Professional Documents

Culture Documents

Ind Next50

Uploaded by

Rajesh KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ind Next50

Uploaded by

Rajesh KumarCopyright:

Available Formats

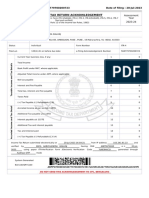

CUSTOMER INSTRUCTION AND SALARY INFORMATION FILE - SIF CREATION GUIDELINES

Dear Valued Customer,

Thank you for choosing Dubai Islamic Bank (DIB) for your WPS requirements.

In order to ensure compliance to all WPS guidelines, please note the following processes:

• Prepare encrypted SIF in the standard format required as per Ministry of Labour and upload the same through WPS functionality

available on Online Banking Portal

• A sample of the SIF file format as required by the Ministry of Labour is available on the following link ‘Sample SIF file’

• The step by step guide to upload the SIF file on Online is available on the following link

• Rejections (if any) shall be notified through a system generated email send on the registered email ID along with the instructions

on how to proceed further.

Please note:

Ministry of Labor standard format required for the WPS salary transfer.

Employee Variable Pay (EVP)

Sample SIF File

EDR,00915012345663,802420101,AE160240043520123456701,2016-01-01,2016-01-31,31,4000.00,2500.00,0

EVP,00915012345663,802420101,500.00,200.00,300.00,0.00,400.00,1100.00,0.00

SCR,0000000123456,802420101,2016-01-26,1130,012016,01,6500.00,AED,abc company only 35 characters

Max

ID Field Label Type Use Mandated contents / Remarks

Size

01 Record Type 3 A M Must be EDR

02 Employee Unique ID 35 AN M Unique Identifier as provided by LRA. Employee id can vary in length from 14 to 35

03 Routing Code of the 9 N M The 9 digit head office routing code as assigned to the AGENT by CBUAE.

AGENT Validated against the master database held in WPS

04 Employee Account 23 AN M The employer must provide the account number of the employee as provided by the agent. Refer CORPORATE RESPONSIBILITY

With Agent Section GUIDE Section 7.6.2. Employee Detail Record (EDR) , on link “UAEWPS ENTAUX 998 - CORPORATE RESPONSIBILITY

GUIDE - V2015-01 (download)for more detils on data to be propagated and the associated validation

05 Pay Start Date 10 D M Must be of the form YYYY-MM-DD. This date cannot be lessthan ‘”2010-10-01

06 Pay End Date 10 D M Must be of the form YYY-MM-DD. This date must be greater than the date indicated in EDR.05 and must also be in

the same month as the date indicated in EDR-05

07 Days in Period 4 N M Must be the number of calendar days for which the salary is being paid. This Must be computed as EDR-06 - EDRDS + 1

08 Income Fixed 15 N M Valid amount (e.g., 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00.

Component Negative amounts are Not permitted and the file will be rejected.

09 Income Variable 15 N M Valid amount (e.g., 2345.87 / 23.00 / 22).If no contribution from this component then send 0.00.

Component Negative amounts are Not permitted and the file will be rejected.

10 Days on Leave for 4 N M This shall be the number of days that the employee has availed of leave without pay in the pay period. If no leave

period has been availed off then indicate with zero “0”

Employee Variable Pay details (EVP)

Max

ID Field Label Type Use Mandated contents / Remarks

Size

01 Record Type 3 A M Must be EVP

02 Employee Unique ID 35 AN M Unique Identifier as provided by LRA. Same as the one available in the EDR

03 Routing Code of the 9 N M The 9 digit head office routing code as assigned to the AGENT by CBUAE Validated against the master database held

AGENT in WPS.Same as the one indicated in the corresponding EDR record.

04 Housing Allowance 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

05 Conveyance Allowance 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

06 Medical Allowance 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

07 Annual Passage 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

Allowance NOT permitted and the file will be rejected.

08 Overtime Allowance 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

09 All Other Allowances 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

10 Leave Encashment 15 N M Valid amount (e.g. 2345.87 / 23.00 / 22). If no contribution from this component then send 0.00. Negative amounts are

NOT permitted and the file will be rejected.

Max

ID Field Label Type Use Mandated contents / Remarks

Size

01 Record Type 3 A M Must be SCR

02 Employer Unique ID 35 AN M The unique id for the employer as assigned by LRA. Validated against the master database held in WPS. Employer Id

can vary in length from 13 to 35

03 Routing Code of the 9 N M The 9 digit routing code as assigned to the BANK by CBUAE.

Employers Bank Validated against the master database held in WPS

04 File Creation Date 10 D M Must be of the form YYYY-MM-DD shall be validated to be a date that is less than or equal to that of the processing

date equal to that of the processing date on WPS

05 File Creation Time 4 N M Must be of the form HHMM

06 Salary Month 6 N M Must be of the form MM-YYYY. The actual month for which the salary is being paid. Please note that LRA makes key

decisions based on the value provided in this field. The SIF file in its entirety will be rejected if the data supplied in this

field is not in the same month & year as that provided in the EDR-05 & EDR-06 of all the EDR records

07 EDR Count 10 N M Must be the number of EDR records in the file.

08 Total Salary 15 N M Valid amount (e.g., 2345.87 / 23.00 / 22). will be validated to be equal to the sum of all the fixed

and variable components indicated in all the EDR records in the file.

09 Payment Currency 3 A M Curreny is always assumed to be AED

10 Employer Reference 35 AN O Documentary Field

FDR (Refund Details Record)

Max

ID Field Label Type Use Mandated contents / Remarks

Size

01 Record Type 3 A M Must be FDR

02 SIF File Name 100 AN M The original SIF file name in which the salary information was provieded for the specific employee. Separate FDR must

be used for each SIF + Employee combination.

03 ACK File Name 100 AN M The ACK file name for the SIF file indicated in FDR-02 for this for this record.

04 Agents Routing Code 9 N M The 9 digit routing code as assigned to the AGENT by CBUAE.

Validated against the master database held in WPS

05 Employee Unique ID 35 AN M Unique identifier as provided by LRA. validated against the master database held in WPS Employee id can vary in

lenght from 14 to 35

06 Refund Amount Requested 15 N M Valid amount (e.g., 2345.87 / 23.00 / 22). Shall be equal to or less than the sum of EDR-08 & EDR-09

07 Refund Request Code 3 N M A valid refund request code. Refer Section 10.

08 Employee Account 23 AN M The employer must provide the account number of the employee as was made available in the original SIF/PAF file

with Agent without any alterations.

09 Future Use 1 A M Leave blank. A space has to be sent in as the data.

10 Future Use 5 A M Must be “EWPMS”

The codes as indicated are valid as at the time of publishing this document. Additions/Deletions are possible and will be made available to Banks, Exchange Houses

and 3rd Party Service Providers from time to time. Updating this and/or other related documents is at the sole discretion of the CBUAE.

001 Errors in computation of fixed wages

002 Errors in computation of variable wages

003 Errors in computation of wages

004 Same data sent through multiple WPS Participant

005 Same data sent through another WPS Participant.

006 Duplicate contents sent in error by WPS Participant

007 Duplicate contents sent in error by employer.

008 Salary file sent in error by WPS Participant

009 Error in computation of Salary period

010 Request Refund of Transferred Monies - Employee Terminated

011 Request Refund of Transferred Monies - Employee Out of Country

012 Request Refund of Transferred Monies - Agent Changed

013 Request Refund of Transferred Monies - Cash settlement outside WPS

014 Request Refund of Transferred Monies - Cheque settlement outside WPS

015 Request Refund of Transferred Monies - Other reasons

016 Incorrect Employee Account With Agent in SIF

FCR (Refund Control Record)

Max

ID Field Label Type Use Mandated contents / Remarks

Size

01 Record Type 3 A M Must be FCR

The unique id for employer as assinged by LRA. Validated the master database held in WPS

02 Employer Unique ld 35 AN M

Employer ld can vary in length from 13 to 35

03 Employer Reference 35 AN O Documentary Field

04 Bank Code of the 9 N M The 9 digit routing code as assigned to the BANK by CBUAE.

Employer Validated against the master database held in WPS

05 Account Number of 23 AN M Account number where the monies will need to be credited if the refund request is accepted by the agent. This account

Employer with Bank number will be used as one of the narratives in the accounting entry that will be posted. The account number MUST be

left padded with zero,s Entities will receive the 23 digits but may opt to use the least significant “X” digits for their internal processing.

06 Total Refund Claimed 15 N M Valid amount (e.g., 2345.87 / 23.00 / 22).

07 FDR Count 10 N M The total number of FDR in this file.

08 Future Use 1 A M Leave blank. A space has to be sent in as the data.

09 Future Use 1 A M Leave blank. A space has to be sent in as the data.

10 Future Use 5 A M Must be “EWPMS”

5189822 5189552

Dubai Islamic Bank

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Eka Sloki GitaDocument1 pageEka Sloki GitaRajesh KumarNo ratings yet

- Ind Next50Document2 pagesInd Next50Rajesh KumarNo ratings yet

- Ind Next50Document2 pagesInd Next50Rajesh KumarNo ratings yet

- Shareholding Pattern Ordinary SharesDocument6 pagesShareholding Pattern Ordinary SharesRajesh KumarNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Rajesh KumarNo ratings yet

- Factsheet NIFTY Quality Low-Volatility 30Document2 pagesFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- User Guide On Paying MCA21 Fees Via NEFT: BanksDocument4 pagesUser Guide On Paying MCA21 Fees Via NEFT: BanksRajesh KumarNo ratings yet

- Nifty Low VolatilityDocument2 pagesNifty Low VolatilityRajesh KumarNo ratings yet

