Professional Documents

Culture Documents

Figure in Lakh Prepared by - Ca. Shivam Gupta

Uploaded by

Aayush Lohana0 ratings0% found this document useful (0 votes)

34 views11 pagesCMA data for Cloth Shop

Original Title

cma data

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCMA data for Cloth Shop

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views11 pagesFigure in Lakh Prepared by - Ca. Shivam Gupta

Uploaded by

Aayush LohanaCMA data for Cloth Shop

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

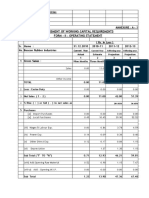

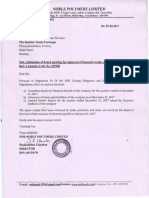

GURVINDAR SINGH BHATIA

GURUNAANAK VASTRA BHANDARQ

CMA DATA

Figure in Lakh

PREPARED BY - CA. SHIVAM GUPTA

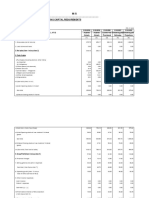

FORM II (OPERATING STATEMENT)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

1. Gross Income

(i.) Sales(net of returns)

(a.) Domestic Sales 11.36 40.26 58.96 68.96 76.90

(b.) Export Sales 0.00 0.00 0.00 0.00 0.00

(c.) Sub-total(a+b) 11.36 40.26 58.96 68.96 76.90

(d.) % rise(+) or fall(-) in sales turnover as 254.40 46.45 16.96 11.51

compared to Previous Year

(ii.) Other Income

(a.) Duty Drawback 0.14 0.00 0.00 0.00 0.00

(b.) Cash assistance 0.00 0.00 0.00 0.00 0.00

(c.) Commission & brokerage received 0.00 0.00 0.00 0.00 0.00

(d.) Sub-total (a + b + c) 0.14 0.00 0.00 0.00 0.00

(iii.) Total (i) + (ii) 11.50 40.26 58.96 68.96 76.90

2. Cost of Sales

(i.) Purchases 15.16 38.59 52.03 64.54 67.90

(ii.) Other trading exp.s (carriage inward, commission 0.01 0.06 0.10 0.12 0.15

and brokerage on purchase)

(iii.) Sub-total (i) + (ii) 15.17 38.65 52.13 64.66 68.05

PREPARED BY -CA. SHIVAM GUPTA Page : 1

(iv.) Add: Opening Stock 4.14 10.48 15.41 17.39 23.50

(v.) Sub-total (iii) + (iv) 19.31 49.13 67.54 82.05 91.55

(vi.) Less: Closing Stock 10.48 15.41 17.39 23.50 26.23

(vii.) Total cost of sales (v) - (vi) 8.83 33.72 50.15 58.55 65.32

3. Selling General & Administrative 0.47 1.58 2.37 2.52 2.86

4. Operating Profit (before Interest and Depriciation 2.20 4.96 6.44 7.89 8.72

[1(iii) - 2(vii) - 3]

5. Interest 0.00 0.00 0.50 1.00 1.00

6. Depreciation 0.00 0.02 0.02 0.14 0.15

7. Operating Profit (after Interest Depreciation)(4- 2.20 4.94 5.92 6.75 7.57

5-6)

8.

9. Profit Before TAX/Loss [7 + 8(iii)] 2.20 4.94 5.92 6.75 7.57

10. Provision for Taxes 0.00 0.00 0.00 0.00 0.00

11. Net Profit/Loss (9 - 10) 2.20 4.94 5.92 6.75 7.57

12.

