Professional Documents

Culture Documents

Pand L-Class Question

Uploaded by

Biswajit PrustyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pand L-Class Question

Uploaded by

Biswajit PrustyCopyright:

Available Formats

Question:

Prepare Income Statement based on the following information

The following transactions are July 2011 activities of Bob’s Bowling, Inc., which operates

several bowling centers (for games and equipment sales).

a. Bob’s collected $ 11,000 from customers for games played in July.

b. Bob’s sold bowling equipment inventory for $ 6,000; received $ 4,000 in cash and the

rest on account.

c. Bob’s received $ 1,500 from customers on account who purchased merchandise in June.

d. The men’s and Ladies’ bowling leagues gave Bob’s a deposit of 4,600 for the upcoming

fall season.

e. Total cost of bowling merchandised sold during the period to Bob’s is $ 2,100

f. Bob’s paid $ 1,800 on the electricity bill for June (recorded as expense in June)

g. Bob’s paid $ 3,800 to employees for work in July

h. Bob’s purchased $ 1,800 in insurance for coverage from July 1 to October 1

i. Bob’s paid $ 1,200 to plumbers for repairing a broken pipe in the restrooms

j. Bob’s received the July electricity bill for $ 2,300 to be paid in August

k. Bob’s pay income tax at 30% on Profit Before Tax

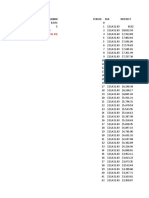

Prepare an Income Statement for Bob’s Bowling, Inc., for the month of July 2011.

You might also like

- Case Pricing Options AtlanticDocument4 pagesCase Pricing Options AtlanticBiswajit PrustyNo ratings yet

- Gillette Indonesia Case Study (Epgp-11-026)Document1 pageGillette Indonesia Case Study (Epgp-11-026)Biswajit PrustyNo ratings yet

- Psi Case Study (Epgp-11-026)Document2 pagesPsi Case Study (Epgp-11-026)Biswajit PrustyNo ratings yet

- Session 4 Money and Monetary PolicyDocument50 pagesSession 4 Money and Monetary PolicyBiswajit PrustyNo ratings yet

- Labour Reforms and Manufacturing Performance - InstructorDocument25 pagesLabour Reforms and Manufacturing Performance - InstructorBiswajit PrustyNo ratings yet

- Session 2 Tracking The Cost of LivingDocument28 pagesSession 2 Tracking The Cost of LivingBiswajit PrustyNo ratings yet

- QM Excel LogisticDocument20 pagesQM Excel LogisticBiswajit PrustyNo ratings yet

- India's Industrial Sector - Role of MSMEsDocument14 pagesIndia's Industrial Sector - Role of MSMEsBiswajit PrustyNo ratings yet

- The Business Cycle: Economies Do Not Always Produce To Their Potential Output. of Potential OutputDocument59 pagesThe Business Cycle: Economies Do Not Always Produce To Their Potential Output. of Potential OutputBiswajit PrustyNo ratings yet

- FM Loan ProblemDocument4 pagesFM Loan ProblemBiswajit PrustyNo ratings yet

- Case 3-Positioning The Tata NanoDocument3 pagesCase 3-Positioning The Tata NanoBiswajit PrustyNo ratings yet

- Decoding The Dna of Toyota's Production SystemDocument7 pagesDecoding The Dna of Toyota's Production SystemBiswajit PrustyNo ratings yet

- Organizational Behavior-II: Organizational Theory, Design, and ChangeDocument44 pagesOrganizational Behavior-II: Organizational Theory, Design, and ChangeBiswajit PrustyNo ratings yet

- AMAZONDocument10 pagesAMAZONBiswajit PrustyNo ratings yet

- MM Project On The Marketing Strategy of Coca Cola (Epgp-11-026)Document13 pagesMM Project On The Marketing Strategy of Coca Cola (Epgp-11-026)Biswajit PrustyNo ratings yet

- Mini CaseDocument1 pageMini CaseBiswajit PrustyNo ratings yet

- Profit Loss Account-Session 4-1Document48 pagesProfit Loss Account-Session 4-1Biswajit PrustyNo ratings yet

- Koya Cab Case AnswerDocument2 pagesKoya Cab Case AnswerBiswajit Prusty100% (2)

- Mini ProjectDocument4 pagesMini ProjectBiswajit PrustyNo ratings yet

- Vora and Company (Epgp 11 040)Document3 pagesVora and Company (Epgp 11 040)Biswajit PrustyNo ratings yet

- SM Project BriefDocument3 pagesSM Project BriefBiswajit PrustyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)