Professional Documents

Culture Documents

Commodity - Metals - &energy 13-09-19 PDF

Commodity - Metals - &energy 13-09-19 PDF

Uploaded by

The red RoseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity - Metals - &energy 13-09-19 PDF

Commodity - Metals - &energy 13-09-19 PDF

Uploaded by

The red RoseCopyright:

Available Formats

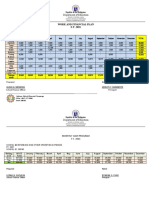

METALS & ENERGY OUTLOOK

Date: Sep 13 2019

BULLION- GOLD

MCX GOLD FUTURE

Gold Closed lower on Thursday Amid the

European Central Bank’s rate cut and promise

quantitative easing Thursday. That pushed

the yellow metal to one-week highs above

$1,500 in anticipation of similar dovish action

from the Federal Reserve.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

37898 38228 37662 37750 -0.59 36966 37314 37532 38013 38446 38664 22439 11116

STRATEGY: - As long as 37600/37400 holds support we could see 38000/38150 levels.

BULLION- SILVER

MCX SILVER FUTURE Silver Prices closed Lower on Thursday Amid

The ECB cut its deposit rate to a record low of -

0.5%, while promising that rates would stay

low for longer. It said it would restart bond

purchases at a rate of 20 billion euros a month

from Nov. 1.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

47430 48082 46951 47128 -0.78 45561 46256 46692 47653 48518 48954 41455 10500

STRATEGY: As long as 47000/46500 holds support we could see 47500/48000 levels.

ENERGY- CRUDE

MCX CRUDE FUTURE

Crude Oil prices Closed lower on Thursday on concerns

that sanctioned Iranian supplies might come roaring

back. OPEC’s vow to balance the market with supply

cuts were trumped by fears there might be a resolution

soon to the near-year-long U.S. embargo on Iranian

crude.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

4019 4024 3826 3899 -2.7 3611 3718 3809 3963 4114 4205 375371 12299

STRATEGY: - As long 3990/4030 resist we could see 3850/3810 levels.

ENERGY- NATURAL GAS

MCX NATURAL GAS FUTURE

Natural Gas prices Closed Lower on Thursday Amid

Estimates of future supplies of U.S. natural gas

increased to 3,374 trillion cubic feet, a 20% increase

over the last projection in 2016, according to a

biennial assessment of the nation’s gas resources at

the end of 2018.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

182.7 183.9 179.3 183 -0.27 175.6 177.5 180.2 183.1 186.7 189.4 69802 10133

STRATEGY: - As long as 186/192 resist we could see 180/177 levels.

BASE METAL- COPPER

MCX COPPER FUTURE

Copper prices closed higher on Thursday after the

United States said it would delay imposing a new

round of tariffs on China, raising hopes of a thawing of

tensions that could bode well for demand for the

metal.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

451.9 456.95 445.2 452.85 0.53 434.6 439.9 446.4 454.4 463.4 469.9 31657 5450

STRATEGY: As long as 448/445 holds support we could see 457/460 levels.

BASE METAL- ZINC

MCX ZINC FUTURE

Zinc prices closed higher on Thursday Amid the

United States said it would delay imposing a new

round of tariffs on China, raising hopes of a thawing

of tensions that could bode well for demand for the

metal.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

187 187.65 183.3 184.9 0.8 178.6 180.9 182.9 186.3 189.6 191.6 19087 2536

STRATEGY: As long as 183/182 holds support we could see 187/188 levels.

BASE METAL- NICKEL

MCX NICKEL FUTURE

Nickel Prices closed marginally Lower on

Thursday Amid the United States said it would delay

imposing a new round of tariffs on China, raising

hopes of a thawing of tensions that could bode well

for demand for the metal.

OPEN HIGH LOW CLOSE % CG S3 S2 S1 R1 R2 R3 VOL OI

1262 1284.2 1238 1254.6 -0.06 1187 1212.7 1233.7 1269.8 1305.1 1326.1 60538 11166

STRATEGY: As long as 1245/1220 holds support we could see 1285/1300 levels.

PIVOT POINTS

COMMODITY R2 R1 PIVOTS S1 S2

GOLD OCT 38,446 38,013 37,880 37,532 37,314

SILVER SEP 48,518 47,653 47,387 46,692 46,256

CRUDE SEP 4,114 3,963 3,916 3,809 3,718

NATURAL GAS SEP 186.7 183.1 182.1 180.2 177.5

COPPER SEP 463.4 454.4 451.7 446.4 439.9

NICKEL SEP 1,305 1,270 1,259 1,234 1,213

LEAD SEP 155.8 154.6 154.3 153.7 152.9

ZINC SEP 189.6 186.3 185.3 182.9 180.9

ALUMINIUM SEP 141.1 140.2 139.9 139.3 138.8

Important Data released on Global Economies on Sep 13 2019

Time Event Forecast Previous

ALL DAY

CNY Bank Holiday -- --

06:00 Pm

USD Core Retail Sales m/m 0.1% 1.0%

06:00 Pm

USD Import Prices m/m -0.5% 0.2%

07:30 Pm

USD Prelim UoM Consumer Sentiment 90.4 89.8

Research Desk

PRIYANK UPADHYAY Priyank.upadhyay@ssjfinance.com +91 22 4300 8861

(AVP-RESEARCH)

VIRAT UPADHYAY virat.upadhyay@ssjfinance.com +91 22 4300 8870

(RESEARCH ANALYST)

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed

to any other person. The manner of circulation and distribution of this document may be restricted by law or regulation in certain countries,

including the United States. Persons into whose possession this document may come are required to inform them of, and to observe, such

restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report

is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation

would be illegal. No person associated with SSJ Finance is obligated to call or initiate contact with you for the purposes of elaborating or following

up on the information contained in this document. The material is based upon information that we consider reliable, but we do not represent that

it is accurate or complete, and it should not be relied upon as such. Neither SSJ Finance, nor any person connected with it, accepts any liability

arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional

advice. Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective

investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. We and

our affiliates, officers, directors, and employees world-wide, including persons involved in the preparation or issuance of this material may; (a)

from time to time, have long or short positions in, and buy or sell the securities thereof, of company(ies) mentioned herein or (b) be engaged in

any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of

the company(ies) discussed herein or may perform or seek to perform investment banking services for such company(ies) or act as advisor or

lender / borrower to such company(ies) or have other potential conflict of interest with respect to any Suggested Weight age and related

information and opinions. The same persons may have acted upon the information contained here. No part of this material may be duplicated in

any form and / or redistributed without SSJ Finance’s prior written consent. No part of this document may be distributed in Canada or used by

private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although

its accuracy and completeness cannot be guaranteed.

You might also like

- 30 Min Strategy PDFDocument14 pages30 Min Strategy PDFThe red RoseNo ratings yet

- Commodities-Daily Technical Report: GoldDocument7 pagesCommodities-Daily Technical Report: GoldThe red RoseNo ratings yet

- Commodity Technical Report Oct 09Document7 pagesCommodity Technical Report Oct 09The red RoseNo ratings yet

- Commodity DailyDocument7 pagesCommodity DailyThe red RoseNo ratings yet

- DisclaimerDocument1 pageDisclaimerThe red RoseNo ratings yet

- Morning Technical Levels For Metals and Energy: Commodity Exchange Contract Trend S2 S1 LTP R1 R2 BullionDocument1 pageMorning Technical Levels For Metals and Energy: Commodity Exchange Contract Trend S2 S1 LTP R1 R2 BullionThe red RoseNo ratings yet

- Weekly Levels 07-11102019 - WorksheetDocument1 pageWeekly Levels 07-11102019 - WorksheetThe red RoseNo ratings yet

- Daily Comm ME - bhr9sd5xDocument3 pagesDaily Comm ME - bhr9sd5xThe red RoseNo ratings yet

- Daily Comm ME - Svb33of9Document3 pagesDaily Comm ME - Svb33of9The red RoseNo ratings yet

- Precious Metal Weekly Commodity Outlook::-Gold Price Closed Higher Last Week in Further Buildup ToDocument8 pagesPrecious Metal Weekly Commodity Outlook::-Gold Price Closed Higher Last Week in Further Buildup ToThe red RoseNo ratings yet

- Daily Commodities Coverage: Commodity ResearchDocument6 pagesDaily Commodities Coverage: Commodity ResearchThe red RoseNo ratings yet

- Commodities-Daily Technical Report: GoldDocument7 pagesCommodities-Daily Technical Report: GoldThe red RoseNo ratings yet

- Commodity Insight: Market OverviewDocument9 pagesCommodity Insight: Market OverviewThe red RoseNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Nagaland Economic Survey 2021-22Document70 pagesNagaland Economic Survey 2021-22R.Yiben HumtsoeNo ratings yet

- TaxationDocument4 pagesTaxationKatzkie DesuNo ratings yet

- Chapter 19Document29 pagesChapter 19monikaNo ratings yet

- Income Statement - FacebookDocument6 pagesIncome Statement - FacebookFábia RodriguesNo ratings yet

- 1570251533116Document30 pages1570251533116wishfinvishnu vermaNo ratings yet

- Swot Analysis of Online Food Ordering Industry in IndiaDocument1 pageSwot Analysis of Online Food Ordering Industry in IndiaAbdul Wajid0% (1)

- Port Harcourt Electricity Distribution Company PLCDocument3 pagesPort Harcourt Electricity Distribution Company PLCdecorindo2002No ratings yet

- Business Project TopicsDocument4 pagesBusiness Project TopicsSOMOSCONo ratings yet

- Written ReportDocument5 pagesWritten Reportcp9343888No ratings yet

- BUS251.02 - Team Alpha - FInal Slides UpdatedDocument40 pagesBUS251.02 - Team Alpha - FInal Slides UpdatedFahim IslamNo ratings yet

- J CurveDocument2 pagesJ CurveAnoop PatsariyaNo ratings yet

- ECN202 Ass Monira Sultana Kheya18211802 2Document11 pagesECN202 Ass Monira Sultana Kheya18211802 2Wasifa TahsinNo ratings yet

- Pay Bill of Gazzetted OfficerDocument1 pagePay Bill of Gazzetted OfficerMudassar LadlaNo ratings yet

- CP (Including Redeemed) - 17.08.2018Document3,212 pagesCP (Including Redeemed) - 17.08.2018HariNo ratings yet

- EVfinal Doing BussinessDocument4 pagesEVfinal Doing BussinessCinthia RodriguezNo ratings yet

- Kalet Almanza Erick Londoño Daniel Romero Presented To The Teacher: Elna Navarro Curso:9GDocument7 pagesKalet Almanza Erick Londoño Daniel Romero Presented To The Teacher: Elna Navarro Curso:9GJesús RomeroNo ratings yet

- MCP - Work.and-Financial - Plan Malauli Word NewDocument2 pagesMCP - Work.and-Financial - Plan Malauli Word NewGhie Yambao SarmientoNo ratings yet

- Payslip 5 2022Document1 pagePayslip 5 2022All in OneNo ratings yet

- Bail-Out Period: The Firm's Investing Decisions Capital Budgeting TechniquesDocument3 pagesBail-Out Period: The Firm's Investing Decisions Capital Budgeting Techniquesgem dexter LlamesNo ratings yet

- Branch and Unit BankingDocument1 pageBranch and Unit BankingSheetal Thomas100% (1)

- Globalisation, Structural Adjustment and Small and Micro-Sized Enterprises IN MalawiDocument296 pagesGlobalisation, Structural Adjustment and Small and Micro-Sized Enterprises IN MalawiWondemeneh AsratNo ratings yet

- Forward Rates - July 8 2021Document2 pagesForward Rates - July 8 2021Lisle Daverin BlythNo ratings yet

- Proforma Invoice: Devi IndustriesDocument1 pageProforma Invoice: Devi IndustriesRavi FrankNo ratings yet

- IBM556 Written ReportDocument15 pagesIBM556 Written ReportFaiz FahmiNo ratings yet

- A Review of Global Cement Industry Trends: Concreatech, New Delhi, November 2018Document20 pagesA Review of Global Cement Industry Trends: Concreatech, New Delhi, November 2018Akhilesh AgarwalNo ratings yet

- Aruna 1 PDFDocument5 pagesAruna 1 PDFChelsi GehlotNo ratings yet

- Chapter 2 World Trade: An Overview: International Economics, 10e (Krugman/Obstfeld/Melitz)Document8 pagesChapter 2 World Trade: An Overview: International Economics, 10e (Krugman/Obstfeld/Melitz)Mianda InstituteNo ratings yet

- Jio FiberDocument1 pageJio FiberBalachandar PNo ratings yet

- Key Takeaways From Household Consumption Expenditure SurveyDocument6 pagesKey Takeaways From Household Consumption Expenditure SurveyMayankNo ratings yet

- Global CorporationsDocument19 pagesGlobal CorporationsAprielyn Dicen BSIT-3B100% (2)