Professional Documents

Culture Documents

CAS 6 Material Cost

Uploaded by

Dilip0 ratings0% found this document useful (0 votes)

55 views1 pageThis document summarizes the classification, measurement, assignment, and presentation of material costs according to CAS 06. It outlines how to value materials received through purchase or self-manufacture and assign direct and indirect material costs. Abnormal losses are excluded from material costs. Disclosures include quantities and rates of major material items forming 5% of total material cost.

Original Description:

Cost Accounting Standards 6

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the classification, measurement, assignment, and presentation of material costs according to CAS 06. It outlines how to value materials received through purchase or self-manufacture and assign direct and indirect material costs. Abnormal losses are excluded from material costs. Disclosures include quantities and rates of major material items forming 5% of total material cost.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

55 views1 pageCAS 6 Material Cost

Uploaded by

DilipThis document summarizes the classification, measurement, assignment, and presentation of material costs according to CAS 06. It outlines how to value materials received through purchase or self-manufacture and assign direct and indirect material costs. Abnormal losses are excluded from material costs. Disclosures include quantities and rates of major material items forming 5% of total material cost.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

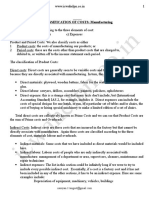

CAS : 06

Material Cost

Classification of Cost Measurement of Cost Assignment of Cost

Presentation & Disclosures

Valuation of Receipt of Mat Valuation of issue of Assignment of Mat

Mat Cost

Purchased Mat Self Mfg Mat Direct Cost :

Pur Price Direct Mat Consistently use any

+ Freight inwards + Direct Labour one of the method: 1- Job work cost shall be

+ Duties & Taxes + Direct Ovhd form part of material

+ Insurance FIFO cost

+ Direct Exp Not to Include: LIFO 2- Sub contracted cost

(-) Trade Dis Administrative Oh Weighted Average shall form part of

(-) Rebate Finance Cost Etc material cost

(-) Refundable tax Marketing Cost

(-) Subsidies/Grant For Captive Indirect Cost :

Consumption go to Allocate only if they are

Not Form part of Mat Cost : CAS -4. significant over :

1- Finance Cost 1- Tools,

2- Penalty 2- Stores,

3- Demurrage 3- Spares,

4- Detention charges 4- Jigs & Fixtures,

5- Consumable Stores

Changes in Forex Rate : etc.

1- Conversion on the date of

transaction

2- Any subsequent changes shall form

part of material cost

Normal Loss : shall be absorbed by good

units.

Abnormal loss : exclude from material cost

Disclosures :

1- Quantity and rates of major items of material shall be disclosed.

2- Major items are those who forms 5% of cost of material.

You might also like

- Chapter 2 Cost ClassificationsDocument18 pagesChapter 2 Cost Classificationsmarizemeyer2No ratings yet

- Assignment 1571213755 SmsDocument15 pagesAssignment 1571213755 SmsRahul Kumar Sharma 17No ratings yet

- Accounting StandardsDocument56 pagesAccounting StandardsAkshay KumarNo ratings yet

- Far05. PpeDocument4 pagesFar05. PpeJohn Kenneth BacanNo ratings yet

- PPE Presentation - 11.22.2020Document21 pagesPPE Presentation - 11.22.2020Makoy BixenmanNo ratings yet

- ea2e5ecc-fa8e-46c7-891a-a70d7ab7fc6fDocument13 pagesea2e5ecc-fa8e-46c7-891a-a70d7ab7fc6fKajal SharmaNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- As - 2: Valuation of InventoriesDocument18 pagesAs - 2: Valuation of InventoriesrajuNo ratings yet

- FormulasDocument12 pagesFormulasMathivanan NatarajNo ratings yet

- AS 2 - Valuation of Inventories: Paper 1: Financial Reporting Chapter 1 Unit 3Document32 pagesAS 2 - Valuation of Inventories: Paper 1: Financial Reporting Chapter 1 Unit 3arvindNo ratings yet

- 1 Introduction To Cost Accounting (2017)Document62 pages1 Introduction To Cost Accounting (2017)kilogek124No ratings yet

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- 13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFDocument6 pages13.3 As 2 Valuation of Inventories Revision Notes by Nitin Goel Sir PDFSrinishaNo ratings yet

- Basics in FinanceDocument7 pagesBasics in FinanceAshraf S. Youssef100% (1)

- L 3-4 Material and Labour CostsDocument51 pagesL 3-4 Material and Labour CostspriyankaNo ratings yet

- Costing Formulas NewDocument62 pagesCosting Formulas Newvenky_1986100% (6)

- Chapter 5Document41 pagesChapter 5Đặng TrangNo ratings yet

- Chapter 2 - Inventories, Biological Assets and Equity SecuritiesDocument32 pagesChapter 2 - Inventories, Biological Assets and Equity SecuritiesAngela DizonNo ratings yet

- Classification of CostDocument23 pagesClassification of CostShohidul Islam SaykatNo ratings yet

- (Financial Accounting & Reporting 1B) : Lecture AidDocument27 pages(Financial Accounting & Reporting 1B) : Lecture AidShe RCNo ratings yet

- Ind As 2 InventoryDocument17 pagesInd As 2 InventorySaloniNo ratings yet

- 01a Cost Flows HandoutDocument12 pages01a Cost Flows HandoutRishika RathiNo ratings yet

- Far Notes For QualiDocument10 pagesFar Notes For QualiMergierose DalgoNo ratings yet

- Auditing 2Document10 pagesAuditing 2antonette seradNo ratings yet

- Costing Formulae Topic WiseDocument83 pagesCosting Formulae Topic WiseViswanathan SrkNo ratings yet

- Classification of CostsDocument84 pagesClassification of CostsRoyal ProjectsNo ratings yet

- AS 2 Valuation of InventoriesDocument11 pagesAS 2 Valuation of InventoriesBharatbhusan RoutNo ratings yet

- Wiley Online Notes For Inventory FinalDocument14 pagesWiley Online Notes For Inventory FinalsukoorNo ratings yet

- Wiley Online Notes For Inventory FinalDocument14 pagesWiley Online Notes For Inventory FinalsukoorNo ratings yet

- Ind As-2 SummaryDocument7 pagesInd As-2 Summarysagarsingla1234509876No ratings yet

- Contractor Chart of AccountsDocument2 pagesContractor Chart of AccountsDaves VestNo ratings yet

- Chapter 18 IAS 2 InventoriesDocument6 pagesChapter 18 IAS 2 InventoriesKelvin Chu JYNo ratings yet

- Zrive IB 1Q23 Intro To Valuation Methods Up2Document9 pagesZrive IB 1Q23 Intro To Valuation Methods Up2Luis Soldevilla MorenoNo ratings yet

- Cost Not Qualifying For Recognition (Expensed Immediately) : Order of Priority: 1) Fair Value of Property ReceivedDocument1 pageCost Not Qualifying For Recognition (Expensed Immediately) : Order of Priority: 1) Fair Value of Property ReceivedALMA MORENANo ratings yet

- Inventory ValuationDocument16 pagesInventory ValuationKillari PadmasriNo ratings yet

- DEDUCTIONSDocument13 pagesDEDUCTIONSmigueltanfelix149No ratings yet

- PAS 2 Inventory PAS 16 PPEDocument33 pagesPAS 2 Inventory PAS 16 PPEBeatriz Jade TicobayNo ratings yet

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-2Document14 pagesCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-2Tanvir Ahmed ChowdhuryNo ratings yet

- 0111070057MFC14401CR162Techniques of Corporate Valuation2-Techniques of Coporate ValuationDocument57 pages0111070057MFC14401CR162Techniques of Corporate Valuation2-Techniques of Coporate ValuationI MNo ratings yet

- C3 - Accounting For InventoriesDocument95 pagesC3 - Accounting For InventoriesHồ ThảoNo ratings yet

- Inventories Lkas 2Document12 pagesInventories Lkas 2kavindyatharaki2002No ratings yet

- Explain The Procedure of Reconciliation of Financial and Cost Accounting DataDocument6 pagesExplain The Procedure of Reconciliation of Financial and Cost Accounting DataKritika JainNo ratings yet

- Costing Formulae Topic WiseDocument81 pagesCosting Formulae Topic Wiseamit kathaitNo ratings yet

- Costing Formulas PDFDocument86 pagesCosting Formulas PDFSimul MondalNo ratings yet

- Audit of Property, Plant, and EquipmentDocument15 pagesAudit of Property, Plant, and EquipmentLuna100% (1)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- SAP PR Release Strategy Concept and Configuration Guide: A Case StudyFrom EverandSAP PR Release Strategy Concept and Configuration Guide: A Case StudyRating: 4 out of 5 stars4/5 (6)

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)