0% found this document useful (0 votes)

2K views2 pagesNike Distribution Channel

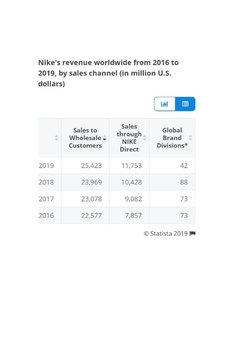

Nike distributes its products through three main channels: wholesalers, direct-to-consumer sales including retail stores and websites, and global brand divisions. While sales to wholesalers make up the largest portion, this percentage has decreased in recent years as direct-to-consumer sales have increased. Nike is focusing on growing direct sales to consumers, which provide higher margins than wholesaler sales. The company aims to increase direct-to-consumer sales to $8 billion by 2017 in order to continue shifting its distribution strategy.

Uploaded by

Prashant SrivastavCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views2 pagesNike Distribution Channel

Nike distributes its products through three main channels: wholesalers, direct-to-consumer sales including retail stores and websites, and global brand divisions. While sales to wholesalers make up the largest portion, this percentage has decreased in recent years as direct-to-consumer sales have increased. Nike is focusing on growing direct sales to consumers, which provide higher margins than wholesaler sales. The company aims to increase direct-to-consumer sales to $8 billion by 2017 in order to continue shifting its distribution strategy.

Uploaded by

Prashant SrivastavCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd