Professional Documents

Culture Documents

Problem Case Financial Manager Chapter 1

Uploaded by

Sukindar Ari Shuki Santoso0 ratings0% found this document useful (0 votes)

59 views5 pageskunci jawaban mcgraw

Original Title

problem case Financial manager chapter 1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentkunci jawaban mcgraw

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

59 views5 pagesProblem Case Financial Manager Chapter 1

Uploaded by

Sukindar Ari Shuki Santosokunci jawaban mcgraw

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

A B C D E F G H

1 03 Case model 9/7/2019 18:23 10/1/2015

2

3 Chapter 3. Financial Statements, Cash Flow, and Taxes

This spreadsheet model is designed to be used in conjunction with the chapter's integrated case and the

4

related PowerPoint slide presentation.

5

6 EXHIBITS: INPUT DATA (for D'Leon)

7

8 Table IC3.1 Balance Sheets

9 2016 2015

10 Assets

11 Cash $ 7,282 $ 57,600

12 Accounts receivable 632,160 351,200

13 Inventories 1,287,360 715,200

14 Total current assets $ 1,926,802 $1,124,000

15 Gross fixed assets 1,202,950 491,000

16 Less: accumulated depreciation 263,160 146,200

17 Net fixed assets $ 939,790 $ 344,800

18 Total assets $ 2,866,592 $1,468,800

19

20 Liabilities and equity

21 Accounts payable $ 524,160 $ 145,600

22 Accruals 489,600 136,000

23 Notes payable 636,808 200,000

24 Total current liabilities $ 1,650,568 $ 481,600

25 Long-term debt 723,432 323,432

26 Total liabilities $ 2,374,000 $ 805,032

27 Common stock (100,000 shares) 460,000 460,000

28 Retained earnings 32,592 203,768

29 Total common equity $ 492,592 $ 663,768

30 Total liabilities and equity $ 2,866,592 $1,468,800

31

A B C D E F G H

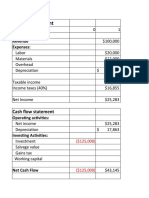

32 Table IC3.2 Income Statements 2016 2015

33

34 Sales $ 6,034,000 $3,432,000

35 Cost of goods sold 5,528,000 2,864,000

36 Other expenses 519,988 358,672

37 Total operating exp. excl. depreciation and amortization $ 6,047,988 $3,222,672

38 Depreciation and amortization 116,960 18,900

39 Earnings before interest and taxes (EBIT) $ (130,948) $ 190,428

40 Interest expense 136,012 43,828

41 Earnings before taxes (EBT) $ (266,960) $ 146,600

42 Taxes (40%) (106,784) 58,640

43 Net income $ (160,176) $ 87,960

44

45 EPS $ (1.602) $ 0.880

46 DPS $0.11 $0.22

47 Book value per share $ 4.926 $ 6.638

48 Stock price $ 2.25 $ 8.50

49 Shares outstanding 100,000 100,000

50 Tax rate 40.00% 40.00%

51 Lease payments $ 40,000 $ 40,000

52 Sinking fund payments 0 0

53

54 Table IC3.3 Statement of Stockholders' Equity, 2016

55 Common Stock Total

56 Retained Stockholders'

57 Shares Amount Earnings Equity

58 Balances, Dec. 31, 2015 100,000 $ 460,000 $ 203,768 $ 663,768

59 Add: Net Income, 2016 (160,176)

60 Less: Dividends to common stockholders (11,000)

61 Addition (Subtraction) to Retained Earnings (171,176)

62 Balances, Dec. 31, 2016 100,000 $ 460,000 $ 32,592 $ 492,592

63

A B C D E F G H

64 Table IC3.4 Statement of Cash Flows, 2016

65

66 Operating Activities

67 Net Income $ (160,176)

68 Depreciation and amortization 116,960

69 Increase in accounts payable 378,560

70 Increase in accruals 353,600

71 Increase in accounts receivable (280,960)

72 Increase in inventories (572,160)

73 Net cash provided by operating activities $ (164,176)

74

75 Long-Term Investing Activities

76 Additions to property, plant, and equipment $ (711,950)

77 Net cash used in investing activities $ (711,950)

78

79 Financing Activities

80 Increase in notes payable $ 436,808

81 Increase in long-term debt 400,000

82 Payment of cash dividends (11,000)

83 Net cash provided by financing activities $ 825,808

84

85 Summary

86 Net decrease in cash $ (50,318)

87 Cash at beginning of the year 57,600

88 Cash at end of the year $ 7,282

89

90

A B C D E F G H

91 PART A

What effect did the expansion have on sales, after-tax operating income, net operating working capital

92

(NOWC), and net income?

93

94 AT operating income16 = EBIT × (1 – T)

95 AT operating income16 = $ (130,948) × 0.60

96 AT operating income16 = ($78,569)

97

98 AT operating income15 = EBIT × (1 – T)

99 AT operating income15 = $ 190,428 × 0.60

100 AT operating income15 = $114,257

101

102 NOWC16 = Current assets – (Current liabilities – Notes payable)

103 NOWC16 = $ 1,926,802 – $1,013,760

104 NOWC16 = $913,042

105

106 NOWC15 = $ 1,124,000 – $ 281,600

107 NOWC15 = $842,400

108

109 Change in NOWC = NOWC16 – NOWC15

110 Change in NOWC = $913,042 – $842,400

111 Change in NOWC = $70,642

112

113 Change in NI = NI16 – NI15

114 Change in NI = $ (160,176) – $87,960

115 Change in NI = ($248,136)

116

117 PART B

118 What effect did the company’s expansion have on its free cash flow?

119

120 FCF16 = EBIT × (1 – T) + Depreciation – [Capital Expenditures +

121 FCF16 = $ (130,948) × 0.60 + 116,960 – $ 782,592

122 FCF16 = ($78,569) + $ 116,960 – $ 782,592

123 FCF16 = -$744,201

I J

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

Capital Expenditures + ΔNOWC]

121

122

123

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Chapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument8 pagesChapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen Harris100% (1)

- Mini Case (Financial Statements)Document12 pagesMini Case (Financial Statements)Melissa López GarzaNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- FCF 12th Edition Case SolutionsDocument66 pagesFCF 12th Edition Case SolutionsDavid ChungNo ratings yet

- Data Year-End Common Stock Price: Ratios SolutionDocument2 pagesData Year-End Common Stock Price: Ratios SolutionTarun KatariaNo ratings yet

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet

- D'leon Financial Statements Analysis Exercise - SolvedDocument8 pagesD'leon Financial Statements Analysis Exercise - SolvedDIPESH KUNWARNo ratings yet

- Week-2-Chapter-3-Financial-Build-A-Mode LDocument7 pagesWeek-2-Chapter-3-Financial-Build-A-Mode LCrusty GirlNo ratings yet

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- Example 3: Income Statement Example 3: Balance Sheet - AssetsDocument2 pagesExample 3: Income Statement Example 3: Balance Sheet - AssetsAnonymous Gon7kIsNo ratings yet

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Casos FinanzasDocument20 pagesCasos FinanzasPepe La PagaNo ratings yet

- 11.0 Enager Industries, Inc. - DataDocument3 pages11.0 Enager Industries, Inc. - DataAliza RizviNo ratings yet

- Ch03 Tool Kit 2017-09-11Document20 pagesCh03 Tool Kit 2017-09-11Roy HemenwayNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

- Pacific Grove Spice Company CalculationsDocument12 pagesPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroNo ratings yet

- The ABC Company: Balance SheetDocument10 pagesThe ABC Company: Balance SheetFahad AliNo ratings yet

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqNo ratings yet

- Assignment 2Document1 pageAssignment 2Sumbal JameelNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265No ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Ratio and Income and Balance SheetDocument12 pagesRatio and Income and Balance SheetJerry RodNo ratings yet

- 1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Document8 pages1 - Week 6 Final Case Project Workbook - Abc Company - Spring 2019Minh Van NguyenNo ratings yet

- Working Papers SAIDocument7 pagesWorking Papers SAISai RillNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- Value Drivers (Assumptions)Document6 pagesValue Drivers (Assumptions)Phuong ThaoNo ratings yet

- Excel Solution To 10.1-10.4Document14 pagesExcel Solution To 10.1-10.4mansiNo ratings yet

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Trend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio AnalysisDocument4 pagesTrend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio Analysisnaimenim100% (1)

- Panther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)Document7 pagesPanther Tyre Company Balance Sheet 43,100.00 2,018.00 2,019.00 2,020.00 Assets Current Assets Increase or (Decrease)HussainNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Desarrollo de Caso Nº4 MERCURYDocument39 pagesDesarrollo de Caso Nº4 MERCURYclaudia aguillonNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- This Spreadsheet Supports The Analysis of The Case "Flinder Valves and Controls Inc." (Case 43)Document17 pagesThis Spreadsheet Supports The Analysis of The Case "Flinder Valves and Controls Inc." (Case 43)Lalang PalambangNo ratings yet

- Balance Sheet: Current AssetsDocument1 pageBalance Sheet: Current AssetsJawadNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- 3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsDocument3 pages3 Problem: 15: Joshua & White Technologies: December 31 Balance SheetsQudsiya KalhoroNo ratings yet

- Ch02 Tool KitDocument18 pagesCh02 Tool KitPopsy AkinNo ratings yet

- Exercise 5. MiniCase Answer 1Document5 pagesExercise 5. MiniCase Answer 1Linh LinhNo ratings yet

- CH2 FinmaDocument3 pagesCH2 Finmamervin coquillaNo ratings yet

- Gas Grouse Revisi Jawaban Nomor 2Document4 pagesGas Grouse Revisi Jawaban Nomor 2Sukindar Ari Shuki Santoso100% (1)

- Gas or Grouse Business EthicsDocument4 pagesGas or Grouse Business EthicsSukindar Ari Shuki Santoso100% (1)

- Gas Grouse Revisi Jawaban Nomor 2Document4 pagesGas Grouse Revisi Jawaban Nomor 2Sukindar Ari Shuki Santoso100% (1)

- Team 4 - Unocal in BurmaDocument6 pagesTeam 4 - Unocal in BurmaSukindar Ari Shuki SantosoNo ratings yet

- Gas or Grouse Business EthicsDocument4 pagesGas or Grouse Business EthicsSukindar Ari Shuki Santoso100% (1)

- Team 4 - Unocal in BurmaDocument6 pagesTeam 4 - Unocal in BurmaSukindar Ari Shuki SantosoNo ratings yet

- Team 4 - Unocal in BurmaDocument6 pagesTeam 4 - Unocal in BurmaSukindar Ari Shuki SantosoNo ratings yet

- Sofar Sampe Suki Business & ManagementDocument18 pagesSofar Sampe Suki Business & ManagementSukindar Ari Shuki SantosoNo ratings yet

- Sofar Sampe Suki Business & ManagementDocument18 pagesSofar Sampe Suki Business & ManagementSukindar Ari Shuki SantosoNo ratings yet

- Study Plan and Schedule of Classes: Date Class Topics Readings Slides ExercisesDocument3 pagesStudy Plan and Schedule of Classes: Date Class Topics Readings Slides ExercisesSukindar Ari Shuki SantosoNo ratings yet

- Business Communication ModelDocument19 pagesBusiness Communication ModelSri Kartina IndriatiNo ratings yet

- Sofar Sampe Suki Business & ManagementDocument18 pagesSofar Sampe Suki Business & ManagementSukindar Ari Shuki SantosoNo ratings yet

- The Great Inventions Fair BagrutDocument5 pagesThe Great Inventions Fair Bagrutapi-25895447No ratings yet

- Steven B. Achelis - Technical Analysis From A To ZDocument335 pagesSteven B. Achelis - Technical Analysis From A To Zgrantukas1No ratings yet

- Neville Wadia Institute of Management Studies and Research, Pune - 411001 Mba-Ii Sem-Iv Enterprise Performance Management McqsDocument12 pagesNeville Wadia Institute of Management Studies and Research, Pune - 411001 Mba-Ii Sem-Iv Enterprise Performance Management McqsPRATHAMESH SURVENo ratings yet

- 1303南亞 1091210 NomuraDocument9 pages1303南亞 1091210 NomuraDeron LaiNo ratings yet

- Transaction Request For Purchase / Switch / Redemption: Key Partner / Distributor InformationDocument1 pageTransaction Request For Purchase / Switch / Redemption: Key Partner / Distributor Informationvinodmapari105No ratings yet

- 54 Ipo ChecklistDocument8 pages54 Ipo ChecklistsurajgulguliaNo ratings yet

- Philippine School of Business Administration Manila Campus Managerial Economics Midterm ExaminationDocument3 pagesPhilippine School of Business Administration Manila Campus Managerial Economics Midterm ExaminationNaiomi NicasioNo ratings yet

- Assignment BM014 3.5 3 DMKGDocument7 pagesAssignment BM014 3.5 3 DMKGDavid CarolNo ratings yet

- 1 An Introduction Investing and ValuationDocument19 pages1 An Introduction Investing and ValuationEmmeline ASNo ratings yet

- Cfo GM & Manager ClientDocument33 pagesCfo GM & Manager ClientkinananthaNo ratings yet

- Fixed Vs Flexible Exchange RatesDocument63 pagesFixed Vs Flexible Exchange Ratesramya4smilesNo ratings yet

- Principles of Managerial Finance Brief 8Th Edition Zutter Test Bank Full Chapter PDFDocument67 pagesPrinciples of Managerial Finance Brief 8Th Edition Zutter Test Bank Full Chapter PDFSaraSmithdgyj100% (9)

- Resume Financial AnalystDocument2 pagesResume Financial AnalystIshaq KhanNo ratings yet

- Global Capital Market NotesDocument10 pagesGlobal Capital Market NotesAbdulrahman AlotaibiNo ratings yet

- Non Banking Financial CompanyDocument39 pagesNon Banking Financial Companymanoj phadtareNo ratings yet

- FI515 Homework1Document5 pagesFI515 Homework1andiemaeNo ratings yet

- FA2Document2 pagesFA2KirosTeklehaimanotNo ratings yet

- Dr. Gede Pardianto, SP.MDocument4 pagesDr. Gede Pardianto, SP.Myudimindria3598No ratings yet

- 2023 Outlook InsuranceDocument43 pages2023 Outlook InsuranceTerryNo ratings yet

- Ch-11d-Irs, Caps, Floor, FraDocument26 pagesCh-11d-Irs, Caps, Floor, Frashankar k.c.No ratings yet

- Bom Unit-3Document89 pagesBom Unit-3Mr. animeweedNo ratings yet

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsstoryNo ratings yet

- 3 Keys To Achieve Consistent Profit From Stock Market by Adam KhooDocument60 pages3 Keys To Achieve Consistent Profit From Stock Market by Adam KhooSau Fei100% (6)

- Fabm Week 2 FinalsDocument8 pagesFabm Week 2 FinalsDaniella Dela Peña100% (1)

- DocxDocument40 pagesDocxJamaica DavidNo ratings yet

- Financial StatementDocument13 pagesFinancial StatementkeyurNo ratings yet

- Financial Institutions in IndiaDocument4 pagesFinancial Institutions in Indiaabhishekaw02No ratings yet

- Syllabus FINA 6092 - Advanced Financial ManagementDocument5 pagesSyllabus FINA 6092 - Advanced Financial ManagementisabellelyyNo ratings yet

- PHD Consolidated Financials - 31 December 2020Document46 pagesPHD Consolidated Financials - 31 December 2020Aly A. SamyNo ratings yet

- Solution Sampa VideoDocument5 pagesSolution Sampa VideoWalter CamposNo ratings yet