Professional Documents

Culture Documents

Working Capital Numericals

Uploaded by

Shriya SajeevOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Numericals

Uploaded by

Shriya SajeevCopyright:

Available Formats

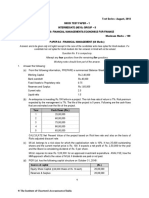

Financial Management

Working Capital, Cash Management & Inventory Management Numerical

1. A firm’s sales are Rs. 25 lakhs, and having an EBIT – Rs. 3 lakhs. It has fixed assets of

Rs. 8 lakhs. The firm is thinking to hold current assets of different size of Rs. 5 lakhs;

Rs. 6 lakhs or Rs. 8 lakhs. Assuming profits and fixed assets do not vary, explain the

impact of these working capital policies.

2. A firm has the following data for the year ending 31 March 2016:

Rs.

Sales 20,00,000

EBIT 2,00,000

Fixed Assets 5,00,000

The three possible current assets holding of the firm are Rs. 5 lakhs; Rs. 4 lakhs or Rs.

3 lakhs. Assuming profits and fixed assets do not vary, explain the impact of these

working capital policies.

3. From the following information of PQR Ltd, you are required to calculate :

(a) Net Operating cycle period

(b) Number of operating cycles in a year

Rs

1 Raw material consumed during the year 6,00,000

2 Average stock of raw material 50,000

3 Work-in-progress inventory 5,00,000

4 Average work-in-progress 30,000

5 Finished goods inventory 8,00,000

6 Average finished goods stock held 40,000

7 Average collection period from debtors 45 days

8 Average credit period availed 30 days

9 No. of days in a year 360 days

4. On 1st January 2016, the Managing Director of Soni Ltd. wishes to know the amount of

working capital that will be required during the year. From the following information

prepare the working capital requirements forecast. Production during the previous year

was 60,000 units. It is planned that this level of activity would be maintained during

the present year. The expected ratio of the cost to selling prices are raw material 60%,

Direct wages 10% and Overheads 20 %. Raw materials are expected to remain in store

for an average of 2 months before issue to production. Each unit is expected to be in

process for one month, the raw materials being fed into the pipeline immediately and

the labour and overhead costs accruing evenly during the month. Finished goods will

stay in the warehouse awaiting dispatch to customers for approximately 3 months.

Credit allowed by creditors is 2 months from the date of delivery of raw material. Credit

allowed by creditors is 3 months from the date of dispatch. Selling price if Rs.5 per

unit. There is a regular production and sales cycle. Wages and overheads are paid on

the 1st of each month for the previous month. The company normally keeps cash in

hand to the extent of Rs.20,000.

1|Prof. Namrata Acharya

Financial Management

5. The following annual figures relate to Nanu Ltd.

Rs.

Sales (at two months credit) 36,00,000

Material consumed (supplier extended two months credit) 9,00,000

Wages paid (monthly in arrear) 7,20,000

Manufacturing expenses outstanding at the end of the year (Cash 80,000

expenses are paid one month in arrear)

Total administrative expenses, paid as above 2,40,000

Sales promotion expenses, paid quarterly in advance 1,20,000

The company sells its products on gross profit of 25% counting depreciation as part of

the cost of production. It keeps one month’s stock each of raw materials and finished

goods, and a cash balance of Rs.1,00,000.

Assuming a 20% safety margin, work out the working capital requirements of the

company on cash cost basis. Ignore work-in-progress.

6. PQ Ltd., a company newly commencing business in 2013 has the under-mentioned

projected Profit and Loss Account:

Rs. Rs.

Sales 2,10,000

Cost of goods sold 1,53,000

Gross Profit 57,000

Administrative Expenses 14,000

Selling Expenses 13,000 27,000

Profit before tax 30,000

Provision for taxation 10,000

Profit after tax 20,000

The cost of goods sold has been arrived as under:

Material used 84,000

Wages and manufacturing Expenses 62,500

Depreciation 23,500

1,70,000

Less: Stock of Finished goods

(10% of goods produced not yet sold) 17,000

1,53,000

The figure given above relates only to finished goods and not to work-in-progress.