(i.) Equity dividend paid 0.00 0.00 0.00 0.00 0.00

(ii.) Dividend Rate 0.00 0.00 0.00 0.00 0.00

13. Retained Profit (11 - 12) 2.20 4.94 5.92 6.75 7.57

14. Retained Profit/Net Profit (%)(13/11)** In Case 100 100 100 100 100

of firms, drawing made during the year by

proprietors/partners

PREPARED BY -CA. SHIVAM GUPTA Page : 2

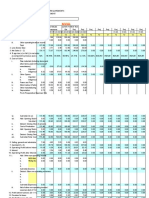

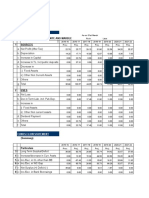

FORM III (ANALYSIS OF BALANCE SHEET)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

Current Liabilites

1. Short-Term borrowings from banks (including bills

purchased Discount & excess borrowings placed on

repayment basis)

(i.) From applicant bank 0.00 0.00 10.00 10.00 10.00

(ii.) From other banks 0.00 0.00 0.00 0.00 0.00

(iii.) (Of which BP & BD) 0.00 0.00 0.00 0.00 0.00

Sub-Total(A) 0.00 0.00 10.00 10.00 10.00

2. Short-term borrowing from others 0.00 0.00 0.00 0.00 0.00

3. Sundry creditors(trade) 1.78 10.90 1.42 2.30 2.00

4. Advance payments from customers/deposits from 0.00 0.00 0.05 0.05 0.07

dealers

5. Provision for taxation 0.00 0.00 0.00 0.00 0.00

6. Dividend payable 0.00 0.00 0.00 0.00 0.00

7. Other statutory liabilities (due within one year) 0.00 0.00 0.00 0.00 0.00

8. Deposits/Instalments of term 0.00 0.00 0.00 0.00 0.00

loans/DPGs/debentures,etc. (due within one year)

9. Other current liabilites & provisions (Due within 1 0.00 0.00 0.00 0.00 0.00

year)(Specify major items)

Sub-Total(B) 1.78 10.90 1.47 2.35 2.07

10. Total current Liabilites(Total 1 To 9) 1.78 10.90 11.47 12.35 12.07

Term Liabilites

PREPARED BY -CA. SHIVAM GUPTA Page : 3

11. Debentures(not maturing within one Year

12. Preference Shares (redeemable after one year)

13. Term loans (excluding instalments payable within 0.00 0.00 0.00 0.00 0.00

one years)

14. Deferred Payment Credits (excluding instalments

due within one year)

15. Terms deposits (repayment after 1 year)

16. From Directors & relatives

17. Other terms liabilities

18. Total terms liabilities(Add 11 to 17) 0.00 0.00 0.00 0.00 0.00

19. Total Outside Liabilites(10+18) 1.78 10.90 11.47 12.35 12.07

Net worth

20. Ordinary share capital 10.00 13.45 17.09 20.71 24.76

21. General reserve

22. Revaluation Reserve

23. Other reserves(excluding provision)

24. Surplus (+) or deficit (-) in profit and Loss account 0.00 0.00 0.00 0.00 0.00

25. Net Worth 10.00 13.45 17.09 20.71 24.76

26. Total Liabilities (19+25) 11.78 24.35 28.56 33.06 36.83

Current Assets

27. Cash and bank balances 0.16 3.40 3.50 2.50 2.24

28. Investment(other than long-term investments

(i.) Government & other Trust securities 0.00 0.00 0.00 0.00 0.00

(ii.) Fixed deposits with banks

29.

(i.) Receivables other than deferred and 0.95 5.37 7.52 5.80 7.00

PREPARED BY -CA. SHIVAM GUPTA Page : 4

exports(including bills purchased &

discounted by banks)

(ii.) Export receivables (including bills purchased/ 0.00 0.00 0.00 0.00 0.00

discounted by banks)

30. Instalments of deferred receivables (due within

one year)

31. Inventory

(i.) Raw material(including stores and other

items used in the process manufacture)

Imported 0.00 0.00 0.00 0.00 0.00

Indigenous

(ii.) Stock-in process

(iii.) Finished goods 10.48 15.41 17.39 23.50 26.23

(iv.) Other consumable spares

Imported

Indigenous

32. Advance to suppliers of raw material stores/spares

33. Advances payment of taxes

34. Other current assets (specify major items) 0.00 0.00 0.00 0.00 0.00

35. Total Current Assets(add 27 To 34) 11.59 24.18 28.41 31.80 35.47

Fixed Assets

36. Gross Block (land & bulding, machinery,Cap.work- 0.19 0.19 0.17 1.40 1.51

in-progress)

37. Depreciation to date 0.00 0.02 0.02 0.14 0.15

38. Net Block(36-37) 0.19 0.17 0.15 1.26 1.36

Other Non-Current Assets

PREPARED BY -CA. SHIVAM GUPTA Page : 5

39. Investments/book debts/advances/ deposits which

are not Current Assets

(i.)

Investments in subsidiary

companies/affiliates

Others

(ii.) Advances to suppliers of capital goods &

contractors

(iii.) Deferred receivables (maturity exceeding one

year)

(iv.) Other

40. Obsolete stock

41. Other non-current assets including dues from 0.00 0.00 0.00 0.00 0.00

directors

42. Total other non-current Assets (Total of 39 To 41) 0.00 0.00 0.00 0.00 0.00

43. Intangible assets (patents,goodwill, preliminary 0.00 0.00 0.00 0.00 0.00

expenses, bad/ doubtful debts not provided for,

etc.

44. Total Assets (35+38+42+43) 11.78 24.35 28.56 33.06 36.83

45. Tangible Net worth(25-43) 10.00 13.45 17.09 20.71 24.76

46. Net Working Capital [(18+25) -(38+42+43)] Tally 9.81 13.28 16.94 19.45 23.40

With

Net Working Capital (35-10) 9.81 13.28 16.94 19.45 23.40

47. Current Ratio (Items 35/10) 6.51 2.22 2.48 2.57 2.94

48. Total Outside Liabilities/ Tangible Net worth(19/45) 0.18 0.81 0.67 0.6 0.49

PREPARED BY -CA. SHIVAM GUPTA Page : 6

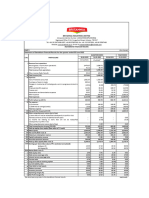

FORM IV (COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

A. Current Assets

1. Stock-in-Trade: 10.48 15.41 17.39 23.50 26.23

(Months' cost of Sales:) 14.26 5.49 4.17 4.83 4.83

2. Receivables other than export and deferred receivables (including 0.95 5.37 7.52 5.80 7.00

bills purchased & discounted by bankers

(Months' domestic sales:) 1.00 1.60 1.53 1.01 1.09

3. Export receivables (including bills purchased & discounted) 0.00 0.00 0.00 0.00 0.00

(Months' export sales:)

4. Advance to suppliers of raw materials and stores/ spares,

consumables

5. Other current assets including cash and bank balances & deferred 0.16 3.40 3.50 2.50 2.24

receivables due within one year (specify major items)

6. Total current Assets (To agree with item 35 in Form III) 11.59 24.18 28.41 31.80 35.47

B. Current Liabilities (Other than bank borrowing for working

capital)

7. Sundry Creditors (trade) 1.78 10.90 1.42 2.30 2.00

(Months' purchases:) 1.41 3.39 0.33 0.43 0.35

8. Advances payment from customers/ deposits from dealers 0.00 0.00 0.05 0.05 0.07

9. Statutory liabilities 0.00 0.00 0.00 0.00 0.00

10. Other current liabilities (Specify major items such as Short-term 0.00 0.00 0.00 0.00 0.00

borrowing, unsecured loans, dividend payable, instalments of TL.

DPG, Public deposits,debentures, etc.

PREPARED BY -CA. SHIVAM GUPTA Page : 7

11. Total (To agree with sub-total B- Form III) 1.78 10.90 1.47 2.35 2.07

FORM V (Computation of maximum permissible Bank Finance for Working Capital)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

1. Total Current Assets,(6 in Form IV) 11.59 24.18 28.41 31.80 35.47

2. Current Liabilities (Other than bank borrowing) (2 1.78 10.90 1.47 2.35 2.07

to 9 of Form III)

3. Working Capital Gap (WCG)(1-2) 9.81 13.28 26.94 29.45 33.40

4. Minimum stipulated net working Capital i.e. 25% 2.45 3.32 6.74 7.36 8.35

of WCG/25% of total current asset as the case

may be depending upon the method of lending

being applied (Export receivables to be excluded

under both methods)

5. Actual/projected net working capital (46 in Form 9.81 13.28 16.94 19.45 23.40

III)

6. Assessed Bank Finance (3-4) 7.36 9.96 20.20 22.09 25.05

7. Item 3 minus item 5 0.00 0.00 10.00 10.00 10.00

8. Maximum permissible bank finance (Item 6 or 7 0.00 0.00 10.00 10.00 10.00

whichever is Lower)

9. Excess borrowings representing shortfall in -7.36 -9.96 -10.20 -12.09 -15.05

NWC(4-5)

PREPARED BY -CA. SHIVAM GUPTA Page : 8

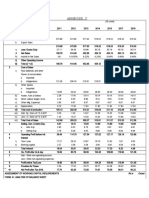

FORM V II Method (Computation of maximum permissible Bank Finance for Working Capital)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

1. Total Current Assets,(6 in Form IV) 11.59 24.18 28.41 31.80 35.47

2. Current Liabilities (Other than bank borrowing) (2 1.78 10.90 1.47 2.35 2.07

to 9 of Form III)

3. Working Capital Gap (WCG)(1-2) 9.81 13.28 26.94 29.45 33.40

4. Minimum stipulated net working Capital i.e. 25% 2.9 6.04 7.1 7.95 8.87

of WCG/25% of total current asset as the case

may be depending upon the method of lending

being applied (Export receivables to be excluded

under both methods)

5. Actual/projected net working capital (46 in Form 9.81 13.28 16.94 19.45 23.40

III)

6. Assessed Bank Finance (3-4) 6.91 7.24 19.84 21.50 24.53

7. Item 3 minus item 5 0.00 0.00 10.00 10.00 10.00

8. Maximum permissible bank finance (Item 6 or 7 0.00 0.00 10.00 10.00 10.00

whichever is Lower)

9. Excess borrowings representing shortfall in -6.91 -7.24 -9.84 -11.50 -14.53

NWC(4-5)

PREPARED BY -CA. SHIVAM GUPTA Page : 9

FORM VI (FUNDS FLOW STATEMENT)

PARTICULARS ACTUAL ESTIMATED PROJECTED YEARS

31/03/2017 31/03/2018 31/03/2019 31/03/2020 31/03/2021

1. Sources 0.00 0.00 0.00 0.00 0.00

(a.) Net profit (After tax) 0.00 4.94 5.92 6.75 7.57

(b.) Depreciation 0.00 0.02 0.02 0.14 0.15

(c.) Increase in capital 0.00 -1.49 -2.28 -3.13 -3.52

(d.) Increase in Term Liabilities (Including Public 0.00 0.00 0.00 0.00 0.00

deposits)

(e.) Decrease in 0.00 0.00 0.00 0.00 0.00

(i.) Fixed Assets 0.00 0.00 0.00 0.00 0.00

(ii.) Other non-current assets 0.00 0.00 0.00 0.00 0.00

(f.) Other 0.00 0.00 0.00 0.00 0.00

(g.) Total 0.00 3.47 3.66 3.76 4.20

2. Uses 0.00 0.00 0.00 0.00 0.00

(a.) Net loss 0.00 0.00 0.00 0.00 0.00

(b.) Decrease in term Liabilities (Including public 0.00 0.00 0.00 0.00 0.00

deposits)

(c.) Increase in: 0.00 0.00 0.00 0.00 0.00

(i.) Fixed Assets 0.00 0.00 0.00 1.25 0.25

(ii.) Other non-current assets 0.00 0.00 0.00 0.00 0.00

(d.) Dividend payments 0.00 0.00 0.00 0.00 0.00

(e.) Others 0.00 0.00 0.00 0.00 0.00

(f.) Total 0.00 0.00 0.00 1.25 0.25

3 Long-term Surplus (+)/Deficit (-)(1-2) * (as per 0.00 3.47 3.66 2.51 3.95

PREPARED BY -CA. SHIVAM GUPTA Page : 10

details given below)

4. Increase/decrease in current assets * (as per 0.00 12.59 4.23 3.39 3.67

details given below)

5. Increase/decrease in current liabilities other than 0.00 9.12 -9.43 0.88 -0.28

Bank borrowings

6. Increase/decrease in working capital gap 0.00 3.47 13.66 2.51 3.95

7. Net surplus (+)/deficit (-) (Difference of 3 & 6) 0.00 0.00 10.00 0.00 0.00

8. Increase/decrease in: 0.00 0.00 0.00 0.00 0.00

(i.) Bank borrowing 0.00 0.00 -10.00 0.00 0.00

(ii.) Net Sales 0.00 28.90 18.70 10.00 7.94

*Break-up of(4) 0.00 0.00 0.00 0.00 0.00

(i.) Increase/Decrease in: 0.00 0.00 0.00 0.00 0.00

(a.) Raw Materials 0.00 0.00 0.00 0.00 0.00

(b.) Stocks-in-Process 0.00 0.00 0.00 0.00 0.00

(c.) Finished Goods 0.00 4.93 1.98 6.11 2.73

(ii.) Increase/Decrease in Receivables: 0.00 0.00 0.00 0.00 0.00

(a.) Exports 0.00 0.00 0.00 0.00 0.00

(b.) Domestic 0.00 4.42 2.15 -1.72 1.20

(iii.) Increase/Decrease in stores Spares 0.00 0.00 0.00 0.00 0.00

(iv.) Increase/Decrease in other current assets 0.00 3.24 0.10 -1.00 -0.26

PREPARED BY -CA. SHIVAM GUPTA Page : 11

You might also like

- CMA Report: EverGreen Dry Cleaners AssessmentDocument10 pagesCMA Report: EverGreen Dry Cleaners AssessmentSaranNo ratings yet

- Project Report - Petrol PumpDocument33 pagesProject Report - Petrol PumpNITESH JAISINGHANINo ratings yet

- Assessment of Working Capital Requirements Form Ii: Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii: Operating StatementMD.SAFIKUL MONDALNo ratings yet

- 747WC Model-UnsolvedDocument7 pages747WC Model-UnsolvedGokul BansalNo ratings yet

- Cma FormatDocument14 pagesCma FormatBISHNU PADA DASNo ratings yet

- RAJGHARANADocument20 pagesRAJGHARANAPriyanshu tripathiNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Assessment of Working Capital Requirements Form # II: OperatingDocument10 pagesAssessment of Working Capital Requirements Form # II: OperatingSuzanne Davis100% (2)

- Assessing Working Capital RequirementsDocument24 pagesAssessing Working Capital Requirementsbharat khandelwalNo ratings yet

- BHAGYALAKSMI CMA LOAN BHBHJDocument15 pagesBHAGYALAKSMI CMA LOAN BHBHJbal balreddyNo ratings yet

- Provisional Profit and Loss Accounts For The Period Un-Audited AuditedDocument4 pagesProvisional Profit and Loss Accounts For The Period Un-Audited AuditedAnonymous btsj64wRNo ratings yet

- Form - I: Assessment of Working Capital Requirements: Part A-Operating StatementDocument14 pagesForm - I: Assessment of Working Capital Requirements: Part A-Operating StatementMonilNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- Working Capital AssessmentDocument11 pagesWorking Capital AssessmentRK SharmaNo ratings yet

- Assessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedDocument11 pagesAssessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedVivek SharmaNo ratings yet

- Cma SCPL BG LoanDocument15 pagesCma SCPL BG LoanSteven BryantNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Annexure-I M/s. XYZ Factory - WC Loan: Choudhary Gum Factory Renwal (Jaipur)Document7 pagesAnnexure-I M/s. XYZ Factory - WC Loan: Choudhary Gum Factory Renwal (Jaipur)Pramodh DadiNo ratings yet

- Annexure II-IV Forms Operating Statement Analysis Balance SheetDocument21 pagesAnnexure II-IV Forms Operating Statement Analysis Balance SheetShushant ShekharNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- M DAS CmaDocument16 pagesM DAS CmageeksacctupNo ratings yet

- Form I - Balaji Enterprises Financial Statements 2021-22 and 2022-23 ProjectionsDocument13 pagesForm I - Balaji Enterprises Financial Statements 2021-22 and 2022-23 ProjectionsGEETHA PNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/s.Sri Sai Baba ConstructionsDocument18 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/s.Sri Sai Baba ConstructionsKns RamNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Operating Statement ProjectionsDocument2 pagesOperating Statement Projectionsankita kharbandaNo ratings yet

- Revised Financial Results For December 31, 2016 (Company Update)Document4 pagesRevised Financial Results For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- 16.03.2024 Modified CMA GUPTA - After ChangeDocument6,565 pages16.03.2024 Modified CMA GUPTA - After ChangeRAHUL KUMARNo ratings yet

- CMA Format-2 WC LoanDocument7 pagesCMA Format-2 WC LoanDrPraveen SharmaNo ratings yet

- CMA Statement of Trading ActivityDocument17 pagesCMA Statement of Trading ActivitySubrato MukherjeeNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik PolymersDocument17 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik Polymersamit22505No ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- Padma TractorsDocument35 pagesPadma TractorsArun KumarNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsDocument34 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement Sanoj Kumar Potdar Amounts in Rs. LacsRakesh YadavNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsDocument14 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Shivam Roller Flour Mills Pvt. LTD Amounts in Rs. LacsAKHI9No ratings yet

- Bal SheetDocument4 pagesBal SheetVishal JainNo ratings yet

- Assessment of Working Capital Requirements Form - Ii: Operating StatementDocument17 pagesAssessment of Working Capital Requirements Form - Ii: Operating StatementAshok TiwaryNo ratings yet

- FORM ASSESSMENTDocument4 pagesFORM ASSESSMENTRohit KhandelwalNo ratings yet

- Statemnt of Profit and LossDocument1 pageStatemnt of Profit and LossRutuja shindeNo ratings yet

- SDP Stone Term Laon MarbleDocument72 pagesSDP Stone Term Laon MarbleSURANA1973No ratings yet

- DPL Annual Report 2022 23 Pages 2Document1 pageDPL Annual Report 2022 23 Pages 2workf17hoursformeNo ratings yet

- RP Infra Cma ReportDocument12 pagesRP Infra Cma ReportJitendra NikhareNo ratings yet

- CMA FormatDocument21 pagesCMA Formatapi-377123878% (9)

- International Granimarmo CMA DTA 115 LACS CC - FinalDocument63 pagesInternational Granimarmo CMA DTA 115 LACS CC - FinalSURANA1973No ratings yet

- GSTR-3B Report SummaryDocument7 pagesGSTR-3B Report SummarySONI ASSOCIATESNo ratings yet

- Financial Results Consolidated Q2 FY 2023 2024Document10 pagesFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNo ratings yet

- Integrated Report and Annual Accounts 2016-17-175 175Document1 pageIntegrated Report and Annual Accounts 2016-17-175 175Sanju VisuNo ratings yet

- ITC Report and Accounts 2023 185Document1 pageITC Report and Accounts 2023 185Nishith RanjanNo ratings yet

- CMA NewDocument7 pagesCMA NewKrishna MohanNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Common Size Statement ITCDocument16 pagesCommon Size Statement ITCManjusha JuluriNo ratings yet

- Shree Shyam Granite Cma Data - Xls FINALDocument45 pagesShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Short Answer QuestionsDocument5 pagesShort Answer QuestionsMuthu KrishnaNo ratings yet

- Real Cases 1-7Document14 pagesReal Cases 1-7Romel MedenillaNo ratings yet

- Master Circular on Educational Loan SchemesDocument37 pagesMaster Circular on Educational Loan SchemesAnonymous ARoVf1XfmTNo ratings yet

- Study of Probability of Defaulters in BanksDocument30 pagesStudy of Probability of Defaulters in Bankssundaram MishraNo ratings yet

- MF Cost of Capital - Practice QuestionsDocument4 pagesMF Cost of Capital - Practice QuestionsSaad UsmanNo ratings yet

- Compound InterestDocument4 pagesCompound InterestDaniel DemessieNo ratings yet

- Smart Investment 10-16 Dec 2023Document82 pagesSmart Investment 10-16 Dec 2023vijibaskNo ratings yet

- Lease AccountingDocument7 pagesLease AccountingSandeep Shenoy100% (1)

- Credit Appraisal of Term Loans and Working Capital LimitsDocument66 pagesCredit Appraisal of Term Loans and Working Capital LimitsmaddyvickyNo ratings yet

- Risk and Return AnalysisDocument64 pagesRisk and Return AnalysisHASIRNo ratings yet

- Fin3003 ProjectDocument3 pagesFin3003 Projectapi-283310076No ratings yet

- Derrett J Duncan M - Law in The New Testament - The Parable of Talents AndTwo LogiaDocument12 pagesDerrett J Duncan M - Law in The New Testament - The Parable of Talents AndTwo LogiaRINCONJTNo ratings yet

- Court Ruling on Westmont Investment Corp CasesDocument37 pagesCourt Ruling on Westmont Investment Corp CasesAnn ChanNo ratings yet

- American Express Credit Card Features GuideDocument4 pagesAmerican Express Credit Card Features Guidebokamanush100% (1)

- Get Cash Loans Online in the PhilippinesDocument9 pagesGet Cash Loans Online in the Philippinesmaica_prudenteNo ratings yet

- Fundamentals of Investing: Fourteenth Edition, Global EditionDocument47 pagesFundamentals of Investing: Fourteenth Edition, Global EditionFreed DragsNo ratings yet

- Specimen Paper Answers - Paper 2: Cambridge IGCSE / IGCSE (9 1) Business Studies 0450 / 0986Document18 pagesSpecimen Paper Answers - Paper 2: Cambridge IGCSE / IGCSE (9 1) Business Studies 0450 / 0986Farrukhsg100% (1)

- Investors Finance Corp. v. Autoworld Sales Corps 340 SCRA 735 (2000)Document14 pagesInvestors Finance Corp. v. Autoworld Sales Corps 340 SCRA 735 (2000)Ja VillaromanNo ratings yet

- Financial Leverage and Shareholders' Wealth: An Empirical Analysis of Foods and Beverages Firms in NigeriaDocument8 pagesFinancial Leverage and Shareholders' Wealth: An Empirical Analysis of Foods and Beverages Firms in NigeriaInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Draft Housing Policy InsightsDocument36 pagesDraft Housing Policy Insightsshruti_09No ratings yet

- Derivatives and Risk Management JP Morgan ReportDocument24 pagesDerivatives and Risk Management JP Morgan Reportanirbanccim8493No ratings yet

- Form 3 Maths Lesson Plan 2021Document6 pagesForm 3 Maths Lesson Plan 2021Tcer ReenNo ratings yet

- Class 2-1 - Capital Structure 1Document2 pagesClass 2-1 - Capital Structure 1Anna KucherukNo ratings yet

- Jaipur-Kishangarh Concession (38Document100 pagesJaipur-Kishangarh Concession (38Sreejith MohankumarNo ratings yet

- Exchange Control RegulationsDocument38 pagesExchange Control RegulationsYngCubes JontNo ratings yet

- Assignment 1: 15 Financial Problems with SolutionsDocument2 pagesAssignment 1: 15 Financial Problems with SolutionsJeevan GonaNo ratings yet

- Economics of Power GenerationDocument23 pagesEconomics of Power GenerationAbdullah NawabNo ratings yet

- Financial Management - TVM Assignment 2 - Abdullah Bin Amir - Section ADocument4 pagesFinancial Management - TVM Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirNo ratings yet

- Bank DOCUMENTSDocument30 pagesBank DOCUMENTSHoity ToityNo ratings yet

- Chapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument6 pagesChapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsMona AgarwallaNo ratings yet