Professional Documents

Culture Documents

Reverse Charge Mechanism

Uploaded by

ARJUNCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reverse Charge Mechanism

Uploaded by

ARJUNCopyright:

Available Formats

Reverse Charge Mechanism

GST (Goods and Services Tax)

Generally, the supplier of goods or services is liable to pay GST. be applicable to supplies made to a TDS deductor in terms of

However, in specified cases like imports and other notified notification no.9/2017-Central Tax (Rate) dated 28.06.2017. Thus,

supplies, the liability may be cast on the recipient under the Government entities who are TDS Deductors under Section 51 of

reverse charge mechanism. Reverse Charge means the liability to CGST Act, 2015, need not pay GST under reverse charge in case of

pay tax is on the recipient of supply of goods or services instead procurements from unregistered suppliers.

of the supplier of such goods or services in respect of notified

categories of supply. Registration: A person who is required to pay tax under reverse

charge has to compulsorily register under GST and the threshold

There are two type of reverse charge scenarios provided in law. limit of Rs. 20 lakhs (Rs. 10 lakhs for special category states except

First is dependent on the nature of supply and/or nature of J & K) is not applicable to them.

supplier. This scenario is covered by section 9 (3) of the CGST/

SGST (UTGST) Act and section 5 (3) of the IGST Act. Second ITC:A supplier cannot take ITC of GST paid on goods or services

scenario is covered by section 9 (4) of the CGST/SGST (UTGST) used to make supplies on which recipient is liable to pay tax.

Act and section 5 (4) of the IGST Act where taxable supplies by

any unregistered person to a registered person is covered. Time of Supply: The Time of supply is the point when the supply

is liable to GST. One of the factor relevant for determining time

As per the provisions of section 9(3) of CGST / SGST (UTGST) of supply is the person who is liable to pay tax. In reverse charge,

Act, 2017 / section 5(3)of IGST Act, 2017, the Government may, recipient is liable to pay GST. Thus time of supply for supplies under

on the recommendations of the Council, by notification, specify reverse charge is different from the supplies which are under

categories of supply of goods or services or both, the tax on forward charge.

which shall be paid on reverse charge basis by the recipient of

such goods or services or both and all the provisions of this Act In case of supply of goods, time of supply is earliest of -

shall apply to such recipient as if he is the person liable for paying

the tax in relation to the supply of such goods or services or both. • Date of receipt of goods; or

• Date of payment as per books of account or date of debit in bank

Similarly, section 9(4) of CGST / SGST (UTGST) Act, 2017 / section account, whichever is earlier; or

5(4) of IGST Act, 2017 provides that the tax in respect of the • The date immediately following thirty days from the date of issue

supply of taxable goods or services or both by a supplier, who is of invoice or similar other document.

not registered, to a registered person shall be paid by such person In case of supply of services, time of supply is earliest of -

on reverse charge basis as the recipient and all the provisions of • Date of payment as per books of account or date of debit in bank

this Act shall apply to such recipient as if he is the person liable for account, whichever is earlier; or

paying the tax in relation to the supply of such goods or services • The date immediately following sixty days from the date of issue

or both. Accordingly, wherever a registered person procures of invoice or similar other document.

supplies from an unregistered supplier, he need to pay GST on

Where it is not possible to determine time of supply using above

reverse charge basis. However, supplies where the aggregate

methods, time of supply would be date of entry in the books of

value of such supplies of goods or service or both received by a

account of the recipient.

registered person from any or all the unregistered suppliers is less

than five thousand rupees in a day are exempted. ( Notification Compliances in respect of supplies under reverse charge

8/2017-Central Tax (Rate) dated 28.06.2017). However, vide mechanism:

notification no.38/2017-Central Tax (Rate) dated 13.10.2017, • As per section 31 of the CGST Act, 2017 read with Rule 46 of the

(corresponding IGST notification no.32/2017-Integrated Tax CGST Rules, 2017, every tax invoice has to mention whether the

(Rate) dated 13.10.2017) all categories of registered persons are tax in respect of supply in the invoice is payable on reverse charge.

exempted from the provisions of reverse charge under 9(4) of Similarly, this also needs to be mentioned in receipt voucher as well

CGST / SGST (UTGST) Act, 2017 / section 5(4) of IGST Act, 2017, till as refund voucher, if tax is payable on reverse charge.

