over P2,000,000

5. If over P5,000,000 but not over P10,000,000, then tax is P465,000 PLUS 15% of the excess

over P5,000,000

6. If over P10,000,000, then tax is P1,215,000 PLUS 20% of the excess over P10,000,000

The basis shall be the net estate. That means that there are allowable deductions on the estate.

These deductions include funeral expenses, share of the surviving spouse, medical expenses

incurred by the decedent within 1 year prior to his death, family home deduction of not more

than P1,000,000.00, standard deduction of P1,000,000.00, among others. It is best to consult with

an accountant on this matter to determine the accurate estate tax.

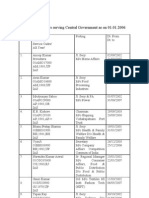

For extrajudicial settlement of estate, the following documents must be submitted with the

BIR:

1. Notice of Death

2. Certified true copy of the Death Certificate

3. Deed of Extra-Judicial Settlement of the Estate

4. Certified true copy of the land titles involved

5. Certified true copy of the latest Tax Declaration of real properties at the time of death

6. Photo copy of Certificate of Registration of vehicles and other proofs showing their correct

value

7. Photo copy of certificate of stocks

8. Proof of valuation of shares of stocks at the time of death

a. For listed stocks – newspaper clippings or certification from the Stock Exchange

b. For unlisted stocks – latest audited Financial Statement of issuing corporation with

computation of book value per share

9. Proof of valuation of other types of personal property

10. CPA Statement on the itemized assets of the decedent, itemized deductions from gross estate

and the amount due if the gross value of the estate exceeds two million pesos

11. Certification of Barangay Captain for claimed Family Home

Other documents may also be requested by the BIR.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- PROMETHEE Hpd2021-ScheduleDocument1 pagePROMETHEE Hpd2021-SchedulemariagianniNo ratings yet

- Company Master Data Vamos YsDocument2 pagesCompany Master Data Vamos YsMallikarjunReddyObbineniNo ratings yet

- Real Estate MortgageDocument2 pagesReal Estate MortgagechocoberriesNo ratings yet

- Jurat SampleDocument1 pageJurat Samplechocoberries100% (1)

- Demand Letter SampleDocument1 pageDemand Letter SamplechocoberriesNo ratings yet

- Abakada Vs ErmitaDocument3 pagesAbakada Vs ErmitachocoberriesNo ratings yet

- CH 17Document26 pagesCH 17Leisuread 2No ratings yet

- 2013-2014 KLF - Annual ReportDocument8 pages2013-2014 KLF - Annual ReportkzoolfNo ratings yet

- Jaime N. Soriano v. Secretary of Finance, GR No. 184450, 2017-01-24Document3 pagesJaime N. Soriano v. Secretary of Finance, GR No. 184450, 2017-01-24Diane Dee Yanee100% (1)

- Payment Receipt PDFDocument1 pagePayment Receipt PDFSivaprakash VetNo ratings yet

- 14-25 Quiz #5Document2 pages14-25 Quiz #5Xavier Alexen AseronNo ratings yet

- FATA MergerDocument25 pagesFATA MergerAnas SandhuNo ratings yet

- LettersDocument126 pagesLettersnadeemtyagiNo ratings yet

- UNIT - 2 (Demand For Money) by - Mr. Vijay Kumar Dept. of Economics, Mob No. - 7549273042Document9 pagesUNIT - 2 (Demand For Money) by - Mr. Vijay Kumar Dept. of Economics, Mob No. - 7549273042Santosh dhabekarNo ratings yet

- PDS HV 495Document2 pagesPDS HV 495wisonoNo ratings yet

- List of Publications: Dr. R.Sethumadhavan Assistant ProfessorDocument4 pagesList of Publications: Dr. R.Sethumadhavan Assistant ProfessorShanKar HunnurNo ratings yet

- The Brexit and The Rejection of GLOBALISATIONDocument2 pagesThe Brexit and The Rejection of GLOBALISATIONMihai Si Cristina PiticNo ratings yet

- (English-French) Degrowth, Explained (DownSub - Com)Document11 pages(English-French) Degrowth, Explained (DownSub - Com)MOHAMED EL BARAKANo ratings yet

- Latin AmericaDocument169 pagesLatin AmericaAakashAgrawal_01No ratings yet

- Identifying Text Structure - TEACHERDocument2 pagesIdentifying Text Structure - TEACHERDelma LozanoNo ratings yet

- Robert Maxwell Watts v. United States, 220 F.2d 483, 10th Cir. (1955)Document6 pagesRobert Maxwell Watts v. United States, 220 F.2d 483, 10th Cir. (1955)Scribd Government DocsNo ratings yet

- Sidewalk Labs MIDP Volume 3Document122 pagesSidewalk Labs MIDP Volume 3jillianilesNo ratings yet

- A Raging Fire 14 - 02 - 24Document68 pagesA Raging Fire 14 - 02 - 24sadiqsamNo ratings yet

- Commercial InvoiceDocument4 pagesCommercial InvoiceTuấn ViệtNo ratings yet

- Republic of The Philippines Department of EducationDocument9 pagesRepublic of The Philippines Department of Educationellesig navaretteNo ratings yet

- Home Office and BranchDocument4 pagesHome Office and BranchRed YuNo ratings yet

- Tgs Toyota Supply ChainDocument2 pagesTgs Toyota Supply ChainJoshua Johan100% (1)

- Silicon Valley Bank Fiasco Simply ExplainedDocument21 pagesSilicon Valley Bank Fiasco Simply ExplainedGoMarkhaArjNo ratings yet

- Piston Ring GapDocument1 pagePiston Ring Gapibrahim salemNo ratings yet

- PDFDocument18 pagesPDFpradipNo ratings yet

- BembosBurger PDFDocument34 pagesBembosBurger PDFcreynosocNo ratings yet

- Ecommerce MediaDocument40 pagesEcommerce MediaRajiv Ranjan0% (2)

- 244-Gcsa QBDocument17 pages244-Gcsa QBjeet_singh_deepNo ratings yet

- Case Study Questions For EFA GuesstimateDocument6 pagesCase Study Questions For EFA GuesstimateShubham MehtaNo ratings yet