Professional Documents

Culture Documents

Investment Analysis Tool Instructions

Uploaded by

erlend2012Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment Analysis Tool Instructions

Uploaded by

erlend2012Copyright:

Available Formats

Investment Analysis Tool

Instructions

Introduction

This tool facilitates the analysis of a proposed IT investment by capturing assumptions on spending and benefits, and then computing Return On Investment (ROI)

and other metrics designed to help clarify whether the deal is a desirable one.

Prerequisites

None. No macros or special functions are used.

Steps and FYIs

1) Each deal requires a new copy of this workbook. Only blue cells should have information entered into them. Yellow cells are calculated.

2) Depending on the nature of the proposed investment, different assumptions may apply, both for the spending and the anticipated benefits.

3) The Assumptions block at the top right is meant to capture most of the key parameters so that these may easily be changed.

4) The assumptions that are highly specific to the particular example are contained in the lower half of the Assumptions block, and probably won't apply to all analyse

5) Other implicit assumptions are contained in the formulas themselves, such as costs/salaries rising each year by a given factor.

6) The most important assumptions, however, are contained in the rows under estimates for costs, and estimates for benefits. You should attempt

to capture every possible cost that is likely to ensue from the proposed investment

7) All costs/expenses must be entered as negative numbers

Maintenance

Each deal requires some modification of the sheet, most likely

Otherwise, no regular maintenance should be needed. All dates, for example, are triggered off the Implementation date in the Assumptions block.

Weaknesses/Still To Do

Background and Technical Approach

Note that the benefit calculations implicitly consider productivity savings as a kind of cash inflow. That is, of course, only strictly true if staff can be reduced.

Sources

Much of this was originally taken from ideas garnered from a free "Financial Metrics Lite" spreadsheet tool distributed at

Solutions Matrix.

However, significant modifications were made, to both format and formulas, so that the sheet would be a one-page presentation of ROI metrics,

and to separate out capital costs from expense costs

Other formula information was taken from http://www.cioview.com/whitePapers/CIOview_TCO_NPV_EVA_IRR_ROI.pdf

Creative Commons License

© Copyright 2005-2013 Peter Kretzman.

No support for this model is implied.

This spreadsheet is licensed under a Creative Commons Attribution 3.0 license.

See http://creativecommons.org/licenses/by/3.0/

This kind of license is also referred to as copyleft.

Confidential 08/12/2019 Page 1

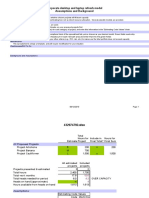

IT Investment Analysis--New Purchase

Proposed investment: New Storage Solution Assumptions:

Vendor: XYZ Vendor Hourly labor cost, fully burdened $75

Productivity boost from project 5%

Prepared by: <Author> Employees boosted in productivity 2

Date: March 1, 2008 Expected implementation date 6/1/2008

Internal labor impl. hours needed 140

Annual salary boost 4%

Payback period: 1.4 years from implementation Interest rate for discounting 10%

Benefits of proposed investment (all dollars in thousands)

2008 2009 2010 2011 2012 Total

Increased IT staff productivity 9 16 17 17 18 77

Maintenance on former SAN (not incurred) 90 90 90 100 100 470

Data Center space savings 2 2 2 2 2 10

Power consumption savings 2 2 2 2 2 10

Total incremental benefits 103 110 111 121 122 567

Costs of proposed investment (all costs should be entered as negative)

Capitalizable: 2008 2009 2010 2011 2012 Total

XYZ hardware (45) (45) (45) (50) (50) (235)

Internal labor for implementation (21) (21)

Professional Services (13) (13)

Expense:

Power installation at colo facility (2) (2)

XYZ hardware maintenance costs (20) (22) (23) (66)

Shipping and Tax (16) (16)

XYZ software license purchase (36) (36)

Total expenditure (153) (45) (45) (72) (73) (389)

Net benefit of proposed investment

Total incremental benefits 103 110 111 121 122 567

Total expenditure (153) (45) (45) (72) (73) (389)

Net benefit (50) 65 66 49 49 178

Cumulative Incremental Cash Flow (50) 15 81 130 178

NPV (5 yr)

Discounted Cash Flow Stream (46) 54 49 33 30 121

Payback Period: 1.4 years from implementation

3 years 4 years 5 years

Simple ROI 33% 41% 46%

Discounted ROI 30% 37% 42%

NPV $58 $91 $121

Internal Rate of Return (IRR) 119%

Modified Internal Rate of Return (MIRR) 52%

Recap of Proposed Costs 2008 2009 2010 2011 2012 Total

Expense dollars (74) 0 0 (22) (23) (120)

CapEx dollars (79) (45) (45) (50) (50) (269)

Total expenditure (153) (45) (45) (72) (73) (389)

Proposed investment: New Storage Solution

Dollars ($ 000s)

80

Break-even 65 66

60 point

49 49

40

20

0

2008 2009 2010 2011 2012

(20)

(40)

(50)

(60)

Net Incremental Benefits Cumulative Incremental Cash Flow

Printed 08/12/2019 Page 2 IT investment--new purchase

You might also like

- Airbus B-E Analysis ModelDocument5 pagesAirbus B-E Analysis ModelTran Tuan Linh100% (3)

- Project ChecklistDocument4 pagesProject Checklisterlend2012100% (1)

- Deloitte Cost OptimizationDocument32 pagesDeloitte Cost OptimizationVik DixNo ratings yet

- Cost Benefit Analysis02Document8 pagesCost Benefit Analysis02mithun7No ratings yet

- 1 Charging Models: Fixed PriceDocument6 pages1 Charging Models: Fixed Pricerajat_rathNo ratings yet

- Case StudyDocument7 pagesCase StudyPatricia TabalonNo ratings yet

- Agile QuestionsDocument13 pagesAgile QuestionsDiwakar_ch_200233% (12)

- Grid CodeDocument188 pagesGrid CodeArchiford NdhlovuNo ratings yet

- 100 Day Plan TemplateDocument1 page100 Day Plan TemplateGeorge ClarkNo ratings yet

- Concept 081 RebadgingDocument1 pageConcept 081 Rebadgingpriyadarshini.ajithNo ratings yet

- Monthly Update Meeting by SlidesgoDocument45 pagesMonthly Update Meeting by SlidesgoZakiyyah Iftinaan100% (1)

- The Role of IT in Supporting Mergers and AcquisitionsDocument7 pagesThe Role of IT in Supporting Mergers and AcquisitionsAjay AroraNo ratings yet

- 7623 01 Mergers and Acquisitions Powerpoint Template 16x9 1Document19 pages7623 01 Mergers and Acquisitions Powerpoint Template 16x9 1jeanrt7No ratings yet

- Enablement ROI Calculator For Sales EnablementDocument54 pagesEnablement ROI Calculator For Sales EnablementMartin BossNo ratings yet

- Roles and ResponsibilitiesDocument2 pagesRoles and Responsibilities\sharmaNo ratings yet

- Performance Management PlanDocument1 pagePerformance Management PlanGold AghareseNo ratings yet

- Perpetual License vs. SaaS Revenue ModelDocument1 pagePerpetual License vs. SaaS Revenue ModelDeb SahooNo ratings yet

- Non-Functional Requirements SpecificationsDocument7 pagesNon-Functional Requirements SpecificationsAmr M. AminNo ratings yet

- Oracle ERP Cloud Assessment for GAP RetailDocument6 pagesOracle ERP Cloud Assessment for GAP RetailshanmugaNo ratings yet

- Personal Expense Tracker 7Document1 pagePersonal Expense Tracker 7Sivamuthu KumarNo ratings yet

- ROI AnalysisDocument2 pagesROI Analysisapi-3809857100% (2)

- 11.00 - Michael CoochDocument28 pages11.00 - Michael CoochMalluru KarthikNo ratings yet

- You Exec - Charts Collection FreeDocument8 pagesYou Exec - Charts Collection FreeNelson ArturoNo ratings yet

- Financial Profit & Loss KPI Dashboard: Open Index 80 % Income StatementDocument11 pagesFinancial Profit & Loss KPI Dashboard: Open Index 80 % Income StatementArturo MunozNo ratings yet

- Template Stock RecommendationSesaDocument41 pagesTemplate Stock RecommendationSesaArijit BoseNo ratings yet

- Business Case Spreadsheet Template AnalysisDocument37 pagesBusiness Case Spreadsheet Template AnalysisluisdmateosNo ratings yet

- Offshoring MckinseyDocument8 pagesOffshoring MckinseyMark LooiNo ratings yet

- Weekly project statusDocument1 pageWeekly project statusChelsea TanNo ratings yet

- It Performance Metrics and Strategy: Raymart D. Etchon, CpaDocument71 pagesIt Performance Metrics and Strategy: Raymart D. Etchon, CpaMay RamosNo ratings yet

- Delloite ConsultingDocument12 pagesDelloite ConsultingblackwhiskyNo ratings yet

- Report LightDocument205 pagesReport LightdaglarogluNo ratings yet

- Financial Modeling - PUNE Financial ModelingDocument1 pageFinancial Modeling - PUNE Financial ModelingBHARAT PRAKASH MAHANTNo ratings yet

- Accenture Digital Learning Business Case ToolDocument6 pagesAccenture Digital Learning Business Case ToolJessica MartinezNo ratings yet

- Cash Flow Analysis of ProposalsDocument22 pagesCash Flow Analysis of ProposalsOliviaNo ratings yet

- Market Strategy FrameworksDocument8 pagesMarket Strategy FrameworksAnkith naiduNo ratings yet

- Whitepaper - IMS - IT Infrastructure ManagementDocument9 pagesWhitepaper - IMS - IT Infrastructure ManagementPrateek ParkashNo ratings yet

- Private Equity Capability ModelDocument8 pagesPrivate Equity Capability ModelCapability ModelNo ratings yet

- Background and Desktop Refresh ModelsDocument4 pagesBackground and Desktop Refresh Modelserlend2012No ratings yet

- Essential KPIDocument4 pagesEssential KPIerlend2012No ratings yet

- Communication Plan Program Management OfficeDocument5 pagesCommunication Plan Program Management OfficeNilson CostaNo ratings yet

- Financial Aspects of Cloud Computing Business ModelsDocument103 pagesFinancial Aspects of Cloud Computing Business ModelsNaman VermaNo ratings yet

- The Most Important Roles For Your PPM: PPM Role PPM Responsibility Typical Organizational Role Your NotesDocument2 pagesThe Most Important Roles For Your PPM: PPM Role PPM Responsibility Typical Organizational Role Your NotesMarielle MaltoNo ratings yet

- Strategic Plan for Content LeadershipDocument11 pagesStrategic Plan for Content Leadershiperlend2012No ratings yet

- HR Cost of Hiring CalculatorDocument2 pagesHR Cost of Hiring Calculatornandex777No ratings yet

- The ROI of Cloud AppsDocument13 pagesThe ROI of Cloud AppsYasserAlmisferNo ratings yet

- Dell Value ChainDocument27 pagesDell Value ChainVed Prakash TiwariNo ratings yet

- Project Gantt Chart PlanDocument12 pagesProject Gantt Chart PlanAnonymous OFP2ygPIdNo ratings yet

- SaaS ENv2Document27 pagesSaaS ENv2Gopu NairNo ratings yet

- Finance Checklist: Startup Name Session Date Phase Actionable Task StatusDocument19 pagesFinance Checklist: Startup Name Session Date Phase Actionable Task StatusS M Tanjilur RahmanNo ratings yet

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- 17 - Defining Service Level Agreement (SLA) For E-Gov ProjectsDocument9 pages17 - Defining Service Level Agreement (SLA) For E-Gov ProjectsdevNo ratings yet

- A Portfolio Strategy: To Execute Your Digital TransformationDocument10 pagesA Portfolio Strategy: To Execute Your Digital TransformationKyaw Htet LuNo ratings yet

- Estimated Two Thirds of IT Investments Fail To Achieve Intended ResultDocument4 pagesEstimated Two Thirds of IT Investments Fail To Achieve Intended ResultwevoliNo ratings yet

- Risk Base Pricing AnalysisDocument8 pagesRisk Base Pricing AnalysisdddibalNo ratings yet

- Free Business Case Template in ExcelDocument68 pagesFree Business Case Template in ExcelFrancisco SalazarNo ratings yet

- Stakeholder Analysis ToolDocument8 pagesStakeholder Analysis ToolRichard Thodé JrNo ratings yet

- 2015 Operational Plan Template: A Presentation Template For Your Company's 2015 Operating PlanDocument23 pages2015 Operational Plan Template: A Presentation Template For Your Company's 2015 Operating PlanCommon plpNo ratings yet

- Kpi Dashboard: WH 2: KPI Handling KPI Stock Take AccuracyDocument6 pagesKpi Dashboard: WH 2: KPI Handling KPI Stock Take AccuracyBeatrixNo ratings yet

- Brand Valuation - Marginal Cash Flow and Excess Cash FlowDocument12 pagesBrand Valuation - Marginal Cash Flow and Excess Cash Flowbipaf44641izzumcomNo ratings yet

- Financial Analysis of Micro-Hydropower Projects - Excel ToolDocument107 pagesFinancial Analysis of Micro-Hydropower Projects - Excel ToolGordan KanižajNo ratings yet

- Axia ROI CalculatorDocument5 pagesAxia ROI CalculatorJ.A. SearlesNo ratings yet

- Implementing an Enterprise Service Bus (ESBDocument8 pagesImplementing an Enterprise Service Bus (ESBdeMontfort nd.No ratings yet

- Computer Hardware Service Centre Setup CostsDocument11 pagesComputer Hardware Service Centre Setup CostsKrishnan NamboothiriNo ratings yet

- Computer Hardware Service Centre: 4. Industry Look Out and TrendDocument11 pagesComputer Hardware Service Centre: 4. Industry Look Out and TrendOhmNo ratings yet

- Checklist For Agile SuccessDocument3 pagesChecklist For Agile Successerlend2012No ratings yet

- Transport StrategyDocument8 pagesTransport Strategyerlend2012No ratings yet

- SAP SD Questions and AnswersDocument16 pagesSAP SD Questions and Answerserlend2012No ratings yet

- People SkillsDocument19 pagesPeople Skillserlend2012No ratings yet

- PGL Logistics Survey QuestionnaireDocument2 pagesPGL Logistics Survey Questionnaireerlend2012No ratings yet

- Sap SDDocument116 pagesSap SDerlend2012No ratings yet

- Sap SD DetailedDocument10 pagesSap SD Detailederlend2012No ratings yet

- Agile Transformation Operating ModelDocument12 pagesAgile Transformation Operating Modelerlend2012100% (6)

- Essential KPIDocument4 pagesEssential KPIerlend2012No ratings yet

- Harvard's 2018 IT Strategic PlanDocument12 pagesHarvard's 2018 IT Strategic Planerlend2012No ratings yet

- The CIO's First 100 Days: A Toolkit: Executive SummaryDocument8 pagesThe CIO's First 100 Days: A Toolkit: Executive SummaryMohit GuptaNo ratings yet

- Strategic Plan for Content LeadershipDocument11 pagesStrategic Plan for Content Leadershiperlend2012No ratings yet

- SAP Order To Cash FlowDocument11 pagesSAP Order To Cash Flowerlend2012No ratings yet

- Change Agility - Jason LittleDocument277 pagesChange Agility - Jason Littleerlend2012No ratings yet

- Communications Plan TemplateDocument1 pageCommunications Plan Templateerlend2012No ratings yet

- Test Plan TemplateDocument2 pagesTest Plan Templateerlend2012No ratings yet

- Risk Issue Decision Action Item Register TemplateDocument6 pagesRisk Issue Decision Action Item Register Templateerlend2012No ratings yet

- IT Monthly Estimation and Planning Tool InstructionsDocument8 pagesIT Monthly Estimation and Planning Tool Instructionserlend2012100% (1)

- Prioritization Worksheet TemplateDocument4 pagesPrioritization Worksheet Templateerlend2012100% (2)

- Background and Desktop Refresh ModelsDocument4 pagesBackground and Desktop Refresh Modelserlend2012No ratings yet

- IT Management Evolves - IT Governance Becomes A Critical EnablerDocument16 pagesIT Management Evolves - IT Governance Becomes A Critical Enablererlend2012No ratings yet

- How To Get Started With IT4ITDocument156 pagesHow To Get Started With IT4ITerlend2012No ratings yet

- Feasibility Study For Tank FarmDocument3 pagesFeasibility Study For Tank FarmFahmy ArdhiansyahNo ratings yet

- Evaluation of ProductsDocument24 pagesEvaluation of ProductsRohan Sen SharmaNo ratings yet

- 600 019 Advanced Petroleum Economics 600.019 Advanced Petroleum EconomicsDocument46 pages600 019 Advanced Petroleum Economics 600.019 Advanced Petroleum EconomicsRoberto MendozaNo ratings yet

- A Guide To The Financial Analysis of Shrimp FarmingDocument22 pagesA Guide To The Financial Analysis of Shrimp FarmingJohn Sebastian Bell-Scott100% (2)

- Managerial Economics (Chapter 14)Document28 pagesManagerial Economics (Chapter 14)api-3703724100% (1)

- Project Economic Appraisal Techniques in Construction Industry - A Comparative StudyDocument7 pagesProject Economic Appraisal Techniques in Construction Industry - A Comparative StudyBagas Prawiro DpNo ratings yet

- Boosting Cattle Supply Through FatteningDocument25 pagesBoosting Cattle Supply Through FatteningaklilNo ratings yet

- CF Remdial AssignmentDocument5 pagesCF Remdial AssignmentMadhav RajbanshiNo ratings yet

- CFA Level1 2017 Mock ExamDocument75 pagesCFA Level1 2017 Mock ExamMauricio CabreraNo ratings yet

- Financial Management-Capital BudgetingDocument24 pagesFinancial Management-Capital Budgetingakash yadavNo ratings yet

- Investment Decision Criteria (PAF)Document32 pagesInvestment Decision Criteria (PAF)VinayGolchhaNo ratings yet

- Case Study of Capital BudetingDocument4 pagesCase Study of Capital BudetingMaunilShethNo ratings yet

- Project Management Career Accelerator - FinalDocument39 pagesProject Management Career Accelerator - FinalDamodar DasNo ratings yet

- Chapter 6 - Capital BudgetingDocument14 pagesChapter 6 - Capital BudgetingThuyDuong BuiNo ratings yet

- Concepts and Techniques: Capital BudgetingDocument66 pagesConcepts and Techniques: Capital BudgetingAMJAD ALINo ratings yet

- Bharti School of Engineering ENGR 3426-Engineering Economics Project (DCF and Risk Analysis)Document23 pagesBharti School of Engineering ENGR 3426-Engineering Economics Project (DCF and Risk Analysis)Victor NwaborNo ratings yet

- Capital Budgeting ProblemsDocument8 pagesCapital Budgeting ProblemsAnantdeep Singh Puri100% (1)

- Cbe Guidance: Diploma in International Financial Reporting (Dipifr)Document14 pagesCbe Guidance: Diploma in International Financial Reporting (Dipifr)info m-alamriNo ratings yet

- Financial Appraisal of Water Treatment FacilityDocument20 pagesFinancial Appraisal of Water Treatment FacilitySarthakAryaNo ratings yet

- Final SumsDocument12 pagesFinal SumsMaryNo ratings yet

- ACBDocument64 pagesACBPrakash GowdaNo ratings yet

- Fazal Haq MarbleDocument19 pagesFazal Haq MarbleADIL ALI SHAHNo ratings yet

- Akash JadhavDocument70 pagesAkash Jadhavninad ghadigaonkarNo ratings yet

- Excel Practice SheetDocument154 pagesExcel Practice SheetAndrew KohNo ratings yet

- Capital Budgeting Techniques ExplainedDocument28 pagesCapital Budgeting Techniques Explainedhashmi4a4No ratings yet

- Evaluation of Information Technology Investment Article2Document12 pagesEvaluation of Information Technology Investment Article2yunus_starkNo ratings yet