Professional Documents

Culture Documents

Exclusions From Indirect Tax PDF

Exclusions From Indirect Tax PDF

Uploaded by

Kunal DixitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exclusions From Indirect Tax PDF

Exclusions From Indirect Tax PDF

Uploaded by

Kunal DixitCopyright:

Available Formats

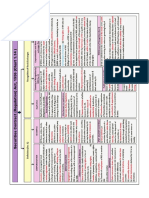

Study Guidelines for November 2019 examination

Final (New) Course Paper 8: Indirect Tax Laws

List of topic-wise exclusions from the syllabus

(1) (2) (3)

S. No. in Topics of the syllabus Exclusions

the (Provisions which are excluded from the

syllabus corresponding topic of the syllabus)

Part-I: Goods and Services Tax

1(ii) Levy and collection of CGST and IGST – (i) Rate of tax prescribed for supply of goods*

Application of CGST/IGST law; Concept of (ii) Rate of tax prescribed for supply of

supply including composite and mixed services*

supplies, inter-State supply, intra-State supply, (iii) Exemptions for supply of goods

supplies in territorial waters; Charge of tax

(iv) Categories of supply of goods, tax on which

including reverse charge; Exemption from tax;

is payable on reverse charge basis

Composition levy

1(v) Input tax credit (i) Manner of determination of input tax credit in

respect of inputs, input services and capital

goods and reversal thereof in respect of real

estate projects

(ii) Manner of reversal of credit of additional

duty of customs in respect of Gold dore bar

1(vii) Procedures under GST including registration, (i) Furnishing of GSTR-2, GSTR-1A, GSTR-3,

tax invoice, credit and debit notes, electronic GSTR-7, GSTR-8

way bill, accounts and records, returns, (ii) Claim of input tax credit and provisional

payment of tax including tax deduction at acceptance thereof

source and tax collection at source, refund, job

(iii) Matching, reversal & reclaim of input tax

work

credit

(iv) Matching, reversal & reclaim of reduction in

output tax liability

1(xvi) Other Provisions Transitional Provisions

Part-II: Customs & FTP

1.(v) Officers of Customs; Appointment of customs Completely excluded

ports, airports etc.

1.(vii) Provisions relating to coastal goods and

vessels carrying coastal goods

1.(viii) Warehousing

1.(x) Demand and Recovery

1.(xi) Provisions relating to prohibited goods,

notified goods, specified goods, illegal

importation/exportation of goods

1.(xii) Searches, seizure and arrest; Offences;

Penalties; Confiscation and Prosecution

1.(xiii) Appeals and Revision; Advance Rulings;

Settlement Commission

1.(xiv) Other provisions

*Rates specified for computing the tax payable under composition levy and special rate of tax prescribed

under Notification 2/2019 CT (R) dated 07.03.2019 [Effective rate 6% - CGST 3% & SGST 3%] are included

in the syllabus.

Notes:

(1) Amendments made by the Central Goods and Services Tax (Amendment) Act, 2018 and Integrated

Goods and Services Tax (Amendment) Act, 2018 [hereinafter referred to as CGST (Amendment) Act,

2018 and IGST (Amendment) Act, 2018 respectively], which are effective as on 30.04.2019, are

applicable for November 2019 examination. Consequently, section 8(b), section 17, section 18 and

section 20(a) of CGST (Amendment) Act, 2018 which have not been made effective till 30.04.2019 are

not applicable for November 2019 examination.

Further, any amendment made by the CGST (Amendment) Act, 2018 or IGST (Amendment) Act, 2018

in any of the topics excluded from the syllabus by way of Study Guidelines as mentioned above, are

also excluded. For instance, section 28 of the CGST (Amendment) Act, 2018 which has amended

section 140 of the CGST Act, 2017 is not applicable for November 2019 examination as section 140

covered under “Chapter XX – Transitional Provisions” has been excluded from the syllabus by way

of Study Guidelines as mentioned above.

(2) In the above table, in respect of the topics of the syllabus specified in column (2) the related exclusion is

given in column (3). Where an exclusion has been so specified in any topic of the syllabus, the provisions

corresponding to such exclusions, covered in other topic(s) forming part of the syllabus, shall also be

excluded.

(3) October 2018 edition of the Study Material is relevant for November 2019 examinations. The amendments

made by (i) the CGST Amendment Act, 2018 and IGST Amendment Act, 2018 as also the notifications and

circulars issued between 01.11.2018 and 30.04.2019 in GST laws and (ii) the notifications and circulars

issued between 01.05.2018 and 30.04.2019 in customs law, to the extent covered in the Statutory Update

for November 2019 examination alone shall be relevant for the said examination. The Statutory Update have

been hosted on the BoS Knowledge Portal.

(4) Amendments have been made with regard to GST rate on real estate sector in pursuance of the decisions

taken by the GST Council in its 33rd and 34th meetings held on 24.02.2019 and 19.03.2019 respectively. In

this regard, it may be noted that rate of tax prescribed for supply of services and manner of determination of

input tax credit in respect of inputs, input services or capital goods and reversal thereof in respect of real

estate projects have been excluded from the syllabus vide Study Guidelines. The remaining amendments

made in relation to real estate sector to the extent covered in the Statutory Update for November 2019

examination alone shall be relevant for the said examination.

(5) The entire content included in the October 2018 edition of the Study Material, except the exclusions

mentioned in the table above, and the Statutory Update for November 2019 examination shall be relevant for

the said examination.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- WiremensDocument1 pageWiremensrabbystarNo ratings yet

- Business Law Chapter-4Document13 pagesBusiness Law Chapter-4Masrur AlveeNo ratings yet

- Liu Lejot & Arner Finance in Asia: Institutions, Regulation & PolicyDocument29 pagesLiu Lejot & Arner Finance in Asia: Institutions, Regulation & PolicyplejotNo ratings yet

- CA Final Securities Law Charts - by CA Swapnil PatniDocument13 pagesCA Final Securities Law Charts - by CA Swapnil PatniAman JainNo ratings yet

- Air Conditioning and Refrigeration ContractorsDocument15 pagesAir Conditioning and Refrigeration ContractorsELI48No ratings yet

- Comparable Values RVR and Visibility TableDocument5 pagesComparable Values RVR and Visibility TablegasparusNo ratings yet

- BS 5266-6 - Emergency Lighting Part 6 - Photoluminescent SystemsDocument12 pagesBS 5266-6 - Emergency Lighting Part 6 - Photoluminescent SystemsBrad WilkinsonNo ratings yet

- 100 Introduction PDFDocument3 pages100 Introduction PDFGere TassewNo ratings yet

- FIDIC CoC Differences and Developments R PDFDocument35 pagesFIDIC CoC Differences and Developments R PDFkmmanoj1968No ratings yet

- Myanmar Financial Institutions LawDocument70 pagesMyanmar Financial Institutions LawNelson100% (1)

- Construction Safety Guidelines - DOLE DAO 13 PDFDocument21 pagesConstruction Safety Guidelines - DOLE DAO 13 PDFJoeDabidNo ratings yet

- NIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFDocument2,602 pagesNIIF Completas 2019 Libro Rojo Ilustrado Parte C PDFvagonet21No ratings yet

- Ra 10350Document27 pagesRa 10350Kayla IgleNo ratings yet

- Uruguay: Goods Documents Required Customs Prescriptions RemarksDocument9 pagesUruguay: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Establishment of A Charitable Foundation in KenyaDocument4 pagesEstablishment of A Charitable Foundation in KenyaPhilip MelliNo ratings yet

- Internal Controls:Sox 404Document6 pagesInternal Controls:Sox 404Laurie ChenowethNo ratings yet

- MSPO ReportDocument39 pagesMSPO Reportmuhammad85No ratings yet

- Banking in Mauritius The Global Business PerspectiveDocument4 pagesBanking in Mauritius The Global Business PerspectivecatchardipNo ratings yet

- Index: Scope of Study 3 Research Methodology Limitations of Study 11Document70 pagesIndex: Scope of Study 3 Research Methodology Limitations of Study 11Krishna Pradeep Lingala100% (1)

- List 14 OKT 22-1Document3 pagesList 14 OKT 22-1rico_coNo ratings yet

- Global Transportation ExucutionDocument11 pagesGlobal Transportation ExucutionKamau RobertNo ratings yet

- 016655Document2 pages016655James O'SullivanNo ratings yet

- BEL Code of ConductDocument10 pagesBEL Code of Conductatulrlondhe143No ratings yet

- SSM - Guideline For BO Reporting Framework (27022020)Document81 pagesSSM - Guideline For BO Reporting Framework (27022020)NURUL MASTURA BINTI KHAIRUDDIN (MOF)No ratings yet

- Doctor Agreement-1Document12 pagesDoctor Agreement-1saiarun1630No ratings yet

- Irda 5 AfDocument3 pagesIrda 5 Afsuveer_lane92No ratings yet

- Competition LawDocument16 pagesCompetition LawJuan CervantesNo ratings yet

- Understanding Preferential Allotment of Securities: Pavan Kumar VijayDocument54 pagesUnderstanding Preferential Allotment of Securities: Pavan Kumar VijayAakash MehtaNo ratings yet

- ECO401 Assignmnet SolutionDocument4 pagesECO401 Assignmnet Solutioncs619finalproject.comNo ratings yet

- LABOR LAW I - Wage DistortionDocument4 pagesLABOR LAW I - Wage DistortionLDNo ratings yet