Goods equal to 15% of the year’s production (in terms of physical units) will be in

process on the average running full materials but only 40% of the other expenses. The

company believes in keeping materials equal to two months consumption in stock.

Average time lag in payment of all expenses is 1 month. Suppliers of material will

extend 1-1/2 month credit. Sales will be 20% for cash and the rest two months credit.

70% of the Income tax will be paid in advance in quarterly instalments. The company

wishes to keep Rs.8,000 in cash. 10% has to be added to the estimate figure for

unforeseen contingencies. Prepare an estimate of working capital.

2|Prof. Namrata Acharya

Financial Management

7. The following information is available in respect of Sai Trading company:

(i) On an average, debtors are collected after 45 days, inventories have an average

holding period of 75 days and creditors.

(ii) The firm spends a total of Rs.120 lakhs annually at a constant rate.

(iii) It can earn 10 percent on investments.

From the information you are required to calculate:

a. The cash cycle and cash turnover,

b. Minimum amounts of cash to be maintained to meet payments as they

become due,

c. Savings by reducing the average inventory holding period by 30 days.

8. A firm maintains a separate account for cash disbursement. Total disbursement are Rs.

1,05,000 per month or Rs.1,26,000 per year. Administrative and transaction cost of

transferring cash to disbursement account is Rs.20 per transfer. Marketable securities

yield is 8% per annum. Determine the optimum cash balance according to William

J.Baumol model.

9. A company’s requirement for 10 days are 6,300 units. The ordering cost per order is

Rs.10 and the carrying cot is Rs.0.26. The following is the discount schedule applicable

to the company.

Lot size Discount per unit (Rs.)

1- 999 0

1,000 - 1,499 0.010

1,500 – 2,499 0.015

2,500 – 4,999 0.030

5,000 – and above 0.050

You are required to calculate the economic order quantity.

10. Marcus Ltd. uses a large quantity of salt in its production process. Annual consumption

is 60,000 tonnes over a 50-week working year. It costs Rs.100 to initiate and process

an order and deliver follow two weeks later. Storage costs for the salt are estimated at

10 paise per tonne per annum. The current practise is to order twice a year when the

stock falls to 10,000 tonnes. Recommend an appropriate policy for Marcus Ltd. and

contrast it with the cost of the current policy.

11. Pari Company is a distributor of air filters to retail stores. It buys its filters from several

manufacturers. Filters are ordered in lot sizes of 1,000 and each order costs Rs.40 to

place. Demand from retail stores is 20,000 filters per month, and carrying cost is

Rs.0.10 a filter per month.

(a) What is the optimal order quantity with respect to so many lot sizes?

(b) What would be the optimal order quantity if the carrying cost were Rs.0.05 a filter

per month?

(c) What would be the optimal order quantity if ordering cost were Rs.10?

3|Prof. Namrata Acharya

You might also like

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- Question Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalDocument12 pagesQuestion Bank B 604 F: Working Capital Management UNIT-1-Basic Working Capital & Computation of Working CapitalBhavya Shrivastava100% (3)

- The New Government Accounting System of The PhilippinesDocument6 pagesThe New Government Accounting System of The PhilippinesGlaiza Gigante100% (1)

- WCM EstimationDocument3 pagesWCM Estimationtanya.p23No ratings yet

- Management Accounting Problem Unit 3Document17 pagesManagement Accounting Problem Unit 3princeNo ratings yet

- Problems in WC EstimationDocument3 pagesProblems in WC EstimationaparnahawaldarNo ratings yet

- MB20202 CF Unit V Working Capital Management Application QuestionsDocument4 pagesMB20202 CF Unit V Working Capital Management Application QuestionsSarath kumar CNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- Ffe Question BankDocument5 pagesFfe Question Banksd8837No ratings yet

- Working Capital Requirement QuestionsDocument2 pagesWorking Capital Requirement QuestionsVIRAL DOSHI100% (1)

- Working Capital ManagementDocument2 pagesWorking Capital ManagementAnkit ThakkarNo ratings yet

- Assessment and Computation of Working Capital Requirements Numerical QuestionsDocument6 pagesAssessment and Computation of Working Capital Requirements Numerical QuestionsNazreena MukherjeeNo ratings yet

- Working Capital PlanningDocument4 pagesWorking Capital PlanningAkshata ShrivastavaNo ratings yet

- Deepak QuestionsDocument5 pagesDeepak Questionsvivek ghatbandheNo ratings yet

- Unit 1 WCM (Practical Problem)Document3 pagesUnit 1 WCM (Practical Problem)niranjan balaramNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- FM 4Document4 pagesFM 4Elizabeth RayNo ratings yet

- Lecture 7-8 Working CapitalDocument18 pagesLecture 7-8 Working CapitalAfzal AhmedNo ratings yet

- Mozammil 029Document4 pagesMozammil 029Iqbal Shan LifestyleNo ratings yet

- Working cap-SEM IIIDocument9 pagesWorking cap-SEM IIIBhushan BhorkadeNo ratings yet

- Budgets and forecasts for business planningDocument4 pagesBudgets and forecasts for business planningSai SumanNo ratings yet

- Study Material of FMDocument22 pagesStudy Material of FMPrakhar SahuNo ratings yet

- Working Capital Management - NumericalsDocument9 pagesWorking Capital Management - NumericalsAnjali JainNo ratings yet

- FM Revision Q BankDocument10 pagesFM Revision Q BankOmkar VaigankarNo ratings yet

- Prepare flexible budgets and cash budgets for business managementDocument3 pagesPrepare flexible budgets and cash budgets for business managementSHARATH JNo ratings yet

- Acm 701 2017-18-1-1-2Document13 pagesAcm 701 2017-18-1-1-2Utkarsh Kumar SrivastavNo ratings yet

- Management Accounting: Final ExaminationsDocument4 pagesManagement Accounting: Final ExaminationsAbdulAzeemNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementdhruvNo ratings yet

- Working Capital ProblemsDocument3 pagesWorking Capital ProblemsSayonarababayNo ratings yet

- Question Compilation - 230316 - 072454Document9 pagesQuestion Compilation - 230316 - 072454Ranjan DhakalNo ratings yet

- AFM - IMM 110 (II) April 20, 2021Document3 pagesAFM - IMM 110 (II) April 20, 2021Aashish RanjanNo ratings yet

- Master BudgetDocument10 pagesMaster BudgetFareha Riaz0% (1)

- Financial ManagementDocument3 pagesFinancial Managementakshaymatey007No ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument3 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekNo ratings yet

- WCM QuestionsDocument13 pagesWCM QuestionsALEEM MANSOORNo ratings yet

- Budgeting For Profit PlanningDocument6 pagesBudgeting For Profit Planningmamannish7902No ratings yet

- ECON F315 - FIN F315 - Compre QP PDFDocument3 pagesECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- Master Budget Cash Flow ProjectionsDocument9 pagesMaster Budget Cash Flow Projections신두No ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- Topic 8 - Budgeting (Student Version)Document37 pagesTopic 8 - Budgeting (Student Version)Khairuna anishaNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- Basics of Financial Management Exam GuideDocument3 pagesBasics of Financial Management Exam GuideAria MazeNo ratings yet

- Illustration: Preparation of Master Budget (Manufacturing Company)Document4 pagesIllustration: Preparation of Master Budget (Manufacturing Company)shimelisNo ratings yet

- 48 17228rtp Ipcc Nov09 Paper3bDocument33 pages48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyNo ratings yet

- Working Capital Policy Sums For FSADocument3 pagesWorking Capital Policy Sums For FSAAbhishek ThakurNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementDocument34 pagesLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephNo ratings yet

- MC&bepproblemsDocument6 pagesMC&bepproblemsNishanth PrabhakarNo ratings yet

- AIOU Financial Reporting Checklist and AssignmentsDocument9 pagesAIOU Financial Reporting Checklist and AssignmentsSyedNo ratings yet

- Working Capital Management TechniquesDocument6 pagesWorking Capital Management TechniquesPiyush MalviyaNo ratings yet

- FM TestDocument5 pagesFM TestSamir JainNo ratings yet

- IMT 07 Working Capital Management M2Document7 pagesIMT 07 Working Capital Management M2solvedcareNo ratings yet

- FM Revision 3rd YearDocument39 pagesFM Revision 3rd YearBharat Satyajit100% (1)

- Budget Numerical PDFDocument5 pagesBudget Numerical PDFDilip BhusalNo ratings yet

- RTP Year Wise Compiliation ICANDocument2,993 pagesRTP Year Wise Compiliation ICANMichael AdhikariNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017From EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017No ratings yet

- Business PlanDocument27 pagesBusiness PlanNichole BalajadiaNo ratings yet

- BUS 251 - Homework SolutionsDocument46 pagesBUS 251 - Homework SolutionsJerry He0% (2)

- WSCSS Schedule 2023 01 01Document13 pagesWSCSS Schedule 2023 01 01mom2asherloveNo ratings yet

- Organizational Capacity AssessmentDocument4 pagesOrganizational Capacity AssessmentValerie F. LeonardNo ratings yet

- My Business PlanDocument15 pagesMy Business PlanWazedur RahmanNo ratings yet

- ACD Savings and Credit CooperativeDocument13 pagesACD Savings and Credit CooperativeAirah GolingayNo ratings yet

- JournalDocument6 pagesJournalAlyssa AlejandroNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Notes Cost Accounting CertificateDocument29 pagesNotes Cost Accounting CertificateNalugo LeilahNo ratings yet

- Ia PPT 2Document18 pagesIa PPT 2lorriejaneNo ratings yet

- Appendix A Itinerary of TravelDocument24 pagesAppendix A Itinerary of TravelJhuvzCLunaNo ratings yet

- Noraini June 2023 Pay Slip PDFDocument2 pagesNoraini June 2023 Pay Slip PDFNoraini NasimamNo ratings yet

- Block 3 MCO 5 Unit 2Document27 pagesBlock 3 MCO 5 Unit 2Tushar SharmaNo ratings yet

- Commissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 G.R. No. 195909 September 26 2012Document14 pagesCommissioner of Internal Revenue vs. St. Lukes Medical Center Inc. 682 SCRA 66 G.R. No. 195909 September 26 2012Roland ApareceNo ratings yet

- 2023 Accounting Paper One Easy MarksDocument14 pages2023 Accounting Paper One Easy Markslindort00No ratings yet

- Gov Act Reviewer (Punzalan)Document13 pagesGov Act Reviewer (Punzalan)Kenneth WilburNo ratings yet

- Accounting Concepts and ConventionsDocument38 pagesAccounting Concepts and Conventions727822TPMB005 ARAVINTHAN.SNo ratings yet

- Xacc280 Chapter 2Document46 pagesXacc280 Chapter 2jdcirbo100% (1)

- Advance Financial Accounting & Reporting 2Document9 pagesAdvance Financial Accounting & Reporting 2Michelle KuehNo ratings yet

- SPPRA Rules Amended 2010 (Amended Uptodate)Document52 pagesSPPRA Rules Amended 2010 (Amended Uptodate)Hammad ShamsNo ratings yet

- Lecture 1 & 2Document35 pagesLecture 1 & 2Phill NamaraNo ratings yet

- Maujan - PK: Nothing Ventured Nothing GainedDocument35 pagesMaujan - PK: Nothing Ventured Nothing GainedZulqarnain Aamir JamalNo ratings yet

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriestaurusNo ratings yet

- Latian Soal UtsDocument3 pagesLatian Soal UtsTania TjanderaNo ratings yet

- Intermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerDocument27 pagesIntermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerMelissaNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument13 pagesPetitioner Vs Vs Respondent: Second DivisionCamille CruzNo ratings yet

- Breakdown of DPWH Project Expense DeductionsDocument2 pagesBreakdown of DPWH Project Expense DeductionsfjgbNo ratings yet

- Startup Valuation Guide: September 2018Document42 pagesStartup Valuation Guide: September 2018adsadNo ratings yet

- CFS ExplanationDocument13 pagesCFS ExplanationDELFIN, LORENA D.No ratings yet