Professional Documents

Culture Documents

Ca Inter Notes

Uploaded by

Ajay RajputOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca Inter Notes

Uploaded by

Ajay RajputCopyright:

Available Formats

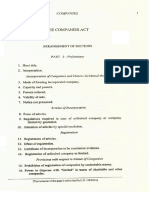

CHAPTER II: INCORPORATION OF COMPANY AND MATTERS

INCIDENTAL THERETO (Section 3-22)

Section 3: Formation of company

Section 4: Memorandum

Section 5: Articles

Section 6: Act to override memorandum, articles, etc.

Section 7: Incorporation of company

Section 8: Formation of companies with charitable objects, etc.

Section 9: Effect of registration

Section 10: Effect of memorandum and articles

Section 11: Commencement of business, etc.

Section 12: Registered office of company

Section 13: Alteration of memorandum

Section 14: Alteration of articles

Section 15: Alteration of memorandum or articles to be noted in every copy

Section 16: Rectification of name of company

Section 17: Copies of memorandum, articles, etc., to be given to members:

Section 18: Conversion of companies already registered:

Section 19: Subsidiary company not to hold shares in its holding company:

Section 20: Service of documents:

Section 21: Authentication of documents, proceedings and contracts

Section 22: Execution of bills of exchange, etc.

CHAPTER III: PROSPECTUS AND ALLOTMENT OF SECURITIES

(Section 23-42)

Section 23: Public offer and private placement:

Section 24: Power of Securities and Exchange Board to regulate issue

and transfer of securities, etc.

Section 25: Document containing offer of securities for sale to be deemed prospectus:

Section 26: Matters to be stated in prospectus

Section 27: Variation in terms of contract or objects in prospectus

Section 28: Offer of sale of shares by certain members of company

Section 29: Public offer of securities to be in demat form

Section 30: Advertisement of prospectus

Section 31: Shelf prospectus

Section 32: Red herring prospectus

Section 33: Issue of application forms for securities

Section 34: Criminal liability for misstatements in prospectus

Section 35: Civil liability for misstatements in prospectus

Section 36: Punishment for fraudulently inducing persons to invest money

Section 37: Action by affected persons

Section 38 : Punishment for personation for acquisition, etc., of securities

Section 39: Allotment of securities by company

Section 40: Securities to be dealt with in stock exchanges

Section 41: Global depository receipt

Section 42: Offer or invitation for subscription of securities on private placement

CHAPTER IV: SHARE CAPITAL AND DEBENTURES

(Section 43-72)

Section 43: Kinds of share capital

Section 44: Nature of shares or debentures

Section 45: Numbering of shares

Section 46: Certificate of shares

Section 47: Voting rights

Section 48: Variation of shareholders’ rights

Section 49: Calls on shares of same class to be made on uniform basis

Section 50: Company to accept unpaid share capital, although not called up

Section 51: Payment of dividend in proportion to amount paid-up

Section 52: Application of premiums received on issue of shares

Section 53: Prohibition on issue of shares at discount

Section 54: Issue of sweat equity shares

Section 55: Issue and redemption of preference shares

Section 56: Transfer and transmission of securities

Section 57: Punishment for personation of shareholder

Section 58: Refusal of registration and appeal against refusal

Section 59: Rectification of register of members

Section 60: Publication of authorised, subscribed and paid-up capital

Section 61: Power of limited company to alter its share capital

Section 62: Further issue of share capital

Section 63: Issue of bonus shares

Section 64: Notice to be given to Registrar for alteration of share capital

Section 65: Unlimited company to provide for reserve share capital on

conversion into limited company

Section 66: Reduction of share capital

Section 67: Restrictions on purchase by company or giving of loans by it for purchase of its shares

Section 68: Power of company to purchase its own securities

Section 69: Transfer of certain sums to capital redemption reserve account

Section 70: Prohibition for buy-back in certain circumstances

Section 71: Debentures

Section 72: Power to nominate

CHAPTER V: ACCEPTANCE OF DEPOSITS BY COMPANIES

(Section 73-76A)

Section 73: Prohibition on acceptance of deposits from public

Section 74: Repayment of deposits, etc., accepted before commencement of this Act

Section 75: Damages for fraud

Section 76: Acceptance of deposits from public by certain companies

Section 76A: Punishment for contravention of section 73 or section 76

CHAPTER VI: REGISTRATION OF CHARGES (Section 77-87)

Section 77: Duty to register charges, etc.

Section 78: Application for registration of charge

Section 79: Section 77 to apply in certain matters

Section 80: Date of notice of charge

Section 81: Register of charges to be kept by Registrar

Section 82: Company to report satisfaction of charge

Section 83: Power of Registrar to make entries of satisfaction and

release in absence of intimatio’n from company

Section 84: Intimation of appointment of receiver or manager

Section 85: Company’s register of charges

Section 86: Punishment for contravention

Section 87: Rectification by Central Government in register of charges

CHAPTER VII: MANAGEMENT AND ADMINISTRATION

(Section 88-122)

Section 88: Register of members, etc.

Section 89: Declaration in respect of beneficial interest in any share

Section 90: Investigation of beneficial ownership of shares in certain cases

Section 91: Power to close register of members or debenture holders or other security holders

Section 92: Annual return

Section 93: Return to be filed with Registrar in case promoters’ stake changes

Section 94: Place of keeping and inspection of registers, returns, etc.

Section 95: Registers, etc., to be evidence

Section 96: Annual general meeting

Section 97: Power of Tribunal to call annual general meeting

Section 98: Power of Tribunal to call meetings of members, etc.

Section 99: Punishment for default in complying with provisions of sections 96 to 98

Section 100: Calling of extraordinary general meeting

Section 101: Notice of meeting

Section 102: Statement to be annexed to notice

Section 103: Quorum for meetings

Section 104: Chairman of meetings

Section 105: Proxies

Section 106: Restriction on voting rights

Section 107: Voting by show of hands

Section 108: Voting through electronic means

Section 109: Demand for poll

Section 110: Postal ballot

Section 111: Circulation of members’ resolution

Section 112: Representation of President and Governors in meetings

Section 113: Representation of corporations at meeting of companies and of creditors

Section 114: Ordinary and special resolutions

Section 115: Resolutions requiring special notice

Section 116: Resolutions passed at adjourned meeting

Section 117: Resolutions and agreements to be filed

Section 118: Minutes of proceedings of general meeting, meeting of Board of Directors and other

Meeting and resolutions passed by postal ballot

Section 119: Inspection of minute-books of general meeting

Section 120: Maintenance and inspection of documents in electronic form

Section 121: Report on annual general meeting

Section 122: Applicability of this Chapter to One Person Company

CHAPTER VIII: DECLARATION AND PAYMENT OF DIVIDEND

(Section 123-127)

Section 123: Declaration of dividend

Section 124: Unpaid Dividend Account

Section 125: Investor Education and Protection Fund

Section 126: Right to dividend, rights shares and bonus shares to be held in abeyance pending

registration of transfer of shares

Section 127: Punishment for failure to distribute dividends

CHAPTER IX: ACCOUNTS OF COMPANIES (Section 128-138)

Section 128: Books of account, etc., to be kept by company

Section 129: Financial statement

Section 130: Re-opening of accounts on court’s or Tribunal’s orders

Section 131: Voluntary revision of financial statements or Board’s report

Section 132: Constitution of National Financial Reporting Authority

Section 133: Central Government to prescribe accounting standards

Section 134: Financial statement, Board’s report, etc.

Section 135: Corporate Social Responsibility

Section 136: Right of member to copies of audited financial statement

Section 137: Copy of financial statement to be filed with Registrar

Section 138: Internal audit

CHAPTER X: AUDIT AND AUDITORS (Section 139-148)

Section 139: Appointment of auditors

Section 140: Removal, resignation of auditor and giving of special notice

Section 141: Eligibility, qualifications and disqualifications of auditors

Section 142: Remuneration of auditors

Section 143: Powers and duties of auditors and auditing standards

Section 144: Auditor not to render certain services

Section 145: Auditor to sign audit reports, etc.

Section 146: Auditors to attend general meeting

Section 147: Punishment for contravention

Section 148: Central Government to specify audit of items of cost in respect of certain companies

Paper 1

AS 1 : Disclosure of Accounting Policies

AS 2 : Valuation of Inventories

AS 3 : Cash Flow Statements

AS 4 : Contingencies and Events occurring after the Balance Sheet Date

AS 5 : Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies

AS 10: Property, Plant and Equipment

AS 11: The Effects of Changes in Foreign Exchange Rates

AS 12: Accounting for Government Grants

AS 13: Accounting for Investments

AS 16: Borrowing Costs

AS 17: Segment Reporting

AS 22: Accounting for Taxes on Income

Paper 5

AS 7 : Construction Contracts

AS 9 : Revenue Recognition

AS 14: Accounting for Amalgamations

AS 18 : Related Party Disclosures

AS 19: Leases

AS 20 : Earnings Per Share

AS 24 : Discontinuing Operations

AS 26 : Intangible Assets

AS 29 : Provisions, Contingent Liabilities and Contingent Assets.

You might also like

- Memorandum of Association PresentationDocument62 pagesMemorandum of Association PresentationUsman Syed100% (1)

- LLC AgreementDocument43 pagesLLC Agreementpeaser0712No ratings yet

- Company LawDocument100 pagesCompany LawPranay PasrichaNo ratings yet

- The New CFO Financial Leadership ManualFrom EverandThe New CFO Financial Leadership ManualRating: 3.5 out of 5 stars3.5/5 (3)

- M&A Disputes: A Professional Guide to Accounting ArbitrationsFrom EverandM&A Disputes: A Professional Guide to Accounting ArbitrationsNo ratings yet

- Difference Between A Private LTD and Public LTDDocument4 pagesDifference Between A Private LTD and Public LTDShoaib Shaik0% (1)

- Companies Act, 2019 (Act 992)Document412 pagesCompanies Act, 2019 (Act 992)Eric Asamoah100% (1)

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- 2019 Form Mag FeedDocument9 pages2019 Form Mag FeedJosephine Kawayo100% (1)

- Wiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Section ListDocument22 pagesSection ListParth SomaniNo ratings yet

- Law Important Question November23Document12 pagesLaw Important Question November23NINTE THANDHANo ratings yet

- INTER SECTIONS LIST NewDocument5 pagesINTER SECTIONS LIST NewKrishna AggarwalNo ratings yet

- Companies Act 2013 in Brief Section WiseDocument21 pagesCompanies Act 2013 in Brief Section WiseJitendra VernekarNo ratings yet

- Key Sections of Company Act 2013Document12 pagesKey Sections of Company Act 2013Keshvendra DwivediNo ratings yet

- CompaniesAct2013 PDFDocument288 pagesCompaniesAct2013 PDFkuldeep Roy SinghNo ratings yet

- Companies Bill Passed by LSDocument309 pagesCompanies Bill Passed by LSRealityviewsNo ratings yet

- Important Sections in Company Law ActDocument9 pagesImportant Sections in Company Law ActSarang PatelNo ratings yet

- Companies Bill 2008Document309 pagesCompanies Bill 2008csrvunNo ratings yet

- Malawi Companies ActDocument274 pagesMalawi Companies Actzengani@gmail.comNo ratings yet

- Companies LawDocument367 pagesCompanies LawRohit SharmaNo ratings yet

- Company Ordinance 1984 PakistanDocument444 pagesCompany Ordinance 1984 Pakistanvick0999No ratings yet

- GST Sections ListDocument8 pagesGST Sections Listsri ranga naiduNo ratings yet

- The Companies ActDocument575 pagesThe Companies ActAqua LakeNo ratings yet

- Companies Act 2004 v1Document389 pagesCompanies Act 2004 v1Aston HamiltonNo ratings yet

- CGST Act As On 1st Oct 2022Document149 pagesCGST Act As On 1st Oct 2022Rajesh AroraNo ratings yet

- U.S. Companies ActDocument447 pagesU.S. Companies ActProperty WaveNo ratings yet

- Karnataka SGST Act 2017Document263 pagesKarnataka SGST Act 2017Rohan KulkarniNo ratings yet

- The Companies Actchapter 388 of The Laws of ZambiaDocument342 pagesThe Companies Actchapter 388 of The Laws of Zambiajosh mukwendaNo ratings yet

- Company ActDocument65 pagesCompany ActlalitNo ratings yet

- CAMA 2020 DownloadDocument606 pagesCAMA 2020 DownloadmayorladNo ratings yet

- Companies Act Sections ListDocument37 pagesCompanies Act Sections ListMohit BhansaliNo ratings yet

- The Investments and Securities Act 2007 NigeriaDocument165 pagesThe Investments and Securities Act 2007 NigeriaIbi MbotoNo ratings yet

- Companies ActDocument417 pagesCompanies ActaakashdadlaniNo ratings yet

- The Companies ActDocument468 pagesThe Companies Actsnacksncandy128No ratings yet

- Companies Bill 2009 24aug2009Document261 pagesCompanies Bill 2009 24aug2009Vignesh AngurajNo ratings yet

- Companies Act Chapter 24 03Document138 pagesCompanies Act Chapter 24 03Irvine Chiwara100% (1)

- Andhra Pradesh Co-Operative Societies ACT, 2010: DraftDocument12 pagesAndhra Pradesh Co-Operative Societies ACT, 2010: Draftram6025No ratings yet

- Title I. General Provisions Deffinitions and ClassificationsDocument4 pagesTitle I. General Provisions Deffinitions and Classificationssheena labaoNo ratings yet

- 0 Income Tax Ordinance 1979Document535 pages0 Income Tax Ordinance 1979farrah_marwatNo ratings yet

- Companies Act No.15 of 2013Document208 pagesCompanies Act No.15 of 2013Yaula SiminyuNo ratings yet

- Tamil Nadu Co-operative Societies RulesDocument309 pagesTamil Nadu Co-operative Societies RulessriramNo ratings yet

- Summary of Cooperative Rules 2007Document100 pagesSummary of Cooperative Rules 2007amkum36No ratings yet

- CGST Act Amended With Notification04.03.2021Document450 pagesCGST Act Amended With Notification04.03.2021Tax NatureNo ratings yet

- Company Law Study PlanDocument10 pagesCompany Law Study PlanSheharyar RafiqNo ratings yet

- Law SectionsDocument31 pagesLaw SectionsVishnu Kaanth NerellaNo ratings yet

- 47 Company Law SectionsDocument32 pages47 Company Law Sectionssameerc1803No ratings yet

- Himachal Pradesh Municipal ActDocument247 pagesHimachal Pradesh Municipal Actbalwant_negi7520No ratings yet

- Super50 SectionsDocument2 pagesSuper50 SectionsLooney ApacheNo ratings yet

- Companies ActDocument198 pagesCompanies ActCelario Jantjies100% (1)

- Legal Profession ActDocument154 pagesLegal Profession Actlumin87No ratings yet

- R&P 1983 Rules Wise & GAR FormsDocument8 pagesR&P 1983 Rules Wise & GAR FormsSebastian Mangneo KukiNo ratings yet

- ZIMBABWE INCOME TAX ACT Chapter 23 06Document336 pagesZIMBABWE INCOME TAX ACT Chapter 23 06Riana Theron MossNo ratings yet

- CGST Act Chapter-wise SummaryDocument7 pagesCGST Act Chapter-wise SummaryKoshi EnterprisesNo ratings yet

- Companies Act 2021 (Amended) PDFDocument331 pagesCompanies Act 2021 (Amended) PDFBhavna Devi BhoodunNo ratings yet

- Law On Enterprises 2005 in VietnamDocument115 pagesLaw On Enterprises 2005 in VietnamAnonymous 7uoreiQKONo ratings yet

- 1997, Credit Unions ActDocument148 pages1997, Credit Unions Actfrans mitterNo ratings yet

- Companies Act 71 of 2008: (English Text Signed by The President)Document339 pagesCompanies Act 71 of 2008: (English Text Signed by The President)imuranganwaNo ratings yet

- ModuleD Co - OrdinanceDocument180 pagesModuleD Co - Ordinancemfarooq87No ratings yet

- Companies Act, 2001 MauritiusDocument285 pagesCompanies Act, 2001 MauritiusJoydeep NtNo ratings yet

- Super50 Sections Analysis For Nov 23Document3 pagesSuper50 Sections Analysis For Nov 23harish jangidNo ratings yet

- IBC Amendment (Amendment and Consolidation) Act Chapter 149 of The Revised Laws of Saint Vincent and The Grenadines, 2009Document114 pagesIBC Amendment (Amendment and Consolidation) Act Chapter 149 of The Revised Laws of Saint Vincent and The Grenadines, 2009Logan's LtdNo ratings yet

- DMCC Company Regulations OverviewDocument76 pagesDMCC Company Regulations OverviewAshutosh PandeyNo ratings yet

- Tax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, ProceduresFrom EverandTax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, ProceduresNo ratings yet

- BA Chapter 2 Understand Employer Organisations Resource WorkbookDocument44 pagesBA Chapter 2 Understand Employer Organisations Resource WorkbookDavid SelvaNo ratings yet

- NOTES (Company Law)Document109 pagesNOTES (Company Law)ALYSSA TOHNo ratings yet

- Company Act DocumentsDocument14 pagesCompany Act DocumentsEshthiak HossainNo ratings yet

- Starting A New Venture: Module For Principles of Entrepreneurship (ENT 530)Document31 pagesStarting A New Venture: Module For Principles of Entrepreneurship (ENT 530)Mohd Azrul Hisham AmranNo ratings yet

- Lecture 10-Corporate and Business Law (Global)Document43 pagesLecture 10-Corporate and Business Law (Global)Altanzul BatbayarNo ratings yet

- 20.types of CompanyDocument20 pages20.types of CompanyHemanta PahariNo ratings yet

- MNR College of Engineering & TechnologyDocument38 pagesMNR College of Engineering & TechnologyDJSATYAMNo ratings yet

- Business and Management Paper 1 Case Study HLSLDocument28 pagesBusiness and Management Paper 1 Case Study HLSLMelisa akgülNo ratings yet

- Private Limited Company Nature of BusinessDocument14 pagesPrivate Limited Company Nature of BusinesskaavyaNo ratings yet

- Joint Stock Company Gp1 by Professor & Lawyer Puttu Guru PrasadDocument32 pagesJoint Stock Company Gp1 by Professor & Lawyer Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Chapter 4: Types of Business Organization: Business Organisations: The Private SectorDocument10 pagesChapter 4: Types of Business Organization: Business Organisations: The Private SectorDhrisha GadaNo ratings yet

- Limited Company Holds Thai RestaurantDocument10 pagesLimited Company Holds Thai RestaurantLegal ckongNo ratings yet

- Ca Final New Course Law MCQDocument5 pagesCa Final New Course Law MCQJayendrakumar KatariyaNo ratings yet

- PPD Lesson 2Document11 pagesPPD Lesson 2Kent Aron Lazona DoromalNo ratings yet

- Introduction to Business & EconomicsDocument128 pagesIntroduction to Business & EconomicsVamsi KrishnaNo ratings yet

- KFC Holdings (Malaysia) BHD: Information Circular To ShareholdersDocument15 pagesKFC Holdings (Malaysia) BHD: Information Circular To ShareholderscutetybeeNo ratings yet

- ManzoorAli - 1829 - 16471 - 1 - Production - Scarcity-Choice-Opportunity Cost - and FirmsDocument17 pagesManzoorAli - 1829 - 16471 - 1 - Production - Scarcity-Choice-Opportunity Cost - and FirmsMuhammad AfzalNo ratings yet

- Banking Academy Faculty of International Business: International Trade and FinanceDocument10 pagesBanking Academy Faculty of International Business: International Trade and FinancePhạm LinhNo ratings yet

- IGCSE Business Studies Revision Chapter 1 OverviewDocument27 pagesIGCSE Business Studies Revision Chapter 1 OverviewTobek69No ratings yet

- Introdcution To LawDocument28 pagesIntrodcution To LawMonika KauraNo ratings yet

- Company Law Tutorials 2020Document3 pagesCompany Law Tutorials 2020Lim Jing Ye SheenaNo ratings yet

- Issue ManagementDocument164 pagesIssue ManagementANUSHKA CHATURVEDINo ratings yet

- Nigerian Institute of Management (Chartered) : Nim/Nyscstrategic Partnership ProgrammeDocument74 pagesNigerian Institute of Management (Chartered) : Nim/Nyscstrategic Partnership ProgrammemichealNo ratings yet

- Christine's Creative Business StartupDocument7 pagesChristine's Creative Business StartupSrinivasa VelupulaNo ratings yet

- SPICe+ HelpDocument30 pagesSPICe+ HelpmohanngpNo ratings yet

- Key Features of A Company 1. Artificial PersonDocument19 pagesKey Features of A Company 1. Artificial PersonVijayaragavan MNo ratings yet