Professional Documents

Culture Documents

Financial Disasters PPTT 2222

Uploaded by

Rohit Jain0 ratings0% found this document useful (0 votes)

18 views2 pagesFinancial Disasters

Original Title

Financial Disasters Pptt 2222

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Disasters

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views2 pagesFinancial Disasters PPTT 2222

Uploaded by

Rohit JainFinancial Disasters

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

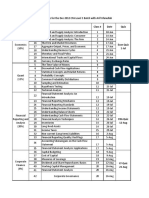

FRM Level 1 | Financial Disasters ASWINI BAJAJ

Chase Manhattan Bank & Drysdale Securities Barings

Nick Leeson, a junior trader, took speculative derivative position in order

Drysdale borrow $300M unsecured funds on capital of $20 million . Made

recoup prior trading losses, which eventually resulted into more losses. Total

investments in bonds; value eventually declined. Unable to repay borrowings;

losses of $1.2 Billion.

forced into Bankruptcy. Chase has brokered these borrowings and hence had

How did it happen?

to absorb losses.

➢ Nick used two strategies – sold straddles on the Nikkei 225 and

How did it happen?

arbitraging price differences on Nikkei 225 futures contracts

➢ Chase failed to detect the unauthorized position; did not believe that the

➢ Earthquake hit Japan, Nikkei plunged, creating huge losses on these

firm’s capital was at risk.

strategies.

➢ Inexperienced managers of Chase did not correctly interpret borrowing

➢ Lesson was in charge of settlements operations which allowed him to

agreements that made chase responsive for payments due.

influence back office employees to hide his trading losses

➢ Drysdale exploited a flaw in computing value of collateral (collateral valued

➢ Lesson was responsible for reporting to multiple managers in a

without considering accrued interest)

convoluted organizational structure, this situation created ambiguity.

➢ Chase did not notice in the contract that it would be held responsible for

➢ Baring lacked risk management oversight, that would have monitored

any payments due.

positions, strategies and risk.

Lesson learned

Lesson learned

➢ Develop accurate methods for evaluating value of collateral

➢ Need to separate the control groups from trading groups

➢ Seek the approval of risk control function when issuing funds.

➢ Regulators across the world also became aware of risk management.

Sumitomo

Yasuo Hamanaka attempted to corner the copper market in a classic market Allied Irish Bank

manipulation strategy. John Rusnak hid $691M losses from management by bullying back office

How did it happen ? employees into not following-up on trade confirmations for imaginary

➢ Yasuo established a dominant long position in futures and simultaneously trades. He used his dominant personality to manipulate back office function

purchased large quantities of physical copper. and avoided reporting of fake covered trade.

➢ As delivery approached, the party with the short position would find little How did it happen?

physical copper available for delivery and would be forced to either pay a ➢ John Rusnak hid losses from management.

large premium for physical copper or unwind its short position. ➢ He made strategies look less risky

➢ Severe losses would be unavoidable if copper prices fell. ➢ These strategies involved very large currency positions.

➢ Low degree of supervision and broad powers allowed Hamanka to ➢ He was able to hide these trading activities from management by

implement his fraudulent trading strategies without detection. creating fake trades to offset his real trades.

➢ This created a high degree of operational risk, which could have been ➢ He made a point of reporting only modest gains so to not raise red flags.

reduced by strong internal control. ➢ He disguised his actions from management by entering false positions in

➢ Lack of supervision allowed Hanamaka to keep two sets of trading books, the firm’s system for calculating risk measures such as value at risk (VaR)

one of which reported large profits , other set recorded huge losses and Conclusion

was secret. ➢ AIB’s management was inexperienced and was unable to figure out

Lessons learned Rusnak’s trading activates

➢ Internal control and supervision should be strong ➢ Suspicions trades were ignored by the management.

➢ Large transactions should have multiple approvals by senior management.

FRM Level 1 | Financial Disasters ASWINI BAJAJ

Banker’s Trust Societe Generale

Procter & Gamble (P&G) and Gibson greetings sought the assistance of Bankers Societe Generale’s junior traders, Jerome Kerviel, was involved in

Trust (BT) to help them reduce finding costs, BT used derivative trades which unauthorized trading activity that resulted in losses of $7.1 billion. The

promised the two companies a high probability small reduction in funding costs incident damaged the reputation of Societe Generale and required the bank

in exchange for a low- probability, large loss. Unfortunately these trades to raise additional funds to meet capital needs.

resulted is significant losses. How did it happen ?

How did it happen? ➢ Jerome Kerviel created fake transaction to hide the size and riskiness of

➢ Derivative structures was intentionally made complex to prevent P&G and his unauthorized positions.

Gibson from fully understanding the trade values and risks that were ➢ Kerviel used his knowledge of control personnel confirming timing to

involved. cancel the trade right before any confirmations took place

➢ The structures were not comparable to other company derivative trades ➢ Given the need to continuously replace fake trades with new ones, he

making it impossible to get a competitive quote. created close to 1,000 fictitious trades

➢ P&G and Gibson were misled into thinking that the structures were tailored ➢ Incorrect handling of trade cancellations, lack of proper supervision, and

to meet their individual needs inability of bank’s trading system to consider gross positions led to this.

➢ They realized that they had been misled after discovering that they had ➢ The system was not set up to flag any unusual levels of trade

suffered huge losses. As a result, the two companies sued BT. Bankers Trust cancellations; banks systems was only set up to evaluate net positions

scandal severely damaged its reputation and forced its CEO to resign instead of both net and gross positions.

Lesson learned ➢ Reason - Weak reporting system for collateral and cash accounts and the

➢ The importance of matching trades with a client’s needs and providing price lack of investigation into unexpected reported trading gains.

quotes that are independent from the front office. Lesson learned

➢ The importance of exercising caution with any form of communication that ➢ Traders who perform large amount of trade cancellations should be

could eventually be made public. flagged.

➢ Tighter controls in situations involving new or temporary managers.

Kidder Peabody ➢ Control personnel should not assume the independence of trading

Joseph Jett misreported gain of $350M. This event did not result in actual loss assistant’s action.

to the company but triggered a loss of confidence in the management of KP ➢ Mandatory vacation rules should be enforced.

How did it happen? ➢ Requirements for collateral and cash reports must be monitored

➢ Joseph Jett, misreported a series of trades which allowed him to report ➢ Profit and loss activity that is outside reasonable expectations must be

substantial artificial profits. investigated.

➢ Jett was able to report profits since the computer system used to report

government bond trading activity did not account for a forward contract’s

present value.

ASWINI BAJAJ

Lesson learned CA, CFA, CS, CFA,FRM, CAIA, CCRA, CIRA, CIIB, AIM

➢ Importance of investing large profits from unknown trading strategies.

bit.ly/aswinibajaj_youtube +91 98311 49876 | +91 98304 97377 www.aswinibajaj.com

You might also like

- NIOSDocument1 pageNIOSRohit JainNo ratings yet

- IC JOSHI Meteorology 4th EditionDocument64 pagesIC JOSHI Meteorology 4th EditionRohit Joshi83% (6)

- 1: Callsigns: CommunicationsDocument5 pages1: Callsigns: CommunicationsRohit Jain100% (1)

- Simplilearn-Batch DetailsDocument1 pageSimplilearn-Batch DetailsRohit JainNo ratings yet

- GE 31 July 2019Document17 pagesGE 31 July 2019Rohit JainNo ratings yet

- Tips To Get The Right Answer in FRM ExamDocument1 pageTips To Get The Right Answer in FRM ExamRohit JainNo ratings yet

- Fly ClubDocument6 pagesFly ClubAbrar ShariefNo ratings yet

- FRM QB LinkDocument1 pageFRM QB LinkRohit JainNo ratings yet

- Subject - CPL - ME (IR) 185 Hours On Single Engine & 15 Hours On Multi Engine at CAADocument2 pagesSubject - CPL - ME (IR) 185 Hours On Single Engine & 15 Hours On Multi Engine at CAAAakash AtaleNo ratings yet

- FRM QB LinkDocument1 pageFRM QB LinkRohit JainNo ratings yet

- FRM Part 1 Self Study Sequence FinalDocument9 pagesFRM Part 1 Self Study Sequence FinalPrabhakar SharmaNo ratings yet

- Tips To Get The Right Answer in FRM ExamDocument1 pageTips To Get The Right Answer in FRM ExamRohit JainNo ratings yet

- SopDocument1 pageSopRohit JainNo ratings yet

- Fly ClubDocument6 pagesFly ClubAbrar ShariefNo ratings yet

- Reading Data2Document8 pagesReading Data2Rohit JainNo ratings yet

- Testing QBDocument1 pageTesting QBRohit JainNo ratings yet

- Pilots and ATC Communications PDFDocument24 pagesPilots and ATC Communications PDFa320No ratings yet

- Testing QuesbankDocument1 pageTesting QuesbankRohit JainNo ratings yet

- IGRUADocument1 pageIGRUARohit JainNo ratings yet

- Pre ATPL Maths and Physics Revision Course-1Document23 pagesPre ATPL Maths and Physics Revision Course-1filzovoc90% (10)

- Pre ATPL Maths and Physics Revision Course-1Document23 pagesPre ATPL Maths and Physics Revision Course-1filzovoc90% (10)

- Cessna 172R Questions AnsweredDocument6 pagesCessna 172R Questions AnsweredRohit JainNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Depository ServicesDocument15 pagesDepository ServicesNaga Mani MeruguNo ratings yet

- AFAR - CUP 2019 ANSWERSDocument9 pagesAFAR - CUP 2019 ANSWERSTakuriNo ratings yet

- Working Paper 173 PDFDocument40 pagesWorking Paper 173 PDFRam IyerNo ratings yet

- Chapter TwoDocument3 pagesChapter TwoBạn Hữu Nhà ĐấtNo ratings yet

- ALI Top 100 SH - 6 30 18 PDFDocument8 pagesALI Top 100 SH - 6 30 18 PDFMarie MNo ratings yet

- Introduction To Asset Pricing ModelDocument36 pagesIntroduction To Asset Pricing ModelMarym MalikNo ratings yet

- 1343 Kaustubh IFMDocument11 pages1343 Kaustubh IFMKaustubh ShilkarNo ratings yet

- Non-Deposit Taking NBFIs Business RulesDocument24 pagesNon-Deposit Taking NBFIs Business RulesPrince McGershonNo ratings yet

- ArcadiaDocument51 pagesArcadiaJohn MarkNo ratings yet

- Studying Open Interest For Stock Direction - OptionTigerDocument10 pagesStudying Open Interest For Stock Direction - OptionTigerJames LiuNo ratings yet

- Financial Theory and Corporate PolicyDocument958 pagesFinancial Theory and Corporate PolicyDiego Ontaneda100% (1)

- Konstruksi Baja (Oentoeng) PDFDocument169 pagesKonstruksi Baja (Oentoeng) PDFAnton Husen PurboyoNo ratings yet

- Finance 345 MidtermDocument2 pagesFinance 345 MidtermMatthew MurrayNo ratings yet

- Dec 2017 CFA Level 1 ScheduleDocument2 pagesDec 2017 CFA Level 1 ScheduleSyed AhmadNo ratings yet

- IAS 34 Interim Financial Reporting RequirementsDocument5 pagesIAS 34 Interim Financial Reporting Requirementsjapvivi ceceNo ratings yet

- On Secondary MarketsDocument13 pagesOn Secondary MarketsGangam Sourabh0% (1)

- VolatilityDocument21 pagesVolatilityRajput JaysinhNo ratings yet

- Olivier de La Grandville - Bond Pricing and Portfolio Analysis (2000, The MIT Press) PDFDocument473 pagesOlivier de La Grandville - Bond Pricing and Portfolio Analysis (2000, The MIT Press) PDFJorgeNo ratings yet

- What Is Financial System?Document46 pagesWhat Is Financial System?Soumya Ranjan SwainNo ratings yet

- Introducing International FinanceDocument14 pagesIntroducing International FinanceVipul MehtaNo ratings yet

- SyllabusDocument31 pagesSyllabusm_gadhvi6840No ratings yet

- JPMorgan PaperDocument30 pagesJPMorgan PaperJan2050No ratings yet

- Ipr & Technology Bulletin Technology and Electronic Payment System in IndiaDocument7 pagesIpr & Technology Bulletin Technology and Electronic Payment System in IndiaVivek DubeyNo ratings yet

- Article TDIndicators - Market Technician No 56 PDFDocument16 pagesArticle TDIndicators - Market Technician No 56 PDFlluuukNo ratings yet

- Overview of Indian Financial MARKETSDocument46 pagesOverview of Indian Financial MARKETSGaurav Rathaur100% (2)

- Financial MArkets in PakistanDocument26 pagesFinancial MArkets in PakistanAamir Inam BhuttaNo ratings yet

- Beta Saham PefindoDocument13 pagesBeta Saham Pefindodanang_apriyantoNo ratings yet

- Gone Fishing With BuffettDocument222 pagesGone Fishing With BuffettFrankie ChanNo ratings yet

- Chapter 3Document7 pagesChapter 3ALI SHER HaidriNo ratings yet

- Treasury Management-ShrutiDocument17 pagesTreasury Management-ShrutishrutimalNo ratings yet