Professional Documents

Culture Documents

Questions - Affidavit of General Financial Condition

Uploaded by

Marnelli Joy Ajas0 ratings0% found this document useful (0 votes)

26 views2 pagesFor a Petition for Insolvency/Rehabilitation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFor a Petition for Insolvency/Rehabilitation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views2 pagesQuestions - Affidavit of General Financial Condition

Uploaded by

Marnelli Joy AjasFor a Petition for Insolvency/Rehabilitation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Annex A

Affidavit of General Financial Condition

1. Are you an officer of the debtor referred to in these proceedings?

2. What is your full name and what position do you hold in the debtor?

3. What is the full name of the debtor and what is the address of its head

office?

4. When was it formed or incorporated?

5. When did the debtor commence business?

6. What is the nature of its business? What is the market share of the debtor

in the industry in which it is engaged?

7. Who are the parties, members, or stockholders? How many employees?

8. What is the capital of the debtor?

9. What is the capital contribution and what is the amount of the capital,

paid and unpaid, of each of the partners or shareholders?

10. Do any of these people hold the shares in trust for others?

11. Who are the directors and officers of the debtors?

12. Does the debtor have any subsidiary corporation? If so, give particulars?

13. Has the debtor properly maintained its books and are they updated?

14. Were the books audited annually?

15. If so, what is the name of the auditor and when was the last audited

statement drawn up?

16. Were all the proper returns made to the various government agencies

which required them?

17. When did the debtor first become aware of its problems?

18. Has the debtor, within the twelve months preceding the filing of the

petition:

a. made any payments, returned any goods or delivered any property

to any of its creditors, except in the normal course of business?

b. executed any mortgage, pledge, or security over any of its properties

in favor of any creditor?

c. transferred or disposed of any of its properties in payment of any

debt?

d. sold, disposed of, or removed any of its property except in the

ordinary course of business?

e. sold any merchandise at less than fair market value or purchased

merchandise or services at more than fair market value?

f. made or been a party to any settlement of property in favor of any

person? If yes, give particulars.

19. Has the debtor recorded all sales or dispositions of assets?

20. What were the sales for the last three years and what percentage of the

sales represented the profit or mark-up?

21. What were the profits or losses for the debtor for the last three years?

22. What are the causes of the problems of the debtor? Please provide

particulars?

23. When did you first notice these problems and what actions did the debtor

take to rectify them?

24. How much, in your estimate, is needed to rehabilitate the debtor?

25. Has any person expressed interest in investing new money to the debtor?

26. Are there any pending and threatened legal actions against the debtor? If

so, please provide particulars.

27. Has the debtor discussed any restructuring or repayment plan with any of

the creditors? Please provide status and details.

28. Has any creditor expressed interest in restructuring the debts of the

debtor? If so, please give particulars.

29. Have employees' wages and salaries been kept current? If not, how much

are in arrears and what time period do the arrears represent?

30. Have obligation to the government and its agencies been kept current? If

not, how much are in arrears and what time period do the arrears

represent?

You might also like

- Affidavit of General Financial ConditionDocument7 pagesAffidavit of General Financial ConditionyonportesNo ratings yet

- Questions For Deposition in A Bill Collection MatterDocument2 pagesQuestions For Deposition in A Bill Collection Matterpwilkers36No ratings yet

- Chapter 4Document2 pagesChapter 4Shane LAnuza100% (4)

- Financial and Management Accounting Frequently Asked Questions - Unit 1 Financial Accounting - An IntroductionDocument5 pagesFinancial and Management Accounting Frequently Asked Questions - Unit 1 Financial Accounting - An Introductionrkl.satishNo ratings yet

- The Context and Purpose of Financial ReportingDocument4 pagesThe Context and Purpose of Financial ReportingFarmanNo ratings yet

- Conceptual Framework Purpose Assist Standards Developed IFRSDocument6 pagesConceptual Framework Purpose Assist Standards Developed IFRSKyleZapantaNo ratings yet

- Ethc - QuizzesDocument14 pagesEthc - QuizzesXyree Mae CenalNo ratings yet

- Commerce Job Interview Questions and AnswersDocument9 pagesCommerce Job Interview Questions and Answerskamal sahabNo ratings yet

- Pink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseDocument26 pagesPink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseGene Albert LopezNo ratings yet

- Self Assessment of Internal Control Accounts Receivable CycleDocument3 pagesSelf Assessment of Internal Control Accounts Receivable CycleChristen CastilloNo ratings yet

- Accounting Enhancement Class Introduction To Accounting and Business Learning ObjectivesDocument5 pagesAccounting Enhancement Class Introduction To Accounting and Business Learning ObjectivesDiane GarciaNo ratings yet

- CH 1Document44 pagesCH 1Julious Caalim100% (1)

- Corporate Law MCQ Part 1Document12 pagesCorporate Law MCQ Part 1Shoaib AhmedNo ratings yet

- Basaysay John Ray B.Document6 pagesBasaysay John Ray B.Mondrei Andrew C. LeonardoNo ratings yet

- Financial Accounting Libby 8th Edition Chapter 1 Q&AsDocument162 pagesFinancial Accounting Libby 8th Edition Chapter 1 Q&AsBrandon SNo ratings yet

- Exercise 3Document4 pagesExercise 3French Jame RianoNo ratings yet

- Midterm RFBTDocument25 pagesMidterm RFBTPamela PerezNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Test Bank For Business and Society Stakeholders Ethics Public Policy 15th Edition Anne Lawrence James WeberDocument36 pagesTest Bank For Business and Society Stakeholders Ethics Public Policy 15th Edition Anne Lawrence James Weberbowgebachelorqcja6100% (40)

- Basic Acctg. TutorialDocument10 pagesBasic Acctg. TutorialFrancesca Agatha EurabaNo ratings yet

- PAS 1 Presentation of Financial Performance QUIZDocument5 pagesPAS 1 Presentation of Financial Performance QUIZcahnNo ratings yet

- MGT211 Grand Quiz Spring 2021Document188 pagesMGT211 Grand Quiz Spring 2021awaisesNo ratings yet

- Ipo AnalysisDocument3 pagesIpo AnalysisAshish GuptaNo ratings yet

- Chapter 3 QuizDocument31 pagesChapter 3 QuizIrene Mae BeldaNo ratings yet

- Quiz on Related Party DisclosuresDocument3 pagesQuiz on Related Party DisclosuresLynssej Barbon0% (1)

- Afar Self TestDocument8 pagesAfar Self Testfor youNo ratings yet

- BL - Corporation CodeDocument25 pagesBL - Corporation CodePrincessAngelaDeLeon0% (1)

- Rethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing, Fully Updated and Revised Edition: Become Financially Free with Commercial Property InvestingNo ratings yet

- Midterm Exam ReviewDocument12 pagesMidterm Exam ReviewHakdog HatdogNo ratings yet

- Q4-PreExam-SET-ADocument4 pagesQ4-PreExam-SET-AAra Russel BathanNo ratings yet

- FA TestDocument13 pagesFA TestJed Riel BalatanNo ratings yet

- ABM-Org - MGMT Week4 ReginaSajoniaDocument6 pagesABM-Org - MGMT Week4 ReginaSajoniaChelseaNo ratings yet

- 3 MarksDocument32 pages3 MarksChandan PNo ratings yet

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionshengNo ratings yet

- Accounting PDFDocument10 pagesAccounting PDFRI AZNo ratings yet

- Finals SerfbtDocument14 pagesFinals SerfbtKyla DabalmatNo ratings yet

- QB REVIEWERDocument17 pagesQB REVIEWERAllen DimaculanganNo ratings yet

- Groupon Derivative SuitDocument31 pagesGroupon Derivative Suitjeff_roberts881No ratings yet

- 1styear - Basicaccosqe.2013 1 - 1Document11 pages1styear - Basicaccosqe.2013 1 - 1Darlene VenturaNo ratings yet

- Mock Exam FinalDocument23 pagesMock Exam FinalKamaruslan MustaphaNo ratings yet

- Pre-Award Questionnaire For Conservation International Grant ApplicantsDocument5 pagesPre-Award Questionnaire For Conservation International Grant ApplicantsCORAL ALONSONo ratings yet

- Lesson 23 03Document4 pagesLesson 23 03Monta RogaNo ratings yet

- FRIA QUIZ With AnswersDocument5 pagesFRIA QUIZ With AnswersAlimodin MalawaniNo ratings yet

- Business TerminologyDocument2 pagesBusiness TerminologyTerka HourovaNo ratings yet

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- MGT 602Document6 pagesMGT 602saqib_hakeemNo ratings yet

- BLR 211 Final Exam ReviewDocument19 pagesBLR 211 Final Exam ReviewmercyvienhoNo ratings yet

- The three types of stakeholders in an organizationDocument2 pagesThe three types of stakeholders in an organizationHashiniNo ratings yet

- Chapter 1Document2 pagesChapter 1Nguyễn Thùy LinhNo ratings yet

- Practice Quiz 02 ACTG240 Q2202021Document9 pagesPractice Quiz 02 ACTG240 Q2202021Minh DeanNo ratings yet

- Discussion QuestionsDocument8 pagesDiscussion QuestionsLuis JoseNo ratings yet

- Acrev 422 AfarDocument19 pagesAcrev 422 AfarAira Mugal OwarNo ratings yet

- Cpa Review School of The Philippines: ManilaDocument24 pagesCpa Review School of The Philippines: ManilaRalph Joshua JavierNo ratings yet

- TOA Quizzer 6 - IAS 24 Related Party Disclosures PDFDocument3 pagesTOA Quizzer 6 - IAS 24 Related Party Disclosures PDFabby100% (1)

- FABM2 - First SummativeDocument2 pagesFABM2 - First Summativeje-ann montejoNo ratings yet

- AAO - SNITCH-ParCor Reviewer QuestionsDocument39 pagesAAO - SNITCH-ParCor Reviewer QuestionsKawaii SevennNo ratings yet

- Real Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesFrom EverandReal Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesNo ratings yet

- Sample SPADocument2 pagesSample SPAMarnelli Joy AjasNo ratings yet

- Sample Board Resolution - Ca.certiorariDocument1 pageSample Board Resolution - Ca.certiorariMarnelli Joy AjasNo ratings yet

- Reviewer in BANKING Dizon BookDocument25 pagesReviewer in BANKING Dizon BookMarnelli Joy AjasNo ratings yet

- Obligations and Contracts Jurado MidtermsDocument31 pagesObligations and Contracts Jurado MidtermsLei Bataller BautistaNo ratings yet

- Internal Rate of Return - WikipediaDocument6 pagesInternal Rate of Return - Wikipediapuput075No ratings yet

- Odiamar vs. ValenciaDocument1 pageOdiamar vs. ValenciaabbywinsterNo ratings yet

- Finger Tips 2022 - Part - 2Document350 pagesFinger Tips 2022 - Part - 2aksjsimrNo ratings yet

- PaymentDocument1 pagePaymentakshNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemIra MejiaNo ratings yet

- HQP-HLF-006 Loan Restructuring Computation SheetDocument1 pageHQP-HLF-006 Loan Restructuring Computation Sheetmaxx villaNo ratings yet

- Competitive Futures STEEP Report: Infrastructure - Building For Tomorrow's CompetitionDocument48 pagesCompetitive Futures STEEP Report: Infrastructure - Building For Tomorrow's CompetitionEric GarlandNo ratings yet

- Authorization For Credit Investigation and AppraisalDocument1 pageAuthorization For Credit Investigation and AppraisalMarvin CeledioNo ratings yet

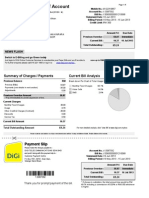

- DiGi Mobile Bill SummaryDocument5 pagesDiGi Mobile Bill SummarySuria YSNo ratings yet

- What Is Cash Reserve Ratio and How Will The CRR Hike ImpactDocument4 pagesWhat Is Cash Reserve Ratio and How Will The CRR Hike ImpactNaveen SharmaNo ratings yet

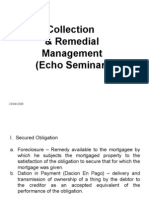

- Remedial and Collection ManagementDocument23 pagesRemedial and Collection ManagementEmily Mauricio100% (2)

- Oblicon Reviewer - Anton MercadoDocument320 pagesOblicon Reviewer - Anton MercadoJL100% (1)

- Sav 1849Document2 pagesSav 1849Michael100% (1)

- Crafting A Business PlanDocument4 pagesCrafting A Business PlanMd. Sajjad HossenNo ratings yet

- 21 Application Format For Registring As NBFCDocument13 pages21 Application Format For Registring As NBFCDarshak ShahNo ratings yet

- Digest-Tan Shuy v. Sps. MulawinDocument1 pageDigest-Tan Shuy v. Sps. MulawinNamiel Maverick D. BalinaNo ratings yet

- Liabilities of Mortgagor and MortgageeDocument4 pagesLiabilities of Mortgagor and MortgageeMahmudul HasanNo ratings yet

- Intro To CmaDocument21 pagesIntro To CmaRima PrajapatiNo ratings yet

- UN, Land Admin in UNECE Region, Dev Trends & Main PrinciplesDocument112 pagesUN, Land Admin in UNECE Region, Dev Trends & Main PrinciplesConnie Lee Li TingNo ratings yet

- Valuing Hotels and Motels for Tax AssessmentDocument20 pagesValuing Hotels and Motels for Tax AssessmentglowrinnNo ratings yet

- Final IR MCB FizaDocument31 pagesFinal IR MCB FizaRida FatimaNo ratings yet

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- Gladys Gardner v. Ally Financial Incorporated, 4th Cir. (2013)Document3 pagesGladys Gardner v. Ally Financial Incorporated, 4th Cir. (2013)Scribd Government DocsNo ratings yet

- Michael C. Dematos Equifax Credit Report SummaryDocument10 pagesMichael C. Dematos Equifax Credit Report SummaryCarlos M. De Matos0% (1)

- Credit Management HandbookDocument48 pagesCredit Management HandbookNauman Rashid67% (6)

- IDFC BANK Repayment Schedule-10865556Document2 pagesIDFC BANK Repayment Schedule-10865556Dinesh KumarNo ratings yet

- Lender of Last ResortDocument2 pagesLender of Last ResortMohd SafwanNo ratings yet

- Exam Badm 201Document29 pagesExam Badm 201NitinNo ratings yet

- Acc501 01 Midterm Spring 2009Document10 pagesAcc501 01 Midterm Spring 2009Awais ChoudaryNo ratings yet

- Contract To Sell of Foreshore LandDocument3 pagesContract To Sell of Foreshore LandJann AnonuevoNo ratings yet