Professional Documents

Culture Documents

Application For Provident Benefits (Apb) Claim: Type or Print Entries

Uploaded by

Shantal CervantesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application For Provident Benefits (Apb) Claim: Type or Print Entries

Uploaded by

Shantal CervantesCopyright:

Available Formats

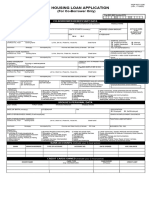

APPLICATION FOR HQP-PFF-285

(V01, 11/2017)

(For IISP Branch Only)

PROVIDENT BENEFITS (APB) CLAIM CLAIM FILE No.

(To be filled out by member/claimant. Print this form back to back on one single sheet of paper)

TYPE OR PRINT ENTRIES

REASON FOR CLAIM (Check appropriate box)

MEMBERSHIP TERM MATURITY RETIREMENT PERMANENT DEPARTURE OPTIONAL WITHDRAWAL

DEATH Effective Date of Retirement_____________ FROM THE COUNTRY OTHERS

Date of Death ____________ Last Day of Service ___________________ TERMINATION FROM THE Please Specify __________________

PERMANENT TOTAL SERVICE BY REASON OF

DISABILITY/INSANITY HEALTH

MEMBERSHIP PROGRAM (Check appropriate box)

Pag-IBIG I Pag-IBIG II MODIFIED Pag-IBIG II (MP2) Pag-IBIG OVERSEAS PROGRAM

(POP)

MEMBER’S PERSONAL DETAILS

LAST NAME FIRST NAME NAME EXTENSION (e.g., Jr., II) MIDDLE NAME MAIDEN NAME Pag-IBIG MID No./RTN

(For married women)

DATE OF BIRTH MARITAL STATUS TAXPAYER IDENTIFICATION No. (TIN)

Single/Unmarried Widow/er Annulled

Married Legally Separated

CLAIMANT, if other than the Member (Last Name, First Name, Name Extension, Middle Name) RELATIONSHIP TO MEMBER

ADDRESS AND CONTACT DETAILS

MEMBER’S PRESENT HOME ADDRESS MEMBER/CLAIMANT CONTACT DETAILS

Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name Subdivision COUNTRY + AREA CODE TELEPHONE

NUMBER

Home

Barangay Municipality/City Province/State/Country (if abroad) ZIP Code

Cell Phone (Required)

CLAIMANT’S PRESENT HOME ADDRESS (Leave blank if the same as member)

Unit/Room No., Floor Building Name Lot No., Block No., Phase No. House No. Street Name Subdivision

Email Address

Barangay Municipality/City Province/State/Country (if abroad) ZIP Code

EMPLOYMENT DETAILS FROM DATE OF Pag-IBIG MEMBERSHIP (Use another sheet if necessary)

DATE OF Pag-IBIG MEMBERSHIP

EMPLOYER/BUSINESS NAME EMPLOYER/BUSINESS ADDRESS

FROM (Month/Year) TO (Month/Year)

AUTHORITY TO CREDIT AUTHORITY TO TRANSFER

IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR PROVIDENT BENEFITS IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR PROVIDENT

CLAIM, I HEREBY AUTHORIZED Pag-IBIG FUND TO CREDIT MY CLAIM PROCEEDS TO MY BENEFITS CLAIM, I HEREBY AUTHORIZED Pag-IBIG FUND TO TRANSFER MY

PAYROLL ACCOUNT/DISBURSEMENT CARD THAT I HAVE INDICATED BELOW: CLAIM PROCEEDS TO MY MP2 ACCOUNT THAT I HAVE INDICATED BELOW:

PAYROLL ACCOUNT/DISBURSEMENT CARD No. BANK’S ADDRESS MP2 ACCOUNT No. AMOUNT TO BE TRANSFERRED

Full Amount Partial Amount P_________

SIGNATURE OF MEMBER DATE SIGNATURE OF MEMBER DATE

APPLICATION AGREEMENT

I hereby certify that I have read and understood the contents hereof, including the guidelines and instructions indicated at THUMBMARKS OF MEMBER/CLAIMANT

the back portion of this form. I further certify under pain of perjury that all information I have indicated herein are true and (If unable to sign)

correct to the best of my knowledge and belief, and that my signature or thumbmark appearing herein is genuine and

authentic. I likewise understand that the processing of this application is subject to pertinent provisions of the

implementing rules and regulations of the Pag-IBIG Fund. In the event of any outstanding Pag-IBIG loan, Pag-IBIG Fund

is hereby authorized to withhold, in whole or in part, the provident benefit subject of this claim, and apply the same as

payment to the said loan as well as other obligations due to the Pag-IBIG Fund as of the date of this application.

I hereby waive my rights under R.A. No. 1405 and authorize Pag-IBIG Fund to verify/validate my payroll LEFT THUMB RIGHT THUMB

account/disbursement card number. (To be done in the presence of Pag-IBIG Fund Personnel)

_________________________________

MEMBER/CLAIMANT _______________________________ _____

(Signature over Printed Name) (Signature over Printed Name of Witness) Date

THIS PORTION IS FOR Pag-IBIG Fund USE ONLY

CLAIMS/HL/STL/LOYALTY CARD VERIFICATION

DV/CHECK/PN/ DATE FILED/HL

PARTICULARS WITH WITHOUT OUTSTANDING BALANCE AS OF VERIFIED BY DATE

APPLICATION/HL ID NO. TAKEOUT DATE

CLAIMS

HOUSING LOAN

MULTI-PURPOSE LOAN

CALAMITY LOAN

LOYALTY CARD

PAYEE/S (Use another sheet if necessary) REMARKS

RECEIPT OF APPLICATION

RECEIVED BY DATE REVIEWED BY DATE APPROVED BY DATE

DISAPPROVED BY DATE REMARKS

THIS FORM MAY BE REPRODUCED. NOT FOR SALE

HQP-PFF-285

(V01, 11/2017)

GUIDELINES AND INSTRUCTIONS

A. When to File

The Application for Provident Benefits Claim (APB [HQP-PFF-285]) may be filed upon the occurrence b. For members with outstanding obligations with the Fund, at the time of termination of membership,

of any of the following: the said obligation shall be deducted from his TAV prior to the release of the provident claim.

1. Membership Maturity - shall be based on 20 years of membership with the Fund, reckoned from c. Release of member’s TAV shall be based on actual savings remitted by the employee and

the initial Pag-IBIG Fund Receipt (PFR) date; provided, the member has remitted a total of 240 employer, if applicable. In the case of member-claimants whose employer counterpart savings

monthly membership savings to the Fund at the time of maturity; have not been remitted to the Fund, a partial release of their TAV shall be made based on actual

2. Retirement - a member shall be compulsorily retired under the Fund upon reaching the age of 65. amounts credited to their accounts. In the same manner, the computation of annual dividends

A member may opt to retire earlier under the Fund upon the occurrence of any of the following shall be based on actual remittances made. Any amount that the Fund may collect from the

events, provided the member is not a housing loan borrower: employer due to enforcement shall be subsequently released to the member or his heirs.

a. Actual retirement from the SSS, GSIS, or from from government service by provision of law; d. In case of member’s death, the release of his provident benefit claims shall be in accordance with

b. Retirement under a private employer’s provident/retirement plan, provided that the member is the laws on succession.

at least 45 years of age at the time of retirement; e. A member who has multiple employers shall be entitled to claim his entire savings anytime upon

c. Reaching the age of sixty (60). occurrence of any of the grounds for membership termination.

3. Permanent Total Disability (PTD) or Insanity – PTD refers to the loss or impairment of a physical 2. Death Benefit

or mental function resulting from injury or sickness, which incapacitates said member to perform a. Upon the death of a member, his legal heirs shall be entitled to receive the applicable death benefit

any work or engage in any business or occupation; in addition to the deceased member’s TAV. The amount of the death benefit shall depend on his

4. Termination from Service by Reason of Health - a member can no longer render service to an membership status with the Fund at the time of his death.

employer due to severe health conditions, as certified by his doctor; - For active members at the time of death – P6,000, regardless of the amount of TAV.

5. Permanent Departure from the Country - a member has been permitted by his host country to - For inactive members at the time of death – the amount is equivalent to member’s TAV or

remain there indefinitely or has permanently left the Philippines to reside in another country; P6,000, whichever is lower.

6. Death; - If TAV offsetting occurred prior to the member’s death – the amount of death benefit to be

7. Optional Withdrawal of Pag-IBIG Savings - members of the Fund after the effectivity of R.A. 9679 granted shall depend on the membership status as of date of death. In case of inactive status

shall have the option to withdraw his or her TAV on the fifteenth (15th) year of continuous as of date of death, the TAV under consideration shall be the TAV prior to offsetting.

membership. Provided the said member has no outstanding loan with the Fund at the time of b. The legal heirs of the deceased member shall still be entitled to death benefit, subject to the

withdrawal. This option may be exercised only once during the membership term; conditions set and under the following circumstances:

8. Any other reasons as may be approved for by the Board. - The check for provident benefit claims based on the grounds for membership termination other

than death is not yet released to the member;

B. Who May File - The member’s provident benefit claim proceeds are not yet credited to his disbursement/cash

The application may be filed by the member, his guardian, or any authorized representative/s. If the card or Payroll Account at the time of his death.

reason for claim is death of the member, the application may be filed by his heir/s or the latter’s 3. Manner of Payment

representative/s, or any appointed court administrator or executor. a. Shall be paid to the member or his legal heirs through any of the following modes:

- Crediting to the claimant’s disbursement/cash card or Payroll Account;

C. Payment of Benefits - Through check payable to the claimant; or

1. Return of Total Accumulated Value - Other similar modes of payment approved by the Board.

a. The TAV to be returned to the member or his legal heirs, less of any and all pending obligations b. Claiming of checks through a representative shall be allowed provided the representative shall

with the Fund, shall consist of member’s remitted accumulated savings; employer’s present the documents that the Fund may require relative to the provident benefit claim.

counterpart savings, if applicable; and dividend earnings credited to the member’s account as

declared by the Board.

CHECKLIST OF REQUIREMENTS

BASIC REQUIREMENTS

1. Application for Provident Benefits Claim (APB, HQP-PFF-285)

2. Pag-IBIG Loyalty Card and one (1) valid ID of member/claimant (present original and submit photocopy)

NOTES:

a. If Pag-IBIG Loyalty Card is not available, two (2) valid IDs (present original and submit photocopy).

b. For retirement purposes, the valid IDs must reflect the member’s date of birth. If the valid IDs do not reflect the date of birth,

submit any of the following:

Birth Certificate of Member issued by Philippine Statistics Authority (PSA)

Non-availability of Birth Record issued by PSA and Joint Affidavit of Two Disinterested Persons (HQP-PFF-029,

notarized)

ADDITIONAL REQUIREMENTS

A. FOR RETIREMENT

1. Certificate of Early Retirement (Notarized) (For Private Employee only at least 45 years old)

2. GSIS Retirement Voucher (For Government Employee)

3. Order of Retirement (For Members under AFP, PNP, BJMP, BFP)

4. Statement of Service (For Members under AFP) or Service Record (For Members under PNP, BJMP, BFP)

B. FOR PERMANENT TOTAL DISABILITY OR INSANITY/TERMINATION FROM THE SERVICE BY REASON OF HEALTH

1. Physician’s Certificate/Statement (With Clinical or Medical Abstract)

C. FOR PERMANENT DEPARTURE FROM THE COUNTRY

1. Photocopy of Passport with Immigrant Visa/Residence Visa/Settlement Visa or its equivalent

2. Sworn Declaration of Intention to Depart from the Philippines Permanently (HQP-PFF-031, notarized) (No need to submit if

already based abroad)

D. FOR DEATH

1. Death Certificate of Member issued by PSA

NOTES:

a. If Death Certificate issued by PSA is not available, submit any of the following:

Death Certificate issued by the Local Civil Registry Office (LCRO) and duly authenticated by PSA.

Photocopy of Death Certificate issued by PSA and with “Original Document Seen” stamped by Pag-IBIG Office (If

with Pag-IBIG Housing Loan and document was previously submitted to Pag-IBIG Office for MRI settlement).

b. For member who died abroad, the Certificate of Death issued abroad should be duly certified by the Philippine Consulate

General/Philippine Embassy in the country where the member died.

2. Proof of Surviving Legal Heirs (HQP-PFF-030, notarized)

3. Certificate of No Marriage (CENOMAR) issue by PSA (If deceased member is single)

4. Marriage Contract and Advisory on Marriage issued by PSA (If deceased member is married)

5. Birth Certificate issued by PSA or Baptismal/Confirmation Certificate of all children (If with child/children)

6. Affidavit of Guardianship (HQP-PFF-028, notarized) (If with child/children below 18 years old, or if child/children is/are

physically/mentally incompetent)

7. To establish kinship with the deceased member, the claimant shall submit any of the following:

a. Birth Certificate issued by PSA or Baptismal/Confirmation Certificate of deceased member/claimant

b. Non-availability of Birth Record issued by PSA and Joint Affidavit of Two Disinterested Persons (HQP-PFF-029,

notarized)

IMPORTANT

1. Pag-IBIG FUND RESERVES THE RIGHT TO REQUEST ADDITIONAL DOCUMENTS, IF DEEMED NECESSARY. PROCESSING OF CLAIMS SHALL

COMMENCE ONLY UPON SUBMISSION OF COMPLETE DOCUMENTS.

2. IN ALL INSTANCES WHEREIN PHOTOCOPIES ARE SUBMITTED, THE ORIGINAL DOCUMENT MUST BE PRESENTED FOR AUTHENTICATION.

3. IF MEMBER/CLAIMANT CANNOT CLAIM PERSONALLY, SUBMIT SPECIAL POWER OF ATTORNEY (HQP-PFF-033) AND TWO (2) VALID ID

CARDS EACH OF THE PRINCIPAL AND ATTORNEY-IN-FACT.

You might also like

- PAGIBIG Application For Provident Benefits ClaimDocument2 pagesPAGIBIG Application For Provident Benefits ClaimMeal StubNo ratings yet

- Application For Provident Benefits (Apb) Claim: Type or Print EntriesDocument2 pagesApplication For Provident Benefits (Apb) Claim: Type or Print Entriesglenn padernal50% (2)

- Application For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFDocument2 pagesApplication For Provident Benefits Claim (HQP-PFF-040, V02.1) PDFPhilip Floro0% (1)

- Pag-IBIG Provident Benefits Claim Form GuideDocument4 pagesPag-IBIG Provident Benefits Claim Form GuideCitiham MarketingNo ratings yet

- Pag-IBIG Provident Benefits Claim FormDocument2 pagesPag-IBIG Provident Benefits Claim FormCarlo Beltran Valerio0% (2)

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimLIERANo ratings yet

- HTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Document2 pagesHTTPS:::WWW - Pagibigfund.gov - ph:document:pdf:dlforms:providentrelated:PFF285 ApplicationProvidentBenefitsClaim V07Zyreen Kate CataquisNo ratings yet

- Application For Provident Benefits (Apb) ClaimDocument2 pagesApplication For Provident Benefits (Apb) ClaimJoey Singson100% (1)

- Calamity Loan Application FormDocument2 pagesCalamity Loan Application FormMervin BauyaNo ratings yet

- PFF285 ApplicationProvidentBenefitsClaim V08Document5 pagesPFF285 ApplicationProvidentBenefitsClaim V08Trisha ApalisNo ratings yet

- Calamity Loan Application SummaryDocument2 pagesCalamity Loan Application SummaryReddy RentarNo ratings yet

- HMDFDocument2 pagesHMDFmaricar0% (1)

- (For IISP Branch Only) : Application AgreementDocument2 pages(For IISP Branch Only) : Application AgreementRachel CabanlitNo ratings yet

- Pag-IBIG MPL Loan ApplicationDocument2 pagesPag-IBIG MPL Loan ApplicationBecca BelenNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V05 PDFHakdog Longgadog100% (1)

- CALAMITY LOAN Pag-IBIG Calamity Loan Application FormDocument2 pagesCALAMITY LOAN Pag-IBIG Calamity Loan Application FormAyan VicoNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpDocument2 pagesMulti-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpMA BethNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 Fillable Final PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V05 Fillable Final PDFSherwin Mandalones67% (3)

- MPL Loan Pag-IbigDocument2 pagesMPL Loan Pag-Ibigchristopher ighotNo ratings yet

- SLF066 CalamityLoanApplicationForm V05 Fillable FinalDocument2 pagesSLF066 CalamityLoanApplicationForm V05 Fillable FinalFrancis Raymond MachadoNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Cheery Fernandez SumargoNo ratings yet

- PAGIBIG SALARY MultiPurposeLoanApplicationForm - V05Document3 pagesPAGIBIG SALARY MultiPurposeLoanApplicationForm - V05michelleqborbeNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Erold John Salvador BuenaflorNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03Document2 pagesSLF065 MultiPurposeLoanApplicationForm V03Belle Adante100% (1)

- Https2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FDocument4 pagesHttps2Fwww Pagibigfund Gov Ph2Fdocument2Fpdf2Fdlforms2Fprovidentrelated2FKingNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V05Document3 pagesSLF065 MultiPurposeLoanApplicationForm V05JOSPEH ONTORIANo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V04Document3 pagesSLF065 MultiPurposeLoanApplicationForm V04Catherine Quijano100% (1)

- Calamity Loan Application Form: Filipino FilipinoDocument2 pagesCalamity Loan Application Form: Filipino Filipinoaljhondelacruz22No ratings yet

- SLF065 MultiPurposeLoanApplicationForm V04 Fillable FinalDocument2 pagesSLF065 MultiPurposeLoanApplicationForm V04 Fillable FinalKristyl AmbitaNo ratings yet

- Pag-IBIG MPL Loan Application FormDocument2 pagesPag-IBIG MPL Loan Application FormGeorgeNo ratings yet

- SLF066 CalamityLoanApplicationForm V08Document2 pagesSLF066 CalamityLoanApplicationForm V08Crispolo BernardinoNo ratings yet

- PAGIBIG CalamityLoanApplicationForm - V06Document3 pagesPAGIBIG CalamityLoanApplicationForm - V06michelleqborbeNo ratings yet

- Member'S Contribution Remittance Form (MCRF) : Employer/Business Name Goldrich Employer/Business AddressDocument4 pagesMember'S Contribution Remittance Form (MCRF) : Employer/Business Name Goldrich Employer/Business Addresslanie canicoNo ratings yet

- SLF066 Calamity Loan Application Form - V05Document2 pagesSLF066 Calamity Loan Application Form - V05Selyun E OnnajNo ratings yet

- Member'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressDocument4 pagesMember'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressBinoe ManalonNo ratings yet

- Member'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressDocument4 pagesMember'S Contribution Remittance Form (MCRF) : Employer/Business Name Employer/Business AddressBinoe ManalonNo ratings yet

- Pag-IBIG Employer Remittance FormDocument4 pagesPag-IBIG Employer Remittance FormMatthew Niño0% (1)

- PFF285 ApplicationProvidentBenefitsClaim V07Document2 pagesPFF285 ApplicationProvidentBenefitsClaim V07jumar_loocNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: Emilia Lani MonaresDocument2 pagesMulti-Purpose Loan (MPL) Application Form: Emilia Lani MonaresSolane LpgNo ratings yet

- SLF066 CalamityLoanApplicationForm V03 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V03 PDFKram Tende AwanucavNo ratings yet

- Pag Ibig Mp2 SavingsDocument2 pagesPag Ibig Mp2 SavingsDela Cruz RosselNo ratings yet

- SLF066 CalamityLoanApplicationForm V04Document2 pagesSLF066 CalamityLoanApplicationForm V04marta100% (4)

- SLF066 CalamityLoanApplicationForm V04 PDFDocument2 pagesSLF066 CalamityLoanApplicationForm V04 PDFLevyCastillo100% (3)

- Calamity Loan Application Form (CLAF)Document2 pagesCalamity Loan Application Form (CLAF)Ayan VicoNo ratings yet

- PFF226 ModifiedPagIBIGIIEnrollmentForm V03Document2 pagesPFF226 ModifiedPagIBIGIIEnrollmentForm V03Eran LopezNo ratings yet

- Pag-IBIG Enrollment FormDocument2 pagesPag-IBIG Enrollment FormArben MontellanoNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Document2 pagesMulti-Purpose Loan (MPL) Application Form: Ledesma Christy Policar 0922-477-1905Bev's AblaoNo ratings yet

- HLF540 ApplicationCondonationPenaltiesAdditionalInterests V01Document1 pageHLF540 ApplicationCondonationPenaltiesAdditionalInterests V01Daisy Marie A. RoselNo ratings yet

- Pag-IBIG MPL Loan ApplicationDocument2 pagesPag-IBIG MPL Loan Applicationcliford caballeroNo ratings yet

- PFF226 ModifiedPagIBIGIIEnrollmentForm V02Document2 pagesPFF226 ModifiedPagIBIGIIEnrollmentForm V02Karl LouisNo ratings yet

- Application For Loan Restructuring: (Under R.A. 9679)Document2 pagesApplication For Loan Restructuring: (Under R.A. 9679)Lovely Clarisse LaureanoNo ratings yet

- Pag-IBIG Member Change Form GuideDocument2 pagesPag-IBIG Member Change Form GuideMarianne CarantoNo ratings yet

- MP 2Document2 pagesMP 2GaryNo ratings yet

- MCRF Pagibig FormDocument3 pagesMCRF Pagibig FormFrench Kamile PagcuNo ratings yet

- HLF1036 HousingLoanApplicationCoBorrower V01Document2 pagesHLF1036 HousingLoanApplicationCoBorrower V01Andrei Notario Manila100% (1)

- Housing Loan Application: (For Co-Borrower Only)Document2 pagesHousing Loan Application: (For Co-Borrower Only)Lumina LipaNo ratings yet

- PagIBIG Loan FormDocument2 pagesPagIBIG Loan FormgdlveeplNo ratings yet

- SLF065 - Multi-Purpose Loan Application Form (Applicable To Imus Branch Members Only) PDFDocument2 pagesSLF065 - Multi-Purpose Loan Application Form (Applicable To Imus Branch Members Only) PDFlokuloku100% (2)

- Auditing TheoryDocument16 pagesAuditing TheoryPatriciaNo ratings yet

- ITC January 2016 Paper 2 Question 2Document4 pagesITC January 2016 Paper 2 Question 2Lemon SherbertNo ratings yet

- Problem 1Document10 pagesProblem 1Shannen D. CalimagNo ratings yet

- Equity Research Report - Dabur India LimitedDocument7 pagesEquity Research Report - Dabur India LimitedShubhamShekharSinhaNo ratings yet

- LT 3. Finacial Management - 1399-3!21!20-02Document72 pagesLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNo ratings yet

- Accounting Achievement Test ReviewDocument7 pagesAccounting Achievement Test ReviewAldi HerialdiNo ratings yet

- LaBelle Iron Works v. United States, 256 U.S. 377 (1921)Document10 pagesLaBelle Iron Works v. United States, 256 U.S. 377 (1921)Scribd Government DocsNo ratings yet

- Price To Value by Bud LabitanDocument180 pagesPrice To Value by Bud Labitanbud_labitan100% (2)

- Are Sukuk and Conventional Bonds CompatibleDocument9 pagesAre Sukuk and Conventional Bonds CompatibleZouher EL BrmakiNo ratings yet

- Presentation On Capital GainsDocument12 pagesPresentation On Capital GainsSheemaShaheenNo ratings yet

- Ch11 kieso ifrs test bank chapterDocument40 pagesCh11 kieso ifrs test bank chapterTrinh LêNo ratings yet

- Economic and Social Statistics of SL 2018 e 0Document194 pagesEconomic and Social Statistics of SL 2018 e 0Aslam MohamedNo ratings yet

- Illustration of Cost of Goods Sold StatementDocument14 pagesIllustration of Cost of Goods Sold StatementShayne PagwaganNo ratings yet

- Rolling StoreDocument34 pagesRolling StoreAmie Jane MirandaNo ratings yet

- Ar PDFDocument255 pagesAr PDFPRAVEEENGODARANo ratings yet

- 02 Questions F3 INT LRPDocument54 pages02 Questions F3 INT LRPshabiumer100% (1)

- Internship Report (Mama Nourly SDN BHD)Document37 pagesInternship Report (Mama Nourly SDN BHD)RaziYangPemurah33% (3)

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- A Seminar Project On A Study On Financial Statement Analysis of SailDocument37 pagesA Seminar Project On A Study On Financial Statement Analysis of SailRj BîmålkümãrNo ratings yet

- Internship Report Phase 2Document77 pagesInternship Report Phase 2Diệu LinhNo ratings yet

- CIR v. General Foods Deduction for Media AdvertisingDocument2 pagesCIR v. General Foods Deduction for Media AdvertisingJacob Dalisay100% (3)

- F6 InterimDocument7 pagesF6 InterimSad AnwarNo ratings yet

- P 1Document8 pagesP 1Ken Mosende TakizawaNo ratings yet

- R&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyDocument1 pageR&D Expenses: Despite Establishing New Facilities With Updated Technologies, R&D Expenses Have Not Been ExplicitlyAmarjeet SinghNo ratings yet

- CA Final Direct Tax Book A-01 Assessment Entities (Year 2022)Document454 pagesCA Final Direct Tax Book A-01 Assessment Entities (Year 2022)Nimish MalhotraNo ratings yet

- Free Cash FlowDocument92 pagesFree Cash FlowManoj BhatNo ratings yet

- Philippine Fiscal PolicyDocument11 pagesPhilippine Fiscal PolicyHoney De LeonNo ratings yet

- Financial Reporting and Analysis by CA K K Ramesh (FRA)Document4 pagesFinancial Reporting and Analysis by CA K K Ramesh (FRA)Nilesh kumarNo ratings yet

- How to Conduct a Successful Acquisition Search: A Guide for Strategic Acquisition SearchDocument11 pagesHow to Conduct a Successful Acquisition Search: A Guide for Strategic Acquisition Searchamit_myfuture0% (1)

- Chapter 2 - Time Value of Money-1Document63 pagesChapter 2 - Time Value of Money-1Prakrit PrakashNo ratings yet