Professional Documents

Culture Documents

Scan 0098

Uploaded by

El-Sayed MohammedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scan 0098

Uploaded by

El-Sayed MohammedCopyright:

Available Formats

672 MODULE 37 TAXES: GIFT AND ESTATE

payer would then have ninety days to file a petition with the ignore the implications of information furnished and should

Tax Court. Alternatively, a taxpayer may choose to pay the make reasonable inquires if the information furnished ap-

additional taxes and file a claim for refund. When the re- pears to be incorrect, incomplete, or inconsistent either on its

fund claim is disallowed, the taxpayer could then commence face or on the basis of other facts known to the CP A.

an action in federal district court.

54. (c) A CPA will be liable to a tax client for damages

resulting from the following activities: (1) failure to file a

client's return ona timely basis, (2) gross negligence or

fraudulent conduct resulting in client losses, (3) erroneous

advice or failure to advise client of certain tax elections, and

(4) wrongful disclosure or use of confidential information.

A CP A will not be liable to a tax client for refusing to sign a

client's request for a filing extension, therefore answer (c) is

correct.

55. (b) According to the AICP A Statements on Stan-

dards for Tax Services, a CP A should not recommend a po-

sition unless there is a realistic possibility of it being sus-

tained if it is challenged. Furthermore, a CPA should not

prepare or sign an income tax return if the CP A knows that

the return takes a position that will not be sustained if chal-

lenged. Therefore, answer (d) is incorrect. Also, a CPA

should advise the client of the potential penalty conse-

quences of any recommended tax position. Therefore, an-

swer (c) is incorrect. Answer (a) is incorrect as a CPA may

not recommend a position that is frivolous even if the posi-

tion is adequately disclosed on the return.

56. (a) While performing services for a client, a CPA

may become aware of an error in a previously filed return.

The CP A should advise the client of the error (as required by

the Statements on Standards for Tax Services) and the

measures to be taken. It is the client's responsibility to de-

cide whether to correct the error. In the event that the client

does not correct an error, or agree to take the necessary steps

to change from an erroneous method of accounting, the CP A

should consider whether to continue a professional relation-

ship with the client.

57. (b) 'A CPA may in good faith rely without verifica-

tion upon information furnished by the client when prepar-

ing the client's tax return. However, the CPA should not

ignore implications of information furnished and should

make reasonable inquiries if information appears incorrect,

incomplete, or inconsistent.

58. (c) Answer (a) is incorrect because IRC §6695(a)

imposes a $50 penalty upon income tax return preparers who

fail to furnish a copy of the return to the taxpayer. An-

swer (b) is incorrect because IRC §6695(b) imposes a $50

penalty upon income tax return preparers who fail to sign a

return, unless the failure is due to reasonable cause. An-

swer (d) is incorrect because IRC §6695(f) imposes a $500

penalty upon income tax return preparers who endorse or

otherwise negotiate a client's tax refund· checks. There is no

code section imposing a penalty for the understating of a

client's tax liability due to an error in calculation.

59. (c) A CPA should consider both: (1) information

actually known to the CPA from the tax return of another

client; and (2) information provided by the client that ap- .

pears to be correct based on the client's returns from prior

years. In preparing or signing a return, a CP A may in good

faith rely without verification upon information furnished by

the client or by third parties. However, the CPA should nor

You might also like

- 609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.From Everand609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.No ratings yet

- QIS-ForM I, II, III Manufacturing FormatDocument9 pagesQIS-ForM I, II, III Manufacturing FormatAshish Gupta67% (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Dead Man Walking Worksheet PDFDocument5 pagesDead Man Walking Worksheet PDFCarola BergaminiNo ratings yet

- TAXATION II REMEDIES CasesDocument26 pagesTAXATION II REMEDIES CasesJayzel LaureanoNo ratings yet

- CASE PLDT V CIRDocument1 pageCASE PLDT V CIRAnony mousNo ratings yet

- Case #6 Qatar Airways Company With Limited Liability vs. Commission On Internal Revenue G.R. No. 238914 June 8, 2020Document2 pagesCase #6 Qatar Airways Company With Limited Liability vs. Commission On Internal Revenue G.R. No. 238914 June 8, 2020Harlene HemorNo ratings yet

- Silicon Philippines vs. Cir DigestDocument1 pageSilicon Philippines vs. Cir DigestAnny YanongNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document25 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Tax Case SummaryDocument10 pagesTax Case SummaryYomari ObiasNo ratings yet

- CIR Vs Isabela Cultural CorpDocument3 pagesCIR Vs Isabela Cultural CorpfrankieNo ratings yet

- Finals Handout TaxDocument3 pagesFinals Handout TaxFlorenz AmbasNo ratings yet

- Case Digest TaxationDocument20 pagesCase Digest TaxationGenevive GabionNo ratings yet

- Untitled DocumentDocument16 pagesUntitled DocumentJolina CabardoNo ratings yet

- Taxation Law Bar Examination 2019 Suggested AnswersDocument8 pagesTaxation Law Bar Examination 2019 Suggested AnswersAngelo Ramos100% (1)

- TRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSDocument2 pagesTRIDHARMA MARKETING CORPORATION Vs COURT OF TAX APPEALSNFNLNo ratings yet

- Commissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestDocument3 pagesCommissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestCharmila Siplon100% (1)

- Fundamentals of Criminal Investigation and IntelligenceDocument189 pagesFundamentals of Criminal Investigation and IntelligenceGABRIEL SOLISNo ratings yet

- CIR v. Isabela Cultural CorporationDocument1 pageCIR v. Isabela Cultural Corporationthirdy demaisipNo ratings yet

- TaxRev Case University PhysiciansDocument15 pagesTaxRev Case University Physiciansj guevarraNo ratings yet

- Cir Vs Mirant Pagbilao CorporationDocument2 pagesCir Vs Mirant Pagbilao CorporationPeanutButter 'n Jelly100% (1)

- Cir Vs Isabel Cultural Corp. GR No. 172231 Feb 12, 2007Document9 pagesCir Vs Isabel Cultural Corp. GR No. 172231 Feb 12, 2007Godfrey Saint-OmerNo ratings yet

- Silicon Phils Inc Vs CirDocument1 pageSilicon Phils Inc Vs CirlacbayenNo ratings yet

- Tax Remedies - Part IDocument11 pagesTax Remedies - Part IRamon AngelesNo ratings yet

- CIR Vs Team Energy CorporationDocument5 pagesCIR Vs Team Energy CorporationDNAANo ratings yet

- BSBDIV501 Assessment 1Document7 pagesBSBDIV501 Assessment 1Junio Braga100% (3)

- Cash Flow StatementDocument11 pagesCash Flow StatementDuke CyraxNo ratings yet

- Taxes: Gift and EstateDocument2 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- Module 40 Taxes: Gift and EstateDocument3 pagesModule 40 Taxes: Gift and EstateZeyad El-sayedNo ratings yet

- Taxes: Gift and Estate: Co A Dition Lly A Ret RN Preparer Wiu Be L Y T DDocument2 pagesTaxes: Gift and Estate: Co A Dition Lly A Ret RN Preparer Wiu Be L Y T DZeyad El-sayedNo ratings yet

- Module 40 Taxes: Gift and EstateDocument2 pagesModule 40 Taxes: Gift and EstateZeyad El-sayedNo ratings yet

- Scan 0011Document2 pagesScan 0011Zeyad El-sayedNo ratings yet

- Procedural Aspects of Preparing Returns: 654 Taxes: Gift and EstateDocument2 pagesProcedural Aspects of Preparing Returns: 654 Taxes: Gift and EstateEl-Sayed MohammedNo ratings yet

- Wassim Zhani Income Taxation of Corporations (Chapter 18)Document14 pagesWassim Zhani Income Taxation of Corporations (Chapter 18)wassim zhaniNo ratings yet

- Deductions DigestDocument5 pagesDeductions DigestJesse Myl MarciaNo ratings yet

- PLDT v. CIRDocument10 pagesPLDT v. CIRJohn FerarenNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE vs. COVANTADocument3 pagesCOMMISSIONER OF INTERNAL REVENUE vs. COVANTAPia Janine ContrerasNo ratings yet

- CIR v. Isabela CulturalDocument4 pagesCIR v. Isabela CulturalDiwata de LeonNo ratings yet

- G.R. No. 118794Document2 pagesG.R. No. 118794AbbyNo ratings yet

- Tax Assignment PDFDocument21 pagesTax Assignment PDFVida MarieNo ratings yet

- Assessments Case DoctrinesDocument9 pagesAssessments Case DoctrinesgooNo ratings yet

- Income Taxation (Old Standard) RemediesDocument2 pagesIncome Taxation (Old Standard) RemediesKenneth CalzadoNo ratings yet

- Taxrev Case DigestsDocument6 pagesTaxrev Case DigestsGabby PundavelaNo ratings yet

- Tax Digests - FandialanDocument5 pagesTax Digests - FandialanjoyfandialanNo ratings yet

- AQ2013 - PETH - Answers 2016Document3 pagesAQ2013 - PETH - Answers 2016LindaBakóNo ratings yet

- 2async023 REMEDIESDocument27 pages2async023 REMEDIESBogs QuitainNo ratings yet

- Departmental Interpretation and Practice Notes No. 12 (Revised)Document6 pagesDepartmental Interpretation and Practice Notes No. 12 (Revised)Difanny KooNo ratings yet

