Professional Documents

Culture Documents

Programme For Syllabus 2016

Uploaded by

Good Win RockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Programme For Syllabus 2016

Uploaded by

Good Win RockCopyright:

Available Formats

THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

(STATUTORY BODY UNDER AN ACT OF PARLIAMENT)

INTERMEDIATE AND FINAL EXAMINATION TIME TABLE & PROGRAMME – DECEMBER 2018

PROGRAMME FOR SYLLABUS 2016

ATTENTION: INTERMEDIATE & FINAL EXAMINATION (DECEMBER – 2018 TERM) WILL BE HELD ON ALTERNATE DATES FOR EACH GROUP.

INTERMEDIATE FINAL

Day & Date (Time: 2.00 P.M. to 5.00 P.M.) (Time: 2.00 P.M. to 5.00 P.M.)

(Group – I) (Group – II) (Group – III) (Group – IV)

Monday,

Financial Accounting (P-05) ------------------- Corporate Laws & Compliance (P-13) -------------------

10th December, 2018

Tuesday, Operations Management & Strategic

------------------- ------------------- Corporate Financial Reporting (P-17)

11th December, 2018 Management (P-09)

Wednesday,

Laws & Ethics (P-06) ------------------- Strategic Financial Management (P-14) -------------------

12th December, 2018

Thursday, Cost & Management Accounting and

------------------- ------------------- Indirect Tax Laws & Practice (P-18)

13th December, 2018 Financial Management (P-10)

Friday,

Direct Taxation (P-07) ------------------- Strategic Cost Management – Decision Making (P-15) -------------------

14th December, 2018

Saturday,

------------------- Indirect Taxation (P-11) ------------------- Cost & Management Audit (P-19)

15th December, 2018

Sunday,

Cost Accounting (P-08) ------------------- Direct Tax Laws and International Taxation (P-16) -------------------

16th December, 2018

Monday, Strategic Performance Management and Business

------------------- Company Accounts & Audit (P-12) -------------------

17th December, 2018 Valuation (P-20)

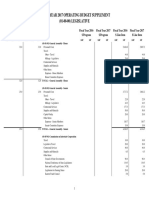

EXAMINATION FEES

Group (s) Final Examination Intermediate Examination

One Group (Inland Centres) `1400/- `1200/-

(Overseas Centres) US $ 100 US $ 90

Two Groups (Inland Centres) `2800/- `2400/-

(Overseas Centres) US $ 100 US $ 90

1. Application Forms for Intermediate and Final Examination has to be filled up through online only and fees will be accepted through online mode only (including Payfee Module of IDBI Bank). No Offline form and DD

payment will be accepted for domestic candidate.

2. STUDENTS OPTING FOR OVERSEAS CENTRES HAVE TO APPLY OFFLINE AND SEND DD ALONGWITH THE FORM.

3. (a) Students can login to the website www.icmai.in and apply online through payment gateway by using Credit/Debit card or Net banking.

(b) Students can also pay their requisite fee through pay-fee module of IDBI Bank.

4. Last date for receipt of Examination Application Forms is 10 th October, 2018.

5. The provisions of direct tax laws and indirect tax laws, as amended by the Finance Act, 2017, including notifications and circulars issued up to 31 st May , 2018, are applicable for December 2018 term of examination for the

Subjects Direct Taxation, Indirect Taxation (Intermediate) , Direct Tax laws and International Taxation and Indirect Tax laws & Practice (Final) under Syllabus 2016. The relevant assessment year is 2018-19. For statutory

updates and amendments please refer to http://icmai.in/studentswebsite/Syl-2016.php

6. Companies (Cost Records and Audit) Rules, 2014 as amended till 20th Dec 2017 is applicable for December 2018 examination for Paper 12- Company Accounts and Audit (Intermediate) and Paper 19-Cost and Management

Audit (Final) under Syllabus 2016 for December 2018 term examination. Please also refer to http://icmai.in/upload/Students/Circulars/Relevant-Info-December 2018.pdf

7. The provisions of the Companies Act 2013 are applicable for Paper 6- Laws and Ethics (Intermediate) and Paper 13- Corporate Laws and Compliance (Final) under Syllabus 2016 to the extent notified by the Government

up to 31st May, 2018 for December 2018 term of examination.

8. For Applicability of IND_AS and amended AS for paper 5 –Financial Accounting and Paper 12-Company Accounts and Audit (Intermediate) and Paper 17-Corporate Financial Reporting (Final) refer to relevant circular in

website for December 2018 term examination. Please refer to http://icmai.in/studentswebsite/Syl-2016.php

9. Pension Fund Regulatory and Development Authority Act, 2013 is being included in Paper 6- Laws and Ethics (Intermediate) and Insolvency and Bankruptcy Code 2016 is being included in Paper 13- Corporate Laws and

Compliance (Final) under Syllabus 2016 for December 2018 term of examination. For further clarification visit our website www.icmai.in

10. Examination Centres: Adipur-Kachchh (Gujarat), Agartala, Agra, Ahmedabad, Akurdi, Allahabad, Asansol, Aurangabad, Bangalore, Baroda, Berhampur (Ganjam), Bhilai, Bhilwara, Bhopal, Bewar City(Rajasthan),

Bhubaneswar, Bilaspur, Bokaro, Calicut, Chandigarh, Chennai, Coimbatore, Cuttack, Dehradun, Delhi, Dhanbad, Duliajan (Assam), Durgapur, Ernakulam, Erode, Faridabad, Ghaziabad, Guntur, Guwahati, Haridwar,

Hazaribagh, Howrah, Hyderabad, Indore, Jaipur, Jabalpur, Jalandhar, Jammu, Jamshedpur, Jodhpur, Kalyan, Kannur, Kanpur, Kolhapur, Kolkata, Kota, Kottakkal (Malappuram), Kottayam, Lucknow, Ludhiana,

Madurai, Mangalore, Mumbai, Mysore, Nagpur, Naihati, Nasik, Nellore, Neyveli, Noida, Palakkad, Panaji (Goa), Patiala, Patna, Pondicherry, Port Blair, Pune, Raipur, Rajahmundry, Ranchi, Rourkela, Salem, Sambalpur,

Shillong, Siliguri, Solapur, Srinagar, Surat, Thrissur, Tiruchirapalli, Tirunelveli, Trivandrum, Udaipur, Vapi, Vashi, Vellore, Vijayawada, Vindhyanagar, Waltair and Overseas Centres at Bahrain, Dubai and Muscat.

11. A candidate who is fulfilling all conditions specified for appearing in examination will only be allowed to appear for examination.

12. Probable date of publication of result: Inter & Final – 21st February, 2019.

* For any examination related query, please contact exam.helpdesk@icmai.in

L. Gurumurthy

Secretary (Acting)

You might also like

- Freight Forwarding Revenues World Summary: Market Values & Financials by CountryFrom EverandFreight Forwarding Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- InterDocument1 pageInterParameswaran T.N.No ratings yet

- Inter Final Dec2020 PDFDocument1 pageInter Final Dec2020 PDFcherry008No ratings yet

- Inter Final J19Document1 pageInter Final J19Apoorv GawadeNo ratings yet

- J20 If Reschedule PDFDocument1 pageJ20 If Reschedule PDFJack kumarNo ratings yet

- Exam Notification RecheduleDocument1 pageExam Notification Rechedulepuda worksNo ratings yet

- Dec2023 Inter Final Exam NotificationDocument1 pageDec2023 Inter Final Exam NotificationMadhuriNo ratings yet

- J21 InterFinalDocument1 pageJ21 InterFinalAnkitKumarNo ratings yet

- Exam Notification RecheduleDocument1 pageExam Notification RecheduletejaminnikantiNo ratings yet

- Inter Final Exam Notification Dec 22Document1 pageInter Final Exam Notification Dec 22Julakanti AjayNo ratings yet

- J20 If Reschedule 2106Document1 pageJ20 If Reschedule 2106girish.nara4967No ratings yet

- Programme For Syllabus 2016 Programme For Syllabus 2022 Programme For Syllabus 2016 Programme For Syllabus 2022Document1 pageProgramme For Syllabus 2016 Programme For Syllabus 2022 Programme For Syllabus 2016 Programme For Syllabus 2022pendurthi ravi kumarNo ratings yet

- (Statutory Body Under An Act of Parliament) CMA Bhawan, 12, Sudder Street, Kolkata - 700 016, IndiaDocument2 pages(Statutory Body Under An Act of Parliament) CMA Bhawan, 12, Sudder Street, Kolkata - 700 016, IndiaRifa Naz Fathy ParavathNo ratings yet

- Jun 2024 Inter Final Exam NotificationDocument1 pageJun 2024 Inter Final Exam Notificationfscdeep6No ratings yet

- Ben MurrayCapital Expenditure Forecast TemplateDocument27 pagesBen MurrayCapital Expenditure Forecast TemplateMuhammad Reza AlkhawarismiNo ratings yet

- J.N.T.U.H. College of Engineering, Hyderabad (Autonomous) : ACADEMIC CALENDAR 2018-2019Document1 pageJ.N.T.U.H. College of Engineering, Hyderabad (Autonomous) : ACADEMIC CALENDAR 2018-2019Bhavya BinnuNo ratings yet

- Programme: Written: M.B.A. (CBCS) 1st SEM. Exam WINTER 2018Document3 pagesProgramme: Written: M.B.A. (CBCS) 1st SEM. Exam WINTER 2018Riteish JadhavNo ratings yet

- Risk Management Fundamental: ISS4008-Audit Teknologi Informasi Ganjil 2018/2019Document28 pagesRisk Management Fundamental: ISS4008-Audit Teknologi Informasi Ganjil 2018/2019Anonymous 1p49q0HV87No ratings yet

- IT-Return-Statistics 18-19Document88 pagesIT-Return-Statistics 18-19ObamaNo ratings yet

- Pakistan Institute of Public Finance Accoutants: Schedule Winter Exam-2020Document2 pagesPakistan Institute of Public Finance Accoutants: Schedule Winter Exam-2020IbrahimGorgageNo ratings yet

- BUSS 102 AssignmentDocument11 pagesBUSS 102 AssignmentDr. Mohammad Noor AlamNo ratings yet

- Prices and Supply of Construction Materials in Iloilo Remain StableDocument7 pagesPrices and Supply of Construction Materials in Iloilo Remain Stableherbert palacioNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- October 20, 2016Document74 pagesOctober 20, 2016SriKadimiNo ratings yet

- All Presentations and Their InfoDocument5 pagesAll Presentations and Their Infopamela17desaiNo ratings yet

- Business PowerpointDocument24 pagesBusiness PowerpointNadia Zahira Putri RachmadiNo ratings yet

- Fiscal Year 2017 Operating Budget Supplement (01-00-00) LEGISLATIVEDocument70 pagesFiscal Year 2017 Operating Budget Supplement (01-00-00) LEGISLATIVEKevinOhlandtNo ratings yet

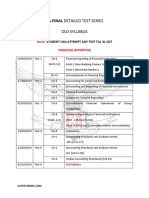

- CA Final Schedule - CA Test SeriesDocument9 pagesCA Final Schedule - CA Test SeriesRahul SinglaNo ratings yet

- Medium Term Budget Estimates For Service Delivery' (Green Book) 2017-20Document3 pagesMedium Term Budget Estimates For Service Delivery' (Green Book) 2017-20Omer MubbasherNo ratings yet

- Ipo02018 19 PDFDocument181 pagesIpo02018 19 PDFbhavya mishraNo ratings yet

- The Information Listed Below Refers To The Employees of LemonicaDocument1 pageThe Information Listed Below Refers To The Employees of LemonicaMuhammad ShahidNo ratings yet

- Strategic Trade Policy Framework - Ministry of Commerce - Government of PakistanDocument6 pagesStrategic Trade Policy Framework - Ministry of Commerce - Government of PakistanMudassar ManzoorNo ratings yet

- PBC List 22.11.2022 - Huawei Intérim 2022Document35 pagesPBC List 22.11.2022 - Huawei Intérim 2022Selmane DjeddaNo ratings yet

- Week 1: Week Subject Topic/S Materials To Be Used Concept PracticeDocument6 pagesWeek 1: Week Subject Topic/S Materials To Be Used Concept PracticeAngelica Nicole TamayoNo ratings yet

- The Following Data Relate To The Operations of Slick SoftwareDocument2 pagesThe Following Data Relate To The Operations of Slick SoftwareAmit PandeyNo ratings yet

- The Following Data Relate To The Operations of Slick SoftwareDocument2 pagesThe Following Data Relate To The Operations of Slick SoftwareAmit PandeyNo ratings yet

- Ca-Final Detailed Test Series: Old SyllabusDocument9 pagesCa-Final Detailed Test Series: Old SyllabusbheemNo ratings yet

- Sec14 SACS SoftwareDocument40 pagesSec14 SACS SoftwareS Bharat SelvamNo ratings yet

- City Government of Tacloban - Annual Procurement Plan For FY 2019Document44 pagesCity Government of Tacloban - Annual Procurement Plan For FY 2019Li MonNo ratings yet

- Annual Performance Report STP UnitsDocument8 pagesAnnual Performance Report STP Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNo ratings yet

- List of Semi Expendable ItemsDocument47 pagesList of Semi Expendable ItemsLeandro BambeNo ratings yet

- Coats GRI Index 2020Document7 pagesCoats GRI Index 2020Risty Amalia NurfauziahNo ratings yet

- April 2020 Examinations UG PG FinalTime TableDocument19 pagesApril 2020 Examinations UG PG FinalTime TablePanthalaraja JagaaNo ratings yet

- AAFR Topic-Wise Test Regards Awais ALIDocument34 pagesAAFR Topic-Wise Test Regards Awais ALIUmmar FarooqNo ratings yet

- Programme For Syllabus 2008 Intermediate Final FoundationDocument3 pagesProgramme For Syllabus 2008 Intermediate Final Foundationguest1No ratings yet

- International Courses TIMETABLE 2018 19 May22th Upd II BMDocument4 pagesInternational Courses TIMETABLE 2018 19 May22th Upd II BMludoscoutNo ratings yet

- Urban Administration and Development Department Rewa Madhya Pradesh - 2032018113548416 PDFDocument45 pagesUrban Administration and Development Department Rewa Madhya Pradesh - 2032018113548416 PDFAkshat MishraNo ratings yet

- Advertisement For The Post of AM (Materials), HR, R and D and Legal.Document12 pagesAdvertisement For The Post of AM (Materials), HR, R and D and Legal.AbhishekNo ratings yet

- Fee Demand Slip Receipt PDFDocument1 pageFee Demand Slip Receipt PDFmaniNo ratings yet

- Ca-Ipcc Detailed Test Series Syllabus: (Old Course) AccountingDocument7 pagesCa-Ipcc Detailed Test Series Syllabus: (Old Course) AccountingDhivyaNo ratings yet

- Exam History Transcript 2536626714457185983Document2 pagesExam History Transcript 2536626714457185983TrevorNo ratings yet

- Executive Summary: - NATIONAL HIGHWAY AUTHORITY (NHA)Document12 pagesExecutive Summary: - NATIONAL HIGHWAY AUTHORITY (NHA)Muhammad Wasif QureshiNo ratings yet

- Company S Condensed Income Statement For 2016 and December 31 2016Document1 pageCompany S Condensed Income Statement For 2016 and December 31 2016Taimur TechnologistNo ratings yet

- The Production Supervisor of The Machining Department For Rodriguez CompanyDocument1 pageThe Production Supervisor of The Machining Department For Rodriguez CompanyMuhammad ShahidNo ratings yet

- ACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationDocument8 pagesACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationAhsan MasoodNo ratings yet

- SAP IntroductionDocument51 pagesSAP IntroductionankitavengNo ratings yet

- SECTION E - 23 ArchidplyDocument24 pagesSECTION E - 23 ArchidplyazharNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document13 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Rashtrasant Tukadoji Maharaj Nagpur University: (181) - : Programme (Written) :-Day Date Subject PaperDocument1 pageRashtrasant Tukadoji Maharaj Nagpur University: (181) - : Programme (Written) :-Day Date Subject PaperVijayanNagalkarNo ratings yet

- All Report MHRD National Institutional Ranking Framework NIRF 2018Document6 pagesAll Report MHRD National Institutional Ranking Framework NIRF 2018Yash ChaudharyNo ratings yet

- Arrays of Pointers To FunctionsDocument6 pagesArrays of Pointers To FunctionsGood Win RockNo ratings yet

- Lo 1Document23 pagesLo 1Good Win RockNo ratings yet

- 2006 HandbookDocument42 pages2006 HandbookDyah Putri Ayu DinastyarNo ratings yet

- Union Int Int Union: ReturnDocument4 pagesUnion Int Int Union: ReturnGood Win RockNo ratings yet

- Handbook of Microbial Biofertilizers: Click HereDocument5 pagesHandbook of Microbial Biofertilizers: Click HereGood Win RockNo ratings yet

- Role of BIOFERTILIZERDocument6 pagesRole of BIOFERTILIZERGood Win RockNo ratings yet

- J. Biol. Chem.-1944-Schwimmer-361-6Document7 pagesJ. Biol. Chem.-1944-Schwimmer-361-6Good Win RockNo ratings yet

- Std12 Chem 2Document405 pagesStd12 Chem 2RajNo ratings yet

- C H P T E R: 1.1 Introduction-What Is A Computer?Document17 pagesC H P T E R: 1.1 Introduction-What Is A Computer?Good Win RockNo ratings yet

- Computer Programming Lecture Notes PDFDocument134 pagesComputer Programming Lecture Notes PDFAnik DuttaNo ratings yet

