Professional Documents

Culture Documents

Morning Star Report 20190726102724

Uploaded by

YumyumCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Morning Star Report 20190726102724

Uploaded by

YumyumCopyright:

Available Formats

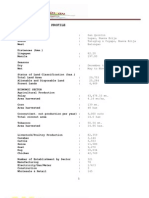

Report as of 26 Jul 2019

BOI AXA Short Term Income Fund-Direct Plan- Quarterly Dividend Payout

Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™

Short Duration CRISIL Short Term Bond Fund TR INR CRISIL Short Term Bond Fund TR INR Q

Used throughout report

Investment Objective Performance

The Scheme seeks to generate income and capital

14,000

appreciation by investing in a diversified portfolio of

13,000

debt and money market securities. However, there can

be no assurance that the income can be generated, 12,000

regular or otherwise, or the investment objectives of 11,000

the Scheme will be realized. 10,000

2014 2015 2016 2017 2018 2019-06

- - 7.22 3.32 0.04 -9.64 Fund

10.47 8.66 9.85 6.05 6.65 4.49 Benchmark

9.39 6.91 8.33 4.78 5.03 0.21 Category

Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha -7.76 3Y Sharpe Ratio -0.54 3 Months -10.55 1.95 -0.49 2019 1.64 -11.10 - -

3Y Beta 1.01 3Y Std Dev 7.09 6 Months -9.63 4.49 0.67 2018 -0.32 -0.99 1.10 0.26

3Y R-Squared 4.78 3Y Risk High 1 Year -8.56 9.06 3.68 2017 1.42 1.53 1.28 -0.93

3Y Info Ratio -1.18 5Y Risk - 3 Years Annualised -0.87 7.51 4.82 2016 0.49 1.77 2.80 1.98

3Y Tracking Error 6.94 10Y Risk - 5 Years Annualised - 8.20 5.76 2015 - - - -

Calculations use CRISIL Short Term Bond Fund TR INR (where applicable)

Portfolio 30/06/2019

Asset Allocation % Net Fixed Income Fund Credit Quality % Fund Credit Quality % Fund

Stocks 0.00 Style Box™ Modified Duration 1.57

AAA 58.86 BBB 0.00

Bonds 78.23 Yield to Maturity 9.71

High Med Low

Credit Quality

AA 15.86 BB 0.00

Cash 21.77 Average Credit Quality AA

A 25.28 B 0.00

Other 0.00

Below B 0.00

Not Rated 0.00

Ltd Mod Ext

Interest Rate Sensitivity

Top Holdings Fixed Income Sector Weightings % Fund Maturity Distribution % Fund

Holding Name Sector %

⁄ Government 6.07 1 to 3 Years 18.60

Coffee Day Natural Resources... - 19.34 › Corporate 72.17 3 to 5 Years 23.24

Aadhar Housing Finance Limited - 11.54 u Securitized 0.00 5 to 7 Years 0.00

Reliance Industries Limited - 8.52 ‹ Municipal 0.00 7 to 10 Years 7.98

Indian Railway Finance... - 6.24 y Cash & Equivalents 21.77 10 to 15 Years 0.00

BHARAT PETROLEUM - 6.13 ± Derivative 0.00 15 to 20 Years 0.00

CORPORATION... 20 to 30 Years 0.00

Coupon Range % Fund Over 30 Years 0.00

Power Finance Corporation Ltd. - 6.07

REC LIMITED - 6.03 0 0.00

GRASIM INDUSTRIES LIMITED - 5.98 0 to 4 0.00

Avendus Finance Private... - 4.78 4 to 6 24.73

IDFC Bank Limited - 3.59 6 to 8 7.65

8 to 10 67.62

Assets in Top 10 Holdings % 78.23 10 to 12 0.00

Total Number of Equity Holdings 0 Over 12 0.00

Total Number of Bond Holdings 10

Operations

Fund Company BOI AXA Investment Mngrs Share Class Size (mil) - Minimum Initial Purchase 5,000 INR

Private Ltd Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 22 40479000 Currency INR Exit Load - - > years

Website www.boiaxa-im.com UCITS - Expense Ratio 0.56%

Inception Date 01/01/2013 Inc/Acc Inc

Manager Name Nitish Gupta ISIN INF761K01777

Manager Start Date 05/12/2018

NAV (26/07/2019) INR 9.13

Total Net Assets (mil) 830.39 INR

(30/06/2019)

© 2019 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may ®

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

ß

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

You might also like

- Morning Star Report 20190726102715Document1 pageMorning Star Report 20190726102715YumyumNo ratings yet

- Morning Star Report 20190726102135Document1 pageMorning Star Report 20190726102135YumyumNo ratings yet

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumNo ratings yet

- Morning Star Report 20190725103353Document1 pageMorning Star Report 20190725103353SunNo ratings yet

- Morning Star Report 20190725103349Document1 pageMorning Star Report 20190725103349SunNo ratings yet

- Axis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunNo ratings yet

- Morning Star Report 20190720091752Document1 pageMorning Star Report 20190720091752YumyumNo ratings yet

- Axis Short Term Retail Growth: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunNo ratings yet

- BNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionDocument1 pageBNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionSunNo ratings yet

- Morning Star Report 20190726102634Document1 pageMorning Star Report 20190726102634YumyumNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- Morning Star Report 20190720091735Document1 pageMorning Star Report 20190720091735SunNo ratings yet

- Morning Star Report 20190726102445Document1 pageMorning Star Report 20190726102445YumyumNo ratings yet

- Morning Star Report 20190720091751Document1 pageMorning Star Report 20190720091751YumyumNo ratings yet

- Morning Star Report 20190726102711Document1 pageMorning Star Report 20190726102711YumyumNo ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Morning Star Report 20190720091834Document1 pageMorning Star Report 20190720091834Chaitanya VyasNo ratings yet

- Axis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityChaitanya VyasNo ratings yet

- Morning Star Report 20190720091725Document1 pageMorning Star Report 20190720091725SunNo ratings yet

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- Morning Star Report 20190720091835Document1 pageMorning Star Report 20190720091835Chaitanya VyasNo ratings yet

- Morning Star Report 20190725103110Document1 pageMorning Star Report 20190725103110SunNo ratings yet

- Morning Star Report 20190720091759Document1 pageMorning Star Report 20190720091759Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumNo ratings yet

- Axis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190720091713Document1 pageMorning Star Report 20190720091713SunNo ratings yet

- Morning Star Report 20190720091852Document1 pageMorning Star Report 20190720091852Chaitanya VyasNo ratings yet

- Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityDocument1 pageAditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate SensitivityVijay ChandranNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Morning Star Report 20190720091758Document1 pageMorning Star Report 20190720091758YumyumNo ratings yet

- Morning Star Report 20190720091722Document1 pageMorning Star Report 20190720091722SunNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Morning Star Report 20190726102554Document1 pageMorning Star Report 20190726102554YumyumNo ratings yet

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173No ratings yet

- Morning Star Report 20190726102434Document1 pageMorning Star Report 20190726102434YumyumNo ratings yet

- Morning Star Report 20190725103334Document1 pageMorning Star Report 20190725103334SunNo ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026No ratings yet

- ICICI Prudential Value Discovery Fund GrowthDocument1 pageICICI Prudential Value Discovery Fund GrowthYogi173No ratings yet

- Morning Star Report 20190726102505Document1 pageMorning Star Report 20190726102505YumyumNo ratings yet

- Morning Star Report 20190726102131Document1 pageMorning Star Report 20190726102131YumyumNo ratings yet

- Morning Star Report 20190726102102Document1 pageMorning Star Report 20190726102102YumyumNo ratings yet

- HDFC Fact SheetDocument1 pageHDFC Fact SheetAdityaNo ratings yet

- Morning Star Report 20190726102049Document1 pageMorning Star Report 20190726102049YumyumNo ratings yet

- Morning Star Report 20191102055140Document1 pageMorning Star Report 20191102055140Yogi173No ratings yet

- Morningstarreport20190906085349 PDFDocument1 pageMorningstarreport20190906085349 PDFChankyaNo ratings yet

- Morning Star Report 20190906085349Document1 pageMorning Star Report 20190906085349ChankyaNo ratings yet

- Morning Star Report 20190726102823Document1 pageMorning Star Report 20190726102823YumyumNo ratings yet

- Morningstarreport20190906085456 PDFDocument1 pageMorningstarreport20190906085456 PDFChankyaNo ratings yet

- Morningstarreport20230426061738 PDFDocument1 pageMorningstarreport20230426061738 PDFmaahirNo ratings yet

- Morningstarreport20190906084720 PDFDocument1 pageMorningstarreport20190906084720 PDFYumyumNo ratings yet

- Morning Star Report 20190906084742Document1 pageMorning Star Report 20190906084742YumyumNo ratings yet

- Morning Star Report 20190906084758Document1 pageMorning Star Report 20190906084758YumyumNo ratings yet

- Morning Star Report 20190906084809Document1 pageMorning Star Report 20190906084809YumyumNo ratings yet

- Morning Star Report 20190906084726Document1 pageMorning Star Report 20190906084726YumyumNo ratings yet

- Axis Overnight Fund Direct Monthly Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Monthly Dividend Reinvestment: Interest Rate SensitivityYumyumNo ratings yet

- Morning Star Report 20190906084702Document1 pageMorning Star Report 20190906084702YumyumNo ratings yet

- Morning Star Report 20190906084705Document1 pageMorning Star Report 20190906084705YumyumNo ratings yet

- Morning Star Report 20190906084738Document1 pageMorning Star Report 20190906084738YumyumNo ratings yet

- Morning Star Report 20190906084720Document1 pageMorning Star Report 20190906084720YumyumNo ratings yet

- Morningstarreport20190906084614 PDFDocument1 pageMorningstarreport20190906084614 PDFYumyumNo ratings yet

- Morningstarreport20190906084705 PDFDocument1 pageMorningstarreport20190906084705 PDFYumyumNo ratings yet

- Morning Star Report 20190906084546Document1 pageMorning Star Report 20190906084546YumyumNo ratings yet

- Axis Overnight Fund Direct Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Weekly Dividend Payout: Interest Rate SensitivityYumyumNo ratings yet

- Morning Star Report 20190906084558Document1 pageMorning Star Report 20190906084558YumyumNo ratings yet

- Morning Star Report 20190906084521Document1 pageMorning Star Report 20190906084521YumyumNo ratings yet

- Morning Star Report 20190906084346Document1 pageMorning Star Report 20190906084346YumyumNo ratings yet

- Morning Star Report 20190906084614Document1 pageMorning Star Report 20190906084614YumyumNo ratings yet

- Morning Star Report 20190906084519Document1 pageMorning Star Report 20190906084519YumyumNo ratings yet

- Morning Star Report 20190906084504Document1 pageMorning Star Report 20190906084504YumyumNo ratings yet

- Morning Star Report 20190906084536Document1 pageMorning Star Report 20190906084536YumyumNo ratings yet

- Axis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityYumyumNo ratings yet

- Morning Star Report 20190906084448Document1 pageMorning Star Report 20190906084448YumyumNo ratings yet

- Morning Star Report 20190906084346Document1 pageMorning Star Report 20190906084346YumyumNo ratings yet

- Axis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityYumyumNo ratings yet

- Morning Star Report 20190906084346Document1 pageMorning Star Report 20190906084346YumyumNo ratings yet

- Morning Star Report 20190906084452Document1 pageMorning Star Report 20190906084452YumyumNo ratings yet

- Axis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityDocument1 pageAxis Overnight Fund Direct Daily Dividend Reinvestment: Interest Rate SensitivityYumyumNo ratings yet

- Morning Star Report 20190906084401Document1 pageMorning Star Report 20190906084401YumyumNo ratings yet

- Morning Star Report 20190906084346Document1 pageMorning Star Report 20190906084346YumyumNo ratings yet

- Supplementary Life Insurance - Enrolment FormDocument1 pageSupplementary Life Insurance - Enrolment FormjeevaNo ratings yet

- Binders For: Architectural CoatingsDocument8 pagesBinders For: Architectural CoatingsAPEX SON100% (1)

- IC Release Management Checklist TemplateDocument5 pagesIC Release Management Checklist Templatepasc colcheteNo ratings yet

- B.Tech Digital Principles and System Design Exam Question BankDocument24 pagesB.Tech Digital Principles and System Design Exam Question Bankdigital1206No ratings yet

- Cylinder PDFDocument22 pagesCylinder PDFhossein soltanipourNo ratings yet

- Complete HSE document kit for ISO 14001 & ISO 45001 certificationDocument8 pagesComplete HSE document kit for ISO 14001 & ISO 45001 certificationfaroz khanNo ratings yet

- ) (Significant Digits Are Bounded To 1 Due To 500m. However I Will Use 2SD To Make More Sense of The Answers)Document4 pages) (Significant Digits Are Bounded To 1 Due To 500m. However I Will Use 2SD To Make More Sense of The Answers)JeevikaGoyalNo ratings yet

- Brazilian Labour Ministry Updates Machinery Safety RulesDocument89 pagesBrazilian Labour Ministry Updates Machinery Safety Rulestomy_ueziNo ratings yet

- Safety and Quality of Health Care System in IndiaDocument18 pagesSafety and Quality of Health Care System in IndiaKNOWLEDGE FeedNo ratings yet

- DMC Bored Cast in Situ Pile ConcretingDocument38 pagesDMC Bored Cast in Situ Pile Concretingmaansi jakkidi100% (1)

- Nurses' Documentation of Falls Prevention in A Patient Centred Care Plan in A Medical WardDocument6 pagesNurses' Documentation of Falls Prevention in A Patient Centred Care Plan in A Medical WardJAY LORRAINE PALACATNo ratings yet

- Tech Note FormatDocument2 pagesTech Note FormatUgonna OhiriNo ratings yet

- Air ConditionDocument4 pagesAir ConditionTaller Energy EnergyNo ratings yet

- Company Law PPT on Types of CompaniesDocument8 pagesCompany Law PPT on Types of CompaniesAbid CoolNo ratings yet

- PRINCIPLES OF MANAGEMENT Model Questions - ADocument4 pagesPRINCIPLES OF MANAGEMENT Model Questions - ALionel MintsaNo ratings yet

- BS 3892-1 1997 - Pulverized-Fuel AshDocument22 pagesBS 3892-1 1997 - Pulverized-Fuel Ashmykel_dp100% (1)

- The Prosecutor's HandbookDocument162 pagesThe Prosecutor's HandbooksamuelNo ratings yet

- Hydraulic Shovel: Engine BucketDocument32 pagesHydraulic Shovel: Engine BucketJulio CRNo ratings yet

- GATE Previous Year Solved Papers CSDocument152 pagesGATE Previous Year Solved Papers CSNagaraja Rao100% (1)

- Municipal Profile of Umingan, PangasinanDocument51 pagesMunicipal Profile of Umingan, PangasinanGina Lee Mingrajal Santos100% (1)

- 11 Core CompetenciesDocument11 pages11 Core CompetenciesrlinaoNo ratings yet

- VATEUD Pilots ManualDocument32 pagesVATEUD Pilots ManualAndreas TzekasNo ratings yet

- International Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonDocument17 pagesInternational Journal of Plasticity: Dong Phill Jang, Piemaan Fazily, Jeong Whan YoonGURUDAS KARNo ratings yet

- FEA Finite Element Analysis Tutorial ProblemsDocument16 pagesFEA Finite Element Analysis Tutorial ProblemsVinceTanNo ratings yet

- Inductive sensor technical specifications in 40 charactersDocument3 pagesInductive sensor technical specifications in 40 charactersBasarNo ratings yet

- Price List 2014: Valid From 01.04.2014, Prices in Euro, Excluding VAT. Previous Price Lists Will Become InvalidDocument106 pagesPrice List 2014: Valid From 01.04.2014, Prices in Euro, Excluding VAT. Previous Price Lists Will Become InvalidarifNo ratings yet

- Artificial IntelligenceDocument4 pagesArtificial IntelligencePrax DNo ratings yet

- 3 Kinds of de Facto Government:: CharacteristicsDocument10 pages3 Kinds of de Facto Government:: CharacteristicsAbigael SeverinoNo ratings yet

- Certified Elder Law Attorney Middletown NyDocument8 pagesCertified Elder Law Attorney Middletown NymidhudsonlawNo ratings yet

- Excel - Bachelorprojekt - Bertil Theis JørgensenDocument944 pagesExcel - Bachelorprojekt - Bertil Theis JørgensenBertil JørgensenNo ratings yet