31.03.2018. This exemption is available only till 31.03.2018. • Maintenance of accounts by registered persons: Every registered

person is required to keep and maintain records of all supplies

The provisions of section 9(4) of the CGST Act, 2017, will not attracting payment of tax on reverse charge

Directorate General of Taxpayer Services

CENTRAL BOARD OF EXCISE & CUSTOMS

www.cbec.gov.in

Reverse Charge Mechanism

GST (Goods and Services Tax)

• Any amount payable under reverse charge shall be paid by debiting the

S. Description of supply Supplier of Recipient of

electronic cash ledger. In other words, reverse charge liability cannot be

No. of service service service

discharged by using input tax credit. However, after discharging reverse

charge liability, credit of the same can be taken by the recipient, if he is 1. Any service supplied Any person Any person located

otherwise eligible. by any person who is located in a in the taxable

• Invoice level information in respect of all supplies attracting reverse located in a non-taxable non-taxable territory other

charge, rate wise, are to be furnished separately in the table 4B of GSTR-1. territory to any person territory than non-taxable

• Advance paid for reverse charge supplies is also leviable to GST. The other than non-taxable online recipient.

person making advance payment has to pay tax on reverse charge basis. online recipient.

2. GTA Services Goods Any factory,

Supplies of goods under reverse charge mechanism:

Transport society, co-

Agency operative society,

S. Description of Supplier of goods Recipient of

(GTA) who registered person,

No. supply of goods goods

has not paid body corporate,

1. Cashew nuts, Agriculturist Any registered integrated partnership firm,

not shelled or person tax at the casual taxable

peeled rate of 12% person;

2. Bidi wrapper Agriculturist Any registered located in the

leaves (tendu) person taxable territory

3. Tobacco leaves Agriculturist Any registered 3. Legal Services by An Any business entity

person advocate individual located in the

advocate taxable territory

4 Silk yarn Any person who Any registered

manufactures silk yarn

including

person

from raw silk or silk a senior

worm cocoons for advocate

supply of silk yarn or firm of

advocates

4A. Raw cotton Agriculturist Any registered

person. 4. Services supplied by An arbitral Any business entity

an arbitral tribunal to a tribunal located in the

5. Supply of lottery State Government, Lottery business entity taxable territory

Union Territory or any distributor or

local authority selling agent 5. Services provided by Any person Any body corporate

way of sponsorship to or partnership

6. Used vehicles, Central Government, Any registered any body corporate or firm located in the

seized and State Government, person partnership firm taxable territory

confiscated Union territory or a

goods, old and local authority

used goods,

waste and scrap

Supplies of services under reverse charge mechanism:

Directorate General of Taxpayer Services

CENTRAL BOARD OF EXCISE & CUSTOMS

www.cbec.gov.in

Reverse Charge Mechanism

GST (Goods and Services Tax)

S. Description of supply Supplier of Recipient of S. Description of supply Supplier of Recipient of

No. of service service service No. of service service service

6. Services supplied by the Central Any business entity 9. Services supplied by A recovery A banking company

Central Government, Government, located in the a recovery agent to a agent or a financial

State Government, State taxable territory banking company or a institution or a non-

Union territory or local Government, financial institution or banking financial

authority to a business Union a non-banking financial company, located in

entity excluding, - (1) territory the taxable territory

company

renting of immovable or local

property, and (2) authority 10. Services supplied by a A person Importer, as

person located in non- located in defined in clause

services specified

taxable territory by way non-taxable (26) of section 2 of

below- (i) services by

of transportation of territory the Customs Act,

the Department of Posts

goods by a vessel from 1962(52 of 1962),

by way of speed post,

a place outside India up located in the

express parcel post, life

to the customs station of taxable territory

insurance, and agency

clearance in India

services provided to

a person other than 11. Supply of services Author Publisher,

Central Government, by an author, or music music company,

State Government or music composer, composer, producer or the

Union territory or local photographer, artist photograph like, located in the

authority; or the like by way of her, artist, taxable territory

(ii) services in relation to transfer or permitting or the like

an aircraft or a vessel, the use or enjoyment

inside or outside the of a copyright covered

precincts of a port or an under section 13(1)(a)

airport;

of the Copyright Act,

(iii) transport of goods or

1957 relating to original

passengers.

literary, dramatic,

7. Services supplied by a A director The company or musical or artistic works

director of a company of a a body corporate to a publisher, music

or a body corporate to company located in the company, producer or

the said company or the or a body taxable territory the like

body corporate corporate 12. Supply of services by the Members of Reserve Bank of