- Cell Biology PDFDocument13 pagesCell Biology PDFGood Win RockNo ratings yet

- Text Book of Engineering Mathematics. Volume IDocument377 pagesText Book of Engineering Mathematics. Volume ISupermen Ngemut Permen94% (18)

- Include Include Include Include Include Struct Char Char Float Void Void Void Void Void Void Char Int Int Int CharDocument6 pagesInclude Include Include Include Include Struct Char Char Float Void Void Void Void Void Void Char Int Int Int CharGood Win RockNo ratings yet

- C Snake GameDocument8 pagesC Snake GameVishvas PatelNo ratings yet

- RecordDocument1 pageRecordGood Win RockNo ratings yet

- Tata Steel 2015 16 PDFDocument300 pagesTata Steel 2015 16 PDFAman PrasasdNo ratings yet

- Decision Areas in Financial ManagementDocument15 pagesDecision Areas in Financial ManagementSana Moid100% (3)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- Monetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFDocument81 pagesMonetary Policy and Commercial Banks in Ethiopia: Credit Creation RolePDFbereket nigussieNo ratings yet

- Thank You For Paying On-Time: Basic Housing Solutions, IncDocument1 pageThank You For Paying On-Time: Basic Housing Solutions, IncMarcelo AnfoneNo ratings yet

- DeliveryHeroSE Annual Financial Statement FinalDocument108 pagesDeliveryHeroSE Annual Financial Statement FinalimranNo ratings yet

- Foreign Direct InvestmentDocument16 pagesForeign Direct InvestmentKuz StifflerNo ratings yet

- Case Study 5Document3 pagesCase Study 5Farhanie NordinNo ratings yet

- The Bse (Corporatisation and Demutualisation) SCHEME, 2005 Logo Stock ExchangeDocument28 pagesThe Bse (Corporatisation and Demutualisation) SCHEME, 2005 Logo Stock ExchangeBhavesh YadavNo ratings yet

- Contoh Laporan KeuanganDocument4 pagesContoh Laporan KeuanganDiva Nadya ArdhetaNo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- Logos of Central Bank of The Philippines and Bangko Sentral NG PilipinasDocument16 pagesLogos of Central Bank of The Philippines and Bangko Sentral NG Pilipinaslaerham50% (2)

- 'KS22936'20201214Document1 page'KS22936'20201214Aakash PrajapatiNo ratings yet

- Top 20 Corporate Finance Interview Questions (With Answers) PDFDocument19 pagesTop 20 Corporate Finance Interview Questions (With Answers) PDFDipak MahalikNo ratings yet

- Relative Purchasing Power Parity Relative Purchasing Power ParityDocument2 pagesRelative Purchasing Power Parity Relative Purchasing Power ParityMohammad HammoudehNo ratings yet

- The Economics of Commercial Real Estate PreleasingDocument33 pagesThe Economics of Commercial Real Estate PreleasingSuhas100% (1)

- Account Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham NamdevNo ratings yet

- LECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Document8 pagesLECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Veejay SalazarNo ratings yet

- Project Case 9-30 Master BudgetDocument6 pagesProject Case 9-30 Master Budgetleizalm29% (7)

- Sustainability Reporting Strategy: Creating Impact Through TransparencyDocument6 pagesSustainability Reporting Strategy: Creating Impact Through TransparencyakashNo ratings yet

- Triangle Chart Patterns and Day Trading StrategiesDocument10 pagesTriangle Chart Patterns and Day Trading Strategiespeeyush24No ratings yet

- Digests Art 1250-1279Document5 pagesDigests Art 1250-1279Gino LascanoNo ratings yet

- The Genesis of Bank Deposits (W. F. Crick)Document13 pagesThe Genesis of Bank Deposits (W. F. Crick)João Henrique F. VieiraNo ratings yet

- Figlewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesDocument5 pagesFiglewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesJermaine R BrownNo ratings yet

- European Salary Survey 2017Document48 pagesEuropean Salary Survey 2017Alexey BelichenkoNo ratings yet

- Indian Aluminium IndustryDocument6 pagesIndian Aluminium IndustryAmrisha VermaNo ratings yet

- Account StatementDocument3 pagesAccount StatementSaeed AnwarNo ratings yet

- Online Request Form For Uco Home LoanDocument2 pagesOnline Request Form For Uco Home Loanbiswajit sarangiNo ratings yet

- The Corporate Director's Guide ESG OversightDocument19 pagesThe Corporate Director's Guide ESG OversightJenny Ling Lee Mei A16A0237No ratings yet

- Bank of The South An Alternative To The IMF World BankDocument45 pagesBank of The South An Alternative To The IMF World BankCADTMNo ratings yet