Professional Documents

Culture Documents

There Is Definitely A Case For Bigger and Faster Transmission of Rates'

Uploaded by

Ritwik BasudeoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

There Is Definitely A Case For Bigger and Faster Transmission of Rates'

Uploaded by

Ritwik BasudeoCopyright:

Available Formats

https://t.

me/TheHindu_Zone_official

4 ECONOMY

>

MUMBAI | FRIDAY, 26 JULY 2019

Reserve Bankof India GovernorSHAKTIKANTA DAS tells ANUP ROY, RAGHU MOHAN and NIRAJ BHATT

Q&A that it is time forbanks to lowerinterest rates and start lending to cash-starved finance companies

afterdue credit appraisal and properriskassessment. Edited excerpts:

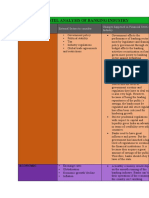

‘There is definitely a case for bigger and

faster transmission of rates’

Why are policy rate cuts not being interaction between the government

transmitted to lending rates at banks? and the RBI in the interests of the

The cost of funds of banks is one of the economy and in the interest of the

factors, which impacts lending rates. overall financial sector. That also gives a

Banks are gradually recovering from better understanding of the overall

stress in their balance sheets due to situation and definitely fine-tunes and

overhang of non-performing assets contributes to the quality of the

(NPAs). Going forward, I don’t think decision-making.

NPAs will be a major impediment in There are certain things that the RBI

transmission of the monetary policy cannot do without the government’s

rates. Most of the large public sector support. For example, the amendment

banks (PSBs) are not under prompt to the RBI Act to give additional powers

corrective action framework (PCA). Of to the RBI in the case of NBFCs, or

the 11 banks that were under PCA, six entrusting powers to the RBI to regulate

have come out. The remaining five we the HFC sector. Similarly, there are

are monitoring, and we expect them to certain areas where the government

improve their performance. There is shares its concerns with the RBI and the

definitely a case for bigger and faster RBI considers and acts on that. For

transmission of rates, at least in respect example, the government is focusing on

of new loans. less-cash economy, or deepening digital

transactions and there are a lot of

But with policy rates and yields being discussions on these issues with RBI.

low and liquidity sufficient, what else Unless there is proper interaction

do banks want? and engagement, it is difficult to achieve

Banks may have constraints, which they the broader objective. Therefore, I don’t

need to address for faster transmission. see any conflict. But yes, there could be

Deposit growth has been in the region of

10-11 per cent. There was this NPA issue

that is gradually getting resolved. But

yes, consequent to the rate cuts by the “GIVEN THE INTERCONNECTEDNESS BETWEEN BANKS, NBFCS,

RBI, the accommodative stance, the

hugely surplus liquidity in the system

HFCS AND OTHER INTERMEDIARIES OVER THE LAST FEW

right from June 1 onwards, and yields on YEARS, IT IS DESIRABLE TO HAVE A COMMON REGULATOR “

government securities coming down by

over 100 basis points since the first

policy rate cut in February, banks differences of opinion, and that is quite

should pass on the rate benefit to natural, which have to be resolved

customers. That is precisely the point I through discussions.

have highlighted and stressed in our

interaction with PSBs. The RBI did not cut rates for a long time

The conditions are absolutely even as the government openly

conducive for faster transmission of PHOTOS: KAMLESH PEDNEKAR advocated cuts. But you have cut rates

interest rate cuts, I repeat, at least for thrice in six months and changed the

new loans. In old loans, there are some What is the possibility of a currency issue? Do you fear losing the internal flow to the NBFC sector. as a handicap in the RBI’s regulatory or stance to accommodative. Is that

rigidities as there are certain rates of war in this scenario? debt management mandate? supervisory functions as banking something done after both views

interest which are locked in for certain Post 2008, there is a greater As already articulated by me, the RBI is But banks believe lending to NBFCs is regulations are applicable to private, converged to form a uniform one?

periods of time, and it may take time. I understanding and coordination the debt manager to the government. risky… public and foreign banks also. In case of When the monetary policy committee

will be having an interaction with among countries and central banks on There is a process of consultation Whileweareimpressinguponbanksthat supervision, we have got identical (MPC) first met under my

private sector banks also sometime next currency issues. We have regular between the RBI and the government on thereisaneedforcreditflowtotheNBFC powers for all of them. So in regulation chairmanship, the MPC obviously

week. This issue will also be discussed meetings through the G-20, the forum of every issue relating to borrowing. And sector,asalsotoothersectors,wehaveto and supervision, we have enough considered inflation and inflation

with them. central bank governors’ meetings under in the present case also, the process of alsorecognisethatbankshavetofollow powers and there is no differentiation outlook, growth and growth outlook

the aegis of G-20, plus the Bank for consultation is very much on. We have theprinciplesofduecreditappraisals between public sector and private prevailing at that time. The view of the

Are high rates in small savings an International Settlements meetings already communicated our views to the andproperriskassessment.Perhaps, sector banks. MPC was that there was a necessity for a

impediment? among major central banks every two government. We will continue to engage therewasinitiallysomecreditaversion. In areas where we do not have power, rate cut. We did that rate cut and

Small savings rates do play a role. But, months. There is a greater coordination, with the government and give our ButnowIthinkthatisgettingclearandin such as changing the management of followed it up twice. If you leave out the

it also needs to be seen from two and a greater interaction of thoughts views. Whatever the RBI needs to say, fact,thecommercialpaperrateshave public sector banks, if there is a government, even outsiders such as

different angles, one is that they are a and views. The common understanding we will say it to the government directly. alsocomedownfromJanuary.So situation and if the RBI feels that some analysts and academicians supported

therefore,thereshouldbeflowofcredit. changes need to be undertaken, the RBI the rate cuts. It’s a question of how the

Will the RBI help in bringing down the can always discuss with the government economy evolves and what the

You have said earlier that the RBI is and the government will definitely give requirement of the economy at

monitoring large NBFCs. Can you give due weightage to the RBI’s views. What particular points of time is.

“PAYMENTS BANKS STARTED OPERATIONS ABOUT some details?

We have undertaken very close

we want to achieve in the case of PSBs,

we can always do it through the Are you comfortable transferring a

TWO YEARS AGO, AND WE SHOULD GIVE THEM monitoring of the top 50 NBFCs and government. I don’t see anything being substantial portion of the RBI reserves?

MORE TIME” that includes some housing finance a handicap for the RBI to carry out its A committee has been constituted for

companies (HFCs), as well. We have duty as an effective regulator. this. The report of the committee is

selected these NBFCs on the basis of expected shortly. When the committee

forward rates by doing more dollar their balance sheet size and credit WhataboutgovernancereformsinPSBs? report comes, we will see and I am sure

swaps? behaviour in the past. We have a good In one of my recent speeches, I have the committee will take a very

We did dollar swaps to infuse liquidity understanding of what the numbers already highlighted the need for considered call after examining all

in the backdrop of a large amount of and cash flows of these firms are. After governance reforms in both public and aspects.

open market operations (OMOs) that all, the RBI is entrusted with the private sector banks. The government

were done in the previous financial responsibility of maintaining financial has also announced in the Budget the Why has RBI decided to raise a

year. Obviously, after doing so much of stability. We also sensitise banks on the need for governance reforms. We have dedicated cadre for regulation and

OMOs, the RBI had to look at other issues in the NBFC sector that need to be given our suggestions to the supervision?

instruments to infuse liquidity. One of dealt with. I think the credit flow will government on such reforms, broadly in Itwasconsiderednecessarybecauseyou

the collateral benefits of the swaps was gather greater momentum very soon. the areas of accountability, needtobuildexpertisewithadedicated

that forward rates came down. But, we performance review, tenure, workforcetohandlecomplexitiesof

did not do dollar swaps to bring down Why did you want to regulate HFCs? remuneration, etc. businessmodelsthatarecomingupfast

forward rates. It was one of the collateral There is a lot of interconnectedness andthekindofinterconnectedness

benefits. between HFCs, banks, NBFCs and other It seems the RBI and the government betweenthemajorplayerssuchasbanks,

financial intermediaries. Given the kind have agreed to not disagree on issues, NBFCs,andotherfinancial

You have provided liquidity to non- of interconnectedness that has unlike what we have seen in the recent intermediaries.Giventhis,weneedto

banking financial companies (NBFCs) happened over the last few years, it is past where the differences were played buildgreaterexpertiseand

through banks, but why are they not desirable that there is one regulator that out publicly. Is it because of your civil professionalismwithregardto

extending credit to the sector? deals with all these financial services background that you strive to regulationandsupervision.Sowe

I now expect better flow of credit to the intermediaries. If you see currently, maintain a balance with the decidedtobuildaseparatecadrewhere

NBFC sector. The government has there are problems in the HFC segment, government? peopleremainwithinthatcadreand

announced in the Budget that it would and that, in turn, are impacting the That is for others to judge really, theirexperiencecontributestotheentire

fiscal support, which the government that has emanated from the meetings in provide partial guarantee on qualifying banking and the NBFC sectors. whether my civil services background is process.Ourboardhasapproveditand

is giving to certain needy sections. the last few years is that any decision assets purchased by PSBs from NBFCs. helping or not. What I believe is what I theRBI’shumanresourcesdepartmentis

Rates are higher in the senior citizen with regards to monetary policy On the same day, we issued a press note There have been some concerns that had articulated on the first day of my workingonthemodalities.

scheme, or in public provident fund. expansion or roll back, especially by assuring adequate liquidity for the the RBI doesn’t have adequate powers joining here. I had clearly said that there

We must also consider that the overall advanced economies, have to be banking sector to meet the liquidity over PSBs such as changing their has to be consultation between the RBI, What about adopting new technologies

share of small savings schemes in total preceded or accompanied by the right requirement of NBFCs. We have made boards. Your view? the government, and other such as data analytics and artificial

deposits is very low. Therefore, it communication, and any expansion or available an additional ~1.34 trillion to The law is very clear. In the context of stakeholders. And, I had also said that intelligence?

should not play a major role as an roll back will have to be calibrated. This the banking system. private sector banks, the RBI enjoys the government is much more than a We are already doing it in some ways and

impediment to rate cuts. is because decisions by developed We have assured banks in very clear certain powers, which it doesn’t enjoy in stakeholder. we will increasingly make greater use of

countries’ central banks such as US and unambiguous terms that adequate the context of PSBs. But I don’t see that It is necessary to have an effective these technologies. We already use some

The IMF has cut India’s growth forecast. Federal Reserve or the European liquidity will be provided to them to analytics for the Central Repository of

What is the RBI’s own forecast looking Central Bank will have a much greater on-lend to the NBFC sector. Banks are Information on Large Credits. We have

like? impact globally. Their monetary policy making their own assessment of our subsidiary ReBIT (Reserve Bank

The next meeting of our monetary stance impacts the currency situation individual NBFCs, and the lending Information Technology) that also

policy committee is due on August 7. and financial market conditions makes use of these tools.

So, currently our research teams throughout the world.

are working on GDP numbers taking

into account the latest data available. Does that automatically prevent the

“IT IS NECESSARY TO HAVE AN EFFECTIVE INTERACTION A payments bank has shut operations

recently after trying for 17 months. Do

possibility of a currency war? BETWEEN THEGOVERNMENTANDTHERBIINTHEINTERESTS you think the model is failing?

How will global trade tensions play out I would think so. OF THE ECONOMY AND THE OVERALL FINANCIAL SECTOR” There are quite a good number of

for India? payments banks that are doing well. I

We are not part of the global supply Why are central banks, including the don’t want to take names. So if one case

chain that much. So to that extent, we RBI, buying gold these days? cycle should start to gather fails, we have to find out the reasons.

are insulated. But, definitely in the We have a committee for reserves momentum. The RBI’s June 7 circular The payments banks’ objectives are

medium and long term, it will have an management that works on asset on the resolution of stressed assets different. It was to make savings

impact on India’s exports and allocation, which takes major framework has also to be kept in mind accounts, payments, remittance

manufacturing. Our exports do have a directional decisions. For deployment in this context, which places the services available to small savers, low

major role, particularly in critical of reserves, there is a clear responsibility on banks. The income households, etc. in a much

sectors like the information technology understanding about how much should framework now gives enough more focused manner and to ensure a

sector and the sectors related to go into bonds, how much should go into flexibility to banks and gives them a wider reach. Payments banks have

intellectual property rights, and even gold assets and, within bonds how bigger role to be proactive and resolve started operations about two years ago,

other export sectors like textiles. So much should go into each country. Also, stressed assets, including NBFCs. Even and we should give them more time.

overall, if trade tensions lead to a we have set criteria that say there should as we are speaking, it is now

contraction in global demand, they will be safety, liquidity and return on our mandatory for banks to sign the inter- The RBI was thinking of a digital

have an impact on Indian exports and investments, in that order. Therefore, a creditor agreement. In a few cases, currency…

in the long run, India will definitely be certain portion is also held in gold as they have already signed agreements It’s an idea which is being examined and

impacted. You cannot take India and part of our asset diversification strategy. and are trying earnestly to resolve the we will see. But on cryptocurrencies our

look at India in isolation from global stressed assets issue. These two things position is very clear and well-

developments. What’s your view on the sovereign bond taken together, it should improve fund communicated.

https://t.me/SSC4Exams https://t.me/Banking4Exams https://t.me/UPSC4Exams

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Mint 02.01.2024Document16 pagesMint 02.01.2024yashh1708No ratings yet

- Westpack JUL 05 Weekly CommentaryDocument7 pagesWestpack JUL 05 Weekly CommentaryMiir ViirNo ratings yet

- Pestel Analysis of Banking IndustryDocument6 pagesPestel Analysis of Banking IndustryAnooja SajeevNo ratings yet

- BSP (Functions)Document27 pagesBSP (Functions)Roxanne Mae CastigadorNo ratings yet

- FMI Updates 2021 MainsDocument13 pagesFMI Updates 2021 MainsGarima LohiaNo ratings yet

- Non-Banking Finance Companies in India's Financial LandscapeDocument18 pagesNon-Banking Finance Companies in India's Financial Landscapeshubham moonNo ratings yet

- What Is The Plan For Public Sector Banks?: HT Parekh Finance ColumnDocument2 pagesWhat Is The Plan For Public Sector Banks?: HT Parekh Finance Columnpaul lekhanNo ratings yet

- Banking Regulation ActDocument18 pagesBanking Regulation ActHomiga BalasubramanianNo ratings yet

- KD Op-Ed - Private Debt Investor - May 2023Document2 pagesKD Op-Ed - Private Debt Investor - May 2023NointingNo ratings yet

- Hancock 110316 PDFDocument21 pagesHancock 110316 PDFSergiu ToaderNo ratings yet

- Bank Privatisation - Ram Mohan 2020Document3 pagesBank Privatisation - Ram Mohan 2020Aditya GuptaNo ratings yet

- Urjit Patel SpeechDocument9 pagesUrjit Patel SpeechSuresh Kumar NayakNo ratings yet

- ConclusionDocument2 pagesConclusionezekiel50% (2)

- Omkar ConclusionDocument2 pagesOmkar ConclusionezekielNo ratings yet

- Reserve Bank of India - Function Wise MonetaryDocument1 pageReserve Bank of India - Function Wise MonetaryVishal KhannaNo ratings yet

- Caa Week 1 November, 2019.inddDocument6 pagesCaa Week 1 November, 2019.inddPraveen P. S. TomarNo ratings yet

- Imp - Central Bank History - Reddy 2019Document9 pagesImp - Central Bank History - Reddy 2019Aditya GuptaNo ratings yet

- Slums of MumbaiDocument4 pagesSlums of MumbaiNiyati BagweNo ratings yet

- Structured Finance - Market Update-T-1-June 2020Document9 pagesStructured Finance - Market Update-T-1-June 2020Tejas GangerNo ratings yet

- Classroom 0 BANKINGDocument19 pagesClassroom 0 BANKINGSimbaBabduNo ratings yet

- Non Banking FinanceDocument14 pagesNon Banking FinanceTanvir KhanNo ratings yet

- Ever NoteDocument22 pagesEver NoteAyush RaiNo ratings yet

- Yielding To Fundamentals? More of A Toss-Up: November 2, 2020Document4 pagesYielding To Fundamentals? More of A Toss-Up: November 2, 2020Gaurav ChopraNo ratings yet

- Old 2 Risk Weight AssetDocument2 pagesOld 2 Risk Weight Assetmokshang.sanghaviNo ratings yet

- The Impact of Capping Interest Rates On The Kenyan EconomyDocument3 pagesThe Impact of Capping Interest Rates On The Kenyan EconomyMuya KihumbaNo ratings yet

- Rbi PPT 2022Document15 pagesRbi PPT 2022A. La NabiNo ratings yet

- Comparitive Analysis of Public and Private Sector Banks NPA-KotakDocument6 pagesComparitive Analysis of Public and Private Sector Banks NPA-KotakMohmmedKhayyumNo ratings yet

- Covid 19 Impact On The Financial Services Sector PDFDocument13 pagesCovid 19 Impact On The Financial Services Sector PDFvishwanathNo ratings yet

- Pestle Analysis Banking IndustryDocument17 pagesPestle Analysis Banking IndustryYASHASVI SHARMA50% (4)

- Banking Chapter 7Document7 pagesBanking Chapter 7Jose Antonio BarrosoNo ratings yet

- Final Presentation 30.8.2019 FM's ConferenceDocument33 pagesFinal Presentation 30.8.2019 FM's Conferencepranathi.862539No ratings yet

- Merger of PsbsDocument3 pagesMerger of PsbsSanjay SolankiNo ratings yet

- 27HennaSikka1 PDFDocument8 pages27HennaSikka1 PDFTanya SinghNo ratings yet

- Bfsi by HDFCDocument4 pagesBfsi by HDFCJANARTHAN SANKARANNo ratings yet

- The Philippine Financial System: ObjectivesDocument5 pagesThe Philippine Financial System: ObjectivesChocochipNo ratings yet

- Mint 12oct2020 PDFDocument16 pagesMint 12oct2020 PDFchintan desaiNo ratings yet

- Covid ImpactDocument43 pagesCovid Impactmichaele gobezieNo ratings yet

- Article 12062023Document2 pagesArticle 12062023haresh swaminathanNo ratings yet

- Cra NPR Infographic Fact SheetDocument1 pageCra NPR Infographic Fact Sheetsambamurthy sunkaraNo ratings yet

- The New Central Bank Act PDFDocument8 pagesThe New Central Bank Act PDFitsmenatoyNo ratings yet

- Capital Ratio FailureDocument20 pagesCapital Ratio FailureRokesh NaiduNo ratings yet

- BSP PresentationDocument27 pagesBSP PresentationMika AlimurongNo ratings yet

- Index - 2021-01-12T120550.813 PDFDocument1 pageIndex - 2021-01-12T120550.813 PDFAkshay BahetyNo ratings yet

- What Next, Reliance Home Finance?: Legislative AdventurismDocument2 pagesWhat Next, Reliance Home Finance?: Legislative Adventurismआई सी एस इंस्टीट्यूटNo ratings yet

- Determinants of Recovery of Stressed Assets in India 0 PDFDocument10 pagesDeterminants of Recovery of Stressed Assets in India 0 PDFv_singh28No ratings yet

- UNIGLOBE COLLEGE (Pokhara University Affiliate) BNK 621: Bank Operations and Management (2 Credits, 36 Net HRS)Document6 pagesUNIGLOBE COLLEGE (Pokhara University Affiliate) BNK 621: Bank Operations and Management (2 Credits, 36 Net HRS)utsavNo ratings yet

- Anual ReportDocument8 pagesAnual ReportjanuNo ratings yet

- What Explains The Low Profitability of Chinese Banks?Document26 pagesWhat Explains The Low Profitability of Chinese Banks?andreutza_sw3378830No ratings yet

- The Primary Functions of RBI IsDocument4 pagesThe Primary Functions of RBI IsAkrutNo ratings yet

- Sbi & HDFC MBA PROJECTDocument7 pagesSbi & HDFC MBA PROJECTKartik PahwaNo ratings yet

- Bank Holding Company Act Supervision ManualDocument1,817 pagesBank Holding Company Act Supervision ManualTaras StadniychukNo ratings yet

- 0rbibulletin 6 PDFDocument122 pages0rbibulletin 6 PDFMani KalhanNo ratings yet

- 006 - Chapter 6Document24 pages006 - Chapter 6male PampangaNo ratings yet

- Corporate Governance Response PaperDocument4 pagesCorporate Governance Response PaperBhumiNo ratings yet

- Banking SectorDocument6 pagesBanking SectorVijay Kumar VipparthiNo ratings yet

- .Recovery Management in Jaipur Central Cooperative BankDocument6 pages.Recovery Management in Jaipur Central Cooperative BanknithyaNo ratings yet

- PEST Analysis of BankingDocument30 pagesPEST Analysis of BankingRoyal Projects100% (2)

- IDirect Banking SectorReport Jun19Document20 pagesIDirect Banking SectorReport Jun19RajeshNo ratings yet

- Revisiting Kenneth Brown's "10-Point Test"Document6 pagesRevisiting Kenneth Brown's "10-Point Test"DEDY KURNIAWANNo ratings yet

- Overseas Sovereign BondsDocument1 pageOverseas Sovereign BondsRitwik BasudeoNo ratings yet

- 2020-05-18 The - Nation PDFDocument48 pages2020-05-18 The - Nation PDFRitwik BasudeoNo ratings yet

- Windows - Help - Amp - Advice May - 2020 PDFDocument78 pagesWindows - Help - Amp - Advice May - 2020 PDFRitwik BasudeoNo ratings yet

- India Today May - 11 - 2020 PDFDocument78 pagesIndia Today May - 11 - 2020 PDFRitwik BasudeoNo ratings yet

- The New York Times April 26 2020 PDFDocument64 pagesThe New York Times April 26 2020 PDFRitwik BasudeoNo ratings yet

- Bloomberg Businessweek 27 04 2020Document68 pagesBloomberg Businessweek 27 04 2020Ritwik BasudeoNo ratings yet

- 2020-05-01 Money Australia PDFDocument94 pages2020-05-01 Money Australia PDFRitwik BasudeoNo ratings yet

- Economic Survey Quiz 22 JulyDocument14 pagesEconomic Survey Quiz 22 JulyRitwik BasudeoNo ratings yet

- 4 2illustrationDocument4 pages4 2illustrationRitwik BasudeoNo ratings yet

- M L Jhingan The Economics of D PDFDocument745 pagesM L Jhingan The Economics of D PDFRitwik BasudeoNo ratings yet

- Don T Be A Wife To A Boyfriend 10 LessonsDocument124 pagesDon T Be A Wife To A Boyfriend 10 LessonsRitwik Basudeo75% (8)

- Corporate Governance - An Introduction: Chapter-IDocument43 pagesCorporate Governance - An Introduction: Chapter-IFalakNo ratings yet

- Readers Digest UKDocument146 pagesReaders Digest UKRitwik Basudeo100% (2)

- Right Brain Left Brain by Barack Obama PDFDocument186 pagesRight Brain Left Brain by Barack Obama PDFRitwik Basudeo100% (1)

- विश्व के सर्वश्रेष्ठ 1000 अनमोल बचन राघव अरोराDocument168 pagesविश्व के सर्वश्रेष्ठ 1000 अनमोल बचन राघव अरोराRitwik BasudeoNo ratings yet

- Economic Survey Quiz 22 JulyDocument14 pagesEconomic Survey Quiz 22 JulyRitwik BasudeoNo ratings yet

- Corporate Governance - An Introduction: Chapter-IDocument43 pagesCorporate Governance - An Introduction: Chapter-IFalakNo ratings yet

- Calculating Present & Future Value: Interest RateDocument1 pageCalculating Present & Future Value: Interest RateRitwik BasudeoNo ratings yet

- CAIIB ABM Sample Questions by Murugan-June 19 Exams PDFDocument841 pagesCAIIB ABM Sample Questions by Murugan-June 19 Exams PDFRaghav WaliaNo ratings yet

- Data Interpretation Questions ForDocument13 pagesData Interpretation Questions ForRitwik BasudeoNo ratings yet

- Basic Manipulations With Rows & Columns Section 02/7: Open 'Sheet 2'. Insert A New Column Between Columns C and DDocument4 pagesBasic Manipulations With Rows & Columns Section 02/7: Open 'Sheet 2'. Insert A New Column Between Columns C and DRitwik BasudeoNo ratings yet

- Banking Awareness Capsule For SBI PO & Clerk Main 2019Document31 pagesBanking Awareness Capsule For SBI PO & Clerk Main 2019BalajiNo ratings yet

- Economic Survey Quiz 22 JulyDocument14 pagesEconomic Survey Quiz 22 JulyRitwik BasudeoNo ratings yet

- Faculty of Management Studies - PDF FORMDocument2 pagesFaculty of Management Studies - PDF FORMRitwik BasudeoNo ratings yet

- Ministry of FinanceDocument3 pagesMinistry of FinanceRitwik BasudeoNo ratings yet

- CRP Po MT Ix PDFDocument28 pagesCRP Po MT Ix PDFVikas ChandraNo ratings yet

- Vision IAS Mains 365 Economy 2019 PDF (@pdf4exams)Document119 pagesVision IAS Mains 365 Economy 2019 PDF (@pdf4exams)Ritwik BasudeoNo ratings yet

- Insurance Bolt PDFDocument31 pagesInsurance Bolt PDFVemu SaiNo ratings yet

- HRM Sample Questions by Murugan-June 19 Exams PDFDocument453 pagesHRM Sample Questions by Murugan-June 19 Exams PDFMahesh Raja B-veNo ratings yet

- Special Class - VI Current Affairs MCQs From July (1-15)Document35 pagesSpecial Class - VI Current Affairs MCQs From July (1-15)Ritwik BasudeoNo ratings yet

- Facts:: Westmont Bank vs. Eugene Ong GR. 132560 1/30/2002Document1 pageFacts:: Westmont Bank vs. Eugene Ong GR. 132560 1/30/2002Nivra Lyn EmpialesNo ratings yet

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocument7 pagesFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNo ratings yet

- Macroeconomics 2 ExamDocument3 pagesMacroeconomics 2 ExamMWEBI OMBUI ERICK D193/15656/2018No ratings yet

- Portfolio ConstructionDocument15 pagesPortfolio ConstructionParul GuptaNo ratings yet

- Stock Options New PDFDocument205 pagesStock Options New PDFankurbbhatt100% (1)

- Entrepreneurship Development RMB 402: Dr. Anurag Joshi Unit 3Document45 pagesEntrepreneurship Development RMB 402: Dr. Anurag Joshi Unit 3piyush singhNo ratings yet

- Group 2 Loan RequirementsDocument5 pagesGroup 2 Loan RequirementsJamelle SilvestreNo ratings yet

- Sip PresentationDocument11 pagesSip Presentationgourav patwekarNo ratings yet

- ERP Implementation Cost Analysis - SAP v6Document8 pagesERP Implementation Cost Analysis - SAP v6Ajay Kumar KhattarNo ratings yet

- Certificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisDocument19 pagesCertificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisGurvinder SinghNo ratings yet

- KASNEB-fa-may-2015 Teacher - Co .KeDocument7 pagesKASNEB-fa-may-2015 Teacher - Co .KeTimo PaulNo ratings yet

- Tutorial 1 AnswerDocument1 pageTutorial 1 AnswerShinChanNo ratings yet

- 91 Paculdo Vs RegaladoDocument2 pages91 Paculdo Vs RegaladoMichael John Duavit Congress OfficeNo ratings yet

- Particulars: Report FinalDocument12 pagesParticulars: Report FinaldananjNo ratings yet

- NCE - Specimen Audit Report March 2020Document4 pagesNCE - Specimen Audit Report March 2020damancaNo ratings yet

- ABP Annual Report 2021Document257 pagesABP Annual Report 2021nit hingongNo ratings yet

- Assignment: Introduction-State Bank of IndiaDocument2 pagesAssignment: Introduction-State Bank of IndiaSarayu BhardwajNo ratings yet

- S AgarwalDocument1 pageS AgarwalSaikat BhowmikNo ratings yet

- Discounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights ReservedDocument23 pagesDiscounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights Reservedmohamed atlamNo ratings yet

- Pakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionDocument1 pagePakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionAdil ShahzadNo ratings yet

- Thailand: Financial System Stability AssessmentDocument136 pagesThailand: Financial System Stability Assessmentสริยา แก้วสุพรรณNo ratings yet

- J. P Morgan - New Bank Licenses - Picking The WinnersDocument9 pagesJ. P Morgan - New Bank Licenses - Picking The WinnersProfitbytesNo ratings yet

- Analysis of Financial StatementDocument47 pagesAnalysis of Financial StatementViransh Coaching ClassesNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Depletion PDFDocument3 pagesDepletion PDFAlexly Gift UntalanNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFSudip MukherjeeNo ratings yet

- Income TaxDocument14 pagesIncome Taxanjuu2806No ratings yet

- Business Math Profit or LossDocument1 pageBusiness Math Profit or LossAnonymous DmjG6o100% (2)

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)