Professional Documents

Culture Documents

RC Company Acquires Wynshel Company in Exchange for 9,000 Common Shares

Uploaded by

Sherlock HolmesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RC Company Acquires Wynshel Company in Exchange for 9,000 Common Shares

Uploaded by

Sherlock HolmesCopyright:

Available Formats

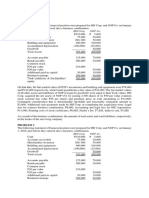

Questions 15 through 18 are based on the following:

On January 1, 2012, RC Company acquired all the net assets of Wynshel Company in exchange

for 9,000 newly issued common shares of RC Company with a par value of P100 and a market

value of P250. Immediately prior to the purchase combination, on January 1, 2012, the book

values and fair values of Wynshel were presented in the following balance sheet:

Book value Fair value

Cash P 100,000 P 100,000

Inventory 300,000 300,000

Plant and equipment (net) 1,650,000 2,000,000

Total assets P2,050,000 P2,400,000

Notes payable P 200,000 P200,000

Common stock 1,000,000

Excess over par 250,000

Retained earnings 600,000

Total liab. and SHE P2,050,000

As part of the combination plan,

You might also like

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- 1. mergers and inv in subsDocument4 pages1. mergers and inv in subsmartinfaith958No ratings yet

- Business CombinationDocument10 pagesBusiness CombinationLora Mae JuanitoNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Business combinations and consolidated financial statementsDocument2 pagesBusiness combinations and consolidated financial statementsCynthia CanlasNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Business Combination Problems Quiz 2Document7 pagesBusiness Combination Problems Quiz 2PrankyJellyNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- St. Scholastica's College Advanced Accounting 2 ProblemsDocument4 pagesSt. Scholastica's College Advanced Accounting 2 ProblemsAlaine Doble CPANo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Problem 1: 105,000 - Correct AnswerDocument1 pageProblem 1: 105,000 - Correct AnswerSophia MilletNo ratings yet

- Drill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingDocument5 pagesDrill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingRobert CastilloNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Accounting For Business Combinations Pre 7 - Midterm QuizzesDocument2 pagesAccounting For Business Combinations Pre 7 - Midterm QuizzesJalyn Jalando-onNo ratings yet

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- Exercise Answers - AcquisitionDocument26 pagesExercise Answers - AcquisitionJohn Philip L Concepcion100% (1)

- UNDERSTANDING INTERCOMPANY TRANSACTIONSDocument2 pagesUNDERSTANDING INTERCOMPANY TRANSACTIONSMark Lyndon YmataNo ratings yet

- Stock AcquisitionDocument5 pagesStock AcquisitionPrankyJellyNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- Assignment Bus. CombiDocument49 pagesAssignment Bus. CombiAe AsisNo ratings yet

- B. P17,600,000 C. P26,200,000 D. P18,200,000Document2 pagesB. P17,600,000 C. P26,200,000 D. P18,200,000Wawex DavisNo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- Afar Drill 3Document7 pagesAfar Drill 3ROMAR A. PIGANo ratings yet

- 2 PFRS For SMEs Business CombinationDocument1 page2 PFRS For SMEs Business CombinationRay Allen UyNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- AcctgDocument11 pagesAcctgsarahbee100% (2)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Class 2 HomeworkDocument7 pagesClass 2 HomeworkAngel MéndezNo ratings yet

- Acct 108 Consolidated Financial Statements QuizDocument5 pagesAcct 108 Consolidated Financial Statements QuizGround ZeroNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Simple Company-WPS OfficeDocument3 pagesSimple Company-WPS OfficeAngeline BautistaNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- Sambal Company comparative balance sheet and cash flow analysisDocument2 pagesSambal Company comparative balance sheet and cash flow analysisconequip philippines100% (1)

- Week 2 - Exercise QuestionDocument2 pagesWeek 2 - Exercise Questionkk23212No ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- 2018cpapassers PDFDocument4 pages2018cpapassers PDFBryan Bryan BacarisasNo ratings yet

- Accounting+for+Business+Combination+HO+No.1Document7 pagesAccounting+for+Business+Combination+HO+No.1secretary.feujpia2324No ratings yet

- Accounting Lessons on Net Asset AcquisitionsDocument2 pagesAccounting Lessons on Net Asset AcquisitionsRafael BarbinNo ratings yet

- Accounting Lessons on Net Asset AcquisitionsDocument2 pagesAccounting Lessons on Net Asset AcquisitionsRafael BarbinNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Practice ExercisesDocument6 pagesPractice ExercisesMyunimintNo ratings yet

- Fundamentals of Accountancy, Business, and Management SFP GuideDocument16 pagesFundamentals of Accountancy, Business, and Management SFP GuideSherlock HolmesNo ratings yet

- Quiz Strat. ManDocument20 pagesQuiz Strat. ManSherlock Holmes100% (1)

- Quiz Researh FinalDocument5 pagesQuiz Researh FinalSherlock HolmesNo ratings yet

- Decision QuizDocument4 pagesDecision QuizSherlock Holmes100% (2)

- R2Document3 pagesR2Sherlock HolmesNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTDocument15 pagesFundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTSherlock HolmesNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTDocument15 pagesFundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTSherlock HolmesNo ratings yet

- R1Document3 pagesR1Sherlock HolmesNo ratings yet

- Prepared By: Mark Vincent B. Bantog, LPTDocument16 pagesPrepared By: Mark Vincent B. Bantog, LPTSherlock HolmesNo ratings yet

- Syllabus Business Research 2Document5 pagesSyllabus Business Research 2Sherlock HolmesNo ratings yet

- Prepared By: Mark Vincent B. Bantog, LPTDocument22 pagesPrepared By: Mark Vincent B. Bantog, LPTSherlock HolmesNo ratings yet

- Notes Compleeting Audit and Post Audit ResponsibilitiesDocument5 pagesNotes Compleeting Audit and Post Audit ResponsibilitiesSherlock HolmesNo ratings yet

- Notes For Pre Final Exam SM 2 1516 Question Will Be in Form of Multiple Choice and Two EssayDocument2 pagesNotes For Pre Final Exam SM 2 1516 Question Will Be in Form of Multiple Choice and Two EssaySherlock HolmesNo ratings yet

- General Notes 1Document6 pagesGeneral Notes 1Sherlock HolmesNo ratings yet

- AuditDocument2 pagesAuditSherlock HolmesNo ratings yet

- Auditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleDocument6 pagesAuditing Notes For Pre Mid Exam A.Y. 15/16 Audit Revenue CycleSherlock HolmesNo ratings yet

- IDocument1 pageISherlock HolmesNo ratings yet

- Seat PlanDocument1 pageSeat PlanSherlock HolmesNo ratings yet

- Ethical Dilemma 1: Divorcing Couple: What Should Andre Do?Document5 pagesEthical Dilemma 1: Divorcing Couple: What Should Andre Do?Sherlock HolmesNo ratings yet

- Rubrics For Presentation BPDocument1 pageRubrics For Presentation BPSherlock HolmesNo ratings yet

- Synthesis Paper RubricDocument1 pageSynthesis Paper RubricSherlock HolmesNo ratings yet

- BSAIS 2018 Curriculum MapDocument2 pagesBSAIS 2018 Curriculum MapSherlock Holmes100% (1)

- Ethical Dilemma 1: Divorcing Couple: What Should Andre Do?Document5 pagesEthical Dilemma 1: Divorcing Couple: What Should Andre Do?Sherlock HolmesNo ratings yet

- The Proper Use of Verb TensesDocument8 pagesThe Proper Use of Verb TensesSherlock HolmesNo ratings yet

- Auditing TheoryDocument14 pagesAuditing TheorySweete ManabatNo ratings yet

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- Insurance Contract and BOTDocument2 pagesInsurance Contract and BOTSherlock Holmes50% (2)

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- 2009 A-1 Class Questions PreviewDocument13 pages2009 A-1 Class Questions PreviewRobert ReantasoNo ratings yet