Professional Documents

Culture Documents

Application Opting For Payment of Tax by Way of Composition Form Vat 250

Application Opting For Payment of Tax by Way of Composition Form Vat 250

Uploaded by

Sunil KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Opting For Payment of Tax by Way of Composition Form Vat 250

Application Opting For Payment of Tax by Way of Composition Form Vat 250

Uploaded by

Sunil KumarCopyright:

Available Formats

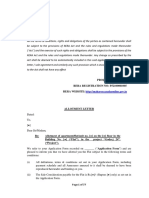

APPLICATION OPTING FOR PAYMENT OF TAX

BY WAY OF COMPOSITION FORM VAT 250

[See Rules 17(2)(b), 17(3)(c), 17(4)(b) & 19(5)]

Date Month Year

01.Tax Office Address:

_____________________________________

_____________________________________

_____________________________________ 02.TIN

03.Name :

Address:

I / we carrying on business as a*works contractor /as a hotelier do hereby apply to pay sales tax by way

of composition.

* i) At the rate of 4% on the total value of the contract executed for the Government or local Authority

subject to such conditions as may be prescribed.

* ii) At the rate of 4% on 50% of the total consideration received or receivable for the contract other

than State Government and local authorities subject to such conditions as may be prescribed.

* iii) At the rate of 4% on 25% of the consideration received or receivable or the market value fixed for

the purpose of stamp duty whichever is higher, for the contract of constructing and selling of residential

apartments, houses, buildings or commercial complexes subject to such conditions as may be

prescribed.

* iv) At the rate of 12.5% on 60% of the total consideration charged for food and drink to such conditions

as may be prescribed.

The details of contracts for which composition is opted for are given below:

Sl.No. Name & Address Nature of Contract Date of Full value of the

of the Contractee Contract Contract

Signature of the Dealer,

Stamp and Seal

(* Strike off whichever is not applicable)

117

You might also like

- Lessee Information StatementDocument4 pagesLessee Information StatementDarryl Jay Medina67% (3)

- Rent Receipt FormatDocument1 pageRent Receipt Formatghani tutorsbotNo ratings yet

- General Contract AddendumDocument1 pageGeneral Contract Addendumapi-320542467No ratings yet

- AP VAT Registration FormsDocument25 pagesAP VAT Registration Formsmhbaig5100% (6)

- Form 35 (See Rule 61 (1) ) Notice of Termination of An Agreement of Hire - Purchase Lease/HypothecationDocument2 pagesForm 35 (See Rule 61 (1) ) Notice of Termination of An Agreement of Hire - Purchase Lease/HypothecationAditya C. DesaiNo ratings yet

- Form 35 Application No:DL190317X3854805: PrintDocument1 pageForm 35 Application No:DL190317X3854805: PrintAkshitNo ratings yet

- Form 34Document1 pageForm 34jaspreet SinghNo ratings yet

- From 35 (1) HhajaaDocument2 pagesFrom 35 (1) Hhajaasikho aur sikhaoNo ratings yet

- Forms of Registration Under Contract Labour Act 1970 PDFDocument7 pagesForms of Registration Under Contract Labour Act 1970 PDFGlendaNo ratings yet

- View Forms - CLRADocument37 pagesView Forms - CLRAAMitNo ratings yet

- Labour Laws FormatsDocument17 pagesLabour Laws FormatsYash Bardhan SinghNo ratings yet

- New FormsDocument7 pagesNew FormsAndrew NelsonNo ratings yet

- Form No 31Document2 pagesForm No 31Ronie GatphohNo ratings yet

- Bidding FormsDocument13 pagesBidding FormsAnita QueNo ratings yet

- Checklist of Requirements GBID 18 Nov 2021Document2 pagesChecklist of Requirements GBID 18 Nov 2021Angelito Dela CruzNo ratings yet

- Special NEW ConsortiumDocument7 pagesSpecial NEW Consortiumallan ripaldaNo ratings yet

- Form 35Document1 pageForm 35Ravindra SwamiNo ratings yet

- Wa0024.Document2 pagesWa0024.sikho aur sikhaoNo ratings yet

- JCT 2011 Pay Less Notice Minor WorksDocument1 pageJCT 2011 Pay Less Notice Minor WorksJohnnyNo ratings yet

- US Internal Revenue Service: f921 AccessibleDocument2 pagesUS Internal Revenue Service: f921 AccessibleIRSNo ratings yet

- Offer To Buy FormDocument2 pagesOffer To Buy FormElizabeth LabisNo ratings yet

- Form 35Document2 pagesForm 35pawan dhingraNo ratings yet

- Form 33Document1 pageForm 33Mela RavalNo ratings yet

- Document Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyDocument20 pagesDocument Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyEDWARD LEENo ratings yet

- Form-I To Section II: To, M/S Gail (India) Limited - Sub: Tender No: Dear SirDocument9 pagesForm-I To Section II: To, M/S Gail (India) Limited - Sub: Tender No: Dear SirVipul MishraNo ratings yet

- Form-I To Section II: To, M/S Gail (India) Limited - Sub: Tender No: Dear SirDocument9 pagesForm-I To Section II: To, M/S Gail (India) Limited - Sub: Tender No: Dear SirVipul MishraNo ratings yet

- NITfor Cleaningand SweepingDocument43 pagesNITfor Cleaningand SweepingRameshbabu PeramNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Form DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004Document4 pagesForm DVAT 09 Cover Page: Application For Cancellation of Registration Under Delhi Value Added Tax Act, 2004hhhhhhhuuuuuyyuyyyyyNo ratings yet

- Kori Engineering Credit Application FormDocument6 pagesKori Engineering Credit Application Formaj.ngadaNo ratings yet

- Agreement To Adopt The Preliminary Agreement1 PDFDocument9 pagesAgreement To Adopt The Preliminary Agreement1 PDFVipul ShahNo ratings yet

- Certificate of Acceptance Construction v2.3Document2 pagesCertificate of Acceptance Construction v2.3Judy Anne Nicole PascuaNo ratings yet

- Godrej 24Document77 pagesGodrej 24Rohan BagadiyaNo ratings yet

- Amendment To ContractDocument1 pageAmendment To ContractGeno GottschallNo ratings yet

- Tender NO.13-Supply, Installation, - Commissioning and Testing of Diesel Generator 100 KW-Financial BidDocument6 pagesTender NO.13-Supply, Installation, - Commissioning and Testing of Diesel Generator 100 KW-Financial BidAbdul MoezNo ratings yet

- Republic of South Africa Trade Marks Act, 1993 PAYMENT (Including Additional Fee) AND Certificate of Renewal/ Restoration Official Date StampDocument1 pageRepublic of South Africa Trade Marks Act, 1993 PAYMENT (Including Additional Fee) AND Certificate of Renewal/ Restoration Official Date StamprodystjamesNo ratings yet

- Enaki Sale AgreementDocument24 pagesEnaki Sale AgreementmorreyNo ratings yet

- Phase2 (Icb/01/works/lungi Phase 2/2019Document10 pagesPhase2 (Icb/01/works/lungi Phase 2/2019AF Dowell MirinNo ratings yet

- NOC Required (1) - Baban BauriDocument4 pagesNOC Required (1) - Baban BauriSandip BanerjeeNo ratings yet

- LetterOfAuth REG0169Document1 pageLetterOfAuth REG0169gelin capiliNo ratings yet

- Edit-Chicago-Residential-Lease 2018 v5Document24 pagesEdit-Chicago-Residential-Lease 2018 v5api-450678717No ratings yet

- Sahulat KYC Application Form and Sahulat Account Opening Form - Dec 2020Document5 pagesSahulat KYC Application Form and Sahulat Account Opening Form - Dec 2020Syed Talib Hussain ShahNo ratings yet

- Form of AgreementDocument51 pagesForm of AgreementHoang Tan NguyenNo ratings yet

- F 2553Document3 pagesF 2553alpinetigerNo ratings yet

- Residential Tenancy Agreement: Form 1aaDocument11 pagesResidential Tenancy Agreement: Form 1aa历史见证No ratings yet

- TDS Form 16 & 16ADocument14 pagesTDS Form 16 & 16AVaibhav NagoriNo ratings yet

- RTB 5Document6 pagesRTB 5shop securityNo ratings yet

- Contract For The Sale and Purchase of Land 2019 Edition: Phone: 02 6572 1447Document79 pagesContract For The Sale and Purchase of Land 2019 Edition: Phone: 02 6572 1447jameelashirazNo ratings yet

- DL5CU0373Document2 pagesDL5CU0373Ghanshyam SinghNo ratings yet

- Form 33 (See Rule 59) Intimation of Change of Address For Recording in The Certificate of Registration and Office RecordsDocument1 pageForm 33 (See Rule 59) Intimation of Change of Address For Recording in The Certificate of Registration and Office RecordsAmit SharmaNo ratings yet

- Noc Tcfuc0351000010918228 27122022 1672126597261Document4 pagesNoc Tcfuc0351000010918228 27122022 1672126597261Deepak KumarNo ratings yet

- Annexure-I DATEDocument22 pagesAnnexure-I DATEajay kumarNo ratings yet

- Pilar Sorsogon Bpls-FormDocument4 pagesPilar Sorsogon Bpls-FormKevin Albert Dela CruzNo ratings yet

- Reservation Agreement TemplateDocument4 pagesReservation Agreement TemplateEllaine D RamirezNo ratings yet

- Application For License Form 4Document2 pagesApplication For License Form 4Aijaz KhajaNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet