Professional Documents

Culture Documents

SAS Main EXAM December 2018 PC-08 PDF

Uploaded by

Vijendra Lodwal0 ratings0% found this document useful (0 votes)

81 views2 pagesOriginal Title

SAS Main EXAM December 2018 PC-08.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

81 views2 pagesSAS Main EXAM December 2018 PC-08 PDF

Uploaded by

Vijendra LodwalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

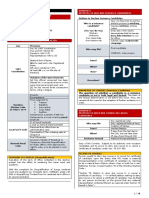

SAS Main EXAM December 2018

PC-8 (Memory based)

1. 0020-Corporate Tax

2. 3601-Grant-in-aid

3. 8680-foreign exchange of variation (loan)

4. 2235- Social Security and Welfare

5. NPS starts 01.01.2004

6. If payment of loan fall due on 31.03.2018 then it must be recovered in previous working day

7. Cost plus contract definition

8. Dr./Cr. Missing prepared (a) Annually (b) Monthly

9. Appropriation Accounts. Appropriation Accounts of Central Ministries (other than Ministry of

Railways) and of Central Civil Departments (excluding Department of Posts and Defence

Services) shall be prepared by the Principal Accounts Officers of the respective Ministries

and Departments (under the guidance and supervision of the Controller General of Accounts)

and signed by their respective Chief Accounting Authorities Appropriation a/c of central civil

ministries (excluding min of rly) prepared by and signed by CAA

10. Public works(answer)

11. CAM 69

12. CAM 39

13. DMS-Focal point branch

14. Statment 15 & 16

15. Cheque remain valid for 90 days

16. To ensure due performance of the contract, which Security is to be obtained from the successful

bidder after awarded the contract

(a) Bid security (b) Performance Security

17. Bill become voucher when stamped and paid

18. Cheque collected through Pay and Account Officer

19. Which of the following is not a Service department

(a) Survay of india , (b) defence, (c) forest.

20. Income tax deduction above 10000 at the rate of 2%

21. Persistent after consultation with CAG(ans)

22. Undisbursed pay and allowance kept for 3 month by DFO

23. Departmental of expenditure(answer)

24. Government dues tendered in the form of a cheque or draft which is accepted under the

provisions of rule 19 and is honoured on presentation, shall be deemed to have been paid-

(a) where the cheque or draft is tendered to the bank, on the date on which it was cleared and

entered in the receipt scroll;

(b) where a cheque or draft is tendered to a departmental officer (in cases where such tendering

is permissible or required under relevant departmental provisions) on the third working day

after its presentation;

(c) if it is sent by post in pursuance of instructions to make payment by post, on the date on

which the cover containing it is put into the post:

(Iv) all of above

25. Capital vs Revenue

(a) Capital shall bear all charges for the first construction and equipment of a project as well as

charges for intermediate maintenance of the work

(b) Revenue shall bear subsequent charges for maintenance and all working expenses.

26. In the case of such transactions of the Central Government, including Railways / Postal /

Defence Departments at State treasuries (both banking and non-banking), these shall be

accounted for by the treasuries in the State Section of Treasury Account under the head 'PAO

Suspense - Transactions adjustable by PAO Ministry / Department of ...............' below the

Major head '8658 - Suspense Accounts' for necessary cash settlement by the State Accountant

General with the Pay and Accounts Office.

27. Direct Benefit Transfer. Select in correct (through contractor like option)

28. Central Public Procurement Portal (CPPP) -full form

29. Invitation to tenders by advertisement should be used for procurement of goods of estimated

value of Rs. 25 lakhs (Rupees Twenty Five Lakh)and above

30. Capital receipts during construction mainly to be utilised in reduction of capital expenditure

:Capital receipts in so far they relate to expenditure previously debited to Capital accruing during

the process of construction of a project, shall be utilised in reduction of capital expenditure.

31. Two bid system (simultaneous receipt of separate technical and financial bids) : For purchasing

high value plant, machinery etc. of a complex and technical nature, bids may be obtained in two

parts as under : (i) Technical bid consisting of all technical details along with commercial terms

and conditions; and (ii) Financial bid indicating item-wise price for the items mentioned in the

technical bid.

32. Accounting of exchange variation. The exchange variation in respect of foreign loans that

have been fully repaid shall be adjusted written off to “8680Miscellaneous Government

Accounts -Write off in terms of Government Accounting Rules and the procedures prescribed by

CGA in consultation with CAG.

33. Due date of Leave Travel Concession claim. Leave Travel Concession claim of a government

servant shall fall due for payment on the date succeeding the date of completion of return

journey. The time limit for submission of the claims shall be as under :-

(a) In case advance drawn : Within thirty days of the due date.

(b) In case advance not drawn : Within sixty days of the due date.

34. Lost cheques.—

A request for the issue of a cheque in lieu of a cheque alleged to be lost, may be entertained if

the request is received by the Pay and Accounts Officer or Accounts Officer or cheque-

drawing D.D.O. who had issued the original cheque, within a period of one year from the

date of issue of the original cheque, irrespective of the date on which the relevant claim had

accrued. However, the concerned Principal Accounts Officer may, nevertheless, order

entertainment of such a request received by the Pay and Accounts Officer or Accounts Officer

of cheque-drawing D.D.O. within a period of 3-1/2 years from the date on which the relevant

claim had become due, wherever this is beneficial.

35. Register of valuable used details.

36. Bills for monthly pay and fixed allowances of Government servants may be signed at any time

not earlier than 5 days before the last working day of the month by the labour of which such

pay and allowances are earned and shall be due for payment on the last working day of the

month to which they relate.

37. Last pay Certificate -forwarded after transfer of a employee for ....

Note: Some questions may be different from original questions but context is same

(source: social media)

You might also like

- Cpcu 552 TocDocument3 pagesCpcu 552 Tocshanmuga89No ratings yet

- CPWD EssayDocument71 pagesCPWD Essayshekarj50% (2)

- Garden Reach Shipbuilders & Engineers LTD.: Invitation To TenderDocument13 pagesGarden Reach Shipbuilders & Engineers LTD.: Invitation To TenderArchie SharmaNo ratings yet

- GSTDocument193 pagesGSTdevikrish897No ratings yet

- Chapter 18 CPWD ACCOUNTS CODEDocument5 pagesChapter 18 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- GST Session 43Document20 pagesGST Session 43manjulaNo ratings yet

- Tendernotice - 1 (3) 5Document1 pageTendernotice - 1 (3) 5SRARNo ratings yet

- Vol II (E5)Document261 pagesVol II (E5)nitinNo ratings yet

- Input Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)Document3 pagesInput Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)dinesh kasnNo ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Document6 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Dec 2019 - Set 2Bhupen SharmaNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- Kerala Financial Code NotesDocument11 pagesKerala Financial Code Notesbashex100% (1)

- © Skill Short Edulife Pvt. Ltd. (2020)Document3 pages© Skill Short Edulife Pvt. Ltd. (2020)Animesh Kumar TilakNo ratings yet

- Inviting Tender SampleDocument5 pagesInviting Tender SampleAagney Alex RobinNo ratings yet

- Income Tax Notification No - SO858 25-03-2009Document25 pagesIncome Tax Notification No - SO858 25-03-2009Sanjay AjudiaNo ratings yet

- RR No. 26-2018Document3 pagesRR No. 26-2018Joseph Adrian LlamesNo ratings yet

- ST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesDocument9 pagesST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesTaruna BajajNo ratings yet

- 3 TdsDocument14 pages3 TdssugasenthilNo ratings yet

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickNo ratings yet

- HW TenderDocument59 pagesHW TenderJashika PattnaikNo ratings yet

- HW Tender PDFDocument59 pagesHW Tender PDFJashika PattnaikNo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- Cma Final Group3 All MCQDocument135 pagesCma Final Group3 All MCQtusharjaipur7No ratings yet

- GST Supplement - Dec 2022Document10 pagesGST Supplement - Dec 2022SAMAR SINGH CHAUHANNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- CHENNAI AAI Tendernotice - 1Document7 pagesCHENNAI AAI Tendernotice - 1ayush aggarwalNo ratings yet

- Overhauling of Boiler and Aux of Unit 1Document33 pagesOverhauling of Boiler and Aux of Unit 1lp mishraNo ratings yet

- Chapter-Vi I-Payments - General InstructionsDocument23 pagesChapter-Vi I-Payments - General InstructionsShakeel KhanNo ratings yet

- BOCW Welfare Cess Rules, 1998Document10 pagesBOCW Welfare Cess Rules, 1998EricKankarNo ratings yet

- Code On Payment of BillsDocument8 pagesCode On Payment of BillsVarun SainiNo ratings yet

- Tax Planning in Case of Foreign Collaborations and Joint VentureDocument3 pagesTax Planning in Case of Foreign Collaborations and Joint VentureDr Linda Mary SimonNo ratings yet

- DT Updates 03-10-22Document3 pagesDT Updates 03-10-22Anup SharmaNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- Input Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxDocument3 pagesInput Tax Credit (Itc) (Section 16) : Sem 5: Procedure and Levy Under Gstgoods and Service TaxmanjulaNo ratings yet

- BBJ Alwire Metallizing TenderDocument3 pagesBBJ Alwire Metallizing TenderpushkarNo ratings yet

- Est Work ProcDocument25 pagesEst Work ProcCash Cash CashNo ratings yet

- Chapter-XVIII 9.3.15Document86 pagesChapter-XVIII 9.3.15Whats Going On ??No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarNo ratings yet

- Annexure 2 SCCDocument6 pagesAnnexure 2 SCCRAYAN FERRAONo ratings yet

- Input Tax Credit (Itc) SystemDocument17 pagesInput Tax Credit (Itc) SystemJasmin BidNo ratings yet

- Possible Questions Tax Study QuestionsDocument1 pagePossible Questions Tax Study QuestionsCara A.No ratings yet

- CGST Act 16-21Document37 pagesCGST Act 16-21Dasari NareshNo ratings yet

- Guidelines For TDS On GSTDocument5 pagesGuidelines For TDS On GSTPWD HIGHWAYNo ratings yet

- Tendernotice - 1 - 2023-03-22T184519.235Document8 pagesTendernotice - 1 - 2023-03-22T184519.235jitendraNo ratings yet

- Terma Rujukan Perunding 2014Document7 pagesTerma Rujukan Perunding 2014gabemzamanNo ratings yet

- SH Enclave (Map Kodaria) in Ge: CA No: CWE/MHOW/06 (T) OF 2022-23 Serial Page No.....................Document4 pagesSH Enclave (Map Kodaria) in Ge: CA No: CWE/MHOW/06 (T) OF 2022-23 Serial Page No.....................LIFTON ELEVATORSNo ratings yet

- A7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFDocument9 pagesA7X1 Special Conditions of Contract Civil Packages R1 Dated 04.03.2020 PDFanjan.kaimal4433No ratings yet

- Advanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToDocument18 pagesAdvanced Tax Laws and Practice: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate ToMurugesh Kasivel EnjoyNo ratings yet

- 23rd Summary Book Amendment Notes MarkedDocument51 pages23rd Summary Book Amendment Notes MarkedCA Kuldeep PandyaNo ratings yet

- BID PROPOSAL - Bidding-Documents - UCC - Sept-2017Document136 pagesBID PROPOSAL - Bidding-Documents - UCC - Sept-2017BEA MERR MAZONo ratings yet

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaNo ratings yet

- Highway Assignment: Rehabilitation and Strengthening of Existing NH-4Document6 pagesHighway Assignment: Rehabilitation and Strengthening of Existing NH-4AKHIL JOSEPHNo ratings yet

- The Building and Other Construction Workers Cess Rules, 1998Document11 pagesThe Building and Other Construction Workers Cess Rules, 1998shanti raj kumarNo ratings yet

- Itc FaqDocument4 pagesItc Faqbhushanbraj811307No ratings yet

- 33-Transition Provision in GSTDocument3 pages33-Transition Provision in GSTJinx GNo ratings yet

- Fully Electronic Refund ProcessDocument4 pagesFully Electronic Refund ProcessCA Sumit GargNo ratings yet

- Chapter 19 CPWD ACCOUNTS CODEDocument2 pagesChapter 19 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- No Interest Under GST On Delayed Filing.....Document6 pagesNo Interest Under GST On Delayed Filing.....qt9m2bqvzkNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- OGE FOIA FY 16-085 - Response LetterDocument2 pagesOGE FOIA FY 16-085 - Response LetterDaily Caller News FoundationNo ratings yet

- Fifa GovernanceDocument39 pagesFifa GovernancecorruptioncurrentsNo ratings yet

- Class 3 E Tendering Digital Signature Form PDFDocument9 pagesClass 3 E Tendering Digital Signature Form PDFManish KapadneNo ratings yet

- Thien Thin Nguyen, A073 279 229 (BIA May 16, 2017)Document12 pagesThien Thin Nguyen, A073 279 229 (BIA May 16, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- SBM Folder CoverDocument17 pagesSBM Folder CoverJayne InoferioNo ratings yet

- Magna Carta For The PoorDocument5 pagesMagna Carta For The PoorTrisha AmorantoNo ratings yet

- (1957) East Africa Law ReportsDocument1,581 pages(1957) East Africa Law ReportsRobert Walusimbi82% (11)

- Texas Homeowners Rights Under ForeclosureDocument9 pagesTexas Homeowners Rights Under Foreclosurelascl500No ratings yet

- Motion To Withdraw FundsDocument2 pagesMotion To Withdraw FundsTenshi FukuiNo ratings yet

- 501.12 AttendanceDocument3 pages501.12 AttendanceMinidoka County Joint School DistrictNo ratings yet

- Topic 5 - Converting Partnership To CompanyDocument33 pagesTopic 5 - Converting Partnership To CompanyJustineNo ratings yet

- Wadia Institute of Himalayan Geology: Application Form For Scientific PostsDocument15 pagesWadia Institute of Himalayan Geology: Application Form For Scientific PostsJeshiNo ratings yet

- Democracy PPT NewDocument11 pagesDemocracy PPT Newlalit13patilNo ratings yet

- Qffiq: Titlrt FDocument2 pagesQffiq: Titlrt Frebek heruNo ratings yet

- Society Registration FormDocument13 pagesSociety Registration FormSunil Megta100% (1)

- Application For Leave: Republic of The PhilippinesDocument3 pagesApplication For Leave: Republic of The PhilippinesEva MaeNo ratings yet

- Responsive PleadingDocument5 pagesResponsive PleadingJay EmNo ratings yet

- Spot ReportDocument1 pageSpot ReportMc AnchorNo ratings yet

- Gandhi Irwin PactDocument2 pagesGandhi Irwin PactBabai KunduNo ratings yet

- Adel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesDocument10 pagesAdel: Midterms Challenges Upon One'S Candidacy 25 PTS Ground 2: Petition To Declare Nuisance CandidatesJoesil Dianne0% (1)

- Assignment On Role of Statistics in Law: Submitted By: Albert Benjamin 1473 Sem IVDocument8 pagesAssignment On Role of Statistics in Law: Submitted By: Albert Benjamin 1473 Sem IValbertNo ratings yet

- 57 - Juridical Pronouncement (Case Law) Relating To SalariesDocument25 pages57 - Juridical Pronouncement (Case Law) Relating To SalariesSunil PillaiNo ratings yet

- Ponce de Leon V RFCDocument103 pagesPonce de Leon V RFCAiyla AnonasNo ratings yet

- QP - Class X - Social Science - Mid-Term - Assessment - 2021 - 22 - Oct - 21Document7 pagesQP - Class X - Social Science - Mid-Term - Assessment - 2021 - 22 - Oct - 21Ashish GambhirNo ratings yet

- Aurelio Umali Vs ComelecDocument14 pagesAurelio Umali Vs ComelecNiñanne Nicole Baring BalbuenaNo ratings yet

- The Latino ThreatDocument4 pagesThe Latino ThreatDuong BuiNo ratings yet

- Montelius AffidavitDocument6 pagesMontelius Affidavitkaimin.editorNo ratings yet

- CEJISS Volume 5 Issue 2 - 2011Document272 pagesCEJISS Volume 5 Issue 2 - 2011Central European Journal of International and Security StudiesNo ratings yet

- 14 FVC Labor Union-PTGWO V Samahang Nagkakaisang Manggagawa Sa FVC-SIGLODocument13 pages14 FVC Labor Union-PTGWO V Samahang Nagkakaisang Manggagawa Sa FVC-SIGLOKorin Aldecoa0% (1)