8. Services supplied by An Any person carrying members of Overseeing Overseeing India.

an insurance agent to insurance on insurance Committee to Reserve Committee

any person carrying on agent business, located in Bank of India constituted

insurance business the taxable territory by the

Reserve

Bank of

India

Directorate General of Taxpayer Services

CENTRAL BOARD OF EXCISE & CUSTOMS

www.cbec.gov.in

You might also like

- Pesa PapDocument5 pagesPesa PapChris Ng'weno OmotoNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- GST Reverse Charge Mechanism Converted MergedDocument20 pagesGST Reverse Charge Mechanism Converted MergedPriyal ShethNo ratings yet

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

- Reverse Charge Mechanism in GST Regime With ChartDocument6 pagesReverse Charge Mechanism in GST Regime With ChartSwathi VikashiniNo ratings yet

- Master CardDocument22 pagesMaster CardAsef KhademiNo ratings yet

- Mastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresDocument66 pagesMastering BIR Year-End Compliance Requirements.: AIT Webinar, January 22, 2022 By: Dante R. TorresClarine Kyla Bautista100% (1)

- Cash Cash EquivalentsDocument11 pagesCash Cash EquivalentsGiulia TabaraNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Taxation Material 3Document11 pagesTaxation Material 3Shaira BugayongNo ratings yet

- Qatar Customer Bill SummaryDocument39 pagesQatar Customer Bill SummaryJennifer ScottNo ratings yet

- Anchoring ScriptDocument7 pagesAnchoring ScriptSakshi Bansal50% (4)

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismjaipalmeNo ratings yet

- GST Reverse Charge: A Three Phased AnalysisDocument8 pagesGST Reverse Charge: A Three Phased AnalysisRashi AroraNo ratings yet

- Reverse Charge MechanismDocument19 pagesReverse Charge MechanismSayyadNo ratings yet

- 51 GST Flyer Chapter12 PDFDocument12 pages51 GST Flyer Chapter12 PDFRashi AroraNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Important GST Amendments in Budget 2023 - Taxguru - in PDFDocument10 pagesImportant GST Amendments in Budget 2023 - Taxguru - in PDFPawan AswaniNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Adobe Scan 21-Feb-2024Document8 pagesAdobe Scan 21-Feb-2024rahatkokate7No ratings yet

- Presentation On Payment Under Reverse Charge in GSTDocument21 pagesPresentation On Payment Under Reverse Charge in GSTApurv Shaurya SrivastavaNo ratings yet

- GST1Document25 pagesGST1DeepikaNo ratings yet

- 6input Tax Credit1867ihhgghDocument35 pages6input Tax Credit1867ihhgghvinit tandelNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- GST TDS MechanismDocument3 pagesGST TDS MechanismDeepak WadhwaNo ratings yet

- Chapter 7 Input Tax Credit Under GSTDocument28 pagesChapter 7 Input Tax Credit Under GSTDR. PREETI JINDALNo ratings yet

- IDT AMENDMENTS AND STATUTORY UPDATES FOR MAY 2019 by Mahesh Gour PDFDocument69 pagesIDT AMENDMENTS AND STATUTORY UPDATES FOR MAY 2019 by Mahesh Gour PDFfarhana shaikNo ratings yet

- Chapter 8 - Input Tax Credit - NotesDocument57 pagesChapter 8 - Input Tax Credit - Notesmohd abidNo ratings yet

- Composition of LevyDocument6 pagesComposition of LevyYalini MeenakshiNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- Draft Compliance Audit Report on Transitional CreditsDocument17 pagesDraft Compliance Audit Report on Transitional CreditsmanoharNo ratings yet

- Revised Report As Per Hqrs InstructionsDocument21 pagesRevised Report As Per Hqrs InstructionsmanoharNo ratings yet

- Time and Value of Supply: Indirect TaxationDocument9 pagesTime and Value of Supply: Indirect TaxationTejasNo ratings yet

- Reverse Charge Mechanism Under GSTDocument7 pagesReverse Charge Mechanism Under GSTramaiahNo ratings yet

- Taxable Event Under GSTDocument4 pagesTaxable Event Under GSTSuman SharmaNo ratings yet

- Refund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)Document5 pagesRefund of Unutilised Input Tax Credit (ITC) : (Goods and Services Tax)dinesh kasnNo ratings yet

- GST - Input Tax Credit - Edition 5Document17 pagesGST - Input Tax Credit - Edition 5Vineet PandeyNo ratings yet

- 74822bos60500 cp13Document48 pages74822bos60500 cp13Looney ApacheNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- Input Tax CreditDocument28 pagesInput Tax CreditKhushbuNo ratings yet

- 15-Composition Levy Scheme PDFDocument3 pages15-Composition Levy Scheme PDFPreet SeepatNo ratings yet

- Unit - 2 Chap - 3 Input Tax CreditDocument17 pagesUnit - 2 Chap - 3 Input Tax CreditRakshit DattaniNo ratings yet

- Goods and Service Tax NoDocument5 pagesGoods and Service Tax NonitinNo ratings yet

- Unit I.4 - Levy and Collection of GSTDocument38 pagesUnit I.4 - Levy and Collection of GSTFake MailNo ratings yet

- 33-Transition Provision in GSTDocument3 pages33-Transition Provision in GSTJinx GNo ratings yet

- Article On Reverse Charge 28jul2017Document8 pagesArticle On Reverse Charge 28jul2017kumar45caNo ratings yet

- Input Tax credit-GSTDocument17 pagesInput Tax credit-GSTSandhya DangiNo ratings yet

- Registration in Gst NovDocument8 pagesRegistration in Gst Novvinod.sale1No ratings yet

- Chapter 14 TDS TCS Under GSTDocument17 pagesChapter 14 TDS TCS Under GSTDR. PREETI JINDALNo ratings yet

- Reverse Charge MechanismDocument16 pagesReverse Charge Mechanismpajemakiii9No ratings yet

- GST Faq by CSDocument6 pagesGST Faq by CSyashj91No ratings yet

- Refunds Under GST: Chapter Thirty FourDocument21 pagesRefunds Under GST: Chapter Thirty FourRajNo ratings yet

- Registration Under GST Law NewDocument3 pagesRegistration Under GST Law NewSunilNo ratings yet

- GST Annexure: Timely Provision of Invoices/debit Note/Credit Note/Other Applicable DocumentsDocument3 pagesGST Annexure: Timely Provision of Invoices/debit Note/Credit Note/Other Applicable Documentsshuklaankit704_24016No ratings yet

- GST Unit 1 BDocument23 pagesGST Unit 1 BMukul BhatnagarNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- RCM ChargesDocument9 pagesRCM Chargesnallarahul86No ratings yet

- Impact GST Manufacturing SectorDocument21 pagesImpact GST Manufacturing SectorPriyanshi AgarwalNo ratings yet

- GST BILL Highlights of Draft Model GST LawDocument6 pagesGST BILL Highlights of Draft Model GST LawS Sinha RayNo ratings yet

- Indirect Tax Laws 1Document10 pagesIndirect Tax Laws 1GunjanNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Tax Law 2 ProjectDocument16 pagesTax Law 2 Projectrelangi jashwanthNo ratings yet

- Returns PDFDocument109 pagesReturns PDFKrishna VamsiNo ratings yet

- GST Seminar Key HighlightsDocument40 pagesGST Seminar Key HighlightsNavneetNo ratings yet

- Input Tax CreditDocument10 pagesInput Tax CreditSme 2023No ratings yet

- Taxguru - In-20 Recent Income Tax Amendments Applicable For AY 20-21 Amp AY 21-22 PDFDocument4 pagesTaxguru - In-20 Recent Income Tax Amendments Applicable For AY 20-21 Amp AY 21-22 PDFARJUNNo ratings yet

- Newsletter GSTC July 2021Document5 pagesNewsletter GSTC July 2021ARJUNNo ratings yet

- Taxguru - In-20 Recent Income Tax Amendments Applicable For AY 20-21 Amp AY 21-22 PDFDocument4 pagesTaxguru - In-20 Recent Income Tax Amendments Applicable For AY 20-21 Amp AY 21-22 PDFARJUNNo ratings yet

- Taxguru - in-ITR 1 2 3 Amp 4 For AY 2020-21 Are Available For E-Filing PDFDocument2 pagesTaxguru - in-ITR 1 2 3 Amp 4 For AY 2020-21 Are Available For E-Filing PDFARJUNNo ratings yet

- Taxguru - in-ITR 1 2 3 Amp 4 For AY 2020-21 Are Available For E-Filing PDFDocument2 pagesTaxguru - in-ITR 1 2 3 Amp 4 For AY 2020-21 Are Available For E-Filing PDFARJUNNo ratings yet

- Karnataka Startup Policy 2015-2020 to Foster InnovationDocument28 pagesKarnataka Startup Policy 2015-2020 to Foster InnovationVishwanath HarnalNo ratings yet

- Notification No. 95 of 2018 CUSTOMS N.T PDFDocument176 pagesNotification No. 95 of 2018 CUSTOMS N.T PDFARJUNNo ratings yet

- EXEMPT SERVICES TITLEDocument16 pagesEXEMPT SERVICES TITLEARJUNNo ratings yet

- Court of Tax AppealsDocument47 pagesCourt of Tax AppealsLady Paul SyNo ratings yet

- Fee ChallanDocument1 pageFee ChallanasimaNo ratings yet

- CASHIER REMITTANCE - AmplopDocument1 pageCASHIER REMITTANCE - AmplopTheo PoaNo ratings yet

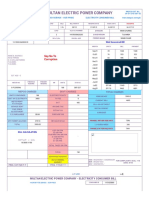

- MEPCO GST No. Electricity BillDocument2 pagesMEPCO GST No. Electricity BillAsad faridNo ratings yet

- Settlement DetailDocument12 pagesSettlement DetailHamza ELNo ratings yet

- EUtvt QPZ 3 C183 A 5 SDocument3 pagesEUtvt QPZ 3 C183 A 5 SSyed100% (1)

- Previous Bill This Bill: Your Payment HistoryDocument3 pagesPrevious Bill This Bill: Your Payment HistoryCikgu HasleyNo ratings yet

- MicriDocument1 pageMicriHashim MalikNo ratings yet

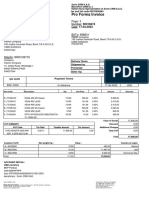

- Pay by Date: Ship To State Code:29 Place of Supply: KarnatakaDocument2 pagesPay by Date: Ship To State Code:29 Place of Supply: KarnatakaGanesh ShettyNo ratings yet

- How To Avoid Overdrafts and FeesDocument1 pageHow To Avoid Overdrafts and FeesPaul Tiberiu MandacheNo ratings yet

- Meeting Minutes: Herman@iliad - Co.za Mervinw@ferreiras - Co.za Wendy@ferreiras - Co.za Suzanne@ferreiras - Co.zaDocument5 pagesMeeting Minutes: Herman@iliad - Co.za Mervinw@ferreiras - Co.za Wendy@ferreiras - Co.za Suzanne@ferreiras - Co.zakrugerajNo ratings yet

- Ore Limita MyBRD Mobile Si MyBRD Net enDocument1 pageOre Limita MyBRD Mobile Si MyBRD Net enEdu MarianaNo ratings yet

- TRAIN Act reforms aim for progressive taxationDocument3 pagesTRAIN Act reforms aim for progressive taxationRONNEL SECADRONNo ratings yet

- Answer To Case 1 - Smith's Market (p.243-244)Document3 pagesAnswer To Case 1 - Smith's Market (p.243-244)Joe CastroNo ratings yet

- APM-MBA Supply Chain Professional with 10+ years experienceDocument2 pagesAPM-MBA Supply Chain Professional with 10+ years experienceaizy_786No ratings yet

- Journal EntryDocument13 pagesJournal Entrybabaloo sharmaNo ratings yet

- Accounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingDocument40 pagesAccounting Dashboard: Dashboard WP ERP Accounting. Once You Get There You Will See The FollowingusmanNo ratings yet

- HR 26 Ay 3128Document2 pagesHR 26 Ay 3128Shankul RajputNo ratings yet

- Tax Compliance Guide For Foreign Investors Mozambique: in Partnership WithDocument46 pagesTax Compliance Guide For Foreign Investors Mozambique: in Partnership WithKeizer MirzaNo ratings yet

- Cash / Credit Invoice: Page 1 of 1Document1 pageCash / Credit Invoice: Page 1 of 1OsmanMehmoodNo ratings yet

- HNFZ Global Services: Resit RasmiDocument4 pagesHNFZ Global Services: Resit RasmiLy NazNo ratings yet

- JNLive - Savings Transaction HistoryDocument1 pageJNLive - Savings Transaction HistoryAndrew HenryNo ratings yet

- Double Taxation Avoidance Agreement (DTAA) in IndiaDocument28 pagesDouble Taxation Avoidance Agreement (DTAA) in IndiakhanafshaNo ratings yet