- Tax REv NotesDocument23 pagesTax REv NotesCti Ahyeza DMNo ratings yet

- MOD E T Gift A DE Tate: UL Axes: N SDocument2 pagesMOD E T Gift A DE Tate: UL Axes: N SEl-Sayed MohammedNo ratings yet

- Offer in Compromise: Form 656Document44 pagesOffer in Compromise: Form 656IRSNo ratings yet

- For GericahDocument22 pagesFor GericahTauniño Jillandro Gamallo NeriNo ratings yet

- Ethics TBS CaseDocument2 pagesEthics TBS CaseAnurag GanNo ratings yet

- Refining Company Vs CIRDocument2 pagesRefining Company Vs CIRRICKY ALEGARBESNo ratings yet

- Tax Digests 2018 CompilationDocument32 pagesTax Digests 2018 CompilationMarhen ST CastroNo ratings yet

- Commissioner vs. Ironcon BuilderDocument5 pagesCommissioner vs. Ironcon Buildermyles15No ratings yet

- CIR Vs Isabela Cultural Corporation (ICC)Document11 pagesCIR Vs Isabela Cultural Corporation (ICC)Victor LimNo ratings yet

- Module 21 P Fessional Responsi I ES: RO B LitiDocument2 pagesModule 21 P Fessional Responsi I ES: RO B LitiHazem El SayedNo ratings yet

- Tax Case No 33-35Document8 pagesTax Case No 33-35Jeah N MelocotonesNo ratings yet

- Revenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeDocument5 pagesRevenue Regulations No. 05-99: Requirements For Deductibility of Bad Debts From Gross IncomeelmersgluethebombNo ratings yet

- Taxation Law AssignmentDocument23 pagesTaxation Law AssignmentTauniño Jillandro Gamallo NeriNo ratings yet

- 2022A HKTF - T1 - Overview - AnsDocument4 pages2022A HKTF - T1 - Overview - Ans周小荷No ratings yet

- CIR Vs Bank of CommerceDocument10 pagesCIR Vs Bank of CommerceShane Fernandez JardinicoNo ratings yet

- Adv. Mallya Oscar, F.k.... Tax LawDocument7 pagesAdv. Mallya Oscar, F.k.... Tax LawOscar MallyaNo ratings yet

- TAX Digests - Prescription of RemediesDocument6 pagesTAX Digests - Prescription of RemediesFrancisCarloL.FlameñoNo ratings yet

- Ca LD Limi A I N or He R An Ind Dual T Xpaye R: o T o T Yea IVI A 'SDocument1 pageCa LD Limi A I N or He R An Ind Dual T Xpaye R: o T o T Yea IVI A 'SZeyad El-sayedNo ratings yet

- Eq o o o o Eq: ND RDDocument8 pagesEq o o o o Eq: ND RDEl-Sayed MohammedNo ratings yet

- Worksheet 5Document1 pageWorksheet 5El-Sayed Mohammed100% (1)

- VbgerettttttttttttttttttttttttttttttttttttttttttttttfdsssssssssssssssssssgDocument1 pageVbgerettttttttttttttttttttttttttttttttttttttttttttttfdsssssssssssssssssssgEl-Sayed MohammedNo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- VGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGDocument1 pageVGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGEl-Sayed MohammedNo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- M ULE E: OD D Btor-Creditor RelationshipsDocument2 pagesM ULE E: OD D Btor-Creditor RelationshipsZeyad El-sayedNo ratings yet

- Alex Act 2 Sc1 Site 2Document5 pagesAlex Act 2 Sc1 Site 2El-Sayed MohammedNo ratings yet

- IMP BooksDocument13 pagesIMP BooksEl-Sayed MohammedNo ratings yet

- Ghewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbDocument1 pageGhewrefgafewekqpergkafklefdbf Fdfbdsamsldfbmfdel Elrwetkgio3P (Regfb Efdgfbfndfskwl Erfgfbgjrewkl 3Retgero3EwrpgfbEl-Sayed MohammedNo ratings yet

- Module 21 Professional ResponsibilitiesDocument2 pagesModule 21 Professional ResponsibilitiesEl-Sayed MohammedNo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- 2 Eptanc: C Offer C - Acc eDocument3 pages2 Eptanc: C Offer C - Acc eHazem El SayedNo ratings yet

- Agency: MU Iple-Choice Answ RSDocument2 pagesAgency: MU Iple-Choice Answ RSZeyad El-sayedNo ratings yet

- MCQ PRDocument1 pageMCQ PREl-Sayed MohammedNo ratings yet

- Module 21 P Fessional Responsi I ES: RO B LitiDocument2 pagesModule 21 P Fessional Responsi I ES: RO B LitiHazem El SayedNo ratings yet

- 2 Eptanc: C Offer C - Acc eDocument3 pages2 Eptanc: C Offer C - Acc eHazem El SayedNo ratings yet

- Scan 0089Document2 pagesScan 0089Anonymous JqimV1ENo ratings yet

- DDSFDFGHJKLJHKLKJHGJKHGKHGJKDocument1 pageDDSFDFGHJKLJHKLKJHGJKHGKHGJKEl-Sayed MohammedNo ratings yet

- Oxs CASDWE213Document1 pageOxs CASDWE213El-Sayed MohammedNo ratings yet

- Mjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFDocument2 pagesMjds ALKDSFDEQWEWFDEQWEWEQWEFEQWEFEl-Sayed MohammedNo ratings yet

- Scan 0093Document3 pagesScan 0093Zeyad El-sayedNo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'El-Sayed MohammedNo ratings yet

- Tax Planning and Strategic ManagDocument2 pagesTax Planning and Strategic ManagEl-Sayed MohammedNo ratings yet

- Professional Responsibilities: Requ RedDocument2 pagesProfessional Responsibilities: Requ RedEl-Sayed MohammedNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- Taxes: Gift and EstateDocument3 pagesTaxes: Gift and EstateZeyad El-sayedNo ratings yet

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1ENo ratings yet

- CFS Session 1 Choosing The Firm Financial StructureDocument41 pagesCFS Session 1 Choosing The Firm Financial Structureaudrey gadayNo ratings yet

- JF 2 7 ProjectSolution Functions 8pDocument8 pagesJF 2 7 ProjectSolution Functions 8pNikos Papadoulopoulos0% (1)

- 0053 SoftDocument344 pages0053 SoftManish KumarNo ratings yet

- Ethics in Marketing - UNIT-2Document27 pagesEthics in Marketing - UNIT-2kush mandaliaNo ratings yet

- Complaint LettersDocument3 pagesComplaint LettersPriyankkaa BRNo ratings yet

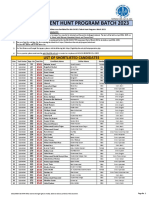

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- Answer Sheet Week 7 & 8Document5 pagesAnswer Sheet Week 7 & 8Jamel Khia Albarando LisondraNo ratings yet

- Combizell MHEC 40000 PRDocument2 pagesCombizell MHEC 40000 PRToXiC RabbitsNo ratings yet

- The Birds of Pulicat Lake Vs Dugarajapatnam PortDocument3 pagesThe Birds of Pulicat Lake Vs Dugarajapatnam PortVaishnavi JayakumarNo ratings yet

- SBI's Microfinance InitiativesDocument3 pagesSBI's Microfinance InitiativesSandeep MishraNo ratings yet

- Short Term FinancingDocument4 pagesShort Term FinancingMd Ibrahim RubelNo ratings yet

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainNo ratings yet

- SUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoDocument4 pagesSUBJECT: Accounting 15 DESCIPTIVE TITLE: Accounting For Business Combination Instructor: Alfredo R. CabisoPrince CalicaNo ratings yet

- Order RecieptDocument1 pageOrder RecieptAnUbHaV TiWaRiNo ratings yet

- CHAPTER 7:, 8, & 9 Group 3Document25 pagesCHAPTER 7:, 8, & 9 Group 3MaffyFelicianoNo ratings yet

- TNPSC Group 1,2,4,8 VAO Preparation 1Document5 pagesTNPSC Group 1,2,4,8 VAO Preparation 1SakthiNo ratings yet

- Prelims Case Analysis AnswersDocument2 pagesPrelims Case Analysis AnswersGirl langNo ratings yet

- Barandon Vs FerrerDocument3 pagesBarandon Vs FerrerCorina Jane Antiga100% (1)

- Tenancy Contract 1.4 PDFDocument2 pagesTenancy Contract 1.4 PDFAnonymous qKLFm7e5wgNo ratings yet

- Case 1 - Masters and Associates - Sasot GroupDocument10 pagesCase 1 - Masters and Associates - Sasot GroupRobin Venturina100% (1)

- Legal and Illegal Earning in The Light of Quran and HadithDocument12 pagesLegal and Illegal Earning in The Light of Quran and HadithComm SofianNo ratings yet

- Tugas BPFDocument2 pagesTugas BPFRichard JapardiNo ratings yet

- Labour Law ProjectDocument16 pagesLabour Law ProjectDevendra DhruwNo ratings yet

- Customer Master - CIN Details Screen ChangesDocument4 pagesCustomer Master - CIN Details Screen Changespranav kumarNo ratings yet