Professional Documents

Culture Documents

Portfolio Risk and Return: Table2. Market Returns

Uploaded by

vinay narneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Risk and Return: Table2. Market Returns

Uploaded by

vinay narneCopyright:

Available Formats

Portfolio Risk and buying the stock of MSLPC(Price:Rs.

393) which

Mr. Gupta has readily accepted as he was

familiar with the high standards of operations of

Return his former employer.

You have collected further data for the market

Mr. Ajay Gupta recently retired after a stint of

and MSLPC.

fifteen years in a Digitech Solutions, a software

products and services company. He had joined Period 1 2 3 4 5 6

MSLPC, the state utilities company straight out of % Return 10 8 12 (7) (4) 11

college. However during the period when the Table2. Market Returns

Y2K ‘opportunity’ was making the news in

software services in India, he felt the need for a Period 1 2 3 4 5 6

career change. Despite being on the wrong side % Return 8 5 9 20 16 6

of forty, with his hard work and passion to learn, Table3. MSLPC Share Price Returns

he went on to become a senior vice president at

Digitech Solutions. Your research department has coverage on both

Digitech Services and MSLPC and they have

He has approached your firm for investment given the following forecast. You also find out

advice with very clear objective in his mind. After from the research database that the beta for

settling all the liabilities from his retirement Digitech Solutions is 1.65

benefits and setting aside some amount in liquid

Prob Tbill Digitech MSLPC Market

funds for his expenses, he is left with a surplus

Recession 0.25 7% 9% 15% (2)%

amount of Rs. 60 lakh which he wishes to invest in

the equity market. He is not interested in any Normal 0.60 7% 16% 10% 14%

stock recommendations from your firm. Boom 0.15 7% 20% 7% 18%

Table4. Research Department Expected Returns

Mr. Gupta is risk averse by nature and has

avoided investing in equities till date. While the You have just received a call from Mr. Gupta

time he was with Digitech Solutions, he has seen who insisted that the risk to his portfolio return

the meteoric rise of the company which has been should be as low as possible and the return

reflected in its share price. As an employee he should be at least 12%, otherwise he will drop

had legal restrictions over investing in Digitech the idea of investing in equity and go back to

Solutions, but now that he has retired, he has fixed deposits instead. He added that he has

made up his mind to buy the Digitech Solutions made some calculations and arrived at an 80%

stock(Price: Rs1021). He has looked at the returns allocation for Digitech Solutions and the residual

over the last 6 years and feels that the recent 20% in MSLPC stock. He is meeting you

16% return after two years of negative returns is tomorrow. Before that you need to come up with

the best time to buy the stock. a report suggesting the best plan of action.

Period 1 2 3 4 5 6 Discussion Points

% Return 18 16 12 (11) (6) 16

A. Analyse the two stock portfolio for

Table1. Digitech Solutions Share Price Returns expected returns and risk

B. Comment on the allocation suggested by

He has heard about diversification and knows

Mr. Gupta and suggest an appropriate

that he shouldn’t be putting all the eggs in one

portfolio in terms of number of shares he

basket. Still he is not very keen in forming a

needs to buy of both the companies.

large equity portfolio and has reluctantly

C. Are the two stocks worth buying?

agreed to invest in one more stock. In light of this,

Comment using CAPM.

you have suggested that he should consider

You might also like

- PCCPL May 2014 UpdateDocument4 pagesPCCPL May 2014 UpdateDuby RexNo ratings yet

- CF Question Paper t2Document3 pagesCF Question Paper t2KUSHI JAINNo ratings yet

- Corporate FinanceDocument7 pagesCorporate Financeseyon sithamparanathanNo ratings yet

- The Burden of Expectations: April 26, 2011Document10 pagesThe Burden of Expectations: April 26, 2011Karthikraja KNo ratings yet

- Hcltech Ibm Deal Mosl 10.12.18Document12 pagesHcltech Ibm Deal Mosl 10.12.18Cilantaro BearsNo ratings yet

- Adani Green Energy - Red AlertDocument8 pagesAdani Green Energy - Red AlertRanjan BeheraNo ratings yet

- Question 262122Document3 pagesQuestion 262122groverpankaj04No ratings yet

- PART-A (Closed Book) (75 Mins)Document4 pagesPART-A (Closed Book) (75 Mins)DEVANSH CHANDRAWATNo ratings yet

- Case 1Document5 pagesCase 1camille70% (10)

- QQ Test 1 Dec2022Document4 pagesQQ Test 1 Dec2022WAN MOHAMAD ANAS WAN MOHAMADNo ratings yet

- Gujarat Technological UniversityDocument2 pagesGujarat Technological UniversityIsha KhannaNo ratings yet

- Query & Solution-3Document5 pagesQuery & Solution-3శ్రీ వాసు. అవనిNo ratings yet

- Epgpx01 Term Iii End Term Examination: Indian Institute of Management RohtakDocument3 pagesEpgpx01 Term Iii End Term Examination: Indian Institute of Management Rohtakkaushal dhapareNo ratings yet

- AFM - Mock-Dec18Document6 pagesAFM - Mock-Dec18David LeeNo ratings yet

- India Equity Analytics For Today - Buy Stocks of Infosys With A Price Target of Rs 3620Document20 pagesIndia Equity Analytics For Today - Buy Stocks of Infosys With A Price Target of Rs 3620Narnolia Securities LimitedNo ratings yet

- Cesc - Buy: Demerger in Sight!Document10 pagesCesc - Buy: Demerger in Sight!AshokNo ratings yet

- 2021 ZA PaperDocument12 pages2021 ZA Papermandy YiuNo ratings yet

- Greaves CottonDocument11 pagesGreaves CottonMahesh Karande (KOEL)No ratings yet

- CF Assignments ShafeqDocument4 pagesCF Assignments Shafeqshafeq mohammedNo ratings yet

- MMP Corfin Study Case - GalihAbimataDocument2 pagesMMP Corfin Study Case - GalihAbimataDImas AntonioNo ratings yet

- Ca Final SFM - New Scheme - Dawn 2022 - Merger - AcquisitionsDocument8 pagesCa Final SFM - New Scheme - Dawn 2022 - Merger - AcquisitionsAnkur SoniNo ratings yet

- SobhaDocument21 pagesSobhadigthreeNo ratings yet

- Convexity CallsDocument3 pagesConvexity CallsNimit VarshneyNo ratings yet

- Bharat Rasayan - Issues and ConcernsDocument5 pagesBharat Rasayan - Issues and ConcernsJayaprakash Gopala KamathNo ratings yet

- ConCall Research Note PI 050311Document6 pagesConCall Research Note PI 050311equityanalystinvestorNo ratings yet

- 05 s601 SFM PDFDocument4 pages05 s601 SFM PDFMuhammad Zahid FaridNo ratings yet

- Finance II Mid-Term Exam 2020Document4 pagesFinance II Mid-Term Exam 2020Yash KalaNo ratings yet

- RHB Equity 360° (Digi, Plantation, Gamuda Technical: Berjaya Corp) - 11/03/2010Document3 pagesRHB Equity 360° (Digi, Plantation, Gamuda Technical: Berjaya Corp) - 11/03/2010Rhb InvestNo ratings yet

- Kmart IncDocument6 pagesKmart IncMary Equality Ferrer100% (1)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajNo ratings yet

- Answer All QuestionsDocument2 pagesAnswer All QuestionsNh FiyyNo ratings yet

- Questionnaire 26-05-2023Document10 pagesQuestionnaire 26-05-2023Kothapalle InthiyazNo ratings yet

- Godrej Consumer 09-06-2021 MotiDocument18 pagesGodrej Consumer 09-06-2021 MotiAnkit SinghNo ratings yet

- Business Studies Class 12: Sample Paper (2019-20)Document12 pagesBusiness Studies Class 12: Sample Paper (2019-20)manvendra gurjarNo ratings yet

- LT Emerging Business FundDocument2 pagesLT Emerging Business FundSankalp BaliarsinghNo ratings yet

- The Right Time ToInvestDocument10 pagesThe Right Time ToInvestPrabu RagupathyNo ratings yet

- PC - IDFC Shriram Merger Event Update - July 2017 20170710181456Document9 pagesPC - IDFC Shriram Merger Event Update - July 2017 20170710181456Mee MeeNo ratings yet

- Buy Reliance CapitalDocument3 pagesBuy Reliance Capitaldps_virusNo ratings yet

- New Format Exam Q Maf620 - Dec 2014Document6 pagesNew Format Exam Q Maf620 - Dec 2014kkNo ratings yet

- REC Ltd. - Re Initiating Coverage - 13082021Document15 pagesREC Ltd. - Re Initiating Coverage - 13082021Rahul RathodNo ratings yet

- 5 - Cost of Cap UploadDocument4 pages5 - Cost of Cap UploadMayank RanjanNo ratings yet

- Afin209 D 1 2020 2Document10 pagesAfin209 D 1 2020 2Kaso MuseNo ratings yet

- 5 Stock Valuation Exercise ProblemsDocument4 pages5 Stock Valuation Exercise Problemsngocphap111No ratings yet

- Financial Analysis of Microsoft CorporationDocument9 pagesFinancial Analysis of Microsoft CorporationRupesh PuriNo ratings yet

- Alluvial Capital Management Q2 2021 Letter To PartnersDocument8 pagesAlluvial Capital Management Q2 2021 Letter To Partnersl chanNo ratings yet

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GNo ratings yet

- Question Paper Code:: Reg. No.Document26 pagesQuestion Paper Code:: Reg. No.Khanal NilambarNo ratings yet

- High Conviction Basket: IT: 18th Sep 2020Document3 pagesHigh Conviction Basket: IT: 18th Sep 2020ommetalomNo ratings yet

- Case Studies and Hot TopicsDocument24 pagesCase Studies and Hot TopicsAnit DevesiyaNo ratings yet

- SFM MaterialDocument106 pagesSFM MaterialAlok67% (3)

- Valuation19 Jan 2022Document10 pagesValuation19 Jan 2022Mayuri ZileNo ratings yet

- Financial Management: Page 1 of 4Document4 pagesFinancial Management: Page 1 of 4Bizness Zenius HantNo ratings yet

- Investment Planning and Portfolio ManagementDocument3 pagesInvestment Planning and Portfolio ManagementTark Raj BhattNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- Questions For Group 1: S.B.Khatri-FM-AIMDocument6 pagesQuestions For Group 1: S.B.Khatri-FM-AIMAbhishek singhNo ratings yet

- ChatGPT Exercise 1 - Written CommunicationDocument5 pagesChatGPT Exercise 1 - Written CommunicationVipin KanojiaNo ratings yet

- You Must Attend Class To Receive Credit For This Assignment: Mccombs School of Business Fin 370 - Case SummaryDocument1 pageYou Must Attend Class To Receive Credit For This Assignment: Mccombs School of Business Fin 370 - Case Summarydarren huiNo ratings yet

- POM Case StudiesDocument3 pagesPOM Case Studieskhalala100% (1)

- The DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationFrom EverandThe DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationNo ratings yet

- Research ReportDocument16 pagesResearch Reportvinay narneNo ratings yet

- Impact On Lactalis OperationsDocument1 pageImpact On Lactalis Operationsvinay narneNo ratings yet

- Session 8 & 9 - Credit Policy & Risk Management (Credit POlicy, RBI, Basel)Document76 pagesSession 8 & 9 - Credit Policy & Risk Management (Credit POlicy, RBI, Basel)vinay narneNo ratings yet

- Agri Fin IndiDocument49 pagesAgri Fin IndiAnonymous qCU0rgOuNo ratings yet

- Impact On Lactalis OperationsDocument1 pageImpact On Lactalis Operationsvinay narneNo ratings yet

- Lactalis' Product RecallDocument11 pagesLactalis' Product Recallvinay narne0% (2)

- And Ales Orce Utomation: Urvashi Makkar and Harinder Kumar Makkar: Customer Relationship ManagementDocument25 pagesAnd Ales Orce Utomation: Urvashi Makkar and Harinder Kumar Makkar: Customer Relationship ManagementRanoo MahajanNo ratings yet

- Credit Lines - Case Study - IBS CollegeDocument11 pagesCredit Lines - Case Study - IBS Collegevinay narneNo ratings yet

- And Ales Orce Utomation: Urvashi Makkar and Harinder Kumar Makkar: Customer Relationship ManagementDocument25 pagesAnd Ales Orce Utomation: Urvashi Makkar and Harinder Kumar Makkar: Customer Relationship ManagementRanoo MahajanNo ratings yet

- Balance of Payment PDFDocument30 pagesBalance of Payment PDFvinay narneNo ratings yet

- Session 8 & 9 - Credit Policy & Risk Management (Credit POlicy, RBI, Basel)Document76 pagesSession 8 & 9 - Credit Policy & Risk Management (Credit POlicy, RBI, Basel)vinay narneNo ratings yet

- Spot Restaurant: Description of BusinessDocument14 pagesSpot Restaurant: Description of Businessvinay narneNo ratings yet

- Balance of Payment PDFDocument30 pagesBalance of Payment PDFvinay narneNo ratings yet

- Balance of Payment PDFDocument30 pagesBalance of Payment PDFvinay narneNo ratings yet

- KPMGDocument1 pageKPMGvinay narneNo ratings yet

- Heritage Tourism in IndiaDocument13 pagesHeritage Tourism in Indiavinay narneNo ratings yet

- Mcdonald'S in India Troubled Times, Troubled Ties: Strategic Management Presentation OnDocument16 pagesMcdonald'S in India Troubled Times, Troubled Ties: Strategic Management Presentation Onvinay narne100% (1)

- Pricing The Stock Through DDM: Topic 1 - Costant Discount ModelDocument1 pagePricing The Stock Through DDM: Topic 1 - Costant Discount Modelvinay narneNo ratings yet

- CaseStudy HA002Document1 pageCaseStudy HA002vinay narneNo ratings yet

- Str11 TourismDocument52 pagesStr11 Tourismvinay narneNo ratings yet

- Heritage Tourism in IndiaDocument13 pagesHeritage Tourism in Indiavinay narneNo ratings yet

- "A Study On Credit Card": (The Plastic Money)Document86 pages"A Study On Credit Card": (The Plastic Money)Gaurav Gaba100% (1)

- Fabm 1-PTDocument10 pagesFabm 1-PTClay MaaliwNo ratings yet

- 4040 CD 89981928Document3 pages4040 CD 89981928Sachin N GudimaniNo ratings yet

- PE Expansion PhaseDocument2 pagesPE Expansion PhaseVikram SenNo ratings yet

- General Terms and ConditionsDocument8 pagesGeneral Terms and ConditionsSudhanshu JainNo ratings yet

- Cutomer and Banker RelationshipDocument23 pagesCutomer and Banker RelationshipSamridhiNo ratings yet

- Public RevenueDocument17 pagesPublic RevenueNamrata More100% (1)

- A Case Study On: Under The Guidance ofDocument27 pagesA Case Study On: Under The Guidance ofbatmanNo ratings yet

- Financial Markets and OperationsDocument27 pagesFinancial Markets and OperationsSakshi SharmaNo ratings yet

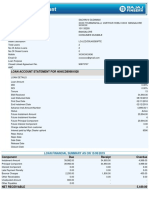

- Streamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221Document4 pagesStreamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221jo220171No ratings yet

- Valuation Practice QuizDocument6 pagesValuation Practice QuizSana KhanNo ratings yet

- FMDocument8 pagesFMRishi SuriNo ratings yet

- Incomplete Pil JurisDocument88 pagesIncomplete Pil JurisJani MisterioNo ratings yet

- Money and Financial InstitutionsDocument26 pagesMoney and Financial InstitutionsSorgot Ilie-Liviu100% (1)

- Financial Management: Short-Term FinancingDocument2 pagesFinancial Management: Short-Term FinancingNicole Athena CruzNo ratings yet

- F5 o VIGDj 8 Tpus IVDocument4 pagesF5 o VIGDj 8 Tpus IVThirupathi KotteNo ratings yet

- Stock - Practice QuestionsDocument1 pageStock - Practice QuestionsWaylee CheroNo ratings yet

- World Economic Depression by Raghuram RajanDocument2 pagesWorld Economic Depression by Raghuram RajanPrashant BahirgondeNo ratings yet

- Module 2 - Assessment ActivitiesDocument3 pagesModule 2 - Assessment Activitiesaj dumpNo ratings yet

- Sample Credit Card BillDocument2 pagesSample Credit Card BillCeresjudicata100% (1)

- 1504107521148Document53 pages1504107521148ameerpet100% (1)

- A192 CH7 Finite Risk ReinsuranceDocument22 pagesA192 CH7 Finite Risk ReinsuranceWingFatt KhooNo ratings yet

- Lock Box in SAP ARDocument4 pagesLock Box in SAP ARNaveen KumarNo ratings yet

- Geopolitical Risk and InvestmentDocument18 pagesGeopolitical Risk and InvestmentGia Hân100% (1)

- Sources of Long Term FinanceDocument308 pagesSources of Long Term FinanceVrinda BansalNo ratings yet

- About Mutual Funds Lakshmi SharmaDocument83 pagesAbout Mutual Funds Lakshmi SharmaYogendra DasNo ratings yet

- Assignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeDocument8 pagesAssignment 1 of Macroeconomics: Chapter 10: Measuring A Nation's IncomeLeo ChristNo ratings yet

- Financial Management Formulas With Solution VuabidDocument13 pagesFinancial Management Formulas With Solution Vuabidsaeedsjaan100% (3)

- Complaint - Colorado Fire & Police Pension Vs CDN Banks CDOR ManipulationDocument100 pagesComplaint - Colorado Fire & Police Pension Vs CDN Banks CDOR ManipulationNationalObserverNo ratings yet

- Citi Insight 2020Document21 pagesCiti Insight 2020Jambo ShahNo ratings yet