- Shareholding Pattern Ordinary SharesDocument6 pagesShareholding Pattern Ordinary SharesRajesh KumarNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- Nifty Low VolatilityDocument2 pagesNifty Low VolatilityRajesh KumarNo ratings yet

- Union Council of Ministers PDFDocument1 pageUnion Council of Ministers PDFRajesh KumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gazette of India: ExtraordinaryDocument18 pagesThe Gazette of India: ExtraordinaryAryan Singh100% (1)

- IAS 1 Presentation of Financial StatementsDocument12 pagesIAS 1 Presentation of Financial StatementsIFRS is easyNo ratings yet

- 1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Document88 pages1 200604 Vietnam Consumer Finance Report 2020 Standard 5 Tran My Nhu 20200610151736Tuấn Tú VõNo ratings yet

- Subsidy Scheme For Coffee ProcessingDocument4 pagesSubsidy Scheme For Coffee ProcessingPankaj SharmaNo ratings yet

- IB Economics SL8 - Overall Economic ActivityDocument6 pagesIB Economics SL8 - Overall Economic ActivityTerran100% (1)

- Income Statement, Oener's Equity, PositionDocument4 pagesIncome Statement, Oener's Equity, PositionMaDine 19No ratings yet

- Alpine Expeditions Operates A Mountain Climbing School in Colorado SomeDocument2 pagesAlpine Expeditions Operates A Mountain Climbing School in Colorado Sometrilocksp SinghNo ratings yet

- Invoice - INNOPARKDocument1 pageInvoice - INNOPARKAnkit SinghNo ratings yet

- FIMA 30013 FS Analysis Premium Notes P1Document5 pagesFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanNo ratings yet

- Ank Palermo Business Advisors Pty LTD Current & Historical Company ExtractDocument4 pagesAnk Palermo Business Advisors Pty LTD Current & Historical Company ExtractFlinders TrusteesNo ratings yet

- Government Regulation No.36 2023 - SummaryDocument9 pagesGovernment Regulation No.36 2023 - SummarySuhendra PangNo ratings yet

- Itr Fy 22-23Document6 pagesItr Fy 22-23Omkar kaleNo ratings yet

- General AbilityDocument14 pagesGeneral AbilityScribd ReaderNo ratings yet

- Aman Jaiswal MRPDocument59 pagesAman Jaiswal MRPAli ShaikhNo ratings yet

- NSE's Certification in Financial MarketDocument23 pagesNSE's Certification in Financial MarketHesham HeshamNo ratings yet

- Payment Method: Bank Transfer, Account Number: 50100498022296, Bank Name:HDFCDocument1 pagePayment Method: Bank Transfer, Account Number: 50100498022296, Bank Name:HDFCBADI APPALARAJUNo ratings yet

- MODULE 3 - Extinguishment of ObligationsDocument8 pagesMODULE 3 - Extinguishment of ObligationsALYSSA LEIGH VILLAREALNo ratings yet

- FIN424 - Assignment 1-2nd Term-2021-22Document7 pagesFIN424 - Assignment 1-2nd Term-2021-22Memoona NawazNo ratings yet

- 679089110072023INBLR4BE1120720231426Document12 pages679089110072023INBLR4BE1120720231426Abishek AbiNo ratings yet

- June 2018Document244 pagesJune 2018Muhammad HaroonNo ratings yet

- Ceres Gardening Company Graded QuestionsDocument4 pagesCeres Gardening Company Graded QuestionsSai KumarNo ratings yet

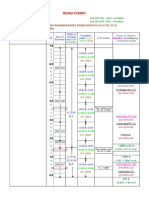

- Road Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Document4 pagesRoad Chart: Kakinada-Rajahmundry Road From KM 0/0 To 27/0Phani PitchikaNo ratings yet

- 0102 34 Si Eog 1Document79 pages0102 34 Si Eog 1Sanjiv KubalNo ratings yet

- Payroll Summary Apr6-May10, 2013Document7 pagesPayroll Summary Apr6-May10, 2013Adriana CarinanNo ratings yet

- Joint Circular No. 01, S. 1998Document4 pagesJoint Circular No. 01, S. 1998Kinleah Vida100% (1)

- Architect CA Instruction ConciseDocument1 pageArchitect CA Instruction ConciseDen OghangsombanNo ratings yet

- IR MCQS by JWT AghazetaleemDocument192 pagesIR MCQS by JWT AghazetaleemAliza NasirNo ratings yet

- Ratio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioDocument7 pagesRatio of Sasbadi Holdings Berhad For Group 2016 1. Liquidity RatioizzhnsrNo ratings yet

- Introduction To Agricultural AccountingDocument54 pagesIntroduction To Agricultural AccountingManal ElkhoshkhanyNo ratings yet

- Bravo Cross Asset Manager Presentation PDFDocument32 pagesBravo Cross Asset Manager Presentation PDFakarastNo ratings yet