Professional Documents

Culture Documents

Cp44u Xal33 PDF

Cp44u Xal33 PDF

Uploaded by

Rohit KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cp44u Xal33 PDF

Cp44u Xal33 PDF

Uploaded by

Rohit KumarCopyright:

Available Formats

Generated on 02 Aug 2019 01:15

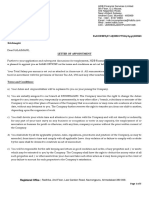

AXIS BANK LTD

PAYSLIP FOR THE MONTH OF JULY - 2019

EMPLOYEE NUMBER : 186636 BANK ACCOUNT : 919010055548456 STANDARD DAYS : 31

NAME : HARESHSHARMA PF ACCOUNT : 186636 LOP DAYS : 0

GRADE : ASSISTANT MANAGER JOINING DATE : 29-JUN-2019 REFUND DAYS : 0

POSTED LOCATION : N223:KAROL BAGH DELHI

CURRENT

EARNINGS MONTHLY RATE MONTH ARREARS TOTAL DEDUCTIONS TOTAL

BASIC 7,500.00 7,500.00 500.00 8,000.00 EMPLOYEE P F 1,922.00

CONVEYANCE ALLOWANCE 1,600.00 1,600.00 107.00 1,707.00 GROUP TERM LIFE 444.00

HOUSE RENT ALLOWANCE 3,750.00 3,750.00 250.00 4,000.00

LOCATION PAY 1,875.00 1,875.00 125.00 2,000.00

LEAVE TRAVEL ALLOWANCE 1,250.00 1,250.00 83.00 1,333.00

MEDICAL ALLOWANCE 1,250.00 1,250.00 83.00 1,333.00

SPECIAL ALLOWANCE 3,700.00 3,700.00 247.00 3,947.00

TOTAL GROSS EARNINGS 22,320.00 GROSS DEDUCTIONS 2,366.00

NET SALARY PAYABLE 19,954.00

NET SALARY PAYABLE(IN WORDS) NINTEEN THOUSAND NINE HUNDRED FIFTY FOUR ONLY

INCOME TAX CALCULATION FOR THE FINANCIAL YEAR 2019 - 2020

INCOME TAX CALCULATION DETAILS OF EXEMPTION U/S 10

DETAILS OF PERQUISITES

PARTICULARS CUMULATIVE ADD: PORJECTED ADD: CURRENT ANNUAL INVESTMENT DETAILS

(UP TO JUN 19) (FOR 8 MONTHS) (JUL 19)

EMPLOYEE P F : 16,322.00

BASIC 0.00 60,000.00 8,000.00 68,000.00 GROUP TERM LIFE : 444.00

CONVEYANCE ALLOWANCE 0.00 12,800.00 1,707.00 14,507.00 DUMMY INVESTMENT : 1,50,000.00

HOUSE RENT ALLOWANCE 0.00 30,000.00 4,000.00 34,000.00 RENT DETAILS

LOCATION PAY 0.00 15,000.00 2,000.00 17,000.00 START DATE END DATE AMOUNT

LEAVE TRAVEL ALLOWANCE 0.00 10,000.00 1,333.00 11,333.00

MEDICAL ALLOWANCE 0.00 10,000.00 1,333.00 11,333.00 SLAB WISE TAX DETAILS

SPECIAL ALLOWANCE 0.00 29,600.00 3,947.00 33,547.00 FROM AMT TO AMT TAX RATE % TAX AMT

TOTAL 0.00 1,67,400.00 22,320.00 1,89,720.00 0.00 0.00 0.00 0.00

SALARY FOR THE YEAR 1,89,720.00 Total 0.00

ADD : INCOME RECEIVED FROM PREVIOUS EMPLOYER SALARY 0.00 DETAILS OF TAX DEDUCTED TILL CURRENT MONTH

GROSS INCOME 1,89,720.00 ELEMENT DESCRIPTION TAX AMT

LESS : STANDARD DEDUCTION 50,000.00

ADD : OTHER TAXABLE INCOME REPORTED BY THE EMPLOYEE 0.00

GROSS TAXABLE INCOME 1,39,720.00

LESS : DEDUCTION UNDER SECTION 80C 1,50,000.00

LESS: DEDUCTIONS U/S 0.00

80CCD,80CCD(1b),80CCG,80D,80DD,80DDB,80E,80G,80GG,80U,80EE

TOTAL INCOME TAX PAYABLE 0.00

MARGINAL TAX TO BE RECOVERED FOR THIS MONTH 0.00

LESS TAX DEDUCTED AT SOURCE TILL CURRENT MONTH 0.00

REMAINING TAX PAYABLE/REFUNDABLE 0.00

TAX PAYABLE/REFUNDABLE PER MONTH 0.00

You might also like

- 44 Bed Detox and Residential Substance Abuse Treatment Facility Proforma - Chapman TustinDocument4 pages44 Bed Detox and Residential Substance Abuse Treatment Facility Proforma - Chapman TustinDaniel L. Case, Sr.100% (2)

- Chapter 05 Test BankDocument73 pagesChapter 05 Test BankBrandon LeeNo ratings yet

- Kalaimani Offer LetterDocument5 pagesKalaimani Offer Letterpower50% (4)

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- IDfC FD CertificateDocument3 pagesIDfC FD Certificatenisha bhardwaj100% (2)

- Progjyoti Joining LetterDocument6 pagesProgjyoti Joining LetterPorag Jyoti Neog75% (4)

- Shriram Offer Letter PDFDocument1 pageShriram Offer Letter PDFHrishikesh89% (9)

- HDFCBANK SlipDocument1 pageHDFCBANK SlipShashikant Thakre67% (21)

- Aug 2018Document1 pageAug 2018Vanita KarandeNo ratings yet

- AccentureDocument6 pagesAccentureVijaybhaskar ReddyNo ratings yet

- Pay Slip Oct 10Document1 pagePay Slip Oct 10vshet43% (7)

- PDFDocument1 pagePDFRaman DiwakarNo ratings yet

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Concentrix Services India Private Limited Payslip For The Month of September - 2021Document1 pageConcentrix Services India Private Limited Payslip For The Month of September - 2021parkeyurkiNo ratings yet

- Accenture Solutions PVT LTDDocument6 pagesAccenture Solutions PVT LTDChethan ChinnuNo ratings yet

- Joining Letter of Axis BankDocument1 pageJoining Letter of Axis BankAnusha GholeNo ratings yet

- Wipro Technologies Sal Slip AprDocument1 pageWipro Technologies Sal Slip AprRohit KumarNo ratings yet

- Mahindra Satyam Offer LetterDocument20 pagesMahindra Satyam Offer LetterMegaladevi Arumugam50% (2)

- Wipro Technologies Sal Slip AprDocument1 pageWipro Technologies Sal Slip AprRohit KumarNo ratings yet

- Wipro Technologies Sal Slip AprDocument1 pageWipro Technologies Sal Slip AprRohit KumarNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- AU Small Finance Bank Offer LetterDocument1 pageAU Small Finance Bank Offer LetterTraining & Placements100% (2)

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Axis Joing LetterDocument4 pagesAxis Joing LetterSuman DasNo ratings yet

- Axis Joing LetterDocument4 pagesAxis Joing LetterSuman DasNo ratings yet

- Naresh PayslipDocument1 pageNaresh PayslipBADI APPALARAJUNo ratings yet

- Payslip Feb 2023Document2 pagesPayslip Feb 2023BADI APPALARAJUNo ratings yet

- Appointment Letter HDB FinanceDocument5 pagesAppointment Letter HDB FinanceMonika Shelar0% (1)

- Offer Letter-AbhishekDocument17 pagesOffer Letter-AbhishekVikas ChaudharyNo ratings yet

- Offer Letter - LokeshwaranDocument3 pagesOffer Letter - LokeshwaranPazhamalairajan Kaliyaperumal100% (1)

- Dec Payslip PDFDocument1 pageDec Payslip PDFHema Kumar Hema KumarNo ratings yet

- 69Document16 pages69Anonymous xaeuoo40% (1)

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- 1555746455PRIYA GAUR - Offer Letter - 20190420 - 131706Document4 pages1555746455PRIYA GAUR - Offer Letter - 20190420 - 131706Priya Gaur33% (3)

- Accenture PaySlip PDFDocument1 pageAccenture PaySlip PDFRohit KumarNo ratings yet

- Shashank Madhu-ICICI BankDocument9 pagesShashank Madhu-ICICI BankSamiksha KolgeNo ratings yet

- Durgesh Jamdar HDB Pay Slip Aug 2022Document1 pageDurgesh Jamdar HDB Pay Slip Aug 2022DURGESH JAMDAR0% (1)

- Hemavathi Dasari 15 Lpa Kafka Admin 3 Years Relevant Offer LetterDocument4 pagesHemavathi Dasari 15 Lpa Kafka Admin 3 Years Relevant Offer LetterMâHï MHNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details: Arrears Current AmountBipuri PavankumarNo ratings yet

- Societe Generale Global Solution Centre Pvt. LTD.: Net Pay: Rs. 61991.00 Sixty One Thousand Nine Hundred Ninety OneDocument2 pagesSociete Generale Global Solution Centre Pvt. LTD.: Net Pay: Rs. 61991.00 Sixty One Thousand Nine Hundred Ninety OnePramod Kumar100% (1)

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Aug PayslipDocument1 pageAug PayslipPriyank Shah0% (1)

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- 126687Document2 pages126687DiptiNo ratings yet

- Samasta Microfinance Limited: Earnings DeductionsDocument1 pageSamasta Microfinance Limited: Earnings DeductionsDhirendraNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro Limitedbharath50% (2)

- Aug PDFDocument1 pageAug PDFDhirendraNo ratings yet

- India AUG 2018Document1 pageIndia AUG 2018vsharsha100% (1)

- Statement For Titanium Times Card Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Document2 pagesStatement For Titanium Times Card Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Rohit KumarNo ratings yet

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- Statement For Titanium Times Card Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Document2 pagesStatement For Titanium Times Card Credit Card HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6Rohit KumarNo ratings yet

- June PayslipDocument1 pageJune PayslipObineni MadhusudhanNo ratings yet

- Shiv SlipDocument1 pageShiv SlipRohit raagNo ratings yet

- The KVB Bank 2013 AnithaDocument6 pagesThe KVB Bank 2013 AnithaSri Thirunav100% (1)

- Saloni Kumari Offer LetterDocument2 pagesSaloni Kumari Offer Letternaukri comNo ratings yet

- Arun Kumar Chandramouli - Newt India - OfferLetter-Designation Revised PDFDocument7 pagesArun Kumar Chandramouli - Newt India - OfferLetter-Designation Revised PDFArun ChandramouliNo ratings yet

- Dheeraj Offer-LetterDocument2 pagesDheeraj Offer-LetterSonu Kumar0% (1)

- Ad31296951 06052021095104Document1 pageAd31296951 06052021095104MayankNo ratings yet

- 1033553563Document1 page1033553563Virendra Nalawde100% (1)

- Salary SlipDocument1 pageSalary SlipPranav Kumar100% (1)

- Welcome LetterDocument1 pageWelcome LetterKaran RathoreNo ratings yet

- CandidateDocument13 pagesCandidateSATHEESH PAPINENINo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- Kushal Gupta Offer LetterDocument2 pagesKushal Gupta Offer LetterKushal GuptaNo ratings yet

- March Pay in SlipDocument1 pageMarch Pay in SlipMahenderNo ratings yet

- August 19 My Salary Slip BCWDocument4 pagesAugust 19 My Salary Slip BCWJai Prakash BahroliyaNo ratings yet

- DecDocument1 pageDecapi-3712839100% (1)

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- HDFC PayslipDocument2 pagesHDFC PayslipRohit KumarNo ratings yet

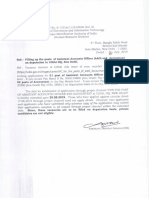

- FAQ Related To Problems in FTO ProcessingDocument3 pagesFAQ Related To Problems in FTO ProcessingRohit KumarNo ratings yet

- Usermanual PfmsDocument44 pagesUsermanual PfmsRohit KumarNo ratings yet

- 315 Def Estt Web PDFDocument227 pages315 Def Estt Web PDFRohit KumarNo ratings yet

- Of Of: Filling The in Vacancy Even Assistant Accounts 4800/-) O2 of AccountantDocument2 pagesOf Of: Filling The in Vacancy Even Assistant Accounts 4800/-) O2 of AccountantRohit KumarNo ratings yet

- Payslip 1 PDFDocument1 pagePayslip 1 PDFabhiNo ratings yet

- HDFC PayslipDocument2 pagesHDFC PayslipRohit KumarNo ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0varshithvarma051No ratings yet

- Financial Analysis of Companies in Confectionery Industry: Huu Nghi Food JSC (HNF) and Haiha Confectionery JSC (HHC)Document2 pagesFinancial Analysis of Companies in Confectionery Industry: Huu Nghi Food JSC (HNF) and Haiha Confectionery JSC (HHC)Khánh VânNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- InvoiceDocument1 pageInvoiceShahil Kumar ShawNo ratings yet

- Invoice DHL No. JKTR002114131Document3 pagesInvoice DHL No. JKTR002114131Tri Wahyuni100% (2)

- Bill 3Document1 pageBill 3Yogesh GhogaleNo ratings yet

- Letter of Authority G.R. No. 222743, April 5, 2017 Medicard Philippines, Inc. vs. Commissioner of Internal RevenueDocument5 pagesLetter of Authority G.R. No. 222743, April 5, 2017 Medicard Philippines, Inc. vs. Commissioner of Internal RevenuecharmainejalaNo ratings yet

- Sponsor DocsDocument2 pagesSponsor DocsMaisa SantosNo ratings yet

- Exam SampleDocument15 pagesExam SampleKim LeNo ratings yet

- How The Effect of Deferred Tax Expenses and Tax Planning On Earning Management ?Document6 pagesHow The Effect of Deferred Tax Expenses and Tax Planning On Earning Management ?Nurlita Puji AnggraeniNo ratings yet

- Pay SlipDocument1 pagePay SlipRaj ThakurNo ratings yet

- Problem 6 16 2Document2 pagesProblem 6 16 2KC Hershey Lor100% (1)

- Taxation Law Case Digests Hernando Bar 2023 - CompressDocument43 pagesTaxation Law Case Digests Hernando Bar 2023 - Compressshaileen reyes-macalinoNo ratings yet

- InvoiceDocument1 pageInvoiceRajan BuradNo ratings yet

- CIR Vs Lingayen ElectricDocument2 pagesCIR Vs Lingayen ElectricRobert Quiambao100% (2)

- F6VNM 2015 Jun QDocument14 pagesF6VNM 2015 Jun QMinh Hương TrầnNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- Chapter 3 Depreciation - Declining and Double Declining MethodPart34Document12 pagesChapter 3 Depreciation - Declining and Double Declining MethodPart34Tor GineNo ratings yet

- South Western Federal Taxation 2014 Individual Income Taxes 37th Edition Hoffman Solutions ManualDocument29 pagesSouth Western Federal Taxation 2014 Individual Income Taxes 37th Edition Hoffman Solutions Manualanthonycarteroayqmwfxkt100% (29)

- Au Tax Refund Tut Part 1 - ProfxDocument22 pagesAu Tax Refund Tut Part 1 - Profxryanrburton09No ratings yet

- Receipt Template 4 ExcelDocument1 pageReceipt Template 4 ExcelHarsh MehraNo ratings yet

- Mid Tax 2-3-19-22Document3 pagesMid Tax 2-3-19-22Alfred Robert BabasoroNo ratings yet

- Sudip DasDocument1 pageSudip DasSurajit SarkarNo ratings yet

- Dizon Vs CIRDocument3 pagesDizon Vs CIRRay John Uy-Maldecer AgregadoNo ratings yet

- Enb FinalDocument11 pagesEnb Finalkevin kipkemoiNo ratings yet

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sahil sachdevaNo ratings